A recent Forbes article, written by the founder of a fintech startup, listed three reasons why fintech is supposedly failing:

- Strategic contradiction between tech and finance. The “contradiction” is supposedly that “the tech idea that you must get big fast and dominate a sector is at odds with the slow-moving nature of finance, and lending in particular.”

- Market realities encourage short-term thinking. According to the author, “market realities and investor demands force organizations (like Lending Club and OnDeck) to abandon data and technology in favor of traditional sales techniques. This growth-at-all-costs mentality is incredibly damaging for the industry.”

- Incumbents in the market are powerful and resistant to change. To quote the author: “Incumbents in the finance sector are incredibly powerful and complacent. Most don’t fear fintech companies looking to take their business because, frankly, not a single one poses a real threat at this time.”

Debunking The Three Reasons

If fintech is failing, these aren’t the reasons. My counter-arguments:

- There is no contradiction between tech and finance. The deployment of ATMs, online banking, online bill pay, eBills, mobile banking, remote deposit capture, online account opening, etc. all prove that tech and finance are very well aligned. Beyond banking, there’s online trading, telematics in insurance, etc.

- Dominating a sector is not a dominating goal. Not every fintech startup goes into the market expecting or hoping to be an Amazon or Google. Many seek to fill unmet needs in various (and not necessarily large) niches of the market. Furthermore, these niche opportunities exist because technology enables a firm to profitably fill the need a non-technologically-driven approach could not, further refuting the “contradiction between tech and finance” argument.

- The venture capital business actually encourages and enables long-term thinking. The short-term pressures on startups is not a “growth-at-all-cost” mentality. If anything, there’s not enough of a (customer) growth mentality, as too many focus on tech development vs. tech deployment.

- Incumbent banks aren’t complacent. The definition of complacent is: “Showing smug or uncritical satisfaction with oneself or one’s achievements.” That doesn’t describe today’s banks. They’re simply unable to react fast to changing technologies and market needs. Don’t confuse that with complacency.

It is true, however, that incumbents are powerful and resistant to change. But that’s not a reason why fintech is supposedly failing — it’s the reason why fintech startups have an opportunity to succeed. If powerful, large banks weren’t resistant to change, they would have already developed and deployed whatever it is fintech startups are working on.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

The Real Reasons Why Fintech is Failing

There are other reasons why fintech is failing — or better yet, why certain segments of fintech are failing (in the US, at least).

Neobanks (sometimes referred to as challenger banks) have not gained much traction in the US. Simple is often considered one of the first neobanks on the scene. It would be hard to consider the firm’s market performance a rousing success, let alone disruptive. The question to address is “Why?”

The answers should be of interest to the fintech entrepreneur who wrote the Forbes article cited above. To move an established and entrenched marketplace like banking, a fintech startup needs to come to market with a step-function improvement in:

- Convenience. Digital music was a step-function improvement in convenience — no more physical CDs to deal with. Simple and other neobank startups don’t (and haven’t) come close to offering the step-function improvement in convenience needed to move the market.

- Cost reduction. Digital photography was a step-function improvement in cost reduction — no more buying film. In the screwed up world of banking, the major costs incurred by consumers are penalties (e..g, overdraft and late fees) and interest expenses. Fintech startups have failed to address these costs on a mass scale.

- Performance. The third way to disrupt the status quo is to deliver superior performance — e.g., increased return on investment. Robo-advisors promise this to consumers who can’t afford (or who don’t want) a human advisor relationship. If the delivered ROI of robo-advisors exceeds that of the human advisors, the human advisors are in big trouble.

Viewed through these lens, if certain fintech startups are failing then it’s their own fault for not focusing on specific and well-defined opportunities — and not because of the reasons listed in the Forbes article.

And when viewed through these lens, it seems clear (to me, at least) that the big opportunity for fintech is not directly with consumers, but with the incumbent financial institutions themselves. The incumbents are the ones most in need of added convenience, cost reduction, and higher performance.

Wait a Second, Fintech Isn’t Failing

What is happening is that fintech isn’t living up to the hype.

Early talk of disruption, displacement, and dinosaurs becoming extinct made for great press, but didn’t pan out.

There are measures of fintech success other than the failure of incumbents, e.g., the incumbent’s investments in fintech startups, and/or the importance of fintech in incumbents’ strategic planning efforts.

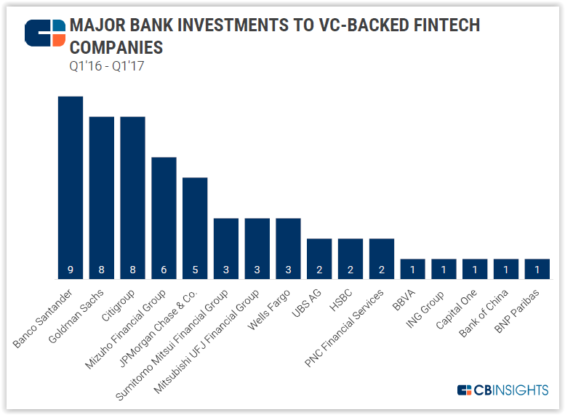

According to CB Insights, since 2012, the top ten US banks by assets under management have participated in 72 rounds totaling $3.6B to 56 fintech companies. Five of the top retail banks in the US have done 19 deals in the past year alone (see the chart below). This doesn’t include non-investing initiatives the banks have entered into with fintech startups.

In addition to the investments that the largest banks have made, another sign of success is the degree to which fintech has become as a strategic planning topic among banks and credit unions of every size.

Some people may think banks and credit unions are ignoring or are blind to fintech threats and opportunities, but that’s not what my colleagues and I find among the mid-sized financial institutions we work with every year.

Looking Past the Perfect Storm

What’s happening to fintech is that the “perfect storm” is abating. Early fintech startups benefited from a “perfect storm” — an unprecedented convergence of four forces:

- Economic conditions. The downturn in the economy around 2007-2008 helped create negative sentiment towards banks, opening the door to new participants.

- Demographic change. The change in consumer sentiment, in and of itself, would not have been sufficient for fintech success. The influx of Millennials coming into adulthood (chronologically, if not behaviorally) between 2008 and 2016 helped to fuel fintech startup growth. These consumers, with no prior history of working with established providers, were more open to new providers.

- Technological change. On the heels of the recession and Millennial Mania came the development of online and mobile technology maturity. Without this maturation, fintech startups would have found it hard (or harder) to reach and serve a critical mass of consumers.

- Regulatory change. The regulatory changes that took place over the past ~8 years all but shut off the spigot on lending to non-credit-worthy consumers and businesses. This further opened the door to fintech startups, who have been willing to lend to lend to borrowers unable to get funds from banks.

Fast forward to 2017, and here’s what fintech startups are facing:

- An improving economy. A stronger economy should raise the credit-worthiness of both consumers and businesses, making them more attractive to the incumbent banks.

- Further demographic change. The oldest Millennials are already in their mid- to late-30s. Historically, consumers in this age range have better credit scores than consumers in their early 20s. More business for the incumbents.

- Regulatory easing. This hasn’t happened yet, but if and when it does, it should further open the lending spigot from banks.

- Funding challenges. Getting funds to lend will increasingly be a challenge for startups (and incumbents). Hence, acquisitions like SoFi’s purchase of Zenbanx. Will it be enough?

- Scaling challenges. As incumbents catch up with fintech development, and as they enjoy the luxury of sitting back and waiting to see what changes will be real and which won’t, they’ll have their pick of fintech startups to partner with to help those startups scale. Other fintech startups will face stiff challenges in terms of marketing and business development funds and skills to grow their businesses.

Maybe Fintech is a B2B, not B2C, Business

Bottom line: Fintech — as a set of startups or a class of technology — is hardly failing.

If individual startups are failing, it’s likely due more to business model shortcomings than to the reasons listed by the author of the Forbes article.

For all the talk of partnerships and investments, the reality of the fintech market (in the US, at least) is that incumbent banks may very well be fintech startups’ best prospects, not their competitors.

In any case, fintech startups would be wise to ignore the ‘fintech is failing’ nonsense.