With more banking and financial services options available to consumers than ever before, banks, credit unions and fintechs are looking for solutions to attract and maintain a relationship with the fastest-growing consumer group — Gen Z.

Based on responses to our survey of 1,039 consumers from various regions across the United States (approximately 40% of them from the Gen Z segment), the four most important factors for Gen Z in choosing a financial service provider are:

- Trust and security

- Rates, products, services and special offers

- The ability to talk to a person when support is needed

- A great digital experience

The research analyzed the data by comparing percentage differences between three demographic segments. These were: Gen Z (age 15-24), Millennials (age 25-40) and Baby Boomers (age 57-75). The patterns identified provide insights regarding consumer banking perspectives that can be used to inform product, services and marketing strategies of financial institutions and fintechs alike.

Take A Step Back:

How well does your marketing team know Gen Z? Would they know that trust and security ranks at the top of Gen Z priorities?

Prioritizing Trust and Security

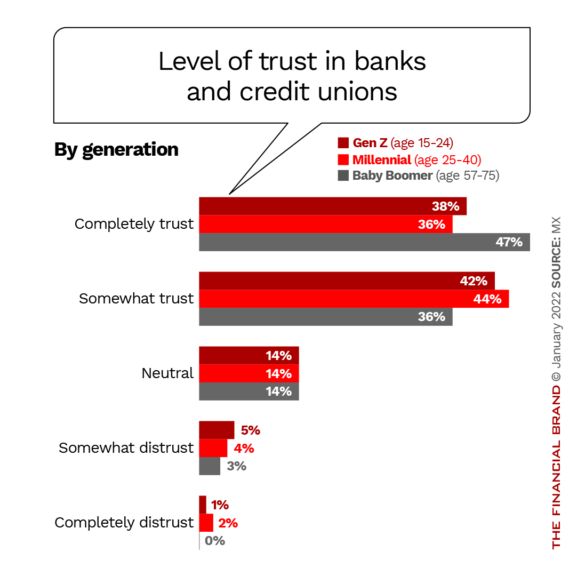

Among the top priorities when choosing a financial service provider, “level of trust and security” was selected by at least 48% of each of the three demographic segments. That said, while most respondents from each group indicated that they at least somewhat trust their primary financial institution regarding their personal financial data, Gen Z and Millennials were less likely than Baby Boomers to completely trust them.

At the forefront of trust is the security of personal data. While financial institutions appear to have secured a general sense of trust from their customers, it’s clear that they have work to do in order to gain consumers’ complete trust in regard to data security, particularly as more consumers prefer digital banking experiences.

At least 57% of each segment indicated that they would like their financial institution to consider providing advanced identity and credit protection, and nearly half of each segment expressed interest in data protection for digital assets.

Among Gen Z and Millennials, the second most important category was “rates, products, services and special offers.” Baby Boomers also prioritized this category but were more likely to prioritize in-person or personalized features — including the ability to talk to a person, the friendliness of the staff and the closeness of the branch.

Innovating with Digital Banking Experiences

When choosing a financial service provider, every generation rated a digital banking experience as at least somewhat important. Nearly half of Gen Z and Millennial respondents indicated that the digital banking experience is “very important” when they’re choosing a financial service provider.

In addition, 20% of both Gen Z and Millennial respondents — and 13% of Baby Boomers — also suggested that banking will be online-only in the future. And Gen Z has higher interest in more types of digital experiences than any other age group, including automated financial guidance (39%) and virtual assistants for managing money (31%).

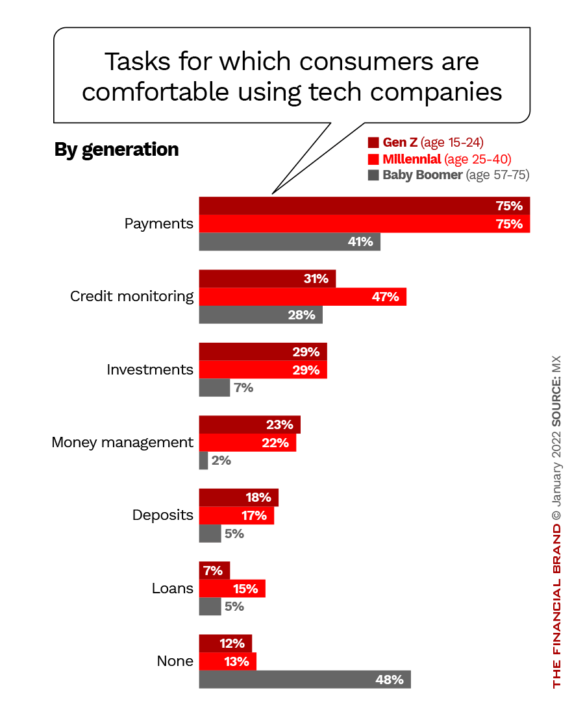

Gen Z and Millennials are also most comfortable using technology companies to conduct various banking tasks, as shown in the chart below.

Finally, in terms of support preferences, Gen Z and Millennials again turned to digital. While all age groups showed high interest in live human chat, call center services and visiting the branch, 53% of Gen Z respondents and 42% of Millennials wanted to be able to find their answer online.

Human Connection Still Matters:

The younger generations still care about the person-to-person conversation, even if they prefer digital as the first connection point.

Further Insights from the Data

Without reliable and secure financial data access, consumers have little transparency or insight into what is going on in their financial lives — and it lowers trust in their financial institutions. By having secure access to their data, they’ll be able to make more informed decisions about their finances and feel good about completing those banking actions digitally. Ultimately, this is what will drive higher retention and greater brand loyalty across all consumer age groups.

As financial institutions speculate on where to invest in future product development, delivering features that can enhance trust, like stronger security services, are a safe bet among both younger and older customers. Money management tools and virtual assistants should be considered as additional opportunities worth exploring, particularly for younger generations.

More details from the research

MX released a joint whitepaper with Finn AI, Q2, and Rival Technologies, based on the research described in this article. The paper explores the use of financial products and services by Gen Z, Millennials, and Baby Boomers and provides valuable additional insights into the relationship between Gen Z and digital banking, customer support preferences, and money transfer apps’ adaptive solutions.

About MX:

MX is the leading data platform for the financial world, providing the industry’s fastest, most secure, and most reliable connectivity network. MX partners with 16,000+ banks, credit unions, fintechs, and 85% of digital banking providers to power the money experience for over 200 million consumers.