A clever, interactive online campaign involving live-streaming ads gave bank customers a vicarious outlet to release their bank rage.

Everyone in the financial industry knows: It’s not easy to get people to switch banks, even those who hate their current bank. This is true in Australia where 49% of consumers say they would be more likely to switch banks if it was easier. But most folks can’t stand the mountain of paperwork and headaches involved. So in July 2012, the Australian government decided to change the rules and made changing banks a simple one-form process — colloquially called “tick and flick” switching.

For Heritage Bank, it was game on. They knew the nations big four banks had thousands of unhappy customers who were ready to dump them. Heritage swooped in with a brilliant and perfectly-timed campaign aimed at the big banks’ least satisfied customers.

For a 24-hour period, Heritage ran a live, interactive “takeover” banner ad on couriermail.com.au. When a visitor clicked on the banner, they were prompted to enter their name, suburb and answer this question: “Do you love your big bank?” Their answer choices were “yes,” “no” and “when pigs fly.”

Once the information was supplied, they were routed to a live broadcast studio and introduced to “Heritage Man,” the on-going star of Heritage’s TV commercials. Behind him were three targets on a wall with the answer choices: Yes, No and When Pigs Fly. Heritage Man would greet them by name, engage in some light-hearted banter, then hurl a tomato at the appropriate target.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

( Read More: Bank Streams Live Rock Concerts In Online Banner Ads )

The overwhelmingly majority of consumers chose the option “When Pigs Fly,” but when the occasional visitor did vote “Yes,” Heritage Man accepted let them know that the bank would always there if they ever changed their mind.

Heritage Bank ran hourly competitions using the #bankrage hashtag, and asked people to nominate what they wanted thrown (besides tomatoes) at targets.

Skip to the 1:35 mark of this video to watch Heritage Man chucking tomatoes around a live TV studio as he interacts with angry bank customers.

The entire tomato chucking spectacle was simultaneously broadcast at a special microsite Heritage created for its “Bye Bye Bank Rage” campaign.

The integrated marketing campaign entitled “Bye Bye Bank Rage” included print, TV and interactive outdoor advertising. The rotten tomato concept was part of a broader bank switching campaign developed by BCM Partnership in conjunction with DG MediaMind.

For the Heritage campaign, BCM transformed two bus shelters in Brisbane into mini, interactive bank branches. The ads were located by the headquarters of competitors BOQ, Westpac, Suncorp and HSBC (what’s known as “ambush positioning”) and include a message on the roof targeted at rival bank executives. The bus shelters also featured interactive screens where people could vote on whether they loved their big bank or not. Over 6,000 people cast their votes.

( Read More: Aussie Bank’s Huge Guerilla ‘Break-Up’ Campaign Mocks Competitors )

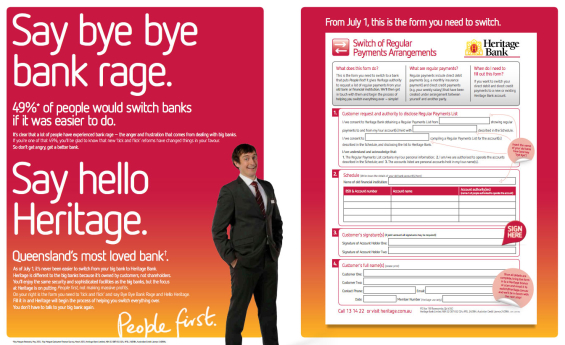

A big double-page print ad Heritage ran in the big Brisbane newspaper as part of its “Bye Bye Bank Rage” campaign.

Key Campaign Results

- 10,000 people visited the byebyebankrage.com microsite during the four-week campaign period.

- Over 5,000 popped on the microsite simply to watch Heritage Man sling tomatoes.

- More than 1,200 tomatoes were launched during the 24-hour period.

- Visitors spent an average of more than two minutes at the site.

- Two-thirds of people recalled seeing the Heritage campaign and took away the key message that “it is now easier to switch banks.”

- 57% said they had a better understanding of what Heritage stands for.

- 49% were more positive about Heritage.

- 42% of consumers made a conscious decision to consider Heritage in the future.

- 44% said the campaign made Heritage Bank stand out from all other institutions.

- 9% would tell friends and relatives about Heritage Bank.

- Most significantly, there was a 10% lift in the number of customers who switched to Heritage in the two months during and after the campaign.