Many banks and credit unions offer financial education in some form or another, but customers aren’t nearly as engaged as they could be. They often aren’t using these resources or aren’t even aware that they are available.

Those who stumble on a blog post about a particular topic — say, how to improve a credit score — also can be turned off by how generic the advice is.

There is a payoff for getting it right, though. Banks that offer financial wellness tools and have personalized their advice report benefits such as greater engagement, an increase in deposits and higher customer satisfaction scores.

Many people are eager for such help too. More than half of consumers — 58% — say they would switch to a financial institution that offers financial health features such as helping them budget smarter and save more, according to a survey commissioned by Personetics.

But less than 10% say they have received communications from their financial institution that helped them manage their money. (The survey, conducted by the research company Censuswide, included 5,000 people from the United States, the United Kingdom and Canada.)

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Financial Wellness Efforts That Stand Out

While most financial institutions struggle to get consumers to engage with their financial wellness offerings, some have reported outsize success, including Bank of America.

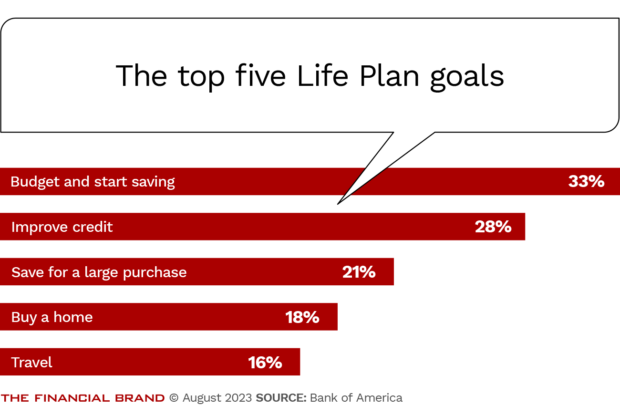

It launched a digital tool called Life Plan in late 2020 and has made it a cornerstone of the way it engages with customers. The tool, available within BofA’s mobile app and online banking platform, lets customers set short- and long-term financial goals such as saving for a vacation or buying a home, then track their progress. Customers also receive personalized guidance and recommendations on incremental steps to take to achieve their goals.

In March 2023, the bank reported that more than 10 million customers had used Life Plan in its first two years. These customers also added more than $55 billion to their BofA accounts in that timeframe.

In addition, Life Plan users scheduled more than 2.3 million follow-up appointments with BofA financial specialists.

Holly O’Neill, the president of retail banking at BofA, said in an interview last spring that she believes there are two key factors driving the success of Life Plan: First, the advice is personalized, and second, financial health is integrated into both the customer experience and BofA’s business strategy.

Higher Customer Satisfaction Among Those Who Use Financial Health Tools

The Spanish banking giant BBVA has also successfully driven engagement. It boasted in a blog post that more than 11.7 million of its customers globally had used its digital financial health tools as of the end of 2021, a 48% increase from a year earlier (the latest data that it has shared).

It also said in the blog post that customer satisfaction is higher for those who have used the tools — which BBVA refers to collectively as its “financial health experience” — compared with those who haven’t.

An Absence of Advice:

Though there are exceptions, banks and credit unions in general aren't getting much traction with their financial wellness efforts. Less than 10% of consumers recall receiving helpful communications about managing their money from their financial institution, according to one survey.

Like BofA, BBVA says it considers financial health the key to building customer relationships.

Rather than posting generic “give up your daily latte to save more” financial advice, BBVA sends customers text messages based on their income, expenses and debt. For example, a customer who is able to cover monthly expenses with some cushion will receive messages about investing to generate returns. In contrast, those who struggle to keep spending in check may receive messages related to saving money.

Read more:

- Why Bank of America Believes Financial Health is the Future of Banking

- Branches Should Become Financial Wellness Centers

What Is ‘Healthy’ Anyway? And How Do You Measure That?

The terms “financial wellness” and “financial health” are vague and subject to personal interpretation, but the nonprofit Financial Health Network has developed an eight-point assessment tool to help make things less fuzzy, as summarized below.

The Eight Indicators of Financial Health

Spend

1. Spend less than income.

2. Pay bills on time.

Save

3. Have sufficient liquid savings.

4. Have sufficient long-term savings.

Borrow

5. Have manageable debt.

6. Have a prime credit score.

Plan

7. Have appropriate insurance.

8. Plan ahead financially.Source: Financial Health Network

Consumers are grouped into three categories: financially healthy, financially coping and financially vulnerable. Only one-third of consumers fall into the financially healthy category, according to the Financial Health Network.

With two-thirds of consumers either financially coping or financially vulnerable, banks and credit unions have a large target market hungry for financial resources and tools.

Below are four ways to get the word out about financial wellness offerings and drive customer engagement.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

1. Make Financial Wellness a Core Business Strategy

Banks and credit union leaders generally recognize that consumer financial health could use a boost and understand that financially healthy consumers are good for the bottom line.

But they don’t necessarily consider “financial wellness” as a core strategy for their business. Instead, they treat financial health-related content and advice as an ancillary offering. The Financial Health Network sees this as a common shortcoming.

Articles and blogs designed to improve financial literacy are worthwhile, but they don’t address the complexity of helping people achieve financial health or alleviate the stress they feel about their financial situation as inflation takes a toll.

2. Give Consumers Hope

Craft campaigns that exude empathy and offer consumers some reassurance. “It is then that you can start to build the foundations of positive financial behaviors and working toward the goals that matter to them,” says Andy Manthei of the nonprofit counseling firm GreenPath Financial Wellness.

“You have to dig into your data and identify how you can serve each person and create touchpoints that connect those pieces of content to the right time in their journey.”

— Andy Manthei

For instance, most Millennials and Gen Zers dream of homeownership, but few believe they can afford it. “You have to find ways to give them hope,” says Manthei, a business development specialist for GreenPath. “You have to dig into your data and identify how you can serve each person and create touchpoints that connect those pieces of content to the right time in their journey.”

In choosing customer segments for proactive outreach, look beyond metrics such as how much people have in savings and what their credit scores are. A larger account balance doesn’t automatically translate into less anxiety. A consumer with a few thousand dollars in a savings account and an above-average income may be feeling as worried as someone with no savings or a low income.

Read more:

- 6 Reasons the Industry’s Approach to Financial Education Is Failing

- See all of our latest coverage of financial education

3. Focus on What Consumers Really Want

Banks and credit unions should resist the urge to jump in by providing financial wellness content they think customers will find interesting or helpful. Instead, ask customers or members what they want and then distribute that content in various ways.

For example, GreenPath conducts consumer focus groups and audience research to inform the financial topics it covers, says Julie Rogier, the company’s content marketing manager. Amid the shaky economy, GreenPath has found that consumers were interested in strategies for managing debt and coping with inflation and rising interest rates. It also found that webinars, blog posts and guides pull the highest engagement rates.

News developments can spark interest in particular topics. Consumers were drawn to GreenPath graphics outlining student loan news and policy announcements shared via social networks.

Also popular were interactive online courses designed to reduce debt, improve credit and help consumers advance toward their financial goals.

4. Measure the Results of Financial Wellness Efforts

How well is a financial health initiative performing in terms of not just engagement, but the outcomes for customers?

Tracking how many consumers open and read articles, watch videos or complete an online course is obvious, but what many financial institutions fail to do is to measure the impact of those engagements, Manthei says.

It’s important to analyze if those who complete an online course on budgeting have improved outcomes, such as fewer overdrafts, an increase in emergency savings, or a decrease in overall debt load, he says.

It’s also helpful to gauge which content delivery method has the most impact, perhaps measuring the difference in financial behaviors between consumers who watched a video series and those who completed a written course.

A study several years ago looking at whether financial literacy programs deliver a return on investment for banks and credit unions suggests that these efforts can help the bottom line. The study — which we covered in more detail here — shows the potential for benefits similar to those reported by BofA and BBVA, such as greater customer loyalty and increased usage of savings and investment products.

From the archives: