It wasn’t until the 20th century that demographers started naming generations. First came the Lost Generation, referring to the millions of men and women born between 1883 and 1900 who died during World War I. Then there was Greatest Generation (born 1901 to 1925), those who came of age during the Great Depression and fought in WWII. That was followed by the Silent Generation (1925 to 1942), then Baby Boomers (mid 1940s to 1960s). The subsequent generation got assigned the anonymous letter “X” because there was nothing particularly noteworthy to mark their formative years. Millennials were temporarily called “Generation Y.”

And now we’re on to Generation Z.

Gen Z is generally defined as those born after January 1, 2000, although some researchers expand the range to start in 1996. There are other names kicking around for Gen Z — iGeneration, Post Millennials, Gen Tech, Pluralist Generation, Digital Natives and the Homeland Generation. Which moniker will ultimately stick? Who knows. But for the time being, we’ll refer to them Gen Z.

It’s worth noting that the “Homeland Generation” label originates from the fact that these kids were the first to grow up in a post 9/11 world, one where the U.S. rolled up every branch of law enforcement into the quasi-fascist sounding “Department of Homeland Security.” In the age of terrorism, Gen Z largely believes that the role of government is to “keep us safe.”

They also won’t remember the global financial implosion of 2008, nor will the Great Recession impact them the same way it shaped the perspective of Millennials. For the most part, Gen Z knows nothing but prosperity — a stock market that has risen 400% since 2009.

The oldest members of Gen Z are just getting out of high school, but like any teenager, they have already formed opinions and preferences about the world of finance, some of which is markedly different than prior generations.

Raddon Research Insights analyzed the results of a national survey encompassing more than 2,500 high school sophomores, juniors and seniors to examine the attitudes Gen Z has toward money. The report explores the ways in which financial marketers can start cultivating relationships with these future account holders and borrowers.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The Saving Generation

Some of the survey findings are intuitive. Virtually everyone in Gen Z uses social media at least once a week. They are willing to get financial services from a technology company. They embrace alternative payment methods like person-to-person (P2P) services.

But there are other, more surprising, findings. Unlike their Millennial predecessors, Gen Z are savers. Gen Z doesn’t want to repeat the mistakes made by previous generations — e.g., burdening themselves with massive student loans. Similarly, Baby Boomers were okay being “house poor” with huge mortgages. Gen Z is more reluctant to go down either path.

Read More: Gen Z Prefers Banks to Big Techs, But Shuns Branches

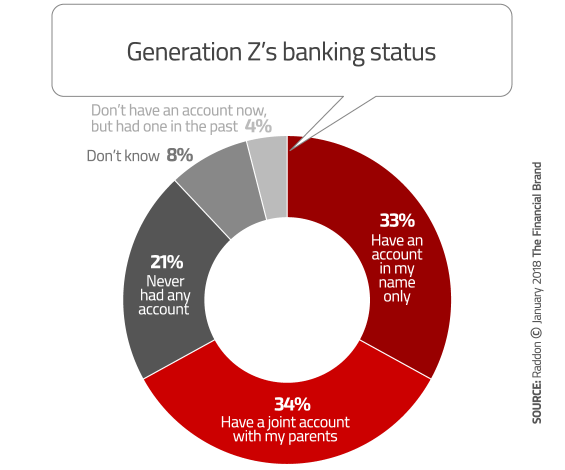

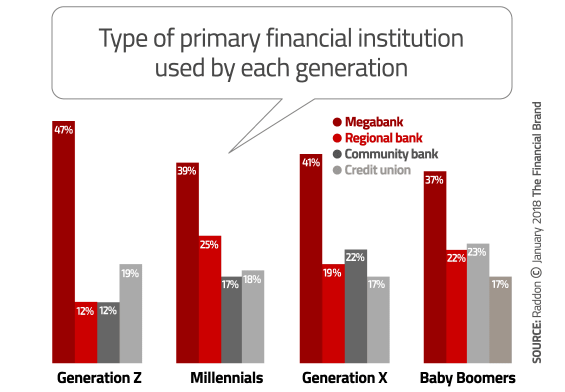

So it may seem difficult to believe since Gen Z can’t have amassed much in the way of “wealth”, but they have indeed already started saving. Many of them already have an account at a bank or credit union, either in their own name or as a joint account with their parents. They also tend to use only one primary financial institution (PFI), and roughly half have chosen one of the six largest banks as their PFI.

Reality Check: Bank of America already has a relationship with one in five Gen Z consumers.

Interestingly, Gen Z consumers who use credit unions are more likely to say they are very satisfied with their PFI (58%) versus 46% who use a major bank as their PFI. Perhaps Gen Z tends to default to those largest institutions with the biggest marketing budgets and the most robust mobile apps only to discover that they are not all they seem to be on the surface?

Gen Z Sub-Segments

Like any generational demographic, Gen Z is not homogeneous in their financial preferences. Based on their banking behaviors, Raddon has clustered Gen Z into three distinct categories:

- Conventionals (34%) – They like the face-to-face interaction that can get at traditional financial institutions. Conventionals are even distrustful of technology companies encroaching in financial services.

- Digitals (37%) –Like conventionals, digitals like traditional banks and credit unions, but prefer to interact digitally. They don’t see tech companies replacing their relationship with their PFI.

- Pioneers (28%) – They are more accepting of technology companies as financial providers and more distrustful of banks and credit unions. They’ll use traditional financial institutions only when they have to.

Gen Z Attitudes Towards Banking Providers

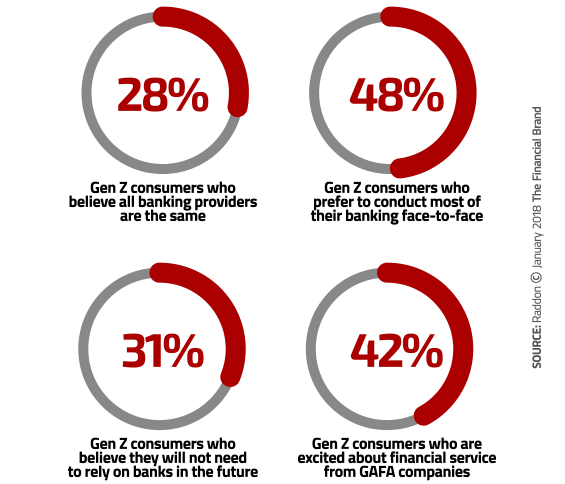

Gen Z consumers have some financial opinions that are difficult to square. For instance, 48% of respondents in Raddon’s research say they prefer to do their banking in a branch — face to face with an employee. Yet at the same time, a third believe they won’t need to use a traditional banking provider in the future, and 42% are excited about using companies like Google, Amazon, Apple or PayPal their financial affairs.

How is that going to work? You can’t switch to Apple or Amazon if you like doing your banking in person. Perhaps Gen Z hasn’t quite thought this all the way through? Maybe they just think the idea of banking with Google or PayPal sounds cool — that they would rather bank somewhere new and trendy, only to realize that an entirely digital/virtual relationship isn’t what they really want?

Financial Marketers Go to School

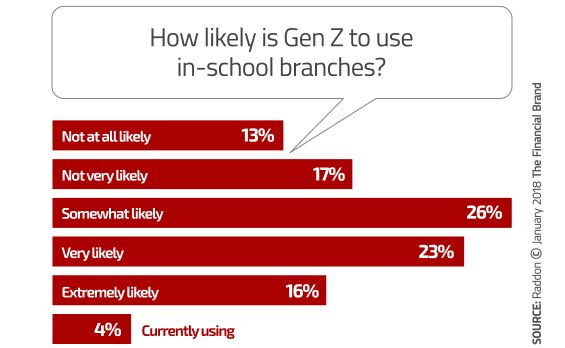

One way to get close to Gen Z is to intercept them where they are: high schools. There’s not many financial institutions taking advantage of this captive audience. Only 20% of Gen Z say there is a bank or credit union branch currently in their school, but 39% say they would be very or extremely likely to use one.

Royal Credit Union in Wisconsin has branches in elementary and high schools around the communities it serves, staffed mostly by students. The branches are open once a week. In 2017, students — through joint accounts with their parents — saved more than half million dollars. Students get a prize after every four deposits, and for every 500 deposits made, Royal donates $250 to their school.

Read More: Four Ways Banks Must Change Before Millennials & Gen Z Will Love You

Safety, Savings and Control

With their penchant for saving, Gen Z are pretty enthusiastic about products that encourage saving and living within a budget. For instance, Millennials are “meh” about pre-paid cards, with 35% saying they are currently using or are interested (by comparison, it’s 13% among all consumers). However, 46% of Gen Z respondents say they already use or are likely to use prepaid cards, presumably because these help control/limit spending.

In Raddon’s research, 49% of Gen Z either already uses or are extremely or likely to use no-overdraft checking compared to 19% of all consumers. No-overdraft accounts may not be very profitable in the near term, but remember that banking providers must win relationships with Gen Z early… before they move into their peak saving and spending years.

KeyBank is one institution offering a no-overdraft account, with its Hassle-Free Checking product. Considering that customers can’t get any checks with this account — ever! — it’s pretty obvious how people will dodge most overdrafts. After all, you can’t overdraw your account if there aren’t a bunch of unprocessed checks floating around out there. With this strictly-digital account, customers can make payments via debit cards, automated debits, wire transfers or bill pay.

In exchange, the account has no monthly maintenance fee, no minimum balance and no overdraft or NSF fees. Any transaction which would take the account negative is denied at the point of sale and therefore does not draw the account negative.

BECU encourages youth savings with their Early Saver Savings Account. Children under 18 are eligible for a savings account with no minimum balance nor monthly fee, which pays 0.10% APY. For balances up to $500, the account pays 6.17% APY. That higher rate means an extra $30.35 in earnings each year for kids who keep their balance above the threshold. On their 18th birthday, the account converts to BECU’s standard Member Advantage account.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Striking The Right Chord With Financial Education

Raddon research revealed that Gen Z is really tuned into financial education. And, Gen Z believes that financial education programs are extremely or very valuable, far more than all other generations. They want it, they appreciate it, and they are more likely than any other generation to attend a financial education program. They want to learn about budgeting, investing and understanding credit. They’ll use online education programs, but most prefer attending a group program. This is a golden opportunity for banks and credit unions willing to offer financial education.

Montecito Bank & Trust takes financial education program on the road every spring. In April, teams of Montecito employees visit schools throughout its market as part of a “Teach Children to Save” outreach initiative. In 2017, some 40 employees visited 22 different schools and interacted with 1,200 students, as they taught Gen Z kids the importance of saving, how to plan for purchases, and how to make their money grow. Older students learn about the power of compounding interest, budgeting, understanding the value and risks of credit, and the importance of safeguarding their financial/personal information.

Tips & Strategies to Target Gen Z

Based on the finding in the study, Raddon offers a dozen different ways banks and credit unions can connect with Gen Z:

1. You need to offer digital capabilities such as remote deposit capture and mobile banking — but you also need to provide Gen Z with access to a branch or at least a live (physical or virtual) person.

2. They love loyalty rewards, thanks to places like Starbucks. Offer accounts with reward points.

3. They also respond well to targeted messages on mobile devices.

4. They are skittish about bank fees and credit card interest, so give them the option of “safe” checking account options such as prepaid debit cards or checking accounts that don’t allow overdrafts.

5. They are savers so emphasis budgeting tools and automatic savings options.

6. Reach them with social media but with a focus on building your brand, not selling product.

7. Get your debit card loaded onto their Apple Pay or Samsung Pay app.

8. Don’t call them checking accounts. It’s a rare Gen Z who will actually write checks. Call them spending or transactional accounts.

9. Use gamification to encourage savings. Gen Z can compete for badges or points like Yelp’s Duke Badge, where you get “Duke status” by checking into a venue more times than anyone else).

10. Offer automatic deposits to savings accounts and allow them to direct savings into buckets such as college, clothes, etc.

11. Consider in-school branches, staffed with students. Even elementary students can be involved.

12. Offer financial education in topics such as budgeting, saving, how to manage credit and even how to finance college.