In a country where almost 9 out of 10 adults are financially illiterate, banks have a unique opportunity to turn the tides. An educated customer is a good customer, and connecting with them early – think high school – is the key.

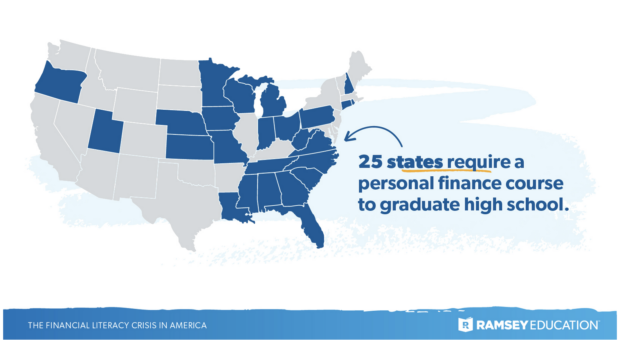

As Americans face record inflation, home prices, and a crippling debt crisis, financial education is more important now than it ever has been. It’s also a non-controversial topic. Americans want it – 88% of American adults say high school did not fully prepare them for handling money, according to a report from Ramsey Solutions. Almost three quarters of adults in the same survey said they would be “further ahead with their money today if they had a personal finance class in high school.” Public support for financial education in schools has historically been strong, and it’s a nonpartisan issue. Thanks to state legislation, educational institutions are catching up to the need – 25 states today require students to take a financial literacy course in high school.

“Growing up, formal financial literacy in school was nonexistent,” said Eric Pointer, president and CEO of the Credit Union of Texas (CUTX), and who worked his way up from bank teller at the institution. “I got my first job at fourteen and had my own checkbook. Later, when I began working for the credit union, I was fortunate to have access to financial education in the form of on-the-job training. I knew others my age that weren’t so lucky and watched as they dug holes that took a long time to climb out from.”

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Loyalty and Satisfaction Guaranteed

Banks do their part to combat this stark reality by offering financial education in various forms to their customers. The major retail banks have their ranges of tools and resources, and local banks and credit unions are often better at community outreach-based education. Public good aside, this approach also benefits banking institutions by creating better, more wealth-generating customers. Customers who lack financial literacy are more likely to make mistakes in their financial decisions, resulting in bankruptcy, defaults, and foreclosures.

“A financially literate customer is a loyal and satisfied customer,” said Danetha Doe, founder of financial education company Money & Mimosas. “Financially unwell and illiterate customers can be a risk to the bank’s bottom line because they are more likely to default on loans and may pose other issues. It’s a lose-lose situation for everyone.”

The problem is, traditional financial education offerings only go so far. Loan counseling is available whenever customers apply for a loan, but usually doesn’t come up until a customer needs the loan. All of the major retail banks offer pretty robust financial education platforms with a variety of content and reports on all sorts of personal money management topics.

The Dangers of Not Teaching Financial Literacy Young:

88% of U.S. adults said high school did not leave them 'fully-prepared' for how to handle money in the real world.

They are also adopting new technologies such as artificial intelligence to more effectively market to their customers and connect them with the right tools at the right times in their financial lives. But is it enough, when the information only reaches them when they seek it out, and when they’re already well into adulthood?

Danetha Doe knows this all too well. Her company focuses on helping women make better financial decisions, closing the gender wealth and financial education gap. Women, young people, and people of color show significantly lower levels of financial literacy, as noted in one paper from the National Bureau of Economic Research, laying bare a social problem around how financial education is reaching the public.

“My journey of financial literacy began at a young age,” recalled Doe. “My parents taught me the power of budgeting and savings and my uncle showed me the power of an abundant mindset. In high school, I took a business finance class that taught me the importance of understanding accounting as an entrepreneur. I can’t stress enough how financial literacy has helped me reach personal goals and has enabled me to turn my passions into a successful business.”

High School financial education has been found to “overwhelmingly” improve credit scores, credit and debt behaviors, and reduce the use of risky alternative financial services like payday lending, Dr. Carly Urban, Professor of Economics at Montana State University, explained in a recent Champlain College report. While most financial education resources offered by banks are marketed to their adult customers, some banks, like the Credit Union of Texas, are getting their foot right into the swinging double doors of Dallas-area high schools.

Dig deeper into financial education initiatives:

- Which Banks Offer HSAs to Customers (And Why Yours Should)

- Building Financial Wellness Strengthens Relationships

- Should Banks Ramp Up Budgeting Tools After the Demise of Mint?

Student Bankers — a Win-Win

In a way, the Credit Union of Texas has come full circle. Founded 100 years ago by a group of Dallas schoolteachers – mostly women – the local bank now has three branches on high school campuses. The branches are run entirely by students.

CUTX opened its first SMART Branch in 2020 inside the campus of Allen High School, a school about 30 miles north of Dallas. The bank branch caters to the student population of the school. Every student employee of a SMART Branch completes three days of intensive banking, marketing and financial literacy training before they start working, and students who complete a year of employment get $1,000 in scholarship money to sweeten the deal.

The program has been a success by any measure — CUTX opened its third SMART Branch last year at Lloyd V. Berkner High School in Richardson, Texas, and has plans to open a fourth by 2025 in East Texas. Eventually the bank will expand into different regions as well as into higher education. Students who work at SMART Branches learn about a range of financial management topics by opening checking and savings accounts, issuing debit cards and working on automotive loans with their peer customers — Pointer sees the personal growth of these students as a marker of success, as well.

CUTX has also partnered with each Independent School District within which it has a SMART Branch, and the National Endowment for Financial Education (NEFE), to develop and launch a modified version of its High School Financial Planning Program (HSFPP) at all SMART Branch locations. At all three locations, a combination of teachers and CUTX team members help oversee the program, teaching the course material to the SMART Branch students each week before they present the various modules to their classmates.

“One of the major benefits of having SMART Branch students teach financial literacy modules to their classmates is that the information is coming from a trusted source,” explained Eric Pointer. “The students are a lot more engaged when it’s their peer in front of the class talking as opposed to a teacher or a more seasoned expert.”

Banking on Gen Z

Conversations around bank marketing can often revolve around technological innovation, but ultimately those efforts to remotely connect with customers will only go so far. For instance, financial institutions are increasingly making use of artificial intelligence embedded in their marketing workflows, or chatbots, to more effectively communicate with their customers, but the Consumer Financial Protection Bureau found that chatbots can actually diminish consumer trust in banks. CUTX’s SMART Branch takes a different approach by providing banking products and financial education through peer-to-peer connections, while also meeting their own business interests.

While waiting for the ROI of good future banking customers, there are plenty of immediate benefits to this community education program. Through its SMART Branches, CUTX naturally grows its customer base, as well as its workforce.

“We currently employ nearly 60 student employees as bank managers, tellers, financial literacy coaches or marketers at the SMART Branch, each of whom receives a $1,000 scholarship,” Pointer said. “We’ve paid more than $71,000 in deposit funds as part of the “Pay for Grades” initiative, which rewards students who receive excellent report cards. And we’ve completed more than 2,700 transactions and opened 315 checking accounts.”

Generation Z, the most likely generation to have taken a personal finance course in high school, is poised to become more financially educated than the typical Millennial, or even Gen X-er, Ramsey research suggests. There is still a ways to go, however, as the younger generation graduates into these challenging economic times. Banks can play a pivotal role in shifting the financial literacy status quo.

Ranica Arrowsmith is a freelance writer based in New Jersey, focusing primarily on the technology, finance and accounting industries. She has written for Accounting Today, MarketWatch Picks, and other publications in the medical technology space.