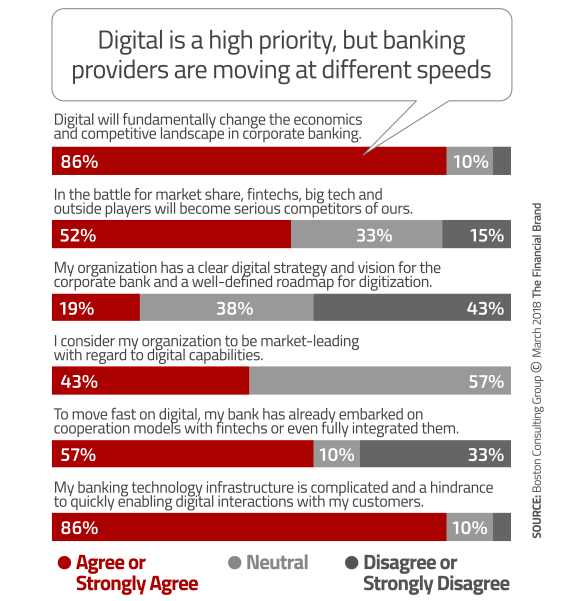

Four out of five financial institutions believe that digital will fundamentally change banking and completely transform the industry’s competitive landscape. But according to research from the Boston Consulting Group, less than half (43%) confess they don’t even have a digital strategy. And an astonishing one-in-five banking execs consider their bank or credit union “market leading” when it comes to digital.

What’s holding them back? The vast majority point their finger at their current technology infrastructure. (Translation: “It’s our core DP’s fault!”)

So what should traditional banking providers do to remedy the situation? Just like with any major transformational initiative, you should begin with a strategy — digital is no different.

“The starting point for each financial institution will depend on its business strategy, market position and capabilities,” Boston Consulting Group says. “But all must consider how they can reshape their distribution models, improve their value propositions and develop end-to-end consumer-centric journeys to increase growth and customer satisfaction.”

The strategy can’t be a series of one-off à la carte initiatives taken on by separate and individual business units. This is the kind of undertaking that will require banks and credit unions to stretch outside their comfort zone; instead of uncoordinated initiatives they need to tackle digital transformation as a comprehensive, enterprise-wide strategy — one that’s lead from the very top by the C-suite, with the CEO firmly at the helm. Without a top-down, integrated approach that involves every aspect of the organization, traditional banking providers will struggle taking advantage of powerful new tools such as robotics, big data, AI and blockchain.

To build a digital transformation strategy, Boston Consulting Group recommends that banks and credit unions focus on four priorities — or pillars:

- Reinvent the consumer journey

- Leverage the power of data

- Redefine the operating model

- Build a digital driven organization

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

1. Reinvent the Consumer Journey

The consumer journey doesn’t get much less frictionless than Amazon’s one-click ordering — see it, like it, click it, buy it. And for many consumers, that’s the purchase journey they expect from everyone they do business with.

Imagine what goes through consumers’ minds when faced with a journey at their bank or credit union that takes days or even weeks. Consumers are apt to think banks and credit unions have had ample time to figure out what Amazon is doing right and emulate it — e.g., “Why doesn’t my bank work like Amazon?? When will they get their act together?

Banking providers need to determine what matters most at critical points in the customer journey — which is going to vary greatly between different consumer segments — and then work relentlessly to improve the experience. The end goal is to completely digitize the consumer journey from start to finish, says BCG (think: rapid digital onboarding and automated digital lending decisions).

Not only does a digitized journey make consumers happy, it also frees up staff for more valuable tasks like cross-selling and relationship building while simultaneously saving the financial institution money by streamlining processes. That’s a triple win.

So what does digitizing the consumer journey look like? Antony Cahill, COO at NAB, describes it as “fundamentally reimagining and redefining all customer experiences.”

“We are doing it in a way that has the customer at the center of everything we do,” he adds.

Siam Commercial Bank has identified five customer journeys — prospecting, advice and sales, onboarding, transactions, and administration — and is digitizing all of them, says Vish Jain, First EVP and Head of New Business and Operating Models.

For example, the bank used to manually trace beneficial owners through company holding structures and then manually compare owners against six different sanctions databases. The process could take days. By digitizing the process, onboarding now takes three minutes.

It’s too overwhelming — and costly — to try to map and change multiple consumer journeys. Boston Consulting Group recommends starting with a few key journeys that have the greatest potential to have the biggest impact. Financial institutions that digitize the most important consumer journeys can increase revenues up to 20% and reduce costs by up to 25%.

To find the most impactful consumer journeys, Boston Consulting Group says you need to do your homework — e.g., looking at customer transaction histories, call center logs and online data to identify those points in the journey that are causing the most pain. Learn from digitizing the first journey or two, then tackle the next.

Even transforming just a few journeys can make a big difference. Boston Consulting Group says one large bank redesigned its credit lending journey and cut the timeframe from application to funding in half, shaving 30% in costs associated with the process. Another bank tackling the same journey saved $200 million over four years.

Read More: Digital Transformation Demands a Culture of Innovation

2. Leverage the Power of Data

Data analytics enable banks and credit unions to better understand consumers, identify business opportunities and reduce costs, says Boston Consulting Group. Advanced analytics allow financial institutions to better anticipate loan defaults or to find consumers who, due to overzealous discounting, are underpaying and then reprice these products and services. Another idea is to use granular cluster analysis to compare an individual consumer product mix to the average for that consumer type and use that information to cross-sell and deepen relationships.

Banks and credit unions can use data mining for better prospect and client targeting. On the prospecting side, prioritize leads and establish connections to between current and potential clients. Use behavioral analytics to identify consumers who are a flight risk and then create individual action plans to keep these consumers loyal.

“Data mining can help banks and credit unions reinvent themselves as partners that offer highly tailored solutions to their clients, rather than suppliers trying to push products that might not match consumer needs,” says Boston Consulting Group.

Siam Commercial Bank used to rely only on the personal networks of its bankers to prospect for customers. Now, the bank also analyzes payment networks to find non-customers who are affiliated with their current customers. The bank then contacts these non-customers to extoll the cost and speed benefits of being on the same Siam Commercial Bank platform as their business partners. The bank also uses data mining to create profiles of their best customers and uses reverse-lookup to find prospects with similar profiles.

Read More: Why Data Privacy Could Be Banks’ Next Big Competitive Battleground

Banks and credit unions can use data mining to improve pricing. In addition to finding adults who are still paying introductory student fees — 30 years later — data mining can analyze and find consumers who may be paying for services they don’t care about and getting other services they would be willing to pay for free. One European bank increased daily banking revenue by almost 15% by tailoring bundle pricing to customers preferences.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

3. Redefine the Operating Model

Consumers increasingly want the best of both worlds: a digital experience when they need speed and convenience and a human experience when they need advice for more complex products such as investments or mortgages or when they have an issue or problem. Boston Consulting Group reports that the percentage of consumers who want a hybrid experience has increased to 43% from 37% in 2015.

Banks and credit unions that combine human interaction with digital and self-service functionality in what Boston Consulting Group calls a bionic network can expect an up to a 15% increase in revenue, up to a 35% reduction in branch costs and up to 15% increases in customer satisfaction.

A large Australian bank used advanced location models to analyze which digital, human and hybrid services were the most in demand what branches. They opened, closed, and renovated branches and trimmed its branch footprint by 30%.

Boston Consulting Group identifies three digital operating models:

1. Digital as Business as Usual Plus. The management team stays in place and the focus is on bite-sized advances. Funding usually comes from the P&L change budget.

- Pros: Quick early wins and cost savings.

- Cons: It’s tough to change a business model that remains siloed within an existing business unit. Since P&L remains in the specific market or line of business, there’s little incentive to reach across business lines. And legacy systems remain an issue.

- Most appropriate for: Banks and credit unions in the early stages of digital transformation.

- Hiring strategy: Retrain existing talent and add external talent where needed.

2. Digital as New Line of Business. The bank or credit union creates a new business unit and names a head of digital. The division owns the digital projects but uses shared services from IT, HR and others.

- Pros: This model can have a more dramatic impact on consumer experience than digital as business plus. There’s also more accountability since you can blame the head of digital when things go wrong. It’s relatively easy to scale by rolling out initiatives across the organization.

- Cons: A new line of business means a more complex organization. Digital will also compete with other business units for IT services. And legacy systems will remain an issue.

- Most appropriate for: Banks and credit unions that have already progressed in digital transformation.

- Hiring strategy: Retrain existing talent and add external talent where needed, only on a bigger scale. You will also need to add new physical spaces that foster innovation and collaboration.

3. Digital Native. This is a new digital bank with its own P&L and technology stack. The focus is on acquiring new customers.

- Pros: New economies and new capabilities can have a rapid impact. There’s no legacy systems to get in the way. The new institution can use off-the-shelf products to launch fast.

- Con: The existing bank remains and it’s difficult to encourage existing bank customers to move to the new bank.

- Most appropriate for: Banks and credit unions that have already progressed pretty far in digital transformation.

- Hiring strategy: The sky’s the limit. Since the best talent typically wants to work with innovative digital platforms, hiring will be easier.

You don’t have to pick a single operating model; Boston Consulting Group notes that many financial institutions run all three models in different markets, regions and business lines.

4. Build a Digital Driven Organization

In a digital driven bank or credit union, digital is treated as a priority that needs a clearly articulated strategy, funding, talent, agile ways of working and an organizational culture that is willing to take risks. That’s not easy to accomplish but can be well worth the effort. Banks and credit unions that digitize can achieve a 20% increase in revenues and a 30% decline in expenses.

“Infusing a digital mindset into a traditional banking culture can be challenging and the need to manage two cultures during the transition can exacerbate the situation. Success depends on engaged senior leadership that is committed to radically changing the bank,” says Boston Consulting Group.

The best place to get ideas in how to create a digital driven organization is to take a lesson from fintechs. For the best learning and sharing of best practices, team up with fintechs, advises Boston Consulting Group.

As they dive into digitization, many banks and credit unions are disappointed in the initial results. Implementation is often slower than expected. It’s difficult to scale digital initiatives across the institution. They don’t have the talent with the necessary digital and analytics skills. The organization doesn’t want to change. And the impact on the bottom line is much smaller than they thought it would be. As a result, initial enthusiasm wanes over the course of the project.

Challenges become roadblocks. Integrating digital applications with the legacy infrastructure is a particular sticking point. One banker told Boston Consulting Group that 80% of the effort on their digital initiatives is spent on integration with legacy systems.

( Read More: The Rise of Digital-First Banking and The Bank of Tomorrow )

APIs allow legacy systems to communicate with digital applications but the mistake that some financial institutions make is that they try to integrate many systems at once. Instead, prioritize APIs based on business value.

Smaller scale can be better in other ways. Rather than embark on a large-scale, long-term digital transformation, go for the quick hits to build momentum and to keep interest (and funding) high. That’s the approach that HSBC took.

“We decided from the beginning that if we spent all our time and resources on engineering the ‘pipes under the floorboards,’ we would lose the confidence of customers, even if we met our objectives in the long term,” explains Niall Cameron, Global Head of Corporate and Institutional Digital at HSBC. We’ve found that a balanced portfolio of short-term, high-impact—predominately channel-based — projects, along with long-term restructuring, is the way to go.”