By Tim Bunch, Web Strategist, Designer and Developer at CapEd FCU

In episode two of this multi-part series on the future on online banking, author Tim Bunch outlines the keys to building an online cross-selling strategy based on automated account analyses. In his first installment, Bunch argued that your online banking system should be viewed as your biggest — and most important — branch. Read the previous article here.

You’ve heard it said before, “Know thy customer.” When it comes to online banking, your visitors are your customers. If you’re going to embrace the future of online banking, you’ll need to know your visitors better than ever before.

The majority of transactions are happening online — that’s a fact. But many financial marketers are not using information available right at their fingertips to understand their customers as well as they should. As a result, the relationship with online customers is not as strong as it could be.

What You Can (And Should) Know About Your Visitors

Wanna know anything about anyone? Just look at their transaction history and bill pay activity. People are largely a reflection of what they spend their money on.

Great tellers will analyze transactions and account details to cross-sell the customer in front of them. Great tellers scan for account details that provide insights into what products or services a customer may need or want. The same thing can be replicated — and automated — in your online banking environment.

Online banking can deliver the same information, along with some major advantages:

- Accounts can be analyzed much faster than in-person

- No pressure from a queue of people waiting to be helped means the cross-sell process doesn’t have to be rushed or feel like an imposition

- Everyone (staff and customers alike) can avoid the discomfort and awkwardness of in-person cross-selling

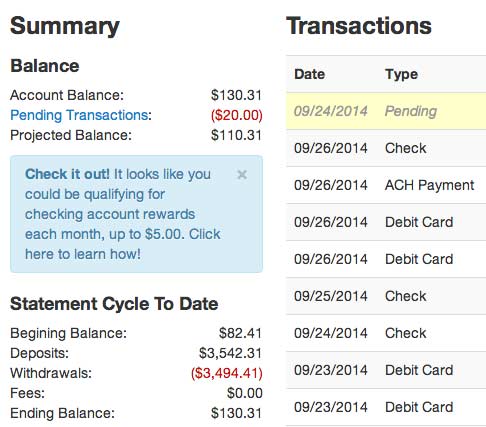

Here’s an easy example. Do you offer rewards checking? Well, your online banking system knows that some visitors would qualify for nice rewards every month. Why not ask those visitors to upgrade their accounts automatically.

A friendly note about a free checking account upgrade. Inside the blue callout box it says, “Check it out! It looks like you could be qualifying for checking account rewards each month, up to $5.00. Click here to learn how!”

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

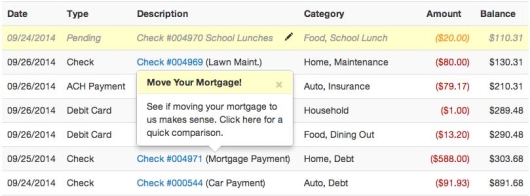

Here’s another example. Do you have a strong home refinance offer? Your online banking system knows which visitors make their mortgage payments to another institution using your checks or bill pay platform. You could provide an estimate of how much they could save by refinancing.

Sensing a customer could benefit from a refinancing offer, the online banking system gives them a little nudge in the right direction. A pop-up box appears over the customer’s mortgage payment sent to another institution.

However, there are some drawbacks and challenges with an automated online cross-selling strategy:

- Lack of personal touch or delivery

- Objections are more difficult to parse

- Difficulty discerning the line between annoyance and helpfulness

Each challenge needs to be evaluated carefully, monitored closely and handled directly. Rely on analytics to gauge success and explore new tactics. You may want to segment your visitors by behaviors. For example, behaviors such as offer rejections or acceptances should alter the behavior of your cross-selling algorithm within your online banking application.

Pace Yourself, Don’t Smother The Customer

Don’t hound someone with an offer until they accept it. “Pushy” sales people do just that: they push people away. With online banking though, it could be easy to forget that our delivery might be coming across as pushy. We need to play with pace, language, and design to achieve the best results. Determining the right pace can be a delicate thing, but it’s better to err on the conservative side and expose them to a little lighter volume of cross-sell marketing than risking backlash because you’ve crossed the line with too much.

Personal Financial Management Tools

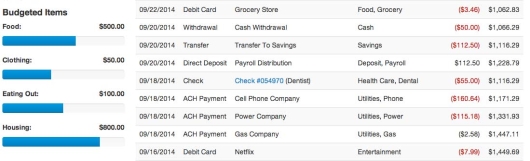

Personal financial management (PFM) tools are showing up more frequently at credit unions and community banks these days. PFM tools like Mint.com assist people with their financial decisions by organizing and analyzing all their accounts. This is the kind of tool consumers desperately need… and want — a single place they can keep track of all their spending, savings and loans.

For financial marketers, there may be no better way to know your visitors than a PFM system, besides sitting down with them face to face. People will voluntarily provide you with a wealth of financial details.

PFM tools also track and categorize spending, helping set goals and achieve with visual feedback in real time. Along with a mobile app, visitors can manage and keep track of their budgets from virtually anywhere. Best of all, this technology is already in play.

Does your visitor want to get out of debt? Help them.

Do they want to build credit? Help them.

Do they need to start an emergency fund, holiday fund, or other savings plans? Help them!

Use the information they provide to show them how to do it and track their progress. The repeating theme here is to help your visitor achieve their financial goals.

Ask For More Information

If there were one more thing financial marketers could do, it would be to simply ask for more information. Isn’t that what we would do if we were discussing their accounts in person?

• Ask about their financial goals

• Ask financial education questions

• Ask how you can improve your products and services

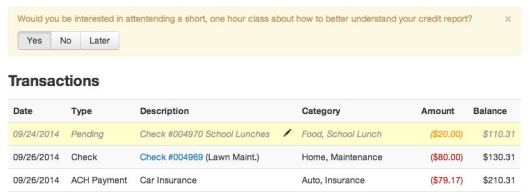

This can be done in a simple, non-intrusive way (Figure 4). Create a simple interaction without a high commitment on the part of the visitor. The frequency of responses should grow over time and become a staple of your online banking application.

A non-threatening request for more information. Pace is critical in this area. Just like a teller that has to judge if someone is in a hurry or not, your online cross-selling solution must also respect a visitor’s time. You can’t ask for every single bit of information you may ever want all at once. You need to separate your requests out over time.

Bottom Line

First and foremost, you must have the best interest of your visitor at heart. This motivating factor will point visitors to the right products and services. It will provide long-term results and the best overall brand experience.

The future of online banking will require a high amount of commitment and investment. Be ready to persevere. Many turn key, third party solutions simply don’t cut it. Keep in mind that they build applications that must suit a wide range of customers, and may not be a good long-term solution.

Competing online is going to get much more complex. Whoever knows their visitor best will win. Take action now to increase your chances of winning in the future.

Tim Bunch is a web strategist, designer and developer at CapEd FCU. As a web standards fanatic, he passionately pursues best practices in web design. Tim is also an avid WordPress developer, music maker and coffee drinker. If you’d like Tim to speak at an upcoming event, please connect him on Twitter or Google+.

Tim Bunch is a web strategist, designer and developer at CapEd FCU. As a web standards fanatic, he passionately pursues best practices in web design. Tim is also an avid WordPress developer, music maker and coffee drinker. If you’d like Tim to speak at an upcoming event, please connect him on Twitter or Google+.