Financial marketers continue to use email for the same reasons they keep using direct mail. It works. And it works better for financial institutions in many cases compared with other industries because banks and credit unions have the advantage of familiarity from routine transactions and a higher level of trust than other senders.

“Email is one of the most effective forms of marketing we do,” says Chris Nichols, Chief Strategy Officer, CenterState Bank. He says his bank institution plans to do more of it in the year ahead. Regarding trust, Nichols observes in a CenterState blog that banks and credit unions in general use more reputable email delivery applications and produce content of a higher quality than the average business email sender.

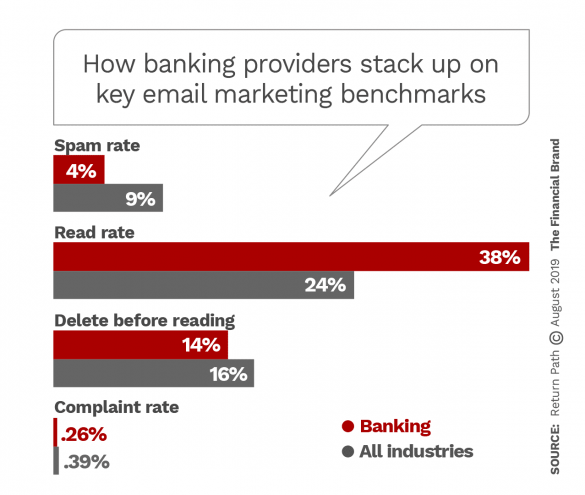

But those advantages only go so far. 14% of financial institutions’ emails are deleted before being read, according to a Return Path report on email deliverability. The firm refers to this metric as the “ignore rate,” one of five factors it says the big mailbox providers — Google, Microsoft and Yahoo — focus on.

While banking’s ignore rate of 14% ranks slightly better than the average for all industries (16%), the rate jumped by three points from 2018 to 2019. All industries saw an increase in emails ignored — by an average of four percentage points. The least ignored emails were those from manufacturing and distribution firms, many of which may have been B2B versus B2C email communications.

On the other hand, an impressive 38% of bank and credit union emails get read, far ahead of the average for all industries of 24%. Only manufacturing and distribution (60%) and insurance (43%) were significantly higher than banking. The high read rate is crucial because it affects deliverability, according to Return Path. Low read rates along with high ignore rates are seen by email providers as indicators of poor engagement. “If your read rates are consistently low,” the email marketing company states, “mailbox providers will begin to view your email as unwanted and start delivering your messages to the spam folder.”

( Read More: 6 Strategic Trends Reshaping the Future of Email Marketing in Banking )

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Email Complaint Rates Low, But Rising

Besides the “delete before reading” rate and the “read” rate, other metrics Return Path says are at more significant than the more commonly used “open” and “click-through” rates are: “messages marked as spam” and “complaint rate.” The latter refers to the rate at which subscribers report your messages as spam to their email provider.

Email providers recommend a complaint rate of no more than 0.2% of all emails sent by a business. The average overall complaint rate in 2018 for all industries was 0.39%, the Return Path research found. For banks and credit unions, the complaint rate of 0.26%, came very close to the recommended level, but it was up significantly from 0.09% the previous year, even more than for senders overall. It’s an issue that should be closely tracked by financial marketers.

One way to avoid complaints is to avoid using purchased lists. “In today’s climate of data privacy, this is a risky practice and often yields low ROI,” states Jackie Mattia, Associate Director for Movable Ink, and lead strategist for the email marketing firm’s financial services clients. Banks and credit unions should focus on emailing to consumers who have an existing relationship and who have chosen to provide their email addresses to the institution.

“They’re the most engaged,” says Mattia.

By contrast to email complaints, which are on the rise, the “Spam rate” — measuring the number of emails sent automatically to the spam or “junk” folder — dropped two percentage points for banks and credit unions, from 6% to 4%. That puts the industry well below the average spam rate of 9%, per Return Path data.

Read More: For Impact, Banking Emails Grow More Targeted and More Creative

Moving from ‘Snapshot’ to Personalized Email Marketing

Even though most banks and credit unions have committed considerable resources to developing and supporting online and mobile banking, “most banks are still stuck in a world of ‘snapshot’ emails,” says Movable Ink’s Mattia. Sometimes this results in showing outdated account information and leaving the consumer confused. To raise the stakes on the email experience, she continues, financial institutions should take steps toward being able to use real-time data populated at the moment when an email is opened.

Even if an institution doesn’t have the necessary resources for real-time email data, personalization looked at more broadly is achievable.

Mattia says the “single most significant trend and development in email marketing is going beyond simple personalization to create truly one-to-one experiences that can mimic the logged-in state of a company’s website.” Even traditional personalization, such as using a person’s name, leads to 29% higher unique open rates and 41% higher unique click rates, according to Experian. Providing customers with visually compelling experiences in email such as account balances, loyalty program progress and exclusive offers will do even more, Mattia maintains.

By adding live website content, marketers can offer recipients a multichannel experience from within the email. Tools exist to essentially copy sections of a bank or credit union’s website and deliver it in the email the moment it’s opened — what Mattia refers to as “web-cropping.”

“It allows financial marketers to capture copy and creative assets that have already been designed, reviewed and approved and simply drop them into an email, without the need for manual updates,” she states.

Read More: 10 Essential Email Marketing Insights for Banks & Credit Unions

6 Specific Suggestions to Improve Email Results

Return Path summed up its email deliverability report with several conclusions. These include:

1. Track how consumers interact with each message and adjust content accordingly. On average, the reports states, marketers lose 34% of new email subscribers within the first month. By watching customer email activity, financial marketers can identify early signs of disengagement and take steps to re-engage with them.

2. Segment your email lists to engage customers more effectively. By analyzing how customers interact with each campaign, you can identify their preferences and build more targeted content and a more personalized experience.

3. Don’t wait to re-engage. “Win-back” emails have an average read rate of 20%. Yet the average marketer continues sending scheduled emails for 259 days after a customer last engages with their program. Try a win-back campaign while people can still remember why they engaged with your email program to begin with, Return Path suggests.

Such reactivation messages can include downgrade offerings (simpler and less costly accounts, for example), offers to waive fees, and messaging to reinforce benefits, Movable Ink’s Jackie Mattia states. She also offers these two suggestions:

4. Don’t sell when you cross-sell. Email marketing is a great way for banks and credit unions to prompt new or existing customers to sign up for additional products or accounts. However, these emails shouldn’t be purely sales messages. They should provide the customer with guidance or other advice-driven content. That could include pointing them to an account that is best suited for them based on behavioral data.

5. Time your emails strategically. Cross-sell and acquisition emails should be sent after the customer reaches a predetermined threshold of engagement, says Mattia. This helps ensure the person doesn’t get overwhelmed before they’ve gotten to a point where they trust your brand and are happy with their existing accounts.

And finally, this point comes from CenterState Bank’s Chris Nichols:

6. Let consumers reply. Banks and credit union emails typically are looking to generate a click, not a reply. But a fair number of institutions still send notifications from a “noreply@” address.

To Nichols, “Nothing says, ‘I don’t care about the customer experience’ more than sending out an essential piece of financial information without giving the customer a clear path to correct the information or find out more.”