A recent poll conducted by The Financial Brand found that 57% of banks and only 23% of credit unions utilize search engine marketing (SEM). Clearly there are many financial institutions that have yet to embrace this powerful approach to marketing.

AdWords is Google’s flagship advertising product and main source of revenue, generating revenues of USD$23 billion in 2009. Both Yahoo! and Microsoft offer SEM programs similar to Google.

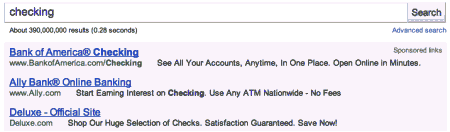

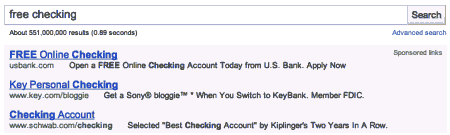

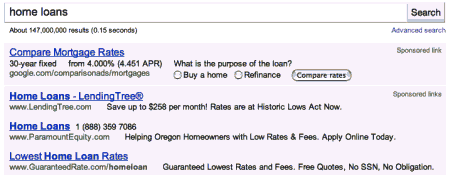

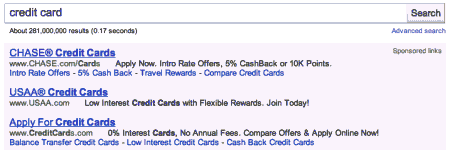

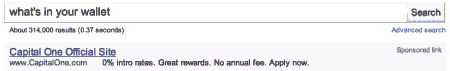

How does Google AdWords work? It’s easy. Once you’ve created an AdWords account, you can define the “keywords” (search terms people use) that will trigger your ads, along with a bid for what you’re willing to pay when someone clicks on one of your ads. Then, when people search Google for the keywords you’ve selected, your text-based ads will be shown as “sponsored links” on the right side of the screen, and sometimes above the main search results (depending on a myriad of factors).

Clickthrough rates (CTR) for the ads are about 8% for the ad in the top position, 5% for the second one, and 2.5% for the third one. Search results can return anywhere from 0 to 12 ads. Google limits the number of ads displayed above its organic results (the ads in gray boxes) to no more than three.

Google’s AdWords platform is as remarkably simple as it is robust. You can specify daily and monthly budgets. You can create campaigns, clusters of keywords and groups for different ads. The level of granular control you want to apply is entirely up to you. You can even choose the websites on which you’d like your ads displayed.

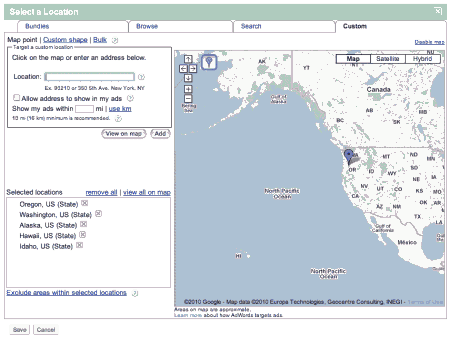

GOOGLE ADWORDS – GEOLOCATION OPTIONSYou can limit your ads to display only in specific cities, postal codes or within a certain number of miles from an address you provide.

Most financial institutions will find AdWords’ geographic search parameters particularly appealing. You can specify that your ads display only within a certain number of miles/kilometers from a physical address, or in certain cities or ZIP codes. Community banks and credit unions should make the most out of this feature, helping them save money on their AdWords budget, but geographic targeting is something every financial institution — even the mega-banks — can utilize effectively.

If you need some help getting started, check out Google’s guide for AdWords beginners. They also have an excellent 36-page PDF you can download. If you feel overwhelmed, you might want to try working with an SEM consultant.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

What’s It Cost? What’s It Worth?

How do you know how much you should bid on the keywords you’d like to purchase? Well, Google has a tool for that as well: The Google AdWords Traffic Estimator. Here you can look up what the bidding ranges are for your desired search terms, and see how frequently people are searching for your keywords. Google will even tell you how competitive a phrase may be, so you’ll know how aggressive you have to be with your bids.

The Financial Brand has assembled a database of keywords financial institutions might be commonly interested in buying, allowing you to compare relative costs. The “Cost/Click” column gives you Google’s estimated average cost-per-click (CPC). Remember, Google displays your AdWords ads for free. They only charge you when someone actually clicks on your ads. The “Searches/Month” column shows you how many people search Google for that keyword or phrase in an average month, so you can get an idea for how many impressions your ad could yield. The “Competition” column shows you how competitive the bidding environment is for each keyword or search term.

Bids can range everywhere from 1¢ all the way up into the hundreds of dollars, depending on how desirable and competitive the search terms are. If you want your ad displayed when someone searches for “Ally Bank,” for instance, you’d only have to bid 5¢. But if you want your ad to pop up when someone Googles for “Capital One,” you can expect to pay around $27.19.

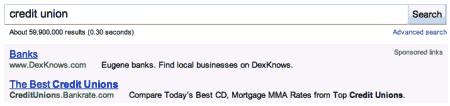

General Banking Terms

Because so few credit unions use SEM programs, the term “credit union” is cheaper than “bank” across the board. You’ll notice that more broad keywords like “bank” and “credit union” are much less expensive than geographically specific terms like “Los Angeles bank” and “Chicago credit union.”

| Keyword | Cost/Click | Searches/Mo. | Competition |

|---|---|---|---|

| bank | $3.04 | 24,900,000 | low |

| community bank | $1.21 | 368,000 | none |

| credit union | $1.63 | 6,120,000 | none |

| credit unions | $1.12 | 165,000 | low |

| interest rates | $6.14 | 550,000 | high |

| bank fees | $3.42 | 33,100 | low |

| green banking | $3.43 | 880 | moderate |

| Chicago bank | $3.70 | 74,000 | low |

| Chicago credit union | $2.46 | 4,400 | none |

| NYC bank | $4.99 | 18,100 | low |

| Los Angeles bank | $7.36 | 18,100 | low |

| California credit union | $1.01 | 40,500 | none |

| Seattle bank | $3.52 | 18,100 | low |

| Seattle credit union | $1.69 | 5,400 | none |

| Colorado bank | $4.30 | 60,500 | low |

| Iowa credit union | $0.81 | 12,100 | none |

| Phoenix credit union | $2.09 | 1,900 | none |

Checking, Savings & Deposit Accounts

As you start to get more focused with your search terms, bidding costs go up. As you can see, bidding gets more expensive and more competitive for specific products and services. If you’re going to pay upwards of $10 for people to click on your ads, then you damn well better know how to convert them into new accounts. (Hint: Simply directing them to your standard, basic page for ‘New Accounts’ on your website ain’t gonna cut it.) Google AdWords campaigns are always more effective when you build a dedicated landing page for each ad (or groups of ads) you create.

| Keyword | Cost/Click | Searches/Mo. | Competition |

|---|---|---|---|

| checking account | $10.35 | 301,000 | high |

| checking accounts | $11.03 | 368,000 | high |

| savings account | $10.52 | 450,000 | moderate/high |

| savings accounts | $9.76 | 110,000 | high |

| interest checking | $14.62 | 22,200 | high |

| free checking | $14.10 | 110,000 | high |

| business checking | $13.93 | 49,500 | high |

| money market | $11.00 | 301,000 | high |

| ATM | $1.96 | 550,000 | low |

| debit card | $5.43 | 301,000 | moderate |

| overdraft fees | $2.34 | 33,100 | low |

| no overdraft fees | $0.05 | 1,900 | moderate/high |

| online banking | $8.42 | 2,240,000 | none |

| mobile banking | $2.32 | 33,100 | moderate |

| direct deposit | $2.75 | 135,000 | moderate |

Lending

As you might expect, lending is the most competitive segment of retail banking right now. What’s it worth to you to have hot, relevant lending leads delivered straight to your online doorstep? Financial marketers who know how to make Google’s AdWord system hum are willing to pony up $5-$20 per click. If you think that sounds expensive, think about how much it takes to produce and air a TV spot. What’s the cost and ROI on that?

| Keyword | Cost/Click | Searches/Mo. | Competition |

|---|---|---|---|

| home loan | $16.49 | 1,830,000 | high |

| home loans | $20.51 | 673,000 | moderate/high |

| mortgage | $15.05 | 9,140,000 | moderate/high |

| mortgage rates | $13.78 | 823,000 | high |

| refi | $17.78 | 60,500 | high |

| refinance | $14.38 | 1,000,000 | high |

| loan | $9.75 | 9,140,000 | moderate/high |

| personal loan | $5.68 | 823,000 | high |

| HELOC | $17.27 | 60,500 | moderate/high |

| home equity | $24.95 | 550,000 | high |

| auto loan | $7.56 | 673,000 | high |

| auto loans | $9.95 | 246,000 | high |

| car loan | $7.03 | 550,000 | high |

| boat loan | $6.69 | 40,500 | high |

| motorcycle loan | $7.00 | 14,800 | high |

| student loan | $20.97 | 1,500,000 | moderate |

| student loans | $12.30 | 823,000 | moderate/high |

| business loan | $5.99 | 301,000 | high |

| business loans | $6.85 | 301,000 | high |

| credit score | $10.03 | 1,000,000 | high |

| credit report | $13.46 | 1,500,000 | high |

| free credit report | $15.64 | 673,000 | extreme |

| FICO score | $9.65 | 110,000 | moderate/high |

Credit Cards

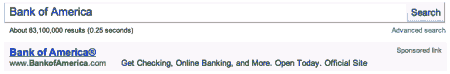

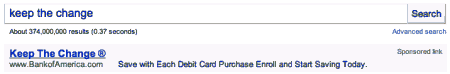

Capital One is among the many companies who believe it’s necessary to bid for Google AdWords on their own names, slogans and other trademarks. The reason? If Capital One’s competitors are willing to buy ads using the company’s name, that means another credit card marketer could appear above Google’s organic results whenever someone searches for Capital One. The astronomical prices for search terms associated with Capital One suggests that the company is artificially inflating bids in an attempt to thwart competitors tempted to draft off the credit card giant’s image and advertising. (Note: Capital One purchases different derivations of their name, including “CapitalOne” and “Capitol One.”) This is almost purely a defensive strategy.

| Keyword | Cost/Click | Searches/Mo. | Competition |

|---|---|---|---|

| credit card | $12.29 | 6,120,000 | moderate/high |

| Capital One | $27.19 | 1,500,000 | low |

| CapitalOne | $18.59 | 1,500,000 | low |

| What’s In Your Wallet? | $12.27 | 1,300 | none |

| Visa | $3.47 | 3,350,000 | moderate |

| student Visa | $2.51 | 60,500 | moderate |

| Mastercard | $6.31 | 550,000 | moderate |

| AmEx | $9.42 | 368,000 | low |

Competitors

If you think it’s unfair or “playing dirty” to buy AdWords ads when people search for your competitors, get over it. It’s smart business and smart marketing. There’s nothing remotely unethical or illegal about it. If you wrestle with the morality of it, tell yourself you could be saving people from making a big mistake. If you are indeed the better choice over your competitors, then you are actually performing a valuable consumer service when you place your ad in their way.

| Keyword | Cost/Click | Searches/Mo. | Competition |

|---|---|---|---|

| Bank of America | $1.42 | 6,120,000 | low |

| BofA | $2.18 | 246,000 | none |

| BofA branch | $0.05 | 12,100 | low |

| Bank of Opportunity | $0.05 | 2,400 | moderate |

| Keep the Change | $1.65 | 22,200 | none |

| Wells Fargo | $8.27 | 2,740,000 | low |

| Wachovia | $3.08 | 1,830,000 | none |

| WaMu | $11.35 | 301,000 | none |

| Citi | $4.91 | 550,000 | low |

| Navy FCU | $0.05 | 368,000 | none |

| Navy Federal Credit Union | $0.80 | 301,000 | none |

| Pentagon FCU | $2.53 | 33,100 | low |

| BECU | $2.91 | 74,000 | none |

| Kinecta | $4.99 | 18,100 | none |

| DFCU | $1.01 | 14,800 | none |

| Wesabe | $0.05 | 2,900 | low |

| Ally Bank | $0.05 | 49,500 | moderate |

| ING DIRECT | $8.66 | 201,000 | low |

| USAA | $3.13 | 823,000 | low |

| Schwab | $5.47 | 550,000 | low |