In 2020, U.S. Bank surveyed 3,000 investors to better understand their financial needs. The data showed that almost half of women (47%) associated financial planning with negative words like fear, anxiety, inadequacy, and dread, compared to just 31% of men.

The feedback was concerning to the bank, which wanted to find better ways to serve women clients, says Beth Lawlor, president of Private Wealth Management and Affluent Wealth Management. “We took that information and we said, ‘How can we better serve that segment of women and bridge that gap so that they have that knowledge, the comfort level, and the confidence that men have?'” she says.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Quest to Serve Women Better Often Starts with a Look in the Mirror

Like many institutions, U.S. Bank believed that the first step to reaching more women and diverse clients was to improve diversity internally. The thesis was simple: “If women feel valued and have a rewarding career journey in U.S. Bank, they’re going to be much more likely to serve other women outside of the bank,” Lawlor says.

By 2022, 63% of U.S. Bank’s new hires were women, and today 58% of its employees are women. The bank has also developed support networks for women internally and with clients, where they could directly solicit feedback about the biggest challenges they were facing.

“We want women to feel both as customers and employees that they’re reflective of our values,” she says. “They are represented, and they have just as strong a seat at the table as men.”

U.S. Bank is not alone. Over the past decade or more, the banking industry as a whole has come to recognize two things: That women face unique challenges in meeting their financial needs, and that many feel those needs are not being met. To their credit, more institutions have taken steps to address these issues.

BMO, for example, has implemented a multi-year strategy focused on improving equity and diversity for employees and customers of the bank. Niamh Kristufek, head of U.S. Business Banking at BMO, says the bank has a “returnship” program for women who are rejoining the workforce after having children.

They also partner with the Mom Project, a nonprofit that focuses on helping women stay active in the workforce throughout their careers. “I think we walk the walk,” she says. “We have a lot of visible females in leadership.”

Read more: Banks Are Trying Out New Ideas to Connect with Female Customers

Financial Anxiety Remains a Problem

Despite the many efforts of this kind, financial anxiety among women has not eased. In fact, there is evidence that it has actually worsened.

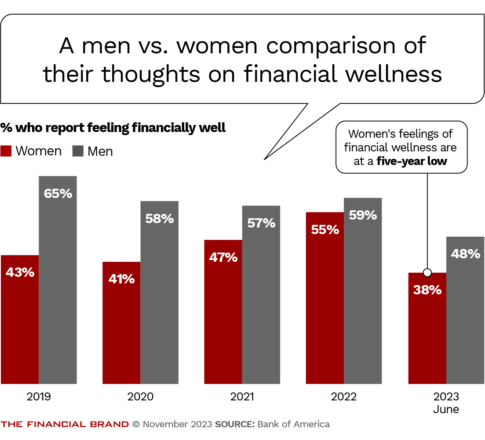

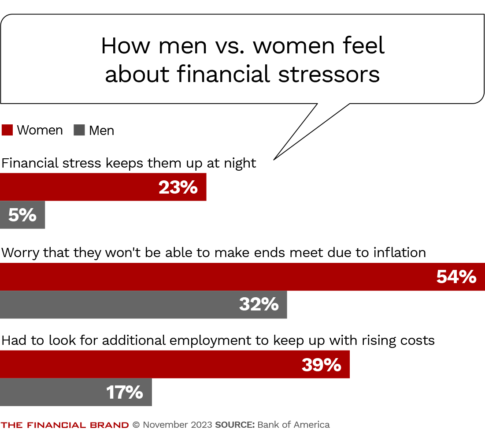

A 2023 report from Bank of America found that women’s feelings of financial wellness is at a five-year low. According to the report, women are significantly more concerned about their finances, with 23% of women reporting finances keeping them up at night, versus just 5% of men.

More than half of women in the survey say they worry about not being able to make ends meet due to inflation (compared with 32% of men), and 39% reported having to look for additional employment to make ends meet, versus just 17% of men. Overall, just 38% of women report feelings of financial wellness, the lowest percentage seen by BoA in the last five years.

This increase in stress is undoubtedly part of widespread economic anxiety fostered by recession fears and volatile interest rates. Still, in almost every category the jump in women’s negative feelings significantly outpaced those of men.

“Just even making day-to-day ends meet, that was a 23-point difference between the genders,” says Lisa Margeson, managing director of retirement research and insights at Bank of America.

Read more:

- Stressed Millennials Could Use Advice on Managing Growing Debt

- Rising Numbers of Stressed Consumers Seek Alternatives to Credit Cards

More Focus Is Needed on Products That Address the Needs of Women

So, has the focus of many banks on diversity in leadership and workforce been a failure in delivering improvements in women’s financial wellness? At best, the data seems to suggest that these efforts are an incomplete answer, and may be only a small step in the right direction. What may still be lacking is a consistent focus on actual products and services that address the day-to-day financial needs of women.

Women have different financial goals and needs than their male counterparts, and banks who want to successfully diversify their customer base need to take this into account. Nine out of ten women are either in charge of their household finances or share responsibility for it, a GoBankingRates survey found.

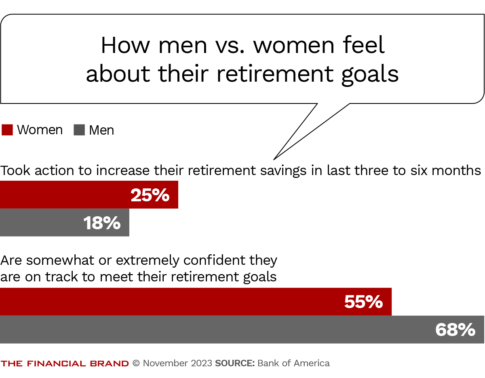

Tanya Hart, chief human resources officer and executive vice president at First Horizon in Memphis, says women still often take time off work to care for children or aging relatives and this can impact their financial goals. Women’s careers are often less linear and they typically earn less than men.

“On top of this, the longer life expectancy of women can also give rise to concerns about healthcare costs and the need for robust retirement savings,” Hart says. “This makes financial planning and wealth management all the more critical.”

Indeed, some banks have created programs tailored to women.

Bank of America offers Better Money Habits, a personal finance education platform that women can use to educate themselves on everything from saving and budgeting to creating a strong credit history. U.S. Bank, for its part, has launched Automated Investor, which is a robo-investment platform offered through U.S. Bancorp Investments. Automated Investor is marketed to women who are new to investing, Lawlor says. The bank also offers educational tools like podcasts, investment programs, and budgeting apps for women who want to learn how to better manage their money.

Notably, 42% of all U.S. businesses — about 12 million — are owned by women, and women-owned businesses employ over 10 million workers, according to the U.S. Small Business Administration. Yet many women-owned businesses are small — more than 80% averaging less than $100,000 in annual revenues — and so are vulnerable to stress and failure.

“Just even making day-to-day ends meet, that was a 23-point difference between the genders.”

—Lisa Margeson, Bank of America

Creating programs to specifically support women-owned businesses and entrepreneurs can also help banks better meet the needs of their women clients. Women are starting businesses at a much higher clip than men, Kristufek says, and banks who don’t provide specialized programming for them are missing opportunities to grow their business.

For example, BMO launched the Zero Barriers to Business program in 2021 which focuses on helping underrepresented groups, including women, get access to capital and educational tools. Through the program, the bank gave $10,000 grants to eight women-owned small businesses in 2022. BMO also partners with the incubator 1871 to help women in fintech develop and launch their startup ideas.

“Not only is it good business because they’re growing at a faster clip, it also serves our purpose,” she says. “We’re going to take on a little more credit risk and a little more loss because we believe there’s value in leaning into areas people haven’t gone before.”

See all of our latest coverage on the topic of financial education.

Use Technology To Meet Women Where They Are

Technology is a key tool that banks can use to engage and serve women. Banks that require you to come into a branch to sign paperwork for a loan, for example, may not work for women who take care of children or own their own businesses.

“I think big banks in particular need to wake up to create digital, easy experiences for everyone,” says Binna Kim, co-founder and chief executive of Vested, a financial marketing firm. Technology makes it easier for all customers to access a bank’s product and several banks are developing robo-advisors and other digital tools marketed specifically to women.

Jenius Bank — a digital-only bank that launched in 2022 — plans to release new tools next year which will allow customers to better understand the financial impact of a specific life event like a divorce or retirement. The bank will also let users link up accounts from different banks to get a better sense of their overall financial picture, says Tracey Dunlap, managing director of Jenius Bank.

“Women may have access to the tools, the accounts, and the products but what they don’t have is a true understanding of, ‘Am I doing this right?'”

— Tracey Dunlap, Jenius

Banks also have a unique opportunity to use data to tell them more about their customer base, Vested’s Kim says. By understanding who your customers are, you can start to take steps to better improve your services to meet their needs.

“The availability of data to marketers and to banks they have so many ways they can better understand their female banking customers,” she says. “But if they underservice these communities and demographics, they’re never going to grow and other banks are going to eat their lunch.”