Bank-at-work programs (financial wellness programs offered by employers to employees) used to be an easy win-win for banks in search of new customers and employers looking to save money and time. Workplace programs, which gained widespread popularity in the ’90s, were an efficient way for financial institutions to scoop up new unbanked clients. And they were beneficial for employers looking to cut payroll costs, saving them money on printing paper checks.

Today, however, only 4.5% of Americans remain unbanked, according to 2021 data from the Federal Deposit Insurance Corporation, and 93% of companies now pay their workers via direct deposit, according to a survey from the American Payroll Association.

As a result, workplace banking has been forced to evolve, as banks and credit unions look for ways to re-invent the programs to meet new competitive challenges.

“Back then, the appeal for employers was more heavily weighted towards direct deposit benefits vs. the banking benefits. Today, we see the opposite,” says Kaley Keeley Buchanan, PNC’s head of Organizational Financial Wellness.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

Using Bank-At-Work to Upsell High-Value Clients

The new era of bank-at-work benefits is moving along two trajectories. First, the biggest institutions see the opportunity to use workplace presence to upsell existing high-value customers into new financial services and increase long-term loyalty.

Take Citi, for example, which in 2021 launched a revamped version of its bank-at-work program to cater to a new, niche clientele: the soon-to-be wealthy. The program, Citi Wealth at Work, provides wealth management and banking services to high-earning professionals in fields including law, asset management and more.

The program was designed as a cross-selling effort to guide retail banking clients to the wealth management side of the bank. Clients could access personalized financial advisors, wealth planners, investment counselors and education resources.

The specialized program focuses on onboarding these clients early in their career and keeping them long-term – expanding the range of services they use at the bank, says Naz Vahid, managing director and global head of Citi Global Wealth at Work. “By getting to know a client’s profile inside-out, we can support them as their needs evolve and through big life events like getting a mortgage, having children, making partner or planning for retirement,” she says.

Similarly, Bank of America’s employee banking program also offers access to personalized wealth management by connecting workers with advisors at Merrill Lynch.

What about smaller institutions that may not have in-house offerings for high net-worth clients? Many community banks are repackaging their bank-at-work operations as financial wellness programs in order to meet increasing demands from employers for expanded services to their teams. But does it work?

Dig deeper:

- Building a Human-Centric Workplace Model for the Future [Podcast]

- How to Deliver Personalized Financial Wellness Tools Consumers Want

How To Merge Bank-At-Work and Financial Wellness

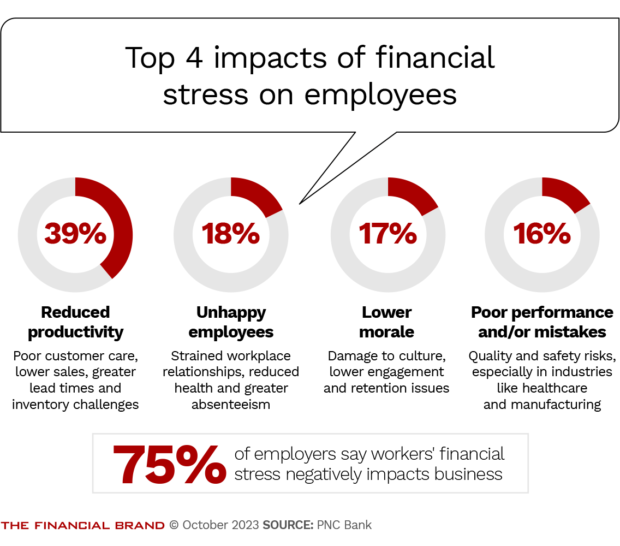

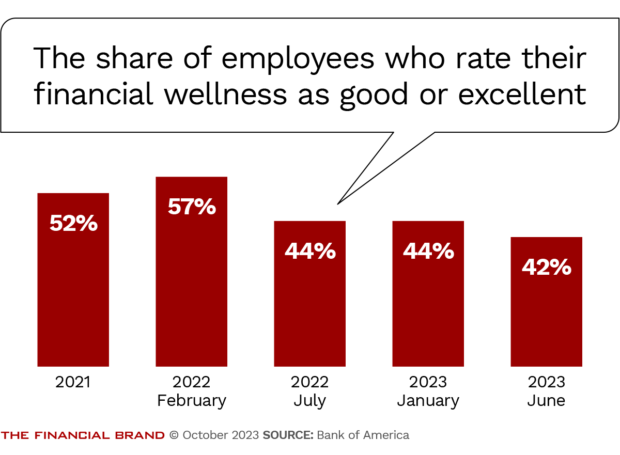

Surveys indicate that employees want to work for companies that offer a variety of financial wellness benefits. PNC’s own 2023 research showed that roughly 80% of workers would stay at a company longer if they offer financial wellness benefits. Many are looking for financial education, personalized financial advice, and student loan assistance.

In theory, employers agree. 96% of employers surveyed by PNC said financial wellness positively impacts retention. The problem is that few employers actually offer financial counseling and education. According to a 2023 study by Bank of America, only two in five employers offer financial wellness benefits.

This is the emerging opportunity: By expanding bank-at-work programs beyond basic banking services and offering other services in partnership with employers, banks can develop deeper relationships with both their consumer and business clients. PNC’s WorkPlace Banking program, for example, offers cash rewards for employees who sign up for some of its services, as well as personalized financial coaching and a financial education program.

At the same time, some banks are leveraging bank-at-work programs to deepen the relationship with the employers themselves. First National Bank of Pennsylvania has offered its bank-at-work program to employers for nearly two decades. Through conversations with employers, Vincent J. Delie, Jr., chairman, president and chief executive of F.N.B. Corporation and First National Bank, says he identified areas where the bank could expand its offerings.

Its bank-at-work program bundles employee financial education programming, discounts on multiple loan and deposit products with business services to their employers. “This program also ties in well with our insurance division’s employee benefits packages for small- and medium-sized businesses, as well as our 401(k) plan offering and retirement services,” he says.

Success Requires Support and Financial Education

Repackaging bank-at-work for financial wellness is not an automatic win, however. The original benefits of bank-at-work, like direct deposit, were relatively easy to activate. Financial wellness, not so much. Just because a company offers financial wellness benefits — and employees say they want them — doesn’t mean employees will automatically use them. Low utilization of benefits is a well-documented challenge for employers. Busy and understaffed HR teams often don’t have time to educate workers comprehensively on a new benefit.

To address adoption, PNC’s Buchanan says the bank works closely with employer clients to help train their workers on its bank-at-work program and offers individualized financial coaching. “We go out and speak to the value of bank at work programs. Financial education is a key component of that,” she says. PNC checks in with employees multiple times throughout the year, with a heavy emphasis during open enrollment, which usually takes place in November.

Employers and employees are not the only ones that may need support and training. To make bank-at-work programs successful, community banks also need to focus on training their own staff to make the new sales pitch. Effectively selling bank-at-work programs to clients requires a set of skills that many retail bank managers lack. A keen understanding of the needs of employers is important if banks are going to successfully promote these programs to new and existing clients.

Increasing Competition from Fintechs and Neobanks

Finally, banks also face increased competition from fintechs and other technology companies in the bank-at-work space – and there are a myriad of options available for employers who want to update their financial wellness benefits. New York City-based fintech Clair launched in 2021 and works with employers to give workers more flexible access to their wages.

The company partners with Pathward NA (a Sioux Falls, S.D.-based provider of banking infrastructure) and offers bank accounts, free ACH transfers, and earned wage access. Nico Simko, founder and chief executive of Clair, says the company is looking to expand into other areas for customers, such as 401(k) and health savings accounts. Simko says the app is popular among employers with hourly wage workers.

“Now a pretty small number of people are fundamentally fully unbanked, but a lot of them are underbanked. Their primary banking relationship does not fulfill all their needs,” Simko says.

Read more:

- Why Neobanks Have Made ‘Underbanked’ an Obsolete Term

- If You Are Going to Bank on Customer Loyalty, Return the Loyalty

Is There a ROI for the New Bank-at-Work Programs?

A long-term challenge facing many bank-at-work programs is presenting a clear return-on-investment to both employers and to banks. While most bank-at-work programs claim to bolster employers’ attraction and retention strategies, this can be fundamentally difficult to measure.

PNC’s Buchanan says the bank regularly collects feedback from workers during training to better understand how they feel about the program. PNC also gives employees a financial wellness score on its online education platform so companies can get a better sense of how well their workers are progressing.

“We’re trying to understand what they’ve found valuable about that session and what are the next topics that they’d like to hear about from our bank at work team,” she says.

It’s important for employers to recognize that programs like PNC’s may not deliver short-term wins. In fact, it can take months for them to gain traction with workers, Todd Shickel, vice president of business development at Indianapolis-based credit union Elements Financial says. He emphasizes employers shouldn’t be discouraged if a program isn’t successful right away.

“In a three- to five-year period if you can get 30% of the employees highly engaged — defined as having three or more of your products and services — then you would have an extremely successful program and you would absolutely be able to justify the investment,” he says.