When building out a campaign to target Millennials and Gen Zers, content is critical.

Content builds relationships.

Relationships are built on trust.

Trust drives revenue.

Content marketing can and should have an indirect impact on revenue growth. Tactics should be performed in concert with and toward the achievement of business goals. While tactics are critical, seeing success with these demographic groups — and any group, really — comes from a content strategy that is integrated with business strategy and supported at an enterprise level.

Don’t ignore your intuition, but balance it with a smart, strategic framework that is tied to overall organizational goals. Trying to execute a social strategy in a vacuum is much less effective than engaging the entire organization to be part of your success. At First National Bank of Omaha we realized that our own younger employees could be a key element in our content marketing outreach.

It’s important to meet consumers where they’re at. Research says that’s on social platforms like YouTube, Facebook and Instagram and through influencer marketing, social groups and identity campaigns. Intersecting younger people where they’re active with relevant content has helped FNBO engage Millennials and Gen Zers effectively.

While there are many insights into the purchasing habits, needs and interests of Millennials and Gen Zers, being a financial institution, we are focused on where those needs and interests intersect with our products and services.

Three years ago, Gen Zers were considered to be the heaviest users of bank branches, often visiting several times a week. This was greater than Millennials and actually four times the rate of people aged 55 and older. A poll commissioned by NerdWallet and conducted by The Harris Poll found that today Gen Zers are less likely than other generations to have visited a physical bank location for personal banking activities (even in normal times). The research also found that 72% of respondents feel regret about their personal spending at times.

The big takeaway for banks and credit unions that both age groups are seeking financial guidance. That reality should factor heavily into any content marketing strategy aimed at capturing the attention of younger generations.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

1. Dollar Belles YouTube Series Spans Both Generations

The first way we’re seeing success is with our “Dollar Belles” video series. We created it to provide Millennials and Gen Zers with the financial knowledge they’re seeking in a way they’re likely to respond to, on a platform they use.

These videos are gaining traction because they address financial topics in a casual, approachable manner. We had 1,940 subscribers on YouTube in July 2020. The Dollar Belles Trailer is our second-most viewed video for 2020, with 622 views. They strengthen our brand’s authenticity by featuring three real employees of FNBO in their 20s, 30s and 40s. The trio discusses such subjects as how to less on less money, favorite financial influencers to follow, creating an eco-friendly living space on a budget, how to build credit and savings and wanderlust on a budget.

All of the growth these video spots has generated is organic. Seeing the results informed our decision to put money behind a paid campaign to promote the video series, launched in early 2020, which we are getting ready to execute.

Read More: Why Millennials and Gen Z Love Megabanks

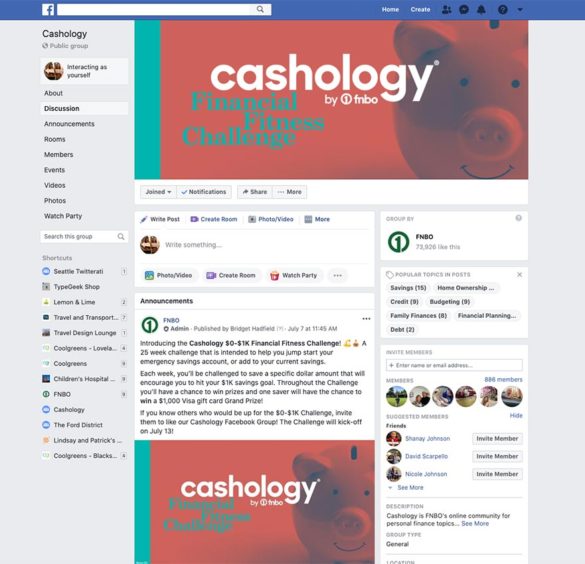

2. Cashology Facebook Group Stresses Personal Financial Management

A second way we’re engaging younger consumers is through a Facebook Group we created specifically to form a supportive, approachable community of like-minded peers around personal finance. At Cashology — also the name of a financial blog on the FNBO website — financial topics like saving, creating a budget, investing, frugal travel and much more are covered.

In July 2020 we kicked off a 25-week challenge to jumpstart followers’ emergency savings as well as other forms of savings.

Our goal was to generate 1,000 members and through mid-July 2020, we were already at nearly 900. Our membership is strongest in our headquarters city of Omaha, so we are looking at ways to expand membership from people located elsewhere. Members skew toward the Millennial segment, so we are actively looking for ways to recruit more interest from Gen Zers.

Read More: The Financial Brand’s Power 100 Social Media Database

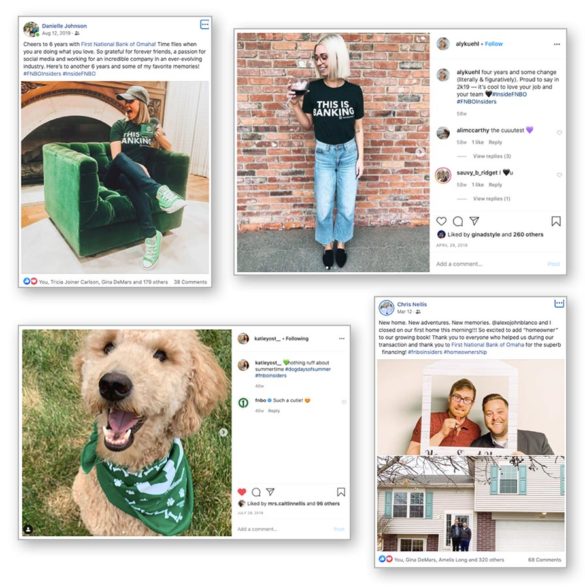

3. Employee Brand Ambassadors Put a Face on Bank’s Brand

About two and a half years ago, we started an Employee Ambassador Program with about 25 FNBO employees. We’ve now passed 45 and are seeing a lot of traction on social media where these ambassadors personally promote the FNBO brand.

We arm our ambassadors with cool swag and then we encourage them to share it on their personal social media channels. We give them topics to consider and they run with it. Posts cover a range of topics including products, employee life, volunteering, sponsorships, financial advice, and of course, swag, in an authentic and engaging way.

It’s a powerful way to show that FNBO is a great place to work and to showcase our brand values in an authentic way. As our ambassadors discuss our brand genuinely on social media, they amplify awareness across their social networks, further expanding our reach to Millennials and Gen Zers in their circles.

Read More: Bank’s LinkedIn Project Builds Sales Leads and Influencer Status

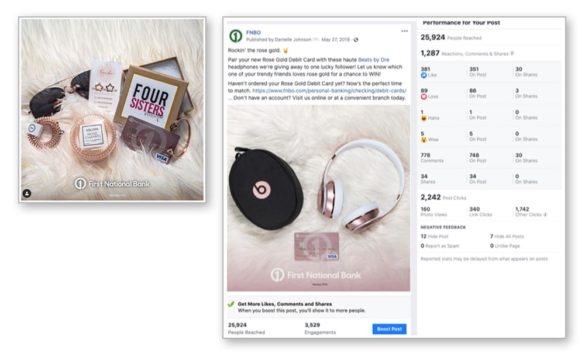

4. Rose Gold Debit Card Hits a Fashionable Nerve

Debit cards aren’t unique, but what was special about this product debut was that we launched the rose gold debit card entirely on social media. We partnered with several local small business customers that resonate with the Gen Z demographic and were able to open 16,664 debit card applications and 7,641 new demand deposit accounts. Companies include the Four Sisters Boutique and Gramercy Boutique in the Omaha. We played off things they’re selling in their shops and tied those products to the debit card.

Card signups went through the roof. People felt like they had to have this card because it matches their rose gold smartphone or because they liked the connection it gave them with some of their favorite brands.

Seeing the success of that initiative led us to create an identity line of debit cards that we later launched on social media as well.

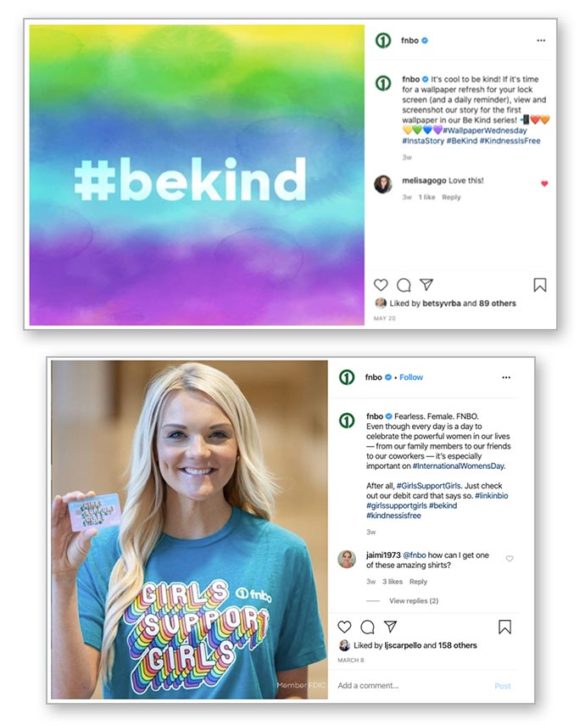

5. Identity Debit Cards Appeal to Consumers Personal Causes

Younger demographics are passionate about causes, even moreso today, and look for companies that stand behind issues they care about. So we launched identity debit cards with that in mind and have seen success with that. Some of the ones we’re seeing a lot of traction with include our Girls for Girls card and BeKind cards.

Girls for Girls connects with Girls Inc., and I can say personally that whenever I put mine down to pay for lunch, the people I am with instantly ask what the card is. They want to know more and it gives me an easy avenue to talk about Girls Inc. and how FNBO supports the important work it does.

The BeKind series features one card with a self-portrait of an employee’s son, Ethan, who tragically committed suicide. With the family’s support, we have a way of telling Ethan’s story and trying to prevent it from happening to others. We partnered with Boys Town and Youth Frontiers, which brings Kindness Retreats into elementary schools across FNBO’s footprint. Where cost is a barrier to those retreats, proceeds from our debit card program fund them so kids can get access to this life-changing information.

It’s a rather simple way to bring awareness to topics and give younger customers a connection point with our brand.

Act Now: Millennials and Gen Z Aren’t Getting Any Younger

The last thing I’ll leave you with as you consider how to engage Millennials and Gen Zers at your own bank is to make an emotional connection.

At its core, branding itself is about that, making an emotional connection between a brand and an individual.

When it’s done well and with consistency, brands can build long-term, trusting relationships with consumers. That kind of bond creates attraction, affinity and affection. The time is not tomorrow but rather today to build bonds between your brand and younger consumers.

Every second you wait is another second your competitors have to beat you to the punch.