With traditional branch-centric models creeping towards obsolescence, bank and credit union executives will be forced to reexamine their marketing strategies at the most fundamental levels. If it sounds like a dire imperative, that’s just the way Rick Spitler, Managing Partner at Novantas LLC, a management consultancy, wants it.

In his essay titled “Reimagining Retail Banking,” Spitler says the new era unfolding before bankers’ eyes presents historic opportunities, but in order to capitalize on them leadership teams will have to respond with radically different thinking than they have in the past. Success will require making bold, difficult choices, some that may even seem counter-intuitive.

“For several years now, retail bankers have looked for a ray of hope in the market outlook, waiting for a rising tide that will lift all boats,” Spitler observes. But he believes the banking industry has reached an inflection point. “It is quite clear that the industry has to revise its traditional business model in advance of a market rebound.”

“Looking ahead, retail growth opportunities will be far more selective and probably less profitable for some time to come,” Spitler adds grimly. “Banks will compete heavily to win new business.”

Those small, incremental improvements financial marketers were once comfortable with in years past won’t cut it anymore says Spitler. In their pursuit of more innovative strategies, all financial institutions will be faced with the same dilemma: how to build upon core strengths while effecting transformative change.

“The advantage will go to banks that can dispassionately assess their changed circumstances,” predicts Spitler. He says that for banks to thrive, they need to shake off the survival mindset that leads to coping tactics, and instead embrace truly transformation thinking — responding innovatively instead of clinging to the past.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Marketing Data Blossoms in Rubble of Branch Networks

One of the banking industry’s burning questions is what to do about branch networks, which many experts believe is in a severe state of overcapacity. Traditional thinking dictates that the core of a bank’s regional branch network must be preserved at all costs. But Spitler says this is precisely where financial institutions should focus: “Often the strongest markets should be the first in line for a thorough overhaul.”

“At the time when up to a fourth of the pre-recession branch network is at risk, there really is no other choice,” he adds.

Spitler argues the only way banks can substantially reduce costs whilemaintaining market share is by turning remote banking channels into complete substitutes for branches.

Some financial marketers mourn the decline in branch traffic, but Novantas argues that there is an upside… a big, juicy one. As consumers migrate from brick-and-mortar to digital channels, more and more valuable marketing data can be collected, analyzed and put to use. As a consumers become increasingly “virtually domiciled,” success for banks in the future will hinge on how well they utilize the volumes of customer information harvested.

The use of customer data sourced both internally and externally with be extensive, intensive and comprehensive, and financial marketers who aren’t prepared for this shift will pay a heavy price, Spitler warns.

Multi-Channel Strategy

When it comes to how delivery channels should be reconfigured and how resources should be divided across them, Spitler believes financial institutions are generally lost.

Back in the old days, it was easy to for banks and credit unions to connect their branches with results. More branches meant more market share, more deposits, more loans, etc. But in the new world, it’s much more complex. Wired consumers increasingly think about their banking product needs first, and then search online for a specific provider. Nowadays, the nearby branch may or may not be a consumer’s primary consideration. In fact, for the first time, Novantas research shows that high net worth customers value the quality of the online banking experience slightly more than branch presence.

Consumers are quickly migrating day-to-day banking behaviors to online and mobile channels, while in-branch traffic is falling fast — at rates of 7% or more annually in some markets. But the more bank and credit union marketers succeed in pushing transactional activities to remote distribution points, the more they struggle with marketing and sales, particularly with virtual customers.

Key Question: How are banks and credit unions going to acquire, expand and retain customer relationships when branches create fewer opportunities to market, counsel and sell in face-to-face environments?

To build a multi-channel strategy, Novantas says financial institutions face a three-part marketing and sales challenge:

- Before a consumer can consider your brand, they have to at least be aware of your brand. How can financial marketers create brand awareness in an increasingly online marketplace?

- How can financial marketers make sure they are presenting the right products to the right people at the right time and in the right channel?

- How can financial marketers engage customers and build loyalty in effective and efficient ways, encompassing the full spectrum of customer touch points?

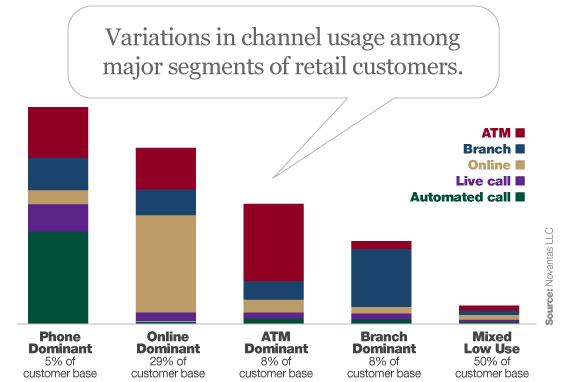

Historically, banks have not been sophisticated in analyzing channel behaviors (e.g., branch vs. ATM vs. internet vs. contact center). But Novantas says banks had better get with it… fast. The gold they once mined from data collected in branches is quickly drying up, with only one of seven transactions now conducted in branches. Understanding how consumers select and use channels will be critical going forward.

To maximize marketing to its fullest extent, banks and credit unions will need a detailed understanding of channel patterns. This illustration from Novantas shows the mindset financial marketers need to build their multi-channel strategies.

Segment-Based Strategy

The volume and complexity of customer data that banks must now digest is simply staggering, Novantas says. And like other industries, banking is not prepared to create nor work with a 360° holistic view of customers — one that spans all channels, all products and all transactions. With customers migrating to remote channels at a blistering pace, there is an urgent need for retail financial institutions to reengineer marketing and sales strategies.

Novantas says banks and credit unions can’t afford to wait any longer. It’s time banks flesh out a formal data analytics and customer segmentation strategy, and within a multi-channel context. It’s all about getting relevant and timely offers in front of targeted customer segments via their preferred channels. The good news is that the banks that successfully make this transition will have a much more precise and effective way to pinpoint offers, far beyond what can be accomplished with sales generalists in a traditional branch model.

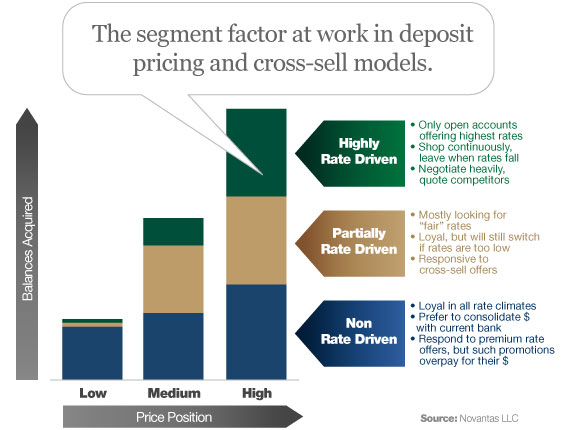

Segment targeting allows banks and credit unions to achieve optimal pricing and maximum profits. Otherwise, special premium rates may be wasted on those who don’t really expect, need or want them.

Novantas uses deposit pricing as an example. The goal is to use rates that ensnare more price-sensitive customers while de-emphasizing price with less sensitive segments.

“By analyzing likely price elasticity at a customer segment level, a bank can identify the proper pricing levels required to retain balances down to a granular level,” Spitler says.

While banks have made great strides in pricing sophistication, Spitler says few have successfully reached the level of segment-based responsiveness. But if he’s right, it’s complex, data-driven strategies like these that will be the norm for bankers looking to maximize profits in the future.