The global pandemic has divided the world into people coping with enforced idleness and people thrust into intense activity. Financial marketers fall into the busier-than-ever category.

“The pandemic is such a momentous once-in-a-lifetime event, I would be really surprised if marketers did not continue to alter their marketing because of it,” says Lily Harder, Senior Director, Marketing Strategy, Comperemedia. Harder predicts the COVID-19 crisis will change not only the way that marketers speak to consumers, but ultimately the way they structure their products and services and the value propositions they build around them.

“We’ve already seen it in the credit card space,” Harder continues, “where some issuers are pivoting to focus their rewards on things that consumers are actually using” — things like essential supplies as opposed to travel.

“After the financial crisis, the banking industry was seen as the villain. Now is an opportunity to turn that perception around.”

— Lily Harder, Comperemedia

In their marketing communications, financial institutions already have shifted from product and brand promotion and the initial wave of “We’re all in this together” messaging to informational communications, according to a Comperemedia report on bank and credit union marketing. And some institutions are beginning to position themselves as a source of added value highlighting various financial tools, all of them digital.

“We’ve seen many financial institutions focus on digital engagement and driving customers to manage their accounts from the comfort, and now safety, of their homes,” observes Elle Kross, Associate Director, Client Strategy, for Movable Ink. The marketing technology company has seen many emails that highlight the institution’s banking app using words and images to educate customers who had not yet tried digital banking, Kross explains.

During and after the 2008 financial crisis, the banking industry was made out to be the villain, Harder observes. Residual trust issues still linger among consumers. But in the current situation financial institutions can be seen as an ally, she believes. “This is an opportunity for marketers to turn that earlier perception around.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Social Media and Email Were Made for Times Like This

Because of the speed with which events are occurring during the pandemic period, most financial marketers are relying primarily on digital marketing. Social media and email in particular have been the channels of choice.

“We’ve seen most financial brands flock to their owned social media channels first to showcase their support,” states Lierin Ehmke, Senior Digital Analyst with Comperemedia. These “flexible and malleable digital channels” allow banks and credit unions to immediately contact their customers to get them support during this time, she adds.

Owned media, along with email, is great for communicating with your own customers, notes Ehmke. It’s also a way to boost content marketing efforts, since social media posts often link back to an institution’s website. On the other hand, if an financial brand is looking to attract new customers, then a paid social strategy would make sense.

Harder points out that email is a great way to reach people with customer-specific information. “You can get a little more personal with email,” she states, “while you wouldn’t post specific information on a social page. In their emails, banks and credit unions ideally should be highlighting product or service features that are best suited for an individual consumer based on their previous behaviors, points out Kross. Such personalization is, if anything, even more important during this crisis period.

10 Examples of Effective Financial Institution Communications

The authorization of the stimulus payments to American consumers prompted a wave of marketing communications from banks and credit unions as well as fintech providers. Some communications addressed questions. Others suggested how best to use the money. The following images come from Mintel’s Comperemedia Omni database. Lily Harder and Lierin Ehmke discussed highlights of each of them in a conversation with The Financial Brand.

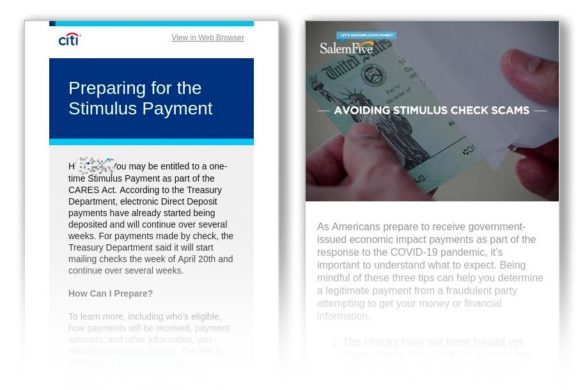

The two email communications above from Citi and Salem Five are examples of how to convey detailed information to consumers. The email from Citi, which was quite long in its full form, deals with issues relating to receiving the government stimulus payment by direct deposit or by check. It contains multiple internal and external links. The subject line was: “What you need to know if you’re getting a stimulus payment.”

Subject lines that are more forward about need-to-know information will generally improve the open rate, Ehmke notes. An email on the same topic from another large bank had this subject line: “If you need us, we’re here for you.” The problem with that, says Harder, is “there’s no reason to open it. Plus it’s very similar to what every other brand has been saying.”

The Salem Five email is a good example of proactively warning consumers about the strong possibility of scam artists preying on consumers eagerly awaiting their money. The message gave very clear warnings of what to look out for and what not to do, including: “Do not respond to IRS calls, texts, or email communications.”

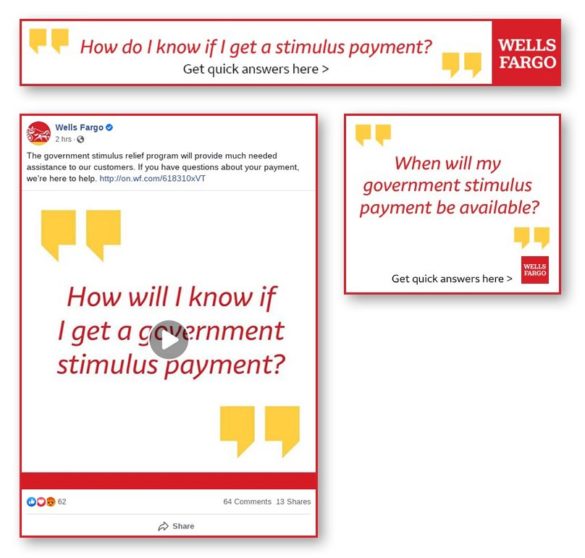

Wells Fargo took a different approach with its stimulus communications, using digital display ads along with owned social. Both Harder and Ehmke felt this was a unique and effective brand play. “Wells Fargo has not had the best PR in recent years, and they’re making the most of the situation to be an ally,” Ehmke states. “So here we have a campaign that lists all these different questions people have, and Wells Fargo is there to deliver the answers for you.”

Harder gives the big bank credit for taking an educational approach and not being self-serving saying something like “Deposit your stimulus check with us.” They are advertising their brand, yes, she adds, but they’re doing it in a way that is providing information not promoting a product.

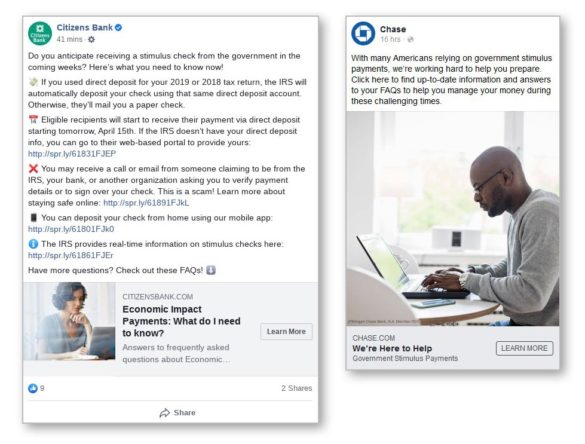

These examples from Citizens Bank and Chase of how to provide information on Facebook illustrate two distinct approaches.

“We see Chase’s approach more often, where you click through to go to the bank’s informational hub,” observes Ehmke. “It’s a content marketing play to drive more traffic to the content on their site. But the Citizens Bank approach is really unique because they’re giving everything upfront. They don’t necessarily care about clicking through to their website. They just care about informing the people that are reading the posts.”

Read More:

- How Financial Marketers Can Take COVID Outreach to the Next Level

- Why COVID-19 Is Rebooting How Gen Z Feels About Money and Banking

Communicating About Financial Tools

Beyond information, some banks and and credit unions offered more specific guidance, financial tools, and even tips on how to use government funds. Fintech efforts are notable in these areas.

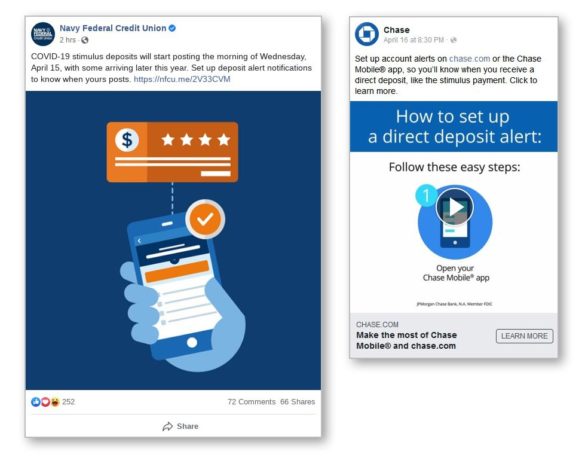

Two more Facebook examples — from Navy Federal and Chase — show how financial institutions can both inform consumers and provide a financial management tool: in this case a deposit alert to inform people of when their stimulus payments arrive.

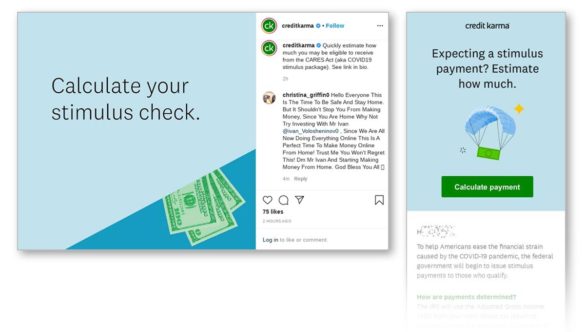

Although the COVID-19 crisis has impacted some fintechs’ capital flow, it also presents these institutions with an opportunity to stand out. Harder was impressed with Credit Karma’s stimulus calculator. “Fintechs often leverage calculator tools to create popularity, and it was very innovative for them to quickly create one regarding the stimulus to help out their customer base,” the analyst states.

The left-hand image is from Instagram. The other is an email. The email’s subject line was: “[NAME] expecting a stimulus payment? Here’s what you need to know.”

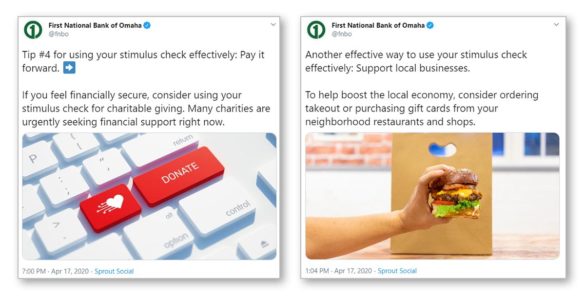

First National Bank of Omaha’s Twitter campaign moves the bank’s marketing message beyond information toward money management. It addresses the question many people may have of what to do with the stimulus money once they receive it.

Harder considers these tweets to be a very proactive approach. “The bank is giving very active advice, but it’s not promotional,” she maintains. “It’s putting their money where their mouth is, going beyond ‘We support you,’ and giving real-life advice that many of their customers are probably asking.”

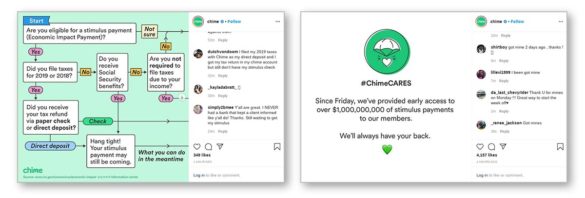

Chime drew national attention for providing early access to stimulus money for its members, which it talked about on Instagram (above right). The flow chart impressed both Harder and Ehmke for helping to provide answers regarding the stimulus program, which has been confusing to many consumers.

“Many of Chime’s customers are younger,” Harder notes, “and this is a rough time for them dealing with their first financial crisis.” Instagram is a good fit for that demographic, she adds.

Read More: The Digital Ads Banking Consumers Hate Most (And Why)

Looking Ahead to the Next Wave of Communications

“We’re seeing a very slow, methodical opening of the economy,” states Harder. “Financial institutions are going to have to find creative ways to help their customers navigate this next stage, which is going to change week to week.” The analyst expects this assistance will be a combination of active advice, like First National Bank of Omaha has been doing, flexibility and product innovation.

Elle Kross of Movable Ink thinks the next stage of marketing communications will focus on things like how the institution is keeping its customers and employees safe as branch locations start to open; how they can assist customers who may have been furloughed or laid off and where they should focus their acquisition strategies — e.g. shifting to deposits and low-risk products.

One of the ongoing challenges for marketers is that the range of consumer pandemic experiences is wide — from many needing help to others actually spending more on certain categories, to those saving for the post-COVID world. “Financial institutions need personalized and appropriate messaging for all these populations to ensure loyalty and retention,” states Kross.

In addition, Harder points out that the potential for the virus to come back in the fall is making people realize the importance of preparedness, financial and otherwise.