For most mid-size and community financial institutions in the U.S., the dominant “challenger bank/neobank” theme of the recent years has been one of “Watch out, they’re coming to eat your lunch.” In reality, it’s far more nuanced than that.

Unless they obtain a banking license challenger banks need to partner with a chartered financial institution to take deposits and have direct access to the payment system. In the U.S. market, several challengers are in the process of applying for charter, but so far only one, Varo Money, has received a national bank license.

This situation creates a very interesting dynamic for many incumbents. Small and mid-size financial institutions provide the backbone of banking services in thousands of communities, but they are hampered by several factors including legacy technology, lack of tech-savvy talent, and of course budgetary constraints. They also face competition from behemoths like Chase, Bank of America, Wells Fargo and Goldman Sachs.

So incumbents are challenged by the giants on one side and tech-savvy challengers on the other. But the challenger banks have yet to find their footing in actively earning interest income.

Maybe there is a big opportunity here.

Community banks and credit unions already have the advantage of having established customers with a definite deposit and loan base to drive revenue. Partnering with a challenger bank or another fintech presents them with the potential to gain operational efficiencies and provide existing customers with improved services while also discovering new customer segments.

In the rest of this article, we’ll explore four key strategies of the most successful U.K.-based challenger banks — Monzo, Starling Bank and Revolut. These competitive insights could prove useful to traditional banks and credit unions not only for speeding up their own digital evolution, but in terms of better understanding the potential for collaboration with these or other digitally savvy players.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

1. The Product Strategy

Everyone wants to be ‘cool’ and what’s cooler than having a fancy, vibrant card and user-friendly banking services literally at your fingertips on your smartphone? That is precisely what these challenger banks aimed for:

- Monzo had its Hot Coral card and engaged the community for inputs.

- Revolut provided multi-currency features at interbank rates for the global generations.

- Starling Bank created a fully digital and intuitive current account for the digital citizens.

But these three challengers haven’t come all this way based just on product. They backed it up with cognizant features that understood customer behavior. Features like the Gambling Block provided by Monzo and Starling Bank — which helps users with gambling problems — proved to be perceptive of customer needs.

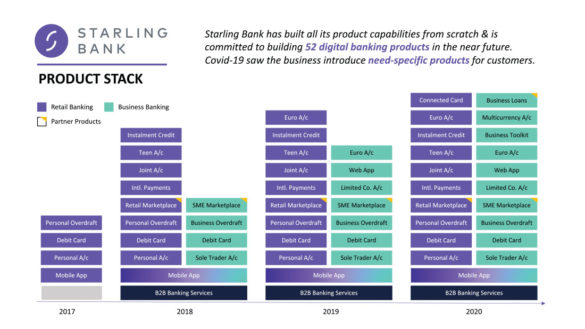

During COVID-19 when many people found it difficult to venture out for groceries, Starling Bank introduced Connected Cards, which users could share with their trusted helpers. Revolut introduced Donations to help users donate to causes that resonated with them.

These aspects go beyond the purview of “banking” and show a customer how their service provider actually cares about and values their financial situation.

Starling Bank is a beautiful example of having a strong and clear vision of a product. The time spent obtaining a U.K. banking license was used to build an efficient technological back end. This allowed the bank to release newer products quickly. From retail-only current accounts in 2017 to a blossoming product offering across retail and small business users in 2020, the product strategy of Starling Bank has enabled them to become a comprehensive service provider in just three years.

2. The Customer Strategy

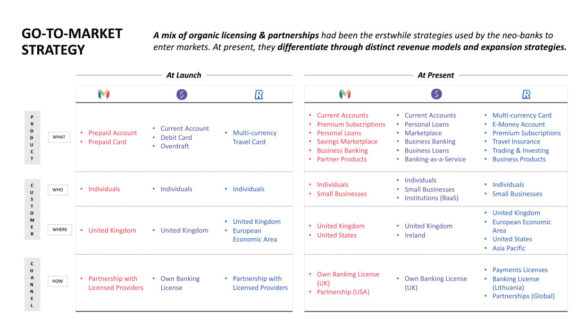

Customers are core to any business and therefore it makes sense to clearly define the target customer segments at the get-go. This trio of challenger banks each started out with retail customer propositions. As the banks grew, this scope expanded to small businesses.

Within these broad categories, the banks found a niche among various sub-segments. Monzo and Starling Bank both introduced teenager banking, for example. Collective banking services like joint accounts, group savings and P2P payments emerged as a natural progression of services for these young consumers.

On the business banking front, the banks grew to encompass small and midsize companies. Starling Bank went a step further and leveraged its technological capabilities to provide banking-as-a-service to other financial institutions.

At the back of this, the customer acquisition strategies played a pivotal role. Make a product that’s good and people will talk about it. Across all three banks, organic referrals were the primary driving force when it came to early-stage adoptions, and all three actively leveraged social media. Eventually the banks employed traditional channels including television advertising.

These strategies produced rapid growth metrics. Monzo grew its user base from three million to four million customers in six months following its TV advertising campaign. Revolut has been adding a million new users per month, but that has more to do with its geographical expansion.

As of October 2020, Revolut provided services in 36 countries. Outside of its U.K. home turf, the fintech’s go-to strategy is to a partnership with a local financial institution along with an e-money payments license. This helps it roll out its primary multi-currency account and card offering in a more time and cost-effective manner.

Read More:

- Fintechs Draw Increasing Attention in Social Media Banking Chats

- Are Challenger Banks on the Rocks? Or Will They Rock You?

3. The Partnership Strategy

In this new era of banking, the realization that you don’t have to be a “bank” to be a bank is a leading example of how financial services has opened up. Both Monzo and Revolut started out in partnership with licensed providers and later on moved to acquire financial licenses to benefit from native capabilities.

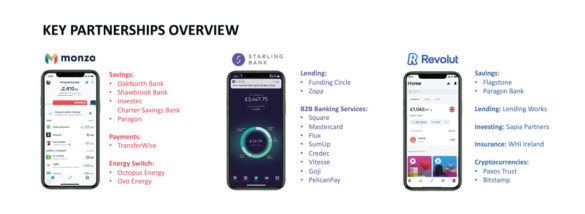

Another partnership variation these challenger banks have pursued is third-party marketplaces, in which external services are embedded on the banks’ platform. This is beneficial in several ways:

- The banks earn partnership commission.

- The third-party service providers get access to a new customer base.

- Customers benefit from bonus services right from their banking app.

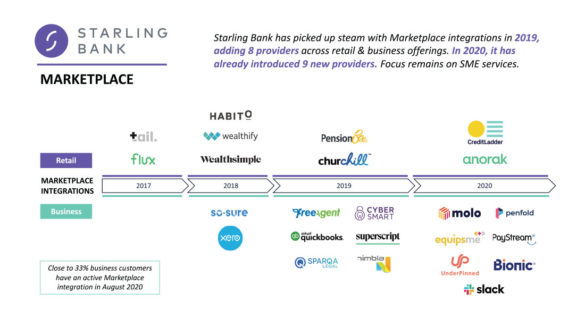

Monzo has a Savings Marketplace which integrates five providers who offer attractive deposit rates. Revolut Connect allows its business customers to integrate with service providers across accounting, bookkeeping, workflow management and more. Starling Bank has made its marketplace offering one of its biggest selling points, with integrations across retail and business use cases.

With its Marketplace, Starling Bank gives its users a true taste of “embedded finance.” Partner offerings range from wealth management and insurance for individual users to taxation, payroll management, employee benefits and much more for small business owners. Such a strategy helps the bank focus on its core mission, while also taking care of the additional needs of customers through specialist providers operating on its platform.

4. The Challenger Bank Expansion Strategy

Given that geographical boundaries are a thing of the past, it should come as no surprise that challenger banks that found success in their domestic markets, would spread their wings and flock to uncharted territories, and the United States is one of the prime target markets.

Now that Varo Money has received a full national banking license, the market is bubbling with anticipation and its British counterparts are poised in the right position.

Fintechs like Revolut, Monzo, N26, Klarna and OakNorth are among the few who have already established or are in the process of establishing operations in the U.S. There are factors which are in their favor, and some that are not.

What works for them

Partnership opportunities

Established brand

Interchange-driven business model

What doesn’t work for them

Existing competitors

Licensing blockades (regulatory)

International expansion costs

The Strategy Matrix for Mid-sized U.S Banks

This brings us back to the incumbents’ situation in the U.S. In our view, the playbook utilized by their neighbors across the Atlantic could turn out to be quite useful even for smaller banks.

Any services-based company is divided into three departments:

- Front office — responsible for customer servicing and sales.

- Middle office — responsible for product servicing and operations.

- Back office — responsible for backend capabilities of the entire operations.

The same hierarchy emerges in all financial institutions globally. Based on the strength of one or multiple departments, a bank or credit union can effectively employ a strategy to collaborate with external entities. Each of these strategies brings its own benefits in terms of business.

| Sourcing Strategy | Marketplace Strategy | BaaS Strategy | |

|---|---|---|---|

| Description | The bank acts as a sourcing partner for other fintechs and brands | Sourcing, onboarding and fulfilment of financial products through APIs | Technology and financial rails access along with banking services |

| Active Department in Partnership | Front Office | Front & Middle Office | Middle & Back Office |

| Examples from U.K. challenger banks | Starling Bank co-lending partnership with Zopa, Funding Circle | Starling Bank Marketplace, Revolut Connect, Monzo Savings Marketplace | Starling Bank, OakNorth’s Banking-as-a-Service |

The fintech landscape in the United States varies from the United Kingdom largely because of its regulations and its approach to innovation. In this situation, where non-U.S. challenger banks might face friction in obtaining appropriate licenses, it leaves a field full of opportunities for licensed small and mid-sized banks and credit unions. Leveraging their existing capabilities and smartly adapting to new strategies of partnering with or building for fintechs will lead to these banks realizing their full potential.

At the end of the day, a collaborative environment is what opens up opportunities for all the players in the game. The challenger banks spearheaded the digital banking revolution in the U.K. and beyond, but perhaps it will be the incumbent financial institutions at the core of communities in America that will lead the change going forward.