Neobanks find themselves caught in the middle of a coronavirus-induced “flight to quality” — and they may not be able to fight it.

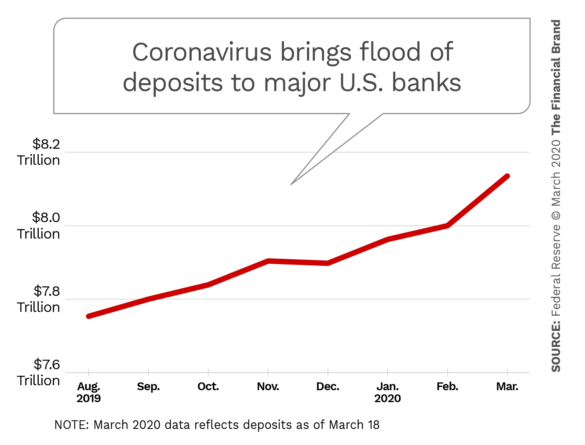

First, investors are moving capital away from risk and toward the safety of larger incumbents. Second, on the deposit side, preliminary figures from the Federal Reserve show large cash movements into the larger incumbent banks, perhaps based on the belief that they are “too big to fail” and provide a haven for cash.

Neobanks are trying to gain and maintain deposits and users’ trust in what is now a very different market than when they launched. Their response to these changes in upcoming months will be critical.

For the record, I like neobanks and think that they have had a profoundly positive influence in making banking services better for everyone. That said, their position as newcomers, heavy dependence on investor support, high valuations and lack of profits puts some in the same category as WeWork. That’s a cautionary comparison and perhaps an overstatement, but apropos amid a pending financial crisis. It’s now harder to see how ease of use will attract investors who are suddenly more worried about trust and safety.

Let’s look at how neobanks are likely going to do in three critical areas, deposits, investors, and interest rates. For purposes of this article, I include in the neobank category the following types of digital-only financial firms: Chime, Revolut, N26 and Monzo, among many others.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Depositors Seeking Safe Havens No Longer Favor Neobanks

The “flight to quality” is already hitting neobanks, according to statistics from the Federal Reserve. This provides the first hints that the world has changed rather suddenly for neobanks.

The chart below shows the jump in funds into large U.S. commercial banks from Federal Reserve data released on March 27. The Fed defines “large U.S. commercial banks” as the top 25 domestically chartered commercial banks ranked by size. While not broken out in the analysis, neobanks would be included in the “small U.S. commercial banks” category.

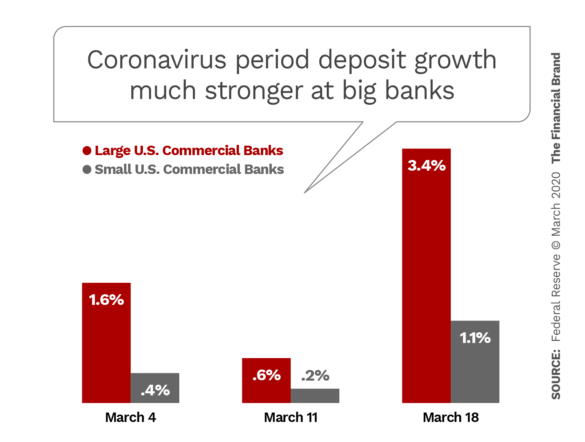

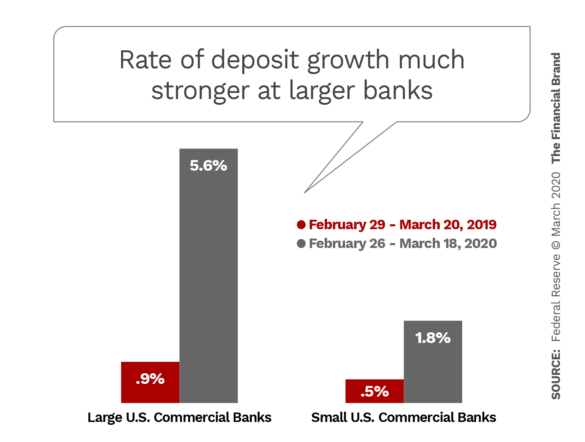

Drilling more deeply into the Fed data shows why this is critical for neobanks. The chart below shows the weekly percentage gain in new deposits from February 26 through March 18 between large and small commercial banks. Large banks showed a monthly gain of 5.6% in deposit increases compared to 1.7% for small banks. More money poured into large banks than small.

For perspective, this represents a remarkable six-fold increase in growth rate for large commercial banks, compared to the prior year. Of critical importance for neobanks is that investors’ preference for large banks more than doubled compared with last year.

This should be terrifying for neobanks.

The comparison between large and small U.S. commercial banks may not be an exact match for neobanks, who would be lumped in with the small bank data, but it is signaling that size matters. Many of the smaller banks lumped in this analysis have been around quite a while, and if it’s that hard for them to attract deposits away from the top 25 banks, it will be even harder for neobanks.

Clearly, this data is signaling that neobanks are going to have to fight even harder for deposits, given a protracted period of economic turbulence. The problem is that they have limited tools to compete. The first is to offer higher interest on accounts, which we will see is becoming more expensive. The second is to provide other unknown new services, which cost time and money to develop. Additional expenses of any kind combined with reduced deposits will stress their business models and force them to go back to investors for more money. Investors may no longer have the funds to support them, or will offer it at rates that severely challenge the neobanks’ operations.

N26 cofounder Maximillian Tayenthal, one of the first neobank execs to speak of the crisis, told Bloomberg that account openings had been declining in March, and that “in certain markets we’re seeing a 10% drop.”

So it begins. N26 and Neobanks not only need openings but real deposits, and if the “flight to quality” is as severe in N26’s primary markets as it is in the U.S., a drop in account openings is only part of the story.

Read More: Social Distancing Gives Branch Appointment Scheduling New Importance

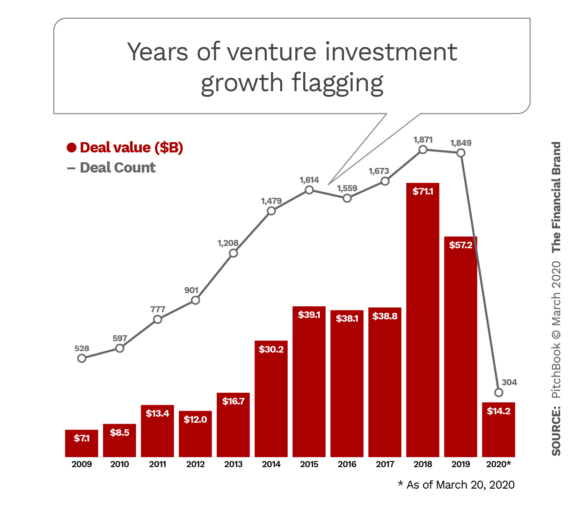

Are Venture Capitalists Looking Into the Abyss?

Corporate venture capital activity is shown in the graph below and is far behind last year. Whether this trend continues and rises to the level of “disaster” remains to be seen, but it will undoubtedly impact neobanks dependent on funding to survive.

Neobanks have been either blessed or cursed, with a tremendous amount of easy money from deep-pocketed V.C. investors. Their business models require regular investment to acquire clients and scale because they typically operate at a loss.

The party is over.

If SoftBank is any indicator, the market for both fundraising and investment is now clearly limited. Softbank’s second fund failed to meet its fundraising target, and it is now forced to sell down its investments rather than invest. While Softbank certainly doesn’t represent the industry, its difficulties signal changing times.

On the bright side, both “One,” a new neobank specializing in the middle class, and NorthOne, specializing in small and medium-sized business, were both able to raise Series A funding in March. Whether their raises were up to expectations is impossible to know. Dry powder remains, so let’s not look at this gift to the industry too closely.

One observation is that Revolut’s $500 million raise in February was beautifully timed to take advantage of a market peak. Still, its valuation at a massive $5.5 billion may be hard to support in this new environment. That it has a war chest is good, when it does fund again — and it will need to, given its cash burn. Its valuation will take a hit, and investors will look for profits. The search for profitability will be a trend that will hit all neobanks seeking funding this year.

Interest Expense Has Suddenly Become a Real Factor for Neobanks

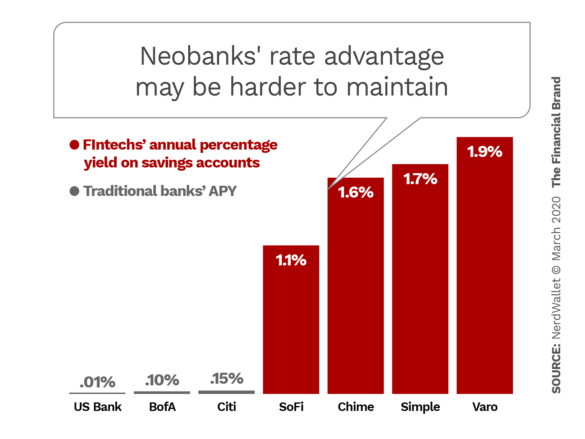

Neobanks have effectively been buying clients from the marketplace and have depending on investors to prop up their operations. Commonly they buy their way in by offering higher interest rates that traditional financial institutions do.

On March 3, the entire U.S. yield curve slipped below 1%. As of March 13, only the 30-year yield is above 1%. Meanwhile, top neobanks are paying out 1.7% in interest. There is no rebound in sight — indeed, markets are looking for more rate cuts to come. So, in rough numbers, if neobanks are buying the short end of the curve at one-five years, they’re earning 0.42%, paying 1.7%, and losing 1.28% on every customer’s account.

How much longer can they afford to buy clients with high-yield savings? Compared to their expenses in advertising, one of their more significant expenses, the interest deficit probably won’t break the “bank” — at least not for a while. That said, if they are forced to lower their interest rates, will they still maintain the ability to attract customers? That is an unknown, but if they become less attractive, that will add to their losses, and at a time when they are suffering another hit.

That hit is that neobanks’ revenue from interchange fees — one of their larger sources of revenue — is declining. However, while their revenue from interchange fees will undoubtedly take a hit by people staying home, I think this loss will be on the scale of three-four months and will rebound relatively quickly.

The other issues are systemic, longer-term and more pernicious.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

No Disaster for Neobanks in the Offing

I am not predicting disaster for neobanks. If ever there were nimble competitors able to stop and turn on a dime to meet a market challenge, it would be neobanks. In addition, the market for 100% digital banking is exploding as a result of COVID-19. This trend won’t end any time soon, and neobanks are perfectly positioned to capitalize on it.

The problem is that incumbents learned from neobanks in the past years and bettered their digital offerings to the point that the digital convenience gap that neobanks enjoyed is closing.

That doesn’t mean that clients actually like traditional banks. They don’t, and find no joy doing business with them. However, in times of market volatility, they want size and the perception of security it brings. Neobanks can’t possibly fight this, and it will severely hamper their ability to draw clients away from incumbents and potentially force them to scale back their world-conquering ambitions.

Make no mistake about it, neobanks must draw clients and deposits away from incumbents in order to survive. While new young first-time account openers are certainly great clients, neobanks do not have the luxury of time to wait for these clients and their accounts to mature; they must steal business to meet what will soon be increasing investor demands for profit.

What the End Game and Exit Strategies May Look Like

The market has changed radically for neobank services in just a few short months, and if the flow of capital into new accounts from clients slows and investors balk at the high valuations, we can look for a shakeout in the industry. I don’t think it will hit the major players, but the large number of “me too” players that lack clear product differentiation make some form of consolidation a given.

There seem to be three exit strategies for neobanks challenged by what appears to be a prolonged downturn.

1. Sale to an incumbent bank, a variation on the recent trend for incumbents to buy fintechs.

Neobanks will be in the awkward position of trying to find an incumbent that “needs” the intellectual property of the neobank, to modernize their tech or appeal to millennials somehow. While undoubtedly possible, only a few neobanks have the intellectual property necessary to pull this off.

2. Consolidation with another neobank.

To my knowledge, this hasn’t been done yet on any scale. Neobank investors will get a low-return exit that will cost them dearly. Neobank accounts with small deposits and even lower loyalty to the neobank will not sell at a premium.

3. Close.

This is the most damaging scenario, but it is also the only one that we have already seen. N26 did this in the U.K. market last year. Presumably, they found that their clients had no saleable value, and with only a digital presence, closing was as easy as turning off the servers.

Also to be seen, and beyond the scope of this article, is the impact of neobanks’ coming, sudden evolution, on the small but active group of traditional banks that have made working with fintechs a significant business line. Neobanks will need to evolve quickly to keep ahead, or watch incumbents use these fintechs to chip away at their advantages.

Richard Turrin is the author of Innovation Lab Excellence: Digital Transformation From Within, reviewed by The Financial Brand here.