When it comes to digital transformation in the banking industry, the Holy Grail is to have a culture of innovation embedded in the financial institution’s DNA. Few do yet, but banking providers at least appear to be making progress.

What many increasingly recognize is that becoming truly a digital-first institution not only removes the existential threat — a purely “survival instinct” — but is actually a clear path to increased profitability.

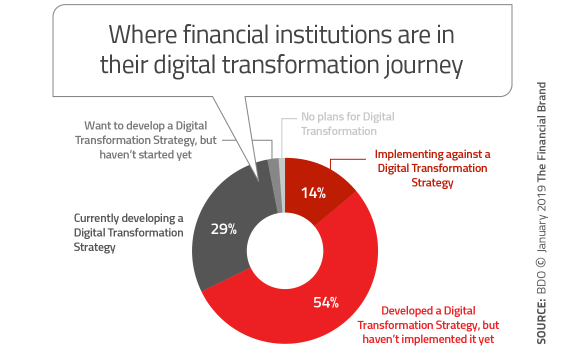

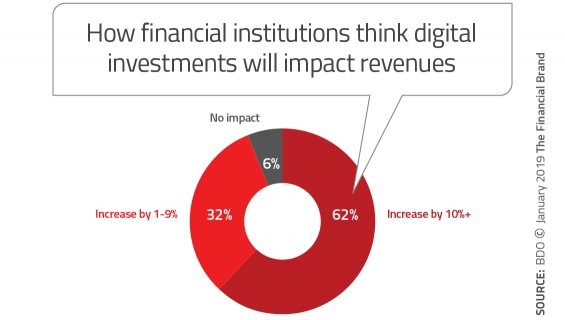

According to a study by BDO, nine out of ten financial institutions in the survey say they either have a digital transformation strategy or are developing one. And almost two-thirds of respondents in the survey say they anticipate revenue gains of 10% of greater within three years, if they take appropriate steps now. Of course that’s a big conditional “if.”

Plans mean little without execution and implementation. Only one in seven of those with a digital transformation plan are actually in the process of implementing the strategy. 29% admit they are still formulating their strategy.

“Without a strategy, it’s easy to get lost in the weeds — wrapped up in a variety of digital projects that may, or may not, actually get you where you want to go,” states Malcolm “Chip” Cohron, National Digital Transformation Services leader within BDO’s Technology and Business Transformation Services practice. “The mistake we often see financial institutions make is confusing digital implementation with digital strategy. An implementation project should deliver immediate ROI, but it isn’t, in and of itself, transformational. It’s only when all of these projects lead to a bigger goal that digital transformation is truly effective.”

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Route to Digital DNA

“The most appropriate digital transformation level for a bank or credit union is any level above the current one.”

— Malcolm Cohron, BDO

Developing a strategy is the crucial first step to climbing the rungs of what BDO calls the “Innovation Maturity Scale“:

- Business as Usual — No digital transformation initiatives

- Lab Rat —Try, test explore

- Opportunist — Placing smart bets and focusing on low-hanging fruit

- Strategist — Adapting; taking intentional steps toward a clearly defined strategy

- DNA — Culture of innovation, intrinsic to everything the institution does.

Of the 100 mid-size U.S. financial institutions surveyed by BDO, only one admitted it still didn’t have any digital transformation initiatives under way. About a quarter of the financial institution respondents described themselves as still in the “Lab Rat” stage — testing and learning. That may or may not correlate with having an innovation lab, but it’s not particularly far along the innovation curve.

“Most of financial services firms are currently in the ‘Opportunist’ position on our scale — placing smart bets and focusing on low-hanging fruit,” Cohron explains, “with a goal of moving toward the ‘Strategist’ position — taking intentional steps toward a clearly defined strategy. However, given the market dynamic of disruptive players coming from outside the industry, the customer shift in expectations and complexity of financial products, it is imperative that financial services companies ultimately embrace the ‘DNA’ position, where innovation is embedded in their corporate culture.”

Cohron declines to point to any particular digital maturity level as most appropriate for a bank or credit union, other than to say it should be “any level that is above their current one.” He adds that it’s critical that all financial institutions continue to move forward in their digital transformation journey, regardless of where they start from.

BDO lists three areas banks and credit unions need to examine in an assessment of their digital maturity:

- Business model maturity – creating new value, market differentiation and revenue in the digital economy

- Process maturity – operational reinvention by optimizing end-to-end process performance and improving efficiency.

- IT maturity – addressing or removing the IT complexities, risks and barriers to innovation.

Read More: 9 Digital Marketing Trends Banks and Credit Unions Can’t Ignore

The Upside to Digital Transformation is Big

BDO covered four industries (natural resources, healthcare, retail, and financial services) in its research, and asked respondents in each for their estimate of the impact of digital investments on both revenue and profitability over the next three years. Financial institutions by far had the highest percentage (62%) expecting a revenue increase of 10% or more. (Retail came in at just 18%, possibly because that industry has already embraced AI and other digital initiatives.)

Much of financial institutions’ optimism can be attributed to their focus on improving customer experience, Cohron observes. 83% of financial services companies cite “improving customer experience” as one of their top three goals over the next three years. 74% cite it as a top short-term goal. “By developing and deploying new customer experience digital platforms, reducing customer churn and up-selling and cross-selling financial products throughout the customer lifecycle,” Cohron states, “many financial institutions are able to increase their sales and overall revenue.”

The analyst also points out that before automation, AI, and other advanced technologies began to be implemented, sorting and analyzing data was largely manual and costly. These technologies will allow banks and credit unions to glean better results and make smarter decisions at a fraction of the time and cost, driving profitability, he says.

Short-Term Transformation Plans

For the vast majority of financial institutions, true digital transformation requires shedding old habits, changing cultural norms, “up-skilling” their employees, and updating or replacing legacy technology platforms, according to BDO’s survey report. A seemingly daunting task.

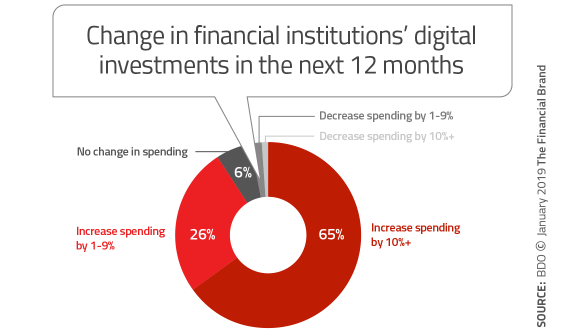

Yet the survey found an abundance of activity in the works among financial institutions backed by a significant financial commitment.

In the short term (12 to 18 months), BDO found the top three priorities for financial services companies were as follows:

- Replace or upgrade legacy IT systems — 88%

- Reduce operational inefficiency — 76%

- Improve customer experience — 74%

Read More: How Financial Marketers Can Bridge the ‘Digital Trust Gap’

The relative position of IT upgrade was not surprising to BDO. As the report notes, IT is the foundation on which all digital initiatives are built. Cohron further observes that, “in general, it does appear that financial services companies have less faith in their own IT capabilities, compared to companies in other industries. Only 39% of financial services firms ranked their current IT infrastructure’s ability to integrate advanced technologies (i.e. automation, sensors, data analytics, etc.) as ‘excellent’ or ‘very good,’ compared to 63% of all organizations.”

How long it takes for banks and credit unions to upgrade or replace their systems varies greatly by organization, Cohron states. Smaller banks that can move more nimbly—or perhaps larger banks with robust resources—may be able to completely replace their legacy IT systems in the next 12-18 months.

Whatever the timing, Cohron believes it’s critical for financial services companies to reduce the complexity of their IT operations, to become more agile and able to pivot when needed. “Luckily,” he says, “the advancements of secure cloud technology, fintech services, digital platforms and other technologies offers many financial institutions a path forward to simplifying their legacy IT.”

One related observation, and suggestion, made by BDO: “Digital transformation is no longer a job for just the IT department. Already more than half (58%) of financial institutions surveyed state that non-tech C-suite executives (CEO, CMO, COO) are leading transformation efforts.

The consulting firm suggests that regardless of who heads their transformation, banks and credit unions should consider creating a digital transformation office (DTO) to ensure individual initiatives are executed against the long-term digital vision. “The DTO should be supported, or even led by, an executive sponsor.”