Bank of Montreal has launched BMO MoneyLogic, an online personal financial management tool. Much like Mint, the financial industry’s dominant PFM platform, MoneyLogic gives customers the ability to view, track and manage both spending and savings accounts, as well as prepare budgets and set financial goals, all within BMO’s online banking system. MoneyLogic features include:

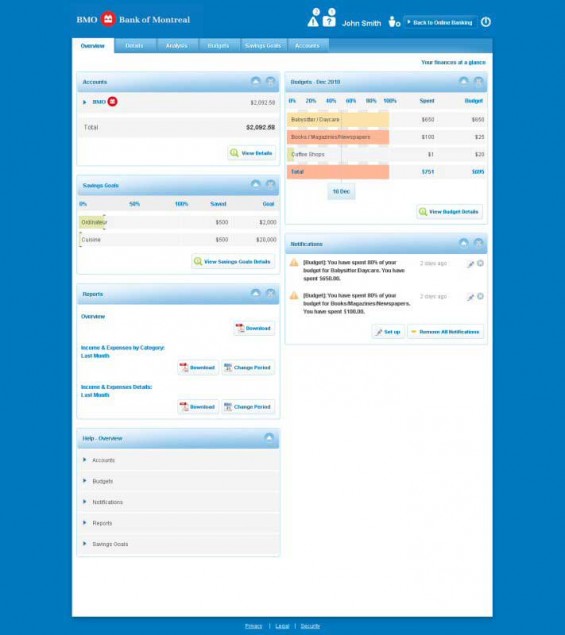

- Transaction Management – Customers can see their spending and saving within categories such as “auto,” “home” or “groceries.” Customers can also create their categories.

- Saving – Customers can set savings goals and track their progress. They can even link specific goals to multiple BMO saving accounts.

- Budgeting – Customers can set budgets and receive notifications when limits have been reached. For instance, a $300 limit can be assigned to the “monthly entertainment” category and the customer will receive a notification if the amount is exceeded.

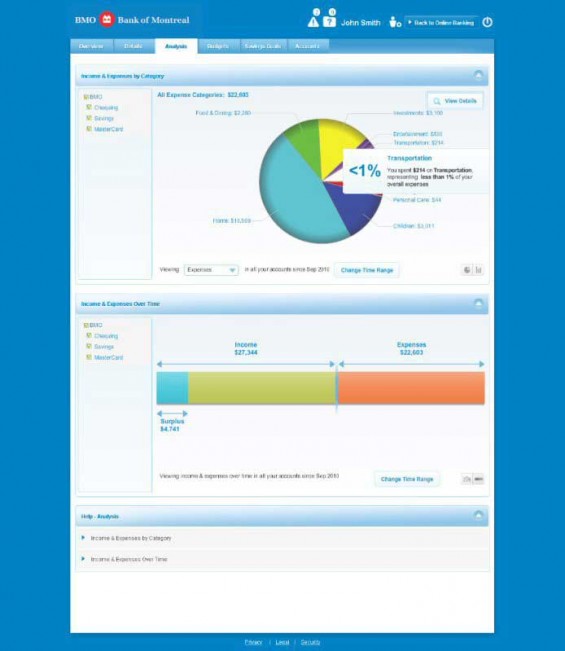

- Reporting – MoneyLogic collects the customer’s spending and saving data, producing easy-to-read charts and graphs.

MoneyLogic can be linked to BMO bank accounts, lines of credit and BMO MasterCard accounts, automatically providing a total view of these accounts.

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

BMO is following closely in the footsteps of its US peers, financial institutions like PNC who helped pioneer bank-branded PFM with its revolutionary Virtual Wallet. BMO claims MoneyLogic is the first such tool from a major bank in Canada, however RBC launched a similar platform, myFinance Tracker, back in June 2010.

The MoneyLogic launch site includes a series of demonstration videos split into four chapters: “Getting Started,” “Track Your Spending Habits,” “Understand Your Spending Habits” and “Set Budgets & Savings Goals.” BMO does a nice, thorough job explaining MoneyLogic, but some things could be a little more clear and crisp, such as this explanation of the notification feature: “The ‘Notifications Widget’ displays customer notifications when a budget or savings goal has hit a goal.” There is also a nice step-by-step guide walking people through the sign-up process.

BMO – MONEYLOGIC OVERVIEW

A three-minute demonstration of BMO’s online personal financial management system.

A poll from Leger Marketing found 40% of Canadians are looking for a tool that will help track their finances more effectively on a day-to-day basis.

“With almost half of our personal banking customers doing their day-to-day banking online, an intuitive, online personal financial management tool such as BMO MoneyLogic will bring clarity to our customers on where their money is going – which is the first step towards setting and achieving both short and long term savings goals whether it’s for your house or your child’s education,” said Lynne Kilpatrick, SVP/BMO.

BMO’s MoneyLogic is built by Strands Personal Finance. BBVA was the first financial institution to implement Strands PFM solution in 2008, followed by ING Netherlands.

BMO (pronounced BEE mo) has over seven million customers and $400 billion in assets.

BMO – MONEYLOGIC LAUNCH ADA 30-second TV commercial BMO used to spark interest in its PFM tool. It takes traditional advertising and marketing to get customers interested in your new offerings and latest innovations. All too often, financial institutions pour their energy into the development of projects only to see them fall flat without any marketing support.