When Ally Bank opened its innovation lab, called “TM Studio,” in 2018, it wanted to drive innovation in a new way. While financial labs often risk becoming something of an ivory tower, where very little of practical use ever materializes, Ally decided to retain only a small permanent lab staff. Projects are driven by teams assembled from experts in various disciplines from around the bank, tasked for a specific project and often rotated out when that’s done.

But before much happens in the Studio, Ally goes to the man or woman on the street.

And that’s pretty much literal, according to Emily Shallal, Senior Director, Customer Strategy & Innovation. Shallal, head of the Studio’s permanent staff, based in Charlotte, N.C., says when Ally decides to develop a new product or service it prefers not to proceed from pre-conceived ideas. So it sends representatives out to meet the public and ask them about what the bank is thinking of. Part of the aim is to get input from both customers and non-customers.

Building Features to Help People Save More

That research was the start of the 18-month process that led to Ally’s development of a new selection of smart savings tools that it has added to its online savings account. “With those consumer conversations, the tools kind of crafted themselves,” says Shallal.

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

She’s oversimplifying, of course, to make the point — it’s one thing to come up with an idea and quite another to make it practical. It took a team including bankers, IT staff, product strategists and user experience designers to develop the savings idea, but consumer input did play a major part. One thing that Shallal notes is how much emotion is tied up with the subject of savings.

“People get really stressed when they talk about money,” says Shallal.

“You can see them tense up.” She recalls one person she and staff met with who became flushed, and began fanning herself, when savings came up.

The consumer research puts a human faces on troublesome statistics about Americans’ difficulty in saving. Study after study points out that large portions of the population cannot pay cash for a $400 emergency, for example. It’s both a frustration and a fear. But actually talking to consumers began to illustrate what would help.

“People love smart algorithms,” says Shallal, who was a financial planner earlier in her career, “but you have to build a level of trust. What we heard from people around automation was often about maintaining control over their money.”

There’s control of money and then there’s self-control, of course. Ally notes that statistical research indicates that four out of five consumers are not personally “wired” to save, tending to spend what they have on hand in the short-term. While people may know in their heads that they must save, their heads don’t always talk to their wallets.

Read More:

- 6 Keys to Designing a Best-in-Class Financial Wellness App

- Are Banks & Credit Unions Losing Out on Savings Apps?

- How to Grow Deposits in a Weird Rate Environment

Features to Drive Savings, Not Just Tips

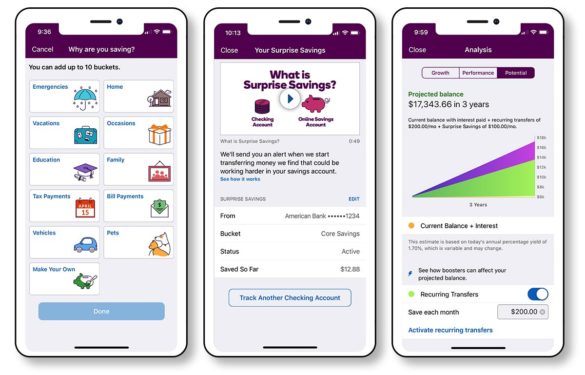

One feature developed for the app was “Buckets,” which gives consumers the ability to pick up to ten savings goals in a single savings account. They can give the goals custom names, such as “Disney World Vacation,” to build an emotional connection. Icons representing different savings purposes are assigned to each bucket. The app tracks the user’s progress toward each goal. This is essentially an electronic version of the traditional envelope method for managing household cash, with more convenience and ease in changing plans.

Another feature is called “Boosters.” There are two types, each of which move excess funds from the consumer’s checking account to their savings account. (Ally can make transfers from its own checking accounts or those of other financial institutions, via ACH withdrawals.) The idea behind both boosters, described below, is to facilitate savings, not just issue tips about how to save.

1. “Recurring Transfers” enable consumers who are confident about their earnings levels to set transfers to follow a regular schedule. The consumer can set the frequency of the transfers and adjust the size and how they are distributed among the buckets. For example, these automated transfers might be directed to one top-priority bucket, for a time.

2. “Surprise Savings” analyzes the linked checking account. Based on cash flow, historical spending patterns, upcoming bills and the overall account balance, this feature of the app computes how much is safe to transfer to savings. The bank does not transfer more than $100 at a time and won’t transfer more than three times in a week, in order to avoid the risk of overdrafts. Account holders can adjust this feature or turn it off, as well.

Ally’s product testing found that both boosters tended to bolster account holders’ confidence levels, creating savings momentum.

The third feature, “Analysis,” shows projections of how savings will build under current settings and allows the consumer to use “what ifs” to see what changes would help them reach their goals more quickly.

Shallal says the company’s research indicates that consumers who use these proactive savings approaches can save five times as much compared to relying solely on accumulating compounded interest.