If it seems as if everyone around you is glued to their smartphone screen, it’s with good reason. The 2014 Fiserv Consumer Trends Survey showed that 68% of Americans over the age of 18 own a smartphone, allowing them to be constantly connected.

Along with the growth of smartphones a new type of consumer has emerged – a mobile-only consumer we refer to as the “mobivore”. These consumers use only their smartphones to go online, forgoing other devices such as desktop or laptop computers and even tablets.

Although mobile-only consumers tend to skew younger, they cross generations and socio-economic segments. Fiserv estimates that mobivores currently make up about 15 to 20 percent of a typical financial institution’s mobile banking user base.

Based on trends and other markets, we can assume more consumers would be mobivores if they had access to true mobile-only functionality, and that this segment is likely to grow.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Unmet Expectations

“‘Mobivores’ currently make up about 15 to 20 percent of a typical financial institution’s mobile banking user base.”

— 2014 Fiserv Consumer Trends Survey

Traditional banking experiences do not meet the needs of mobile-only consumers. Unlike most consumers who want to use multiple banking channels, mobivores only care about what is available on the mobile channel. Even then, their needs are quite different from those of other mobile banking users.

While mobile banking is usually all about quickly and efficiently completing tasks and accessing information, mobivores want a full-service mobile experience that is independent from any other channel. They expect to be able to complete tasks such as enrolling in and managing accounts, contacting a bank representative, filling out and signing forms, receiving notifications, and making payments.

Delivering this robust level of mobile-only banking capabilities requires untangling dependencies from other channels, including online. To add a payee to mobile bill pay today, for example, a user generally has to log in to online banking – not a viable process for a mobile-only user.

Delivering a Mobile-First Experience

To develop a full-service mobile experience suitable for the growing mobivore segment, financial institutions must examine the banking functionalities that are important to mobile-only users and ensure the mobile banking user experience is as frictionless and user-friendly as possible.

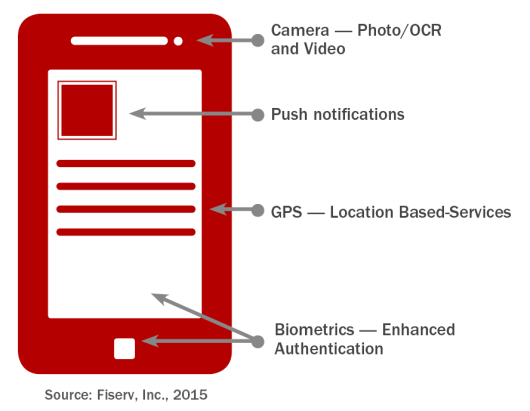

Designed to benefit all mobile banking users, several capabilities are especially important to the Mobivore, including self-service, direct communication and personalization. For example, pre-login balance options, and authentication through fingerprint and voice recognition facilitate quick, secure access to account information. Live chat and click-to-call options also appeal to mobile-only users, who want to make convenient, direct real-time connections when they need assistance.

Taking a picture of a check or bill to quickly and easily capture information – and avoid entering text on a small mobile screen – takes the hassle out of these mobile banking interactions. In the same way, mobivores expect a user-friendly, mobile-based lending experience, from completing an application to checking balances and making payments.

Following are some of the solutions and capabilities that can help financial institutions better serve mobile-only bankers:

- Device-based digital enrollment to enable users to set up digital credentials including passwords and preference settings via the mobile channel.

- Biometrics options to enhance the authentication process. Mobivores want quick, secure access such as fingerprint and voice recognition.

- Pre-login balance options to enable users to see their account balances without entering a password.

- Secure messaging, live chat and click-to-call options to connect users in real-time to a bank or credit union representative.

- Personal digital bankers to build the financial institution’s relationship with the mobile-only consumer. At Kiwibank in New Zealand mobile banking customers can contact a named bank representative at any time for assistance (See Kiwibank’s iPhone App Puts A Service Rep In Everyone’s Pocket).

- Location-based offers for retail purchases to quickly and efficiently market to mobivores in the time they spend using the mobile app.

- Mobile-based loan applications to allow users to apply for a loan from their device after selecting the loan type that works for them. America First Credit Union enhanced its mobile app so members can select and apply for five different loan types within the app.

- Mobile photo bill payment to capture and populate bill payment information when a picture of the paper stub is uploaded, eliminating the need to key in large quantities of data from their phone.

Consumers are accustomed to frictionless, innovative mobile experiences, whether managing travel, shopping, sending photos or making social connections, and they now expect the same from mobile banking. A seamless and user-friendly mobile experience not only benefits the consumer but also gives an advantage to the financial institution.

A focus on delivering the best, most compelling experience for all users will position financial institutions to meet the needs of the growing contingent of mobivores as well as more broadly connected mobile banking users.