In February 2022, MoneyLion was going all in. The company had just completed its $440 million acquisition of embedded finance marketplace Even Financial, and it was hosting a high-profile consumer marketing event tied to Super Bowl LVI – an online party featuring Mike Tyson, NASCAR’s Kurt Busch and a trove of high-profile athletes.

Then everything changed. That summer, the easy money pools that drove high-profile fintech marketing suddenly dried up. At New York City-based MoneyLion, executives realized the company had to shift gears. They didn’t want to go for broke — or perhaps just go broke — on mass marketing. Instead, the company began work on an efficient, data-driven customer acquisition strategy built on content hooks.

Meanwhile, a surge in demand for digital banking touch points injected new potential into the Even Financial acquisition. The unit, rebranded to “Engine by MoneyLion”, ramped up to sell financial marketplaces and search tools that help companies ranging from news publishers to financial wellness websites connect users to third-party financial providers in exchange for a fee.

This two-sided ecosystem – consumer finance paired with enterprise embedded finance – has helped MoneyLion rebound to growth. In the third quarter, the company reported a revenue boost of 24% from the year earlier, to over $110 million. It has gone from losing money at the start of 2022 to building what the portfolio management company Stone Fox Capital calls a $13 million “profit in the process,” measured by the company’s earnings before interest, taxes and amortization.

“They’re definitely starting to separate themselves out from the group,” says George Sutton, an analyst at the investment bank Craig-Hallum. “When you see someone bringing customers in as inexpensively as they are, there’s something unique.”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

MoneyLion Goes Deep, Not Broad, to Drive Customer Growth

To drive its comeback, MoneyLion pivoted from often-expensive methods of new customer acquisition. It focused instead on getting existing users to engage with its services frequently — more like social media than a digital bank — and then cross-selling its products.

The company has built out a dense ecosystem of content, newsletters, blogs, websites, widgets, marketplaces, and social spaces that hook customers on one touchpoint — whether financial and social content, advice or product offers — before selling them on another.

MoneyLion also offers carrots — including up to $50 in cash and couponed deals — to users who refer the app to friends.

“We are now spending more dollars on our own ‘walled garden’ than we are on performance marketing outside of our ecosystem,” says MoneyLion chief executive, Dee Choubey. “The marketing spend doesn’t need to be as large in nominal dollars as it was a year ago to actually be way more productive.”

Dig deeper: Marketing Boosts Deposit & Loan Growth for Community Banks

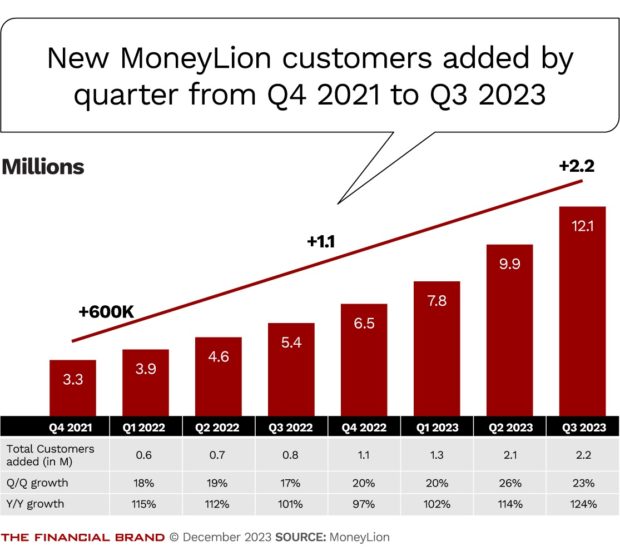

The results are telling. The company grew its membership base to 12.1 million customers in the third quarter, a 23% quarter-on-quarter uptick from when it was already ranked the fourth largest neobank in the U.S. by the consulting company Simon-Kucher. In the third quarter, the company put its customer acquisition cost at $15 and its average revenue per user at $40.

In an interview with The Financial Brand, an emboldened Choubey projects that the MoneyLion app will be a single-destination financial provider and social destination for 40 to 60 million Americans by 2025.

That’s an extremely ambitious goal. The low end of his target range would translate to about 11% of the current U.S. population.

MoneyLion’s Engine That Could

As notable as the surge in its customer base is, the real engine driving MoneyLion’s growth is the embedded finance business. The company’s enterprise play is making up a growing share of its revenue: By the second and third quarters of 2023, Engine contributed roughly 35% of the company’s total revenue.

“The Even Financial business that they purchased really gave them the ability to extend their offerings out to a much, much broader universe of options,” Sutton, the analyst at Craig-Hallum, says. “I think we can now look out to the other end of the rainbow — at something that looks pretty unique and could have a very large market.”

“The Even Financial business that they purchased really gave them the ability to extend their offerings out to a much, much broader universe of options.”

— George Sutton, Craig-Hallum

MoneyLion has married its own product relationships and data with Engine’s hundreds of financial and channel partners to create a service to help a range of financial and nonfinancial companies generate revenue from their internet traffic. Engine uses a wide range of APIs to match users with products based on their financial backgrounds and needs. The offerings are built in-house and by over 400 third-party financial partners offering a range of products from loans and savings to insurance, credit cards, mortgages and more.

Enterprise partners — the companies that pay MoneyLion to embed its marketplace into their websites — receive a revenue share from the third-party financial providers listed on MoneyLion’s marketplaces when users match with one of their products. Meanwhile, MoneyLion charges the product provider origination and software-as-a-service fees, Choubey said.

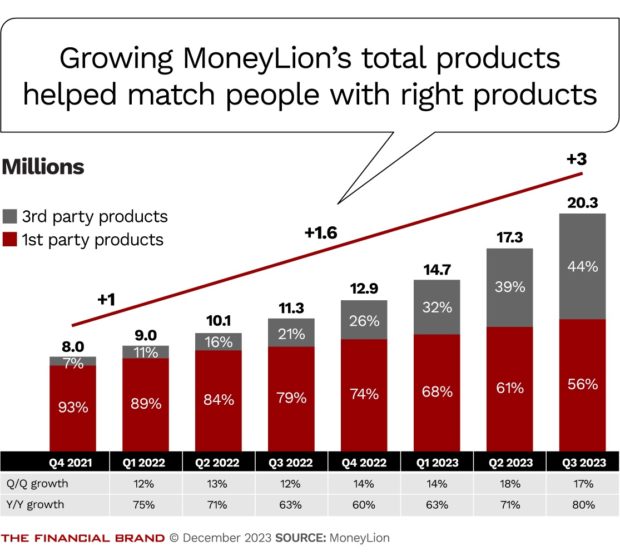

Increasingly, MoneyLion’s users are leaning into its financial partners. The majority of customers added in the third quarter of 2023 started out by using an out-of-house financial product, rather than a MoneyLion offering.

“Because we’re embedded in so many websites, the cost to generate that revenue is significantly lower.”

— Dee Choubey, MoneyLion

With MoneyLion recording a ballooning list of over 1,100 enterprise partners, Engine generated over $39 million in revenue in the third quarter, more than a 14% hike from the year before. “Because we’re embedded in so many websites, the cost to generate that revenue is significantly lower,” Choubey says.

As tight credit markets have shifted demand away from expensive loans, Engine has kept consumers engaged with third-party products like high-yield savings. In the third quarter of 2023, personal loans made up 55% of the enterprise business’ revenue, 30% less than the year before.

“We are seeing that lenders are pulling back because there’s just uncertainty around interest rates,” Choubey said on the company’s most recent earnings call. “The feedback that we’re getting from our lenders is that as soon as we see a modicum of stability in the rate forecast, we actually anticipate personal loans also to come back at some point in 2024.”

Read more:

- What the Federal Crackdown on Bank+Fintech ‘BaaS’ Partnerships Means

- MoneyLion Brings Platform Banking to Life with a Financial Marketplace

Synergies Emerging from the Twin-Track Model

Choubey says MoneyLion’s diversified business model gives it an edge over competitors.

“We earn economics on a vast majority of the financial transactions taking place, as opposed to just relying on what’s happening in our own ecosystem,” Choubey says. “I think that’s really the big differentiator from the business models that are out there.”

“When you see someone bringing customers in as inexpensively as they are, there’s something unique.”

— George Sutton, Craig-Hallum

MoneyLion also stands to capitalize in other ways from making its early foray into embedded finance. Engine may have the data and product advantage to stay ahead of what Future Market predicts is a sector with a market value set to grow to $291 million at a compound annual growth rate of 16.5% over the next decade.

And Engine’s growth could feed back into MoneyLion’s consumer business. Each time the enterprise business acquires another product partner, it adds that offering to its consumer platform, and vice versa. Between the first quarter of 2022 — when MoneyLion completed its Even acquisition — and the third quarter of 2023, it has more than doubled the number of product customers have initiated, from 9 million to 20.3 million.

While most of the users that engage with Engine’s marketplace on third-party sites don’t become customers, their interactions add to the company’s data trove. Already, MoneyLion has gathered over 32 million full consumer profiles, building insights it uses to track consumer engagement and power artificial intelligence tools that provide users with tailored product matches, financial and investment advice and influencer-produced videos on money matters.

The company also uses the insights it collects to anticipate fraud signals and predict whether a user might be denied a credit product or default on a loan.

The company also uses the insights it collects to anticipate fraud signals and predict whether a user might be denied a credit product or default on a loan.

That data is coming from a wide consumer base. While the consumer businesses’ target audience has largely been younger generations and workers with irregular paychecks — who typically have lower credit scores and $50,000 to $150,00 in household income — the Engine typically connects channel partners with consumers who have FICO scores above 740 and up to $250,00 and $300,00 in household income.

That enables MoneyLion to offer the products and in-app content it needs to reach and hook a broad range of consumers, regardless of where they are on the fiscal ladder.

“That is the secret sauce that we’ve built internally to take a cradle-to-grave strategy,” Choubey says.

Charles Gorrivan is a contributing writer at The Financial Brand. In the summer of 2023, he covered the financial services industry for American Banker through the Dow Jones News Fund Business Reporting Program. In 2022, he reported on the New York governor’s race for Gotham Gazette.