Financial institutions find themselves at a critical moment in regard to their use of data. To an increasing extent their future success hangs on their ability to put data to use, especially for marketing and improving the customer experience. Consumers and business customers alike have higher expectations for a personalized experience from their financial provider.

Further, as the banking industry migrates from handling transactions to a greater emphasis on proactively assisting people and businesses with their finances, the importance of accurate, useful and accessible data, from both internal and external sources, will only grow.

At the same time, a powerful countervailing trend is gaining strength — the expectation of consumers that their data will be used to their benefit and will be protected. Along with that, they want complete transparency of how their data will be used.

“All of the customer experience tools of the future won’t matter if the consumer doesn’t trust how you will value their identity, protect their data and be forthright in their interactions,” states Jim Marous in “Using Data to Drive an Improved Customer Experience.”

“Consumers want to know that you will always be engaging on their behalf,” says Marous who is Owner and CEO of the Digital Banking Report (DBR) and Co-publisher of The Financial Brand.

Amplifying all of this is COVID-19’s effect on the world economy. As a result, there is a growing recognition by banks and credit unions that they need to first strengthen the fundamentals needed to succeed in a data-driven world, rather than rushing headlong to embrace each new advance in data science, analytics and artificial intelligence.

These top data priorities are simply stated but difficult to accomplish:

- Knowing what data you have (and where) with access and accountability.

- Determining the accuracy of the data you have or data you bring in (clean data).

- Establishing rigorous governance of privacy, security and ethical use of customer data.

- Hiring and/or upskilling people who understand the importance of good data and its use as well as having the ability to use increasingly sophisticated tools.

Once banks and credit unions firmly establish standards, they can confidently move toward what Google describes as “an un-siloed, data-first business.”

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

A Perfect Storm of Data, New Tools and Changed Expectations

The good news is that the data revolution “is still in the earliest of innings,” as PwC states in its report, “In Data We Trust.” That may seem incongruous, given the amount of data already in existence, but the report quotes research firm IDC that the amount of data created, captured and replicated annually across the world will grow more than five-fold by 2025.

Financial institutions have long had access to both basic accountholder data plus a fire hose of transactional data. But data now comes from many sources, including social media. The fastest-growing areas are user-generated media and metadata (data about data), according to a Bain & Company analysis. Much of this type of data is unstructured. There is great potential with so much data to work with but also several challenges.

The potential lies in several areas:

- Highly personalized customer experiences, in the manner that consumers have come to expect with data-driven companies like Netflix, Uber and Spotify.

- The ability to achieve one-to-one marketing communications and product offers.

- Being able to proactively help consumers manage their finances.

“Few enterprises today actually understand what consumer data they possess or who has access to it, let alone how to control that access.”

— Bain & Company

The challenges, however, are significant. “The reality is that few enterprises today actually understand what consumer data they possess or who has access to it, let alone how to control that access,” Bain states.

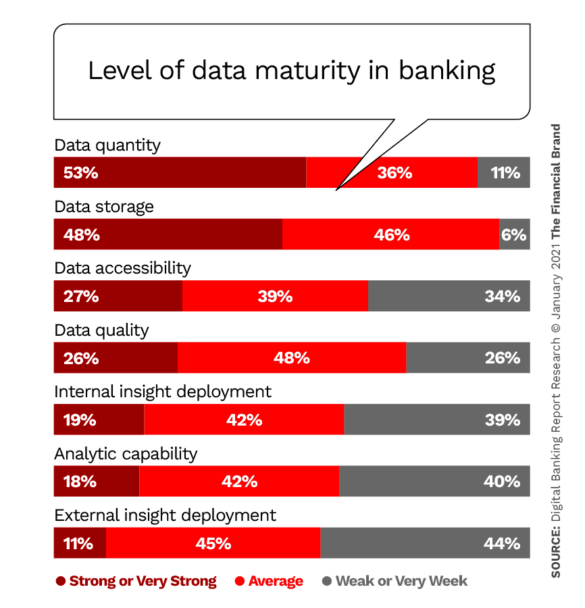

“Data, by itself, is not a valuable asset,” says Marous. “It’s what you do with it” that counts. The ability to utilize data effectively reflects an institution’s “data maturity,” he states. DBR 2020 research found that most financial institutions do not rank themselves highly in terms of data maturity.

Key observation: “Consumer data and analytics can be a powerful enabler of deeper customer intimacy,” Bain observes. “But they have to be treated as critical corporate assets, not just an afterthought. In the rush to accumulate consumer information, many firms have failed to build the capabilities and structures they need to analyze the data and use it strategically.”

Overall Ranking of Data Trends for 2021

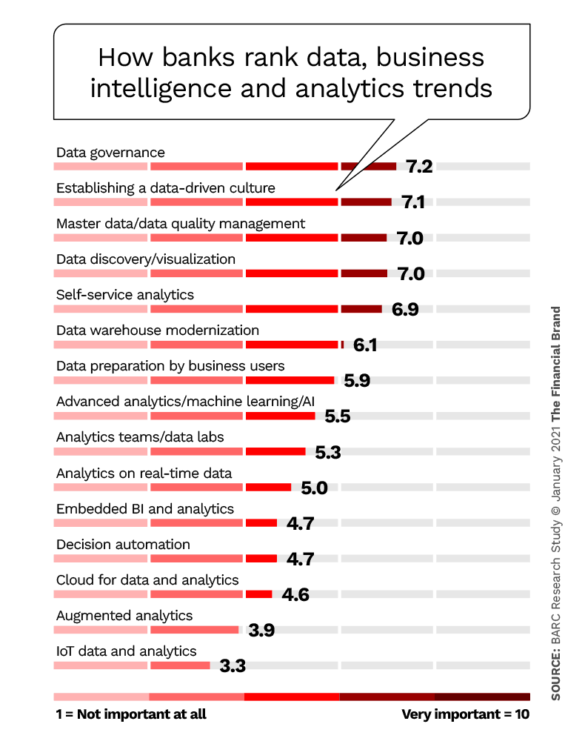

For its annual ranking of data and business intelligence trends, BARC (Business Application Research Center) surveyed more than 2,500 data users, consultants and vendors, including financial institution professionals. The overall ranking by all respondents can be found in the BARC report. Below, the results are shown for the financial institution respondents.

Although some of the categories shown above reflect the specialized language of the data management world, the importance of data quality and governance clearly stands out for financial institutions. Those are two of the four key trends identified below.

Read More:

- Why Data Privacy Could Be Banks’ Next Big Competitive Battleground

- AI’s Real Impact on Banking: The Critical Importance of Human Skills

- Digital Banking Transformation Begins With Quality Data

Key Data Trend 1: Quality of Data Must Improve

It’s not only consumers who lack confidence that the data companies have about them is accurate or secure. Business users within financial institutions — including those in marketing — lack confidence in the data they are presented with.

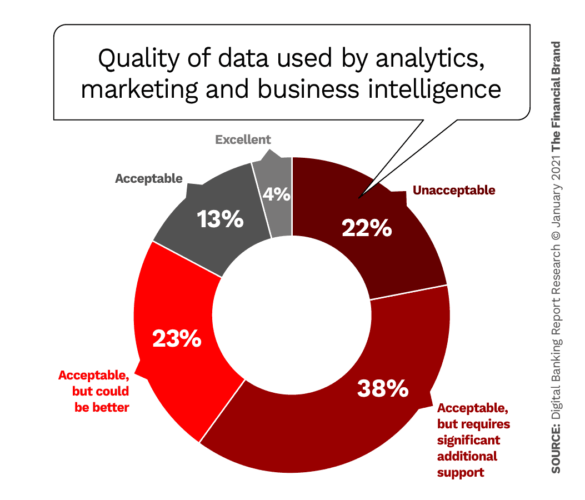

Only 17% of financial institutions considered the quality of data being used to be “acceptable” or “excellent,” according to DBR’s research.

Raising the bar on data quality is a complex undertaking, which may explain why it hasn’t been fully addressed. PwC maintains it will take a new approach — creating a team with cross-functional expertise in finance, lines of business, data science, ethical data use, security and privacy. This team should focus on governing, discovering and protecting the data a financial institution needs and eliminating or minimizing the rest.

Two premises drive the recommendation for a privacy team:

1. All financial institutions have unsecured and unreliable data within the organization.

2. “Low-value, low-quality data is merely a source of risk.”

The risk comes from both bad decisions due to poor-quality data and from criminal or malicious actors accessing sensitive information, according to PwC. Also, the existence of so much unnecessary data “makes it harder to locate and use the high-value data that you really need.”

Practical tip: Candidates for data elimination include such things as drafts, duplicates, superseded data, legacy data and employee personal data.

Experian adds the key point that inaccurate data negatively impacts the customer experience. Who hasn’t been frustrated when two points of contact at a financial institution produce two different versions of the same facts?

Management suggestion: Experian counsels against trying to fix everything at once. Long-term initiatives are needed, it says, but so are “practical outcome-based approaches that identify quick wins.”

Key Data Trend 2. Trust & Transparency Are Vital

Most consumers are willing to provide their data in a fair exchange for products, services and experiences they value, notes Bain. But they also demand control, transparency and security. The firm cites research from the Pew Research Center that 70% of American consumers believe their personal information is less secure than five years ago, and that 79% say they are “somewhat” or “very” concerned about how companies use the data they collect.

“Even as people are increasingly working, living and playing online, 76% say that sharing their data with companies is a ‘necessary evil’.”

— PwC

Adds PwC: “Even as they are increasingly working, living and playing online, 76% of global consumers say that sharing their data with companies is a ‘necessary evil’.”

Statistics like those have attracted attention of regulators and in recent years various rules have been enacted giving consumers more control over their financial data. It’s a safe bet this regulatory and political focus on data issues will increase.

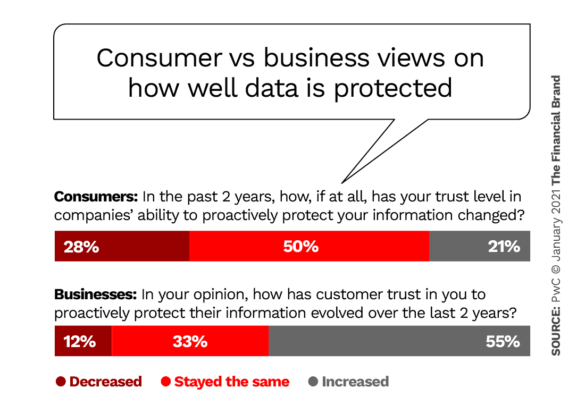

Bank and credit union executives clearly understand the importance of trust. It’s a core underpinning of the banking business. And yet in the area of data usage and protection there is room for improvement in terms of communicating a commitment to data security.

While the data in the above chart is not banking specific, it highlights the need for focused attention on a complex situation. PwC recommends creation of a data trust strategy “that simultaneously maximizes data’s ability to create value and minimizes its capacity to destroy it.”

Core opportunity: Treat trust as a brand attribute, recommends Bain. Ask yourself: “Are we building and using this information asset to better meet the long-term needs of our customers or are we serving some short-term monetization agenda and holding onto data haphazardly, just in case we need it someday?”

Key Data Trend 3. AI and the Rise of Data Governance

In the BARC rankings shown above artificial intelligence and machine learning came in roughly as “somewhat important” among financial institutions. In fact, the category has fallen in importance from 2017 to 2020, the researcher notes. That likely reflects the huge amount of hype over AI. Clearly in the marketing space machine learning and analytics have driven major ad success on the big tech’s digital platforms, Bain notes.

“Should decisions even be offloaded to an algorithm if there is limited trust in the data it relies on?”

— Steve Philpotts, Experian

The low ranking may reflect the two earlier themes: Data quality and transparency. “Should decisions even be offloaded to an algorithm and other cutting-edge technologies if there is limited trust in the data it relies on?” asks Steve Philpotts, General Manager, Data Quality & Targeting for Experian’s Australia operations. Adding to that, Gartner notes that “pre-COVID [AI] models based on historical data may no longer be valid.”

All this has brought to the fore such concepts as “explainable AI,” in which technology is used to help companies explain decisions made by AI algorithms.

Data governance is an essential part of keeping AI and advanced analytics focused on improving the customer experience and people’s lives in general. It’s notable that among the BARC respondents, data governance is on the rise in importance.

Two Distinct Approaches To Data Governance.

Both Bain and PwC advocate a consolidated, enterprise view of data and data management. “Many companies are still trying to govern data function by function,” PwC states. “But data’s monetization potential — and its dangers — don’t stop at the boundaries of an organizational flow chart.” Centralized data governance can help reduce the risk of both wrongful access and missed opportunities for sharing data.

Experian, on the other hand, encourages the “democratization of data” within institutions, easing access to business stakeholders to data they need. It recommends assigning goals and metrics to this broader group of users so they are forced into a sense of ownership and accountability for data.

Key Data Trend 4. Build or Acquire Data Skill Sets

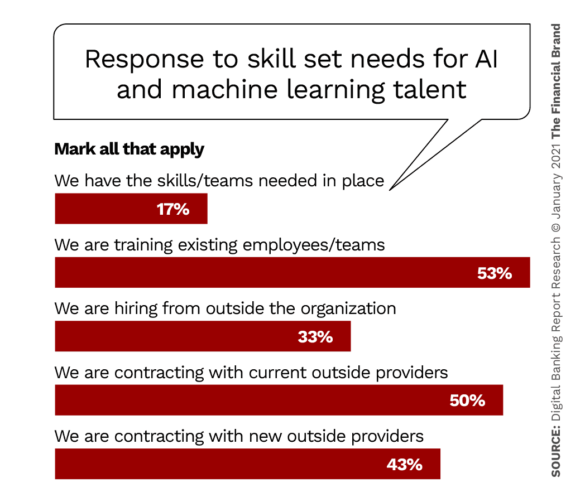

More than four out of five (84%) of respondents to Experian’s 2020 global data management survey said data literacy — the ability to read, work with, analyze and argue with data — will become a core ability for all employees in the next five years. Based on results from Digital Banking Report research, however, the banking industry is well behind where it needs to be. Less than one out of five (17%) of financial institutions believe they have the necessary skills or teams in place to capitalize on AI, and related data technologies.

This gap shows no signs of abating, according to DBR’s Jim Marous. He suggests the solution is to combine outsourced solutions with “upskilling” your workforce.

One caution Marous raises, however, is that while using outside talent is a valid short-term approach, “the ability to deploy the insights to specific product and service needs requires the experience of those who have known the business for years.”