PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect. This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team. Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

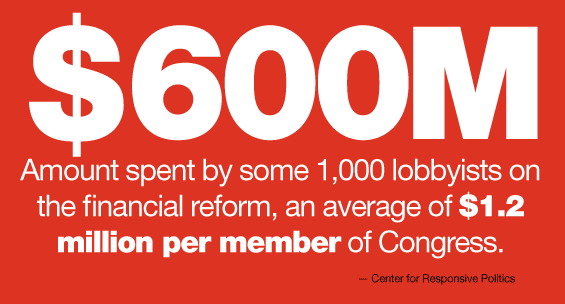

$600 million: Amount spent by some 1,000 lobbyists on the financial reform Act.

— Center for Responsive Politics

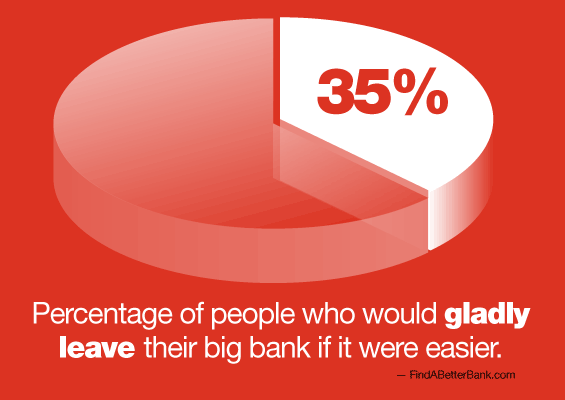

35% of people would gladly leave their big bank if it were easier.

— FindABetterBank.com

35% of people surveyed in 2010 stated that they “prefer to pay in cash for everything I buy”, which is down from 54% in 2002, but up from 18% in 2008.

— Visa U.K.

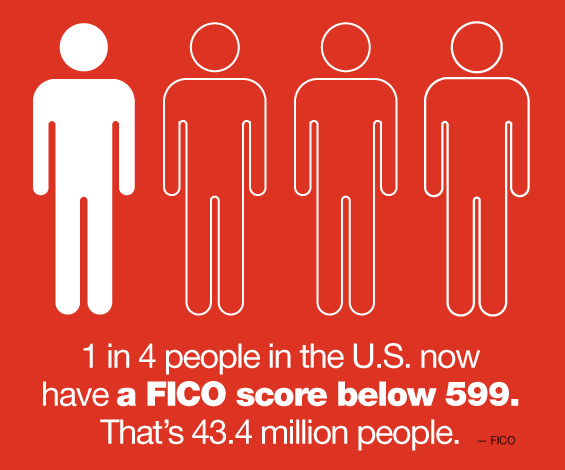

1 in 4 people in the U.S. now have a FICO score below 599. That’s 43.4 million people.

— FICO

1/2 of consumers say they are no longer on track to reach their savings goals for 2010. The key reasons cited were:

- Increase in cost of non-discretionary bills such as utilities, groceries and auto (58%)

- Unanticipated emergencies (30%)

- Difficulty balancing wants versus needs (20%)

- Buying on impulse (20%)

— American Express

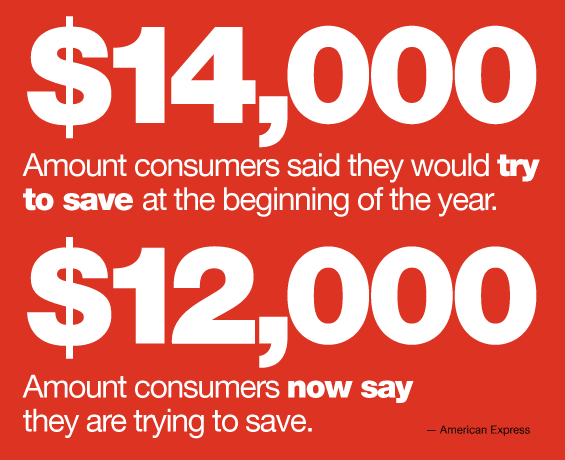

$14,000: Amount consumers said they would try to save at the beginning of the year.

$12,000: Amount they now say they’re shooting for.

— American Express

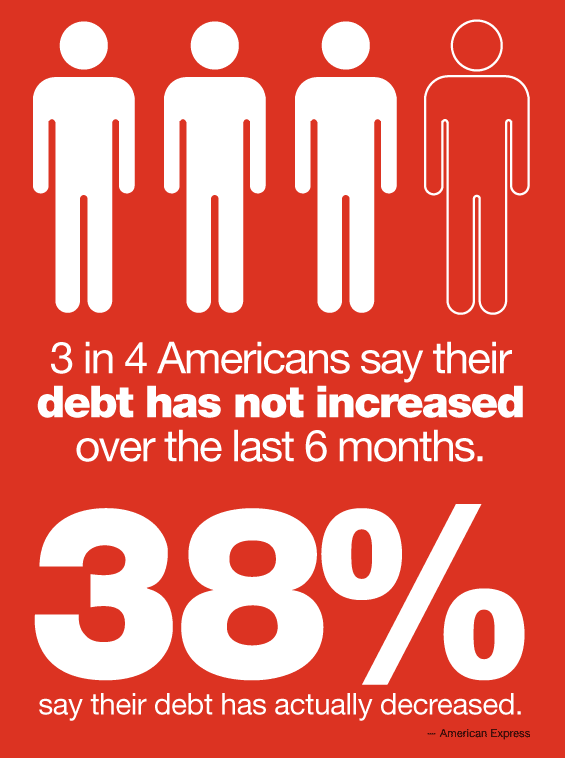

75% of Americans say their debt has not increased over the last six months. 38% say their debt has actually decreased.

— American Express

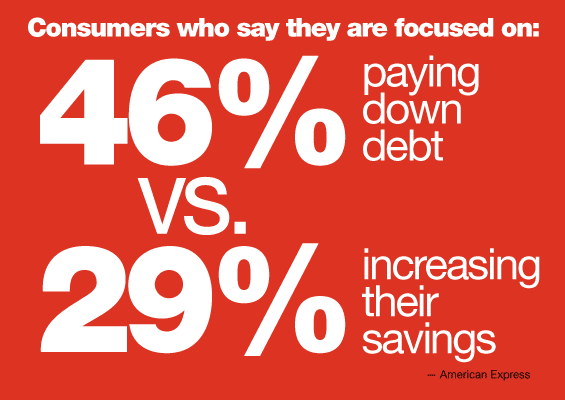

More Americans say they have been focused on paying down debt (46%) than saving (29%) this year.

— American Express

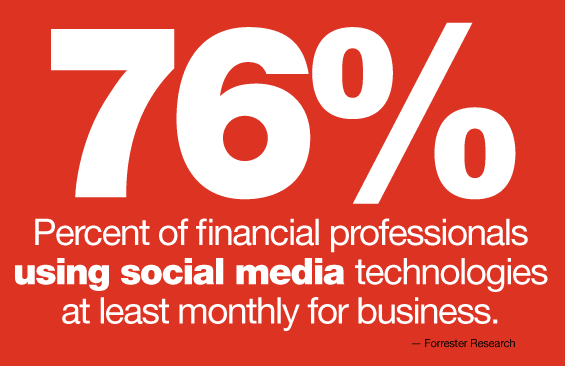

76 percent of financial professionals use social technologies at least monthly for business purposes.

— Forrester Research

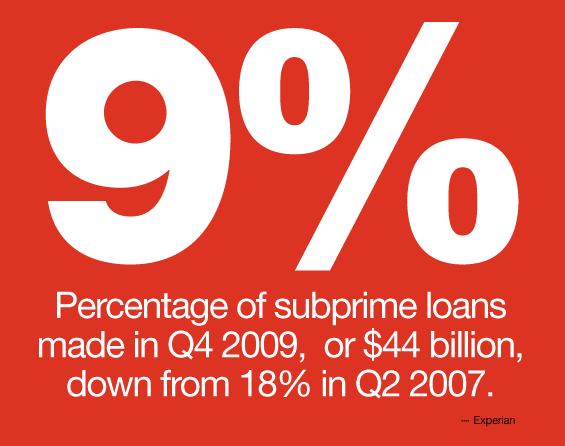

Subprime borrowers got just 9%, or $44 billion, of all consumer loans in the fourth quarter. That is down from 18% in 2007’s second quarter.

— Experian

5.5% of consumer loans (excluding home loans) were at least 30 days past due at the end of the second quarter, down from the year-earlier

— Equifax Inc. and Moody’s Analytics

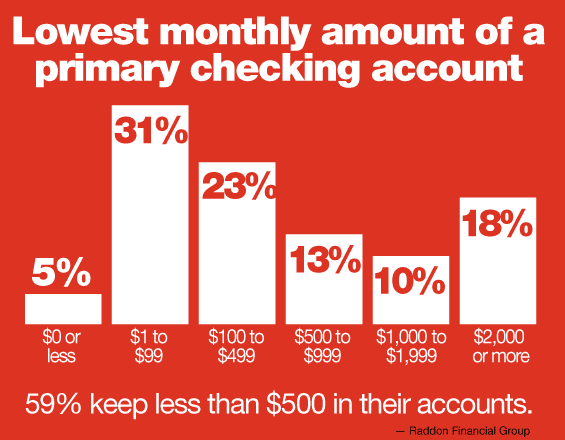

59% of people keep less that $500 in their checking account.

— Raddon Report