Not so long ago, studies and surveys reported Generation Z loved debit cards and avoided credit. It wasn’t the first time a generation said it felt that way: For a while, Millennials were wary of credit cards and hesitated to get into debt, having seen the troubles parents or older siblings faced during the mortgage crisis.

But Gen Z’s relationship to credit cards has changed big time, according to research by TransUnion, as well as analysis of its extensive credit database.

The company compared Gen Z to Millennials when they were in the same age range—22-24 years old — and adjusted dollar figures for credit use and income for inflation.

The research found that, as of yearend 2023, 84% of Gen Zers who are 22-24 years old had general purpose bank card accounts — 23 percentage points more than the proportion of Millennials at the end of 2013. While Gen Z held fewer private label credit cards (see the table below), the 23 point rise in bank cards exceeded the 18 percentage point fall in private label cards.

Product Penetration Among Credit-Active Consumers

The comparison is starker when it comes to balances — and debt-to-income ratios — on various forms of consumer credit held by the two generations at the same points in their lives. Especially notable among TransUnion’s findings is that credit card use among Gen Z is already outpacing Millennials even though less than half of Gen Z is old enough to be using credit.

According to Michele Raneri, vice president and head of U.S. research and consulting, TransUnion has records for 64 million American Millennials, which the company defines as people born between 1980-1994,. They were between 30-44 years old at the end of 2023. By contrast, of the 80 million members of Gen Z — born between 1995-2012 — only 38 million are old enough to be using credit and to be included in the credit bureau’s database. At that size, the Gen Z 18+ credit user segment is already nearly half the size of the entire Millennial generation.

Raneri conducted face-to-face and remote video interviews with Gen Z consumers concerning their use of and attitudes about credit cards and other forms of consumer credit. She found that attitudes and usage varied widely — even as her interviewees told her again and again that everyone in their generation did as they do.

This research, shared in an interview with The Financial Brand, suggests ways that consumer lenders can meet the needs of this expanding segment.

Getting Ready for Tomorrow: Practical Steps to Digital Maturity

This webinar explores practical steps to achieve digital maturity, tailored to the unique pace and needs of your institution.

Read More about Getting Ready for Tomorrow: Practical Steps to Digital Maturity

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How Gen Z’s Debt Burden Exceeds Millennials’

Raneri says the analysis of the two generations is a tale of two recessions. Millennials got hit by the Great Recession early on while Gen Z got a one, two punch: First, the pandemic-induced recession, followed by the flood of government spending and support that helped to produce today’s stubborn inflation. Inflation is driving credit card use among multiple generations as some consumers increasingly rely on credit to make up the shortfall between income and expenses. Both TransUnion and Federal Reserve studies show this has pushed outstanding credit card balances beyond $1 trillion.

However, Gen Z faces a growing challenge. As the table below shows, even when Millennial use of credit at 22-24 is adjusted for inflation, the average balances owed by Gen Z at yearend are always greater.

Increasing Balances Reflect Higher Inflationary Pressures on Gen Z22-24 year olds

Credit card average balances among Gen Zers 22-24 were 26% higher at yearend than the average balances adjusted for inflation among Millennials 22-24 years of age in 2013. Auto borrowing is up 14.3% for Gen Z. And reflecting inflation, constricted housing supply and additional factors, among Gen Z mortgage holders’ average balances are up 44.3% over Millennials in 2013.

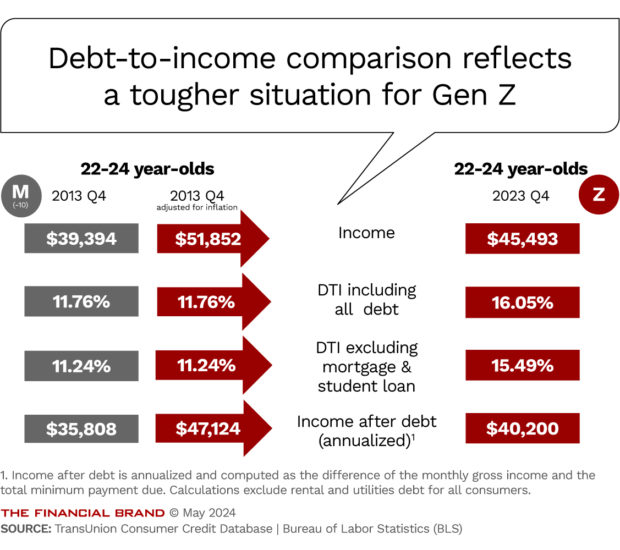

Underscoring the situation is TransUnion’s comparison of the two generations’ debt-to-income ratios at the same points in their lives, as shown below.

When applied to all types of debt, Gen Z faces a ratio of 16.05%, compared to 11.76% for Millennials. Backing out mortgage and student debt does little to change the ratio.

Further, when the 2013 income of Millennials is restated for inflation, they were making almost 15% more than the average among Gen Z today.

The analysis of credit records also found that in the 24 months following origination of new accounts, Gen Z experienced higher delinquency rates for auto, credit card and personal loans. Almost 10% more Gen Z borrowers were 60 or more days past due compared to Millennials a decade earlier.

Other age segments have also seen rising delinquencies in the current economy, according to TransUnion. However, the company says, “The rise seen among younger 22-24-year-old consumers, who are early in their credit journeys, warrants ongoing monitoring.”

Not surprisingly, researchers also found that Gen Z consumers see themselves more negatively than Millennials surveyed recalled feeling when they were 22-24. The Gen Zers say they are less financially stable, less confident about credit, and generally more stressed.

Read more: Credit Cards Fuel Big Banks’ Loan Growth Amid ‘Normalization’

Gen Z and Credit: Looking Beyond Credit Performance

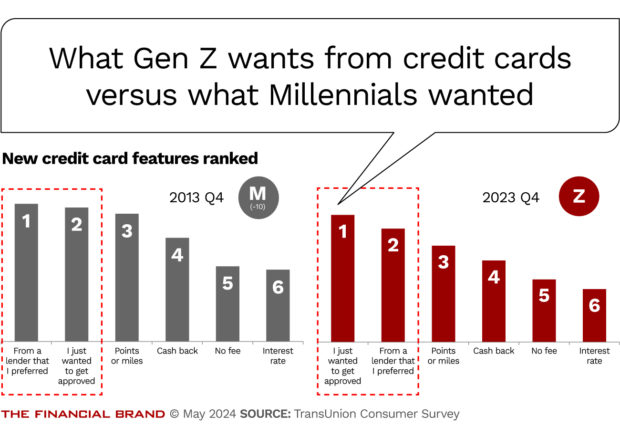

Despite all this, Gen Z is not particularly focused on the potential cost of their credit card usage: The interest rate on a card ranked last of six features Gen Z focuses on.

Many of the Gen Zers interviewed by Raneri seemed ill-prepared by their education for using credit. Indeed, they acknowledge it. Instead, “they learned about credit from movies and social media, such as TikTok,” says Raneri. She thinks this is part of the reason Gen Z doesn’t focus on factors like interest rate when first obtaining credit cards.

Absent the availability of any formal credit education, Raneri says that some Gen Zers interviewed admitted that they’d learned what they know simply through making mistakes and then figuring out what to do after they stumbled.

“There’s an opportunity for lenders to help supply some of the education that’s missing,” says Raneri.

Read more:

- BNPL’s Dark Side: Younger Consumers Face Credit Trouble Ahead

- Should Banks Beware Credit Score ‘Grade Inflation’?

- Shocker: Amex, Chase and Citi Top BNPL Satisfaction Rankings

How Can Card Lenders Make Better Connections with Gen Z?

Given that many in Gen Z aren’t of age yet, Raneri thinks this gives institutions time to improve how they interact with these young consumers. Some suggestions:

• Gain better understanding by talking to fresh faces. Bankers and credit union executives can have trouble identifying with the mindset of credit newcomers because they are steeped in their own knowledge and surrounded by atypical consumers. Friends, family members and employees don’t make good sounding boards because they’ve been exposed to education over time from an industry insider.

Raneri says it’s critical to get a fresher view because she found that many Gen Z consumers have no clue what card issuers are talking about when they use commonly accepted phrasing. Examples include “authorized user” and “credit builder.”

She says one Gen Z woman verbally tussled with her over “authorized user.”

“That is the stupidest term I’ve ever heard,” the woman concluded, having had the meaning explained to her by Raneri. “They need to change the name of that.”

• Recognize that clever can be too clever. Raneri found that many people, asked about credit builder cards, didn’t equate them with secured cards that enable someone to slowly build a positive credit history. They were more likely to think that such cards were subprime offerings, priced to match and to be avoided.

“You’ve got a great opportunity to help them,” says Raneri, “but you also have to name services with names they’ll understand.” She says it’s possible to push a term into the vernacular, but it takes time and persistence.

• Look for ways to educate consumers in the moment as they are applying for or using credit cards and other consumer borrowing features.

Educating young consumers in advance of their credit use can be difficult. Historically many bankers have found that school systems resist having them come in to teach pupils about money. While the Internet offers many resources, not everyone devotes the time to educating themselves before borrowing.

Raneri suggests building education into the credit process. Features like pop-up definitions and explanations can help, giving people a bit of insight while they are using the bank’s app or a website.