“Can you help us figure out what the heck banking is going to look like after the COVID-19 tsunami?” is a question consulting firms all over the world are being asked by clients. Closely followed by: “What do we need to do to be ready?”

Digital consulting firm 11:FS put together a 100-page report examining how the COVID-19 pandemic and its economic aftermath will affect banking in the near term and further out. (The report also covers the impact on the insurance and investment industries.)

A Severe Economic Wallop for Banking

The 11:FS report doesn’t mince words about the economic impact of the coronavirus pandemic:

“The short-, medium- and long-term consequences for the financial services industry are severe. Revenues will drop across most business lines and capital will be precious,” it states.

Though significant loan delinquencies have not kicked in yet, few doubt that they will. Through April, the cumulative new filings for unemployment totaled 30.3 million Americans. Some states are beginning to ease their lockdowns, allowing certain nonessential businesses to reopen. However, business is unlikely to be anywhere close to normal for some time.

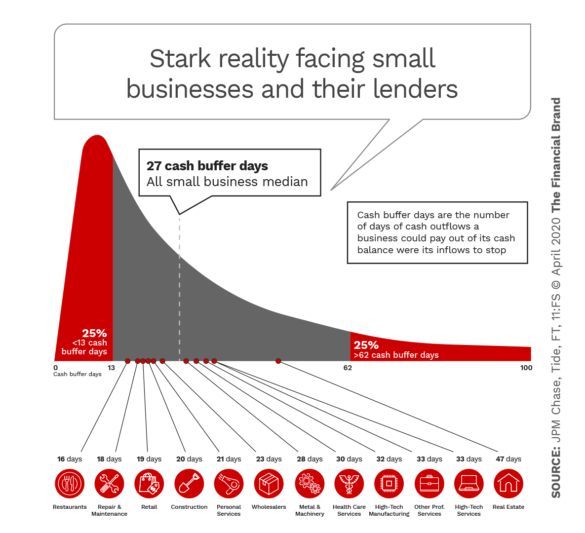

That’s a crucial point. Half of U.S. small businesses have a cash buffer of less than one month according to JPMorgan Chase data cited in the report.

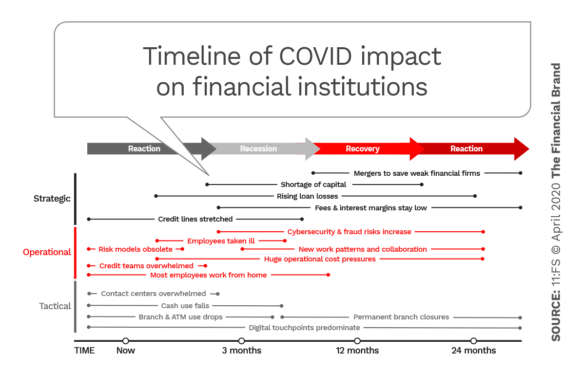

The report goes into more detail on the pandemic’s impact, which, it says, has created “a short-term operational crisis and a long-term revenue loss for financial services firms.” The consultancy created a four-stage timeline to depict the multitude of challenges financial institutions now face.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

5 Long-Term Effects for Banks and Fintechs

Pre-crisis, the banking business overall could be characterized as “gradually digitizing traditional processes with no great urgency,” the report states. The end game of that process — now much more urgent — is for financial institutions to “embrace digital technology and truly digital ways of working to transform their cost bases and uncover new revenues.”

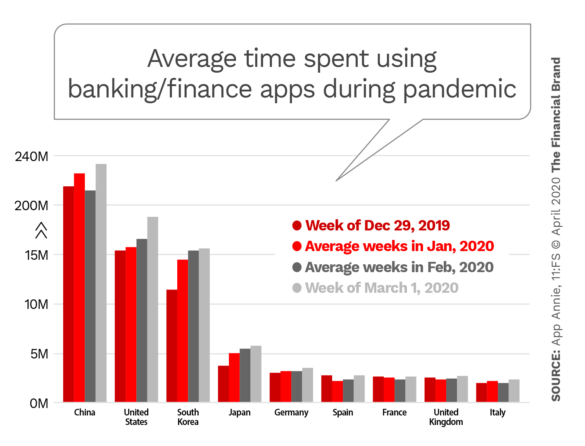

For many institutions the sometimes chaotic reality of having to shift most banking to digital-only almost overnight during the lockdown period will prove to be the catalyst for reinvention, 11:FS believes. Even during the earlier stages of the pandemic, banking and financial app use shot up in the U.S. and elsewhere.

Broadly the 11:FS analysts expect to see five long-term effects on banking of the pandemic:

- Digital partnerships will proliferate, including the rapid growth of “capabilities-as-a-service.”

- Marketplaces will capture a growing share of distribution. Open banking will accelerate this shift.

- Artificial intelligence use will increase, both for operational efficiency (identifying fraud), and customer experience (tailoring content and recommendations).

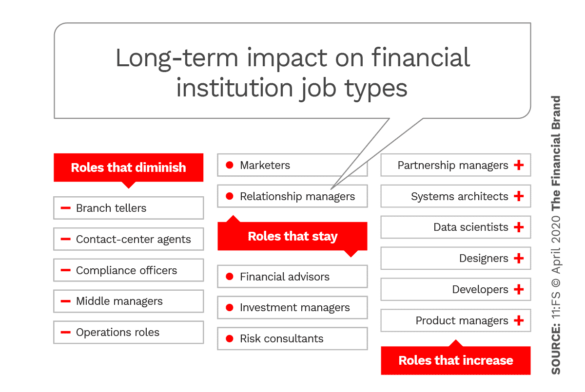

- Fewer people will be needed in some roles (teller and contact center agents) and more in others (advisors and relationship managers).

- Leaner organizations will emerge as a result of all these factors.

Impact on fintechs. 11:FS works with many fintech organizations and it sees a significant impact from the pandemic in that sector, as well.

“The hot air has been let out of the fintech bubble,” the report states. “The sudden onset of recession has closed some of the exit options for venture capital investors. Euphoric valuations based on unrealistic growth expectations will crash back to earth.”

The firm predicts a spike in mergers and acquisitions among both traditional institutions and fintechs. Benjamin Ensor, Director of Research at 11:FS, addresses both types of institution in response to questions from The Financial Brand.

Will upcoming bank mergers result more from capital pressure or from a lack of digital capability?

Benjamin Ensor: Both will play a role but capital pressures and operating costs will be the decisive factor as the world’s economies fall into recession.

With revenues falling sharply, and profitability even faster, and with rising loan and investment losses, financial institutions will seek to preserve their capital. This will threaten the viability of less efficient firms and those that are heavily exposed to particular sectors, like aviation, construction or restaurants. They will be faced with some stark options: Cease to exist — and some banks will fold — or look to merge.

Institutions with a healthier balance sheet will look for strategic acquisitions as targets will likely have a lower price.

Read More: Gap Between Legacy Banks & Fintech Firms Has Shrunk

Fintechs are also under pressure. Will they merge among themselves or be acquired by financial institutions?

Ensor: Companies that just three months ago may have been out raising a larger capital round to grow their business suddenly have to switch to survival mode. Further, the IPO market is now effectively closed in the current environment, so start-ups looking for a soft landing or an exit now have fewer options.

Newer fintechs focused on payments or card businesses often rely on transaction volume for revenue that extends their runway. Payments volume is down dramatically with most bricks and mortar retail now closed. While larger payments businesses likely have the balance sheet to weather the storm, younger ones may struggle.

Specialist fintech lenders who do not lend from the balance sheet and rely on securitization may also struggle.

In contrast, fintechs built around savings and investment apps are doing exceptionally well. Robinhood, in fact, has struggled to cope with volume of retail transactions as investors either seek safety or want to trade in a more volatile market.

“Financial institutions are less likely to buy a challenger bank during this period unless it will make a significant contribution in the short term.”

— Benjamin Ensor, 11:FS

Challenger banks present a mixed picture. Customer growth and transaction volume appear to be lessening, but different organizations have different levels of runway. Challengers that were still at the pre-profit stage going into the pandemic may look exposed now but could have assets of significant value (e.g. strong brand, strong tech).

Fintechs without decent revenues, or a clear path to revenue sustainability and ultimately profitability, will struggle to raise new funding or even survive. Where there are complementary services we could see mergers between fintech firms that result in a larger combined market. For example, a consumer-focused challenger bank in combination with a digital-mortgage or SMB-focused fintech.

I expect we will see many smaller fintechs being acquired by large technology vendors like Intuit and Temenos and cash-rich digital giants like Ant Financial or Tencent. Financial institutions are less likely to buy a challenger bank during this period unless it offers a service or underlying technology that will make a significant contribution in the short term.

In a post-COVID world is there still a role for in-person banking?

Ensor: The “death of the branch” has been rumored for more than a decade, it’s true. The fact remains, however, that more branches exist than are really required for customers to perform most tasks, which is a reflection of poor digital experiences.

The fundamental benefit of a branch is to give a human experience, particularly when discussing difficult financial situations, or for the major lifestyle events such as applying for a mortgage. What many of the new digital services have shown us, which has only been magnified by the current crisis, is that it is possible to offer that personal touch and quickly communicate important messages and information through digital touchpoints in a highly effective and empathetic way.

We cannot underestimate that this is a health crisis that will help to redefine how we think about physical workspaces. As physical distancing measures are eased we may see customers who simply don’t want to risk going to a branch when they can perform most tasks through online or digital app-based banking. Or employees who won’t feel comfortable working in them.

All that said, there will be banks that find a way to make the branch experience safe in a physical health sense and find a way to use their existing real estate footprint.

How can you afford to invest in digital transformation with capital shortfalls and decreased profits?

Ensor: The notion of new investment at a time of cost pressures could seem counterintuitive. But the only way to make financial institutions more efficient, and reduce costs, is to replace inefficient paper-based and batch-based processes with real-time digital processes that create more value for customers.

Institutions that have ignored the digital imperative for the past decade have been caught out by the sudden mandatory adoption of remote working, the mass closure of branches and contact centers and the impracticality of paper-based processes. The ripple effect of that will be felt for a long time.

The customer contact center is an obvious area for digital investment. Incoming calls from anxious customers skyrocketed at the very time contact centers have been forced to close by the coronavirus, resulting in many customers having to wait hours to reach human help.

Digital investment is fundamentally an investment in protecting and improving the bank brand.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Who do you see as the likely winners and losers in banking at the end of this transition?

Ensor: Large banking groups have the balance sheets and reserves to weather the current situation and emerge as the winners. When you combine their market dominance with their technology budgets and access to capital to acquire companies, it paints a gloomy picture for mid-tier and larger regional banks. They are stuck between the huge institutions and the hyper-focused approach of community banks and credit unions.

However, even the largest banks have digital challengers looking to take customers from them — the likes of Chime, Varo Money and SoFi, along with firms such as Betterment, which will be launching a checking and savings service, and Robinhood.

These are all well-backed firms, gaining customers through a highly empathic and human message. Other fintechs, however, such as Dave and Majority, may struggle. But each has been attempting to carve a niche — launching digital accounts for immigrants, for example — that could help them stand out.

Community banks are in an interesting space. They are highly dependent on a small group of core banking service providers, it is true, which limits their ability to differentiate from a product standpoint.

But then you have examples like Oklahoma’s Citizens Bank of Edmond, where Jill Castilla and her team are held up as an example of a single-branch bank with a highly connected and engaged customer base.

The focus on the unique needs of their community and customer base is a distinct advantage for such institutions. They don’t have a national or even state footprint where they have to service tens of millions of varying customer needs and wants.

This narrow focus can and should be the unique advantage community institutions have over their larger competitors.