J.D. Power & Associates 2011 US Retail Bank New Account Study reveals that retail banking consumers are shopping for- and switching banks at an increasing rate.

The study, which examines the bank shopping and selection process, as well as customer satisfaction with the account initiation and on-boarding processes, finds that 8.7% of customers in 2011 indicate they switched their primary banking institution during the past year to a new provider, whereas just 7.7% said the same in 2010. On average, customers in 2011 say they considered 1.9 banks while shopping — up from an average of 1.6 banks in 2010.

“The increased switching rate indicates more consumers are coming into the market, providing more opportunities for banks to acquire new customers,” said Rockwell Clancy, VP/financial services at J.D. Power & Associates. “These customers appear to be more discriminating and diligent when selecting a new bank.”

Why are people switching?

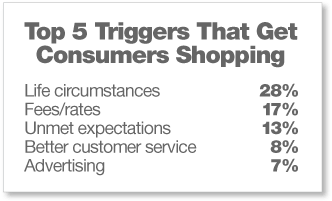

People aren’t necessarily switching for the reasons you might expect. Bankers frequently believe that the primary reason consumers switch is over service issues. Not true. Perhaps the increase in defections can be blamed on all the negative press about banks? Nope. The number one reason consumers switch banks has nothing to do with the industry’s gigantic black eye. Nor service. Nor “gifts and incentives” (aka “bribes”) for new accounts. Not even rates or price.

The #1 reason people switch banks: life circumstances. That means people are in a situation where they feel compelled to switch — e.g., divorce or moving to a new town = a new bank. With unemployment hovering just below 10%, is it any wonder people are moving around looking for work? They are going wherever jobs can be found.

Key Question: What are you doing to target newcomers within your financial institution’s footprint?

Among the other, less significant triggers that get people shopping, only 4% were motivated by promotional gifts/cash, 3% wanted specific account features, 2% did so after receiving a recommendation, and 2% had to because their old branch closed.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

How it works

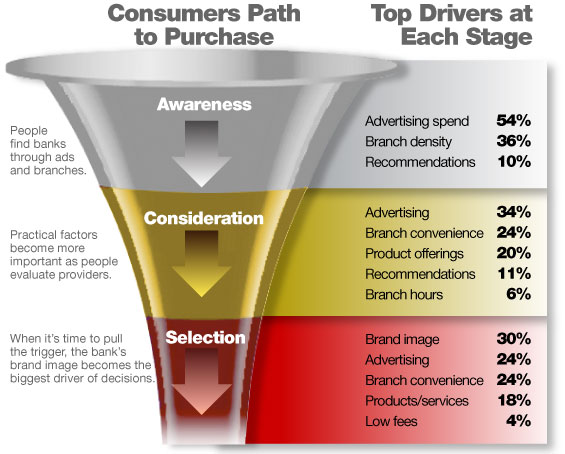

For customers evaluating and ultimately selecting a new bank, the most important factors driving their decision are advertising, branch convenience, products/services, promotional offers, customer experiences, past personal interactions, recommendations and bank reputation.

Surprisingly, pricing — fees and interest rates — carried relatively little weight in influencing customer purchase decisions, despite recent heavy media coverage of changes to fees for bank accounts and credit cards.

PFI status doesn’t pay off

One of the study’s most unexpected findings is that less than one-half (43%) of customers who purchased an additional banking product made that purchase at their primary bank. For customers who turn to another institution for an additional product, promotional offers such as gift cards carry the most weight in influencing the purchase decision.

“Customers who choose to stay with their current primary bank for additional products are most driven by positive past experience and perceptions that their bank is more focused on customers than on profits,” said Clancy. “Clearly, banks that are not providing a noticeably better experience are more likely to lose the business of indifferent customers who are more easily lured by the next attractive promotional offer to come along.”

Apparently banks that perform well in acquiring new customers — Chase, PNC and SunTrust, for example — tend to be more aggressive in their advertising and promotions.

“It’s undeniable that the ‘blunt instruments’ of ad spend, branch density, and promotional offers such as gift cards have been effective during the past year in capturing market share,” said Clancy. “The question is whether these provide sustainable competitive advantage, particularly when compared with customer acquisition gains resulting from positive past experiences with a brand and recommendations from friends and family, which are harder to duplicate.”

The 2011 U.S. Retail Bank New Account Study was based on multiple evaluations from 4,791 customers who shopped for a new banking account or new primary financial institution in a 12-month period. The study was fielded in November and December 2010, and looks at the deposit acquisition strategies of BofA, Bank of the West, BBVA Compass, BB&T, Capital One, Chase, Citi, Comerica, Fifth Third, Harris, HSBC, Huntington, KeyBank, M&I, M&T, PNC, RBS, Citizens, Regions, Sovereign, SunTrust, TD Bank, US Bank, Union Bank and Wells Fargo.