The other day, my daughter asked me what my favorite app was when I was little. My answer: pigs in a blanket. Gen-Y consumers may have grown up with the internet, but the next generation — Millennials — are growing up with the internet in their (parent’s) pocket.

In a recent survey on FindABetterBank, roughly 90% of respondents under the age of 50 indicated that they own smartphones. Many parents — including me — hand their phones off to their kids to keep them entertained. It’s exciting to think about the digital banking services Millenials will expect when they come of age.

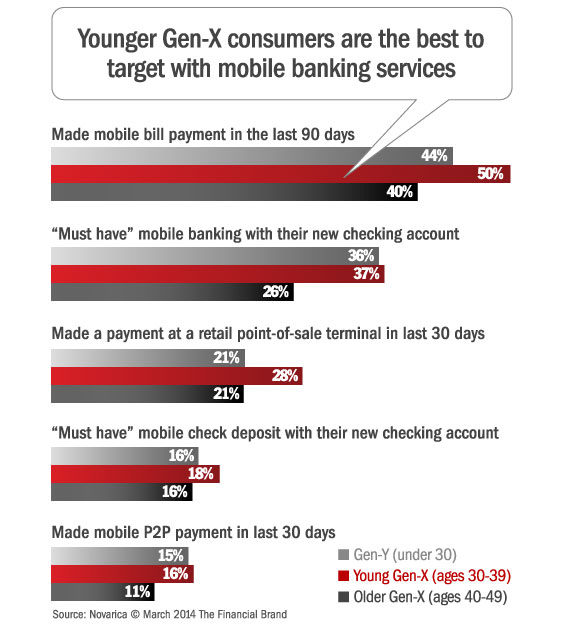

Right now, Gen-Y consumers might be getting all the buzz. The mobile strategies and marketing messages most financial institutions are using target Gen-Y consumers. Obviously winning Gen-Y — and subsequent generations of consumer — is essential for banks and credit unions. But today, at this moment in time, research says the ripest segment for mobile banking services is somewhat older than Gen-Y. Our study found that people between 30 and 39 years old (i.e., “Young Gen-X Consumers”) are the most likely to be interested in using their smartphones for banking and making payments.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Gen-X: What The Survey Revealed

Gen-X consumers use their smartphone for payments more than Gen-Y. Young Gen-X consumers are more likely than Gen-Y consumers to have used their mobile phones to pay bills, make retail POS payments, or send money to friends or family members.

Gen-X consumers want mobile banking features more than Gen-Y. Young Gen-X consumers are 15% more likely than Gen-Y consumers to indicate they “must have” mobile check deposit with their new checking account and they’re slightly more likely to say they must have a mobile banking app.

Now these findings don’t suggest it’s less important to acquire Gen-Y consumers. It does, however, point out that those most likely to want mobile banking services today are people who are a little older and probably have less time on their hands than Gen-Y.