The loan marketplace is finally gaining steam after years of low demand. According to American Banker, loan portfolios at banks with less than $40 billion in assets increased an average of 15% in third quarter 2014 from the previous year, and net interest income rose 11%. The loan-to-deposit ratio for these banks averaged 85.3% for the period, an improvement from 82.4% two years earlier.

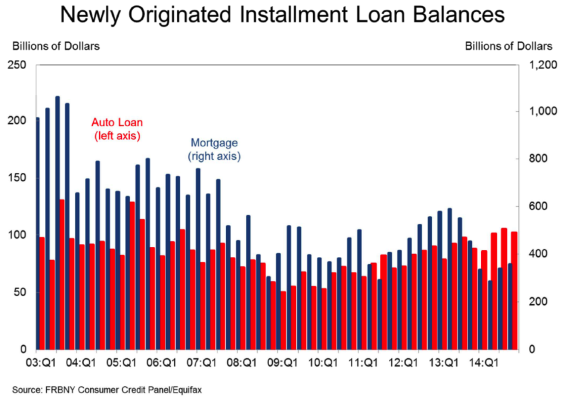

An analysis of the market from the consumer side shows aggregate household debt balances up one percent from third quarter to fourth quarter 2014, with increases in mortgage, auto loan, student loan and credit card balances. Credit card limits, mortgage originations and home equity line of credit (HELOC) limits all increased, while overall delinquency rates were down. The number of credit inquiries in six months, which indicates consumer credit demand, rose four million during the period.

The challenge for financial institutions is how to take advantage of this positive lending environment in ways that satisfy consumers’ immediate needs – and make money.

Traditional loan acquisition programs that send relatively untargeted communications to consumers during peak demand periods (spring home buying season, for example) don’t take advantage of the data insights currently available. Now more than ever, consumers expect marketing messages to be tailored to them, on their terms and timing. And, while there’s better news on the economic front, consumers continue to be afraid they won’t qualify for loans, leaving the offers that are tendered unanswered.

Banking Transformed Podcast with Jim Marous

Listen to the brightest minds in the banking and business world and get ready to embrace change, take risks and disrupt yourself and your organization.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The Consumer Lending Disconnect

Fear of loan rejection keeps about half of potential homebuyers out of the market, according to a national survey by loanDepot, the nation’s third largest private, independent retail home loan lender. Almost 90% of Americans who will need financing to buy a home in the next two years haven’t done anything to see if they qualify, partly because they overestimate how hard it will be.

Fully half of Americans have no idea what credit score is needed to qualify for most loans.

Another obstacle seems to be lack of understanding of FICO credit scores. Fully half of all Americans have no idea what score is needed to qualify for most loans. Nearly 20% believe they need a score of 680 to 770 or higher, while in reality, 33% of all loans closed in February 2014 had an average FICO score under 700.

“In the past, a consumer’s credit score was similar to Santa Claus. It came around maybe once a year, and it knew if you were naughty or nice, but absolutely no one could figure out how it got the job done or where it really came from,” says Sam Maule, emerging payments practice lead, Carlisle & Gallagher Consulting Group.

“Times have changed. Now, credit card companies, banks and credit unions routinely provide consumers with credit scores and advice on how to improve them. However, that still isn’t proactive enough, since it requires the typical consumer to access multiple links and educate themselves on what they are viewing,” Maule added.

Fear of the numbers may not be the only disconnect between consumers and the borrowing process. Traditional banking loan policy still treats lending as an isolated, standalone service instead of a reward that considers an account holder’s total banking relationship. Consumers, on the other hand, think their banks or credit unions should know them and reward them for their loyalty when they need loans.

“Consumers have long held unfulfilled expectations that their financial institutions would take a proactive and holistic approach to risk assessment, underwriting and pricing. While this is often true for larger commercial and wealth management relationships, the reality is that most financial institutions are reactive and transactional in their responses to most retail loan requests despite technology that could close that gap,” says JP Nicols, president and COO of Innosect, an innovation and advisory and analytics firm that works with banks and credit unions.

The lack of a holistic relationship view can cost financial institutions valuable loan business and primary financial status with their existing account holders. For loans to help grow share of wallet, they should be viewed as a part of the total relationship.

Moving Lending to the Digital Age

Conventional loan acquisition programs work, to a point. Trigger programs, for example, tell financial institutions when the credit bureaus get an inquiry so they can follow up with a prequalified offer. They’re effective but, many times, don’t offer enough volume to satisfy institutional goals.

Prescreened loan offers are typically mass marketed at certain times of the year through one or two channels to promote a single product, such as home equity loans. Again, they’re effective for some, but don’t address each consumer’s specific needs, timing or eligibility.

With typical prescreen loan campaigns, about 30-35% of the target can actually qualify, leaving a large portion who can’t. As a result, organizations are constantly looking for ways to get consumer response rates up from less than two percent. Improving the targeting and timing helps to achieve this mission.

A new solution called LoanEngine from Harland Clarke pushes past the common barriers and creates the potential for significantly higher loan acquisition results. LoanEngine is powered by cplXpress™ technology from CUneXus Solutions, recognized in 2014 by KMPG, AWI and the Financial Services Council as one of 10 early stage financial technology companies to watch.

Using this advanced technology, the solution prescreens account holders quarterly, proactively offers them up to 10 products — including home equity, auto, credit card and debt consolidation loans — at every touchpoint and gives them the ability to accept an offer without an application.

“The ability to communicate to a retail lending client during their ‘Zero Moment of Truth’ regarding a loan has been traditionally impossible. This is the first tool that enables banks to engage with their account holders at the time they want to borrow through multiple channels. Properly executed, this service can lead to substantial direct returns on investment,” says David Gerbino, FinTech marketing consultant.

The power behind LoanEngine is a multiproduct loan decision engine that combines pricing automation, targeting and risk assessment to generate personalized offers appropriate for each financial institution’s risk tolerance. Because each offer is based on consumers’ creditworthiness, product ownership and product usage, they can access, review and accept multiple offers anytime, anywhere, including credit shopping locations.

“The ultimate goal of the product is to let the consumers know of offers that might be available to him or her without the need of the traditional application process,” explained Dave Buerger, CEO of CUneXus. “With this solution, loans can be approved 24/7, with little need for input from the customer or member.”

How LoanEngine Works

When a financial institution enrolls in LoanEngine, account holders are prescreened at the credit bureau for a default credit product, meaning a product with wide appeal and generous credit criteria, such as an auto loan. FICO scores, 20 other attributes, along with current product ownership information are reviewed against an additional product criteria matrix to qualify consumers for offers like credit cards, home equity loans and personal loans.

39% of adults with mobile phones and bank accounts reported using mobile banking

— Federal Reserve’s 2015 Consumers and Mobile Financial Services Report

Traditional loan programs push offers to consumers on a financial institution’s schedule, usually through direct mail or email. LoanEngine extends offers through direct mail, email, online and mobile banking platforms, call centers and using branch tellers, allowing consumers to access their preselected, preapproved offers through multiple channels anytime, day or night.

Offers are refreshed every 90 days using a new credit bureau prescreen to ensure consumers still qualify for credit. Not only does this multichannel approach allow consumers to access loan offers in the channels and at times they prefer, it helps solve financial institutions’ longstanding challenge to monetize online and mobile banking.

“The standard lending model is based on the idea that consumers will come looking to borrow funds,” says Bradley Leimer, digital banking expert and CUneXus advisor. “But instead of waiting for the consumer to act, CUneXus has built a system where, via banking apps and other means, a series of customized offers can be perpetually in front of consumers.”

Despite its sophistication, LoanEngine is extremely easy for financial institutions to implement. A typical prescreened, single product campaign can take six to eight weeks to develop and execute. Once an initial campaign is set up in LoanEngine, subsequent programs take approximately a week per quarter to implement.

In addition to generating demand for big balance products like home equity and auto loans, LoanEngine has the potential to drive growth for product lines that often don’t get marketing support, such as unsecured, boat and recreational vehicle loans. Most importantly, it rewards account holders with personalized, relevant loan offers and moves financial institutions toward primary status.

A Case for Success

Although fairly new, LoanEngine’s foundational software cplXpress has proven effective for many financial institutions. One of the largest U.S. credit unions — with assets of more than $2.2 billion and almost 230,000 members — used cplXpress to offer multiple preselected loans with credit limits.

They ran a 90-day pilot for 31,000 credit union members, offering auto, RV, boat and motorcycle loans, Visa credit cards and overdraft loans. They generated 1,158 loans in 90 days, increasing average revenue per accepted loan offer by more than 70% and nearly tripling revenue compared to a loan campaign conducted the year before. Return on investment was more than 363% and acquisition cost per loan dropped 50%.