The importance of data and artificial intelligence is at the center of almost all conversations around digital banking transformation. Until recently, actual use of data and AI has lagged behind the level of interest in the banking industry.

Several studies done by the Digital Banking Report confirm that banking and credit union leaders believe AI provides a competitive advantage, yet broad enterprise adoption beyond the use for security and risk was less than 25%. This is not a recipe for success.

The good news is that while much work still needs to be done in the deployment of data and advanced analytic solutions, the pandemic hastened advances in data collection, AI use cases and skills training. It also increased the rate of adoption of enhanced data democratization. These advances have been made across all asset sizes of organizations and across all regions of the world.

In fact, a 2021 McKinsey global survey on AI found that the number of companies reporting AI adoption in at least one function had increased to 56%, up from 50% in 2020. More importantly, the survey also indicates that AI’s economic return is growing.

But, challenges still remain. At the core is the overall trust in the data collected and the results achieved through analysis. According to IBM research, 78% of organizations across all countries said it is very or critically important that they can trust AI output to be fair, safe, and reliable. Aligned with these findings, 83% stated that there was a need to be able to explain how AI arrived at a decision.

Other challenges include the existence of data silos, the complexity of data, and lack of tools for developing AI models. Not surprisingly, an increasing number of financial institutions are also challenged by limited AI skillsets that inhibit successful AI adoption.

Read More: The State of Customer Data Management in Banking

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

With Data … Less is More

There is no lack of data available for banks and credit unions. That said, the vast majority of data is stored in unstructured forms or within data silos that are not integrated. This results in an increasing amount of data that keeps growing. While this may appear to provide the foundation for vast insights, the reality is that much of the data is either unusable or irrelevant. In other words, less data may create more – and better – results.

The risk of too much data is that there is a cost for holding more data than is needed to achieve the results desired. In addition, with the marketplace changing faster than ever, the value of data becomes lower as time passes. For instance, channel behavior insights from before the pandemic are of less value as consumers and businesses have increased their use of digital options. Finally, if a significant amount of data available is outdated or untrusted, bad decision making can occur.

On the plus side there are significant benefits to eliminating ‘data hoarding’. First of all, data minimization allows for focussing on the specific needs of the intended analysis. This results in responsible collection of data, faster processing, more accurate decision-making, decreased cost and improved compliance.

This ‘less is more’ concept also applies as organizations seek to transfer data from bloated, legacy IT systems to more modern core platforms that provide the ability to launch new digital capabilities internally or in the cloud. By separating essential data from ‘nice-to-have’ data, organizations will be in a better position to support agile innovation and build new business models faster than would be possible if all data was transferred.

In the end, a perfectionist approach to data collection can negatively impact the goal of creating and using a data and insight platform that can serve the needs of the business quickly.

Impact of Data and AI Across the Organization

According to McKinsey, AI adoption is most common in the areas of operational efficiency, product and service development, and marketing and sales, although many organizations are leveraging data and advanced analytics across multiple functions. As digital transformation has become an increasing area of attention, organizations are trying to cut costs with service-operations optimization and contact-center automation. The largest increase in the use of AI has been seen in the areas of AI enhancements of existing products and services, predictive intervention, marketing-budget allocation and spending effectiveness.

AI’s Cost Impact:

Across functions, organizations report greater cost reductions from AI adoption since the pandemic, while revenue increases have held steady.

While it is expected that revenue enhancements will increasingly be achieved as organizations build more robust data strategies, cost savings from AI are currently having the greatest impact, especially when organizations have used AI in product and service development, marketing and sales, and strategy and corporate finance.

McKinsey found that the use of AI was most financially rewarding at those institutions where advanced AI practices were leveraged. These organizations tended to spend more efficiently on AI as an outgrowth of test and learn strategies and took advantage of cloud technologies to a greater extent. These organizations were more likely to use design thinking, measure results more extensively and had well-designed data strategies and protocols.

Read More: 4 Reasons Why Your Financial Institution’s Chatbot Project Failed

Combining Technology with the Human Touch

According to research from Juniper, the number of global online and mobile banking users will exceed 3.6 billion by 2024, with online and mobile banking growth expected to increase by 54% compared to 2020. In this new digital banking ecosystem, loyalty will increasingly be driven by the ability to build engagement through digital channels as opposed to simply convenience.

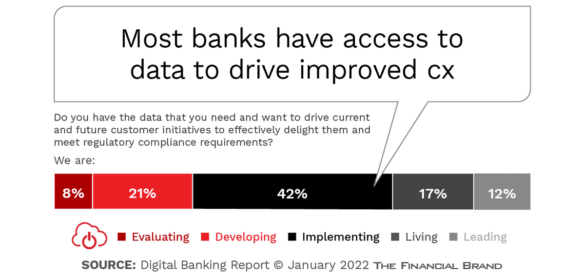

For a financial institution to remain competitive, digital interactions must exceed what was available in branches. Seamless, contextual engagement, with a foundation of data and AI, will need to be delivered at a speed and scale never before imagined. Communication will also need to make an emotional connection with the customer that provides evidence of the benefits of sharing personal financial information.

There needs to be a balance between digital delivery and human engagement across all channels, in real time.

Banks and credit unions must illustrate that they know a customer, understand a customer, and will reward a customer by customizing interactions to each individual’s financial journey and objectives. Consumers want a personalized experience regardless of the channel they select. The want the GPS of financial relationships, with advice delivered based on real-time changes in marketplace and their financial life. This is achieved with data and advanced analytics driving a humanized communication stream.

According to insights from IBM, “We now face a double paradox — on the one hand, we experience discomfort because AI collaboration can offer radically alternative ways of seeing and living in a world we hadn’t even imagined. On the other hand, AI collaboration provides comfort, offering very targeted and customized propositions, often matching our desires and preferences in a very tailored fashion.”

Nonmonetary Benefits to Data Modernization

In research conducted by MIT Sloan Management Review and Boston Consulting Group, it was found that the value of a strong data strategy and use of AI went beyond strict economics. The research found that 58% of respondents who had participated in an AI implementation found their AI solutions improved efficiency and decision-making among teams. More than three-quarters of these firms (78%) also reported improved collaboration within teams.

It was also found that organizations that used AI to ‘create new value’ were 2.5 times more likely to feel that AI is helping their company competitively compared with those that said they are using AI primarily to cut costs or simply improve existing processes. These firms were also 2.7 times more likely to agree that AI helps capture opportunities in adjacent industries (think Open Banking).

Increasing deployment of AI technology and the resultant insights across the organization can create new behaviors and skills. By sharing insights at all levels and in all departments, opportunities are found that were not possible in the past. Innovation increases and customer engagement is enhanced.

The Future of AI in Banking

Across all industries, we are in the midst of an AI-powered digital age, resulting in increased efficiencies, enhanced access to real-time data and insights, connectivity across organizations, and continued enhancements that will benefit financial institutions and consumers beyond comprehension. While challenges remain and banks and credit unions move from experimentation to scaling AI implementations across the organization, the benefits can’t be ignored.

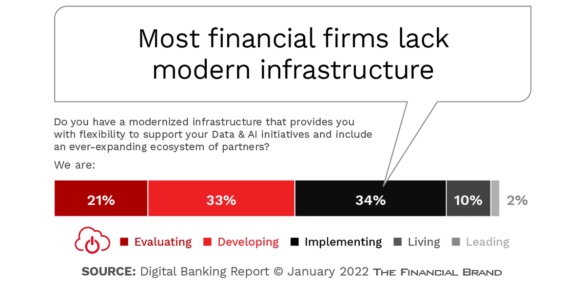

Financial institutions must have a clear data strategy, building use cases for AI, invest in a modern technology core, determine the most impactful data assets, and reimagine operating models that have been stuck in the past. “Now more than ever, financial institutions must adopt AI technologies as the foundation for new value propositions and distinctive customer experiences,” states McKinsey.

The future AI-driven financial institution will be able to improve back-office operations, decisioning, and the innovation process, while using data to create engagements that are intelligent, personalized, and omnichannel. The biggest change may be a move away from the traditional siloed organization to a platform operating model that has cross-functional teams organized as a series of platforms within the bank.

The result will be increased agility and speed and an improved alignment of goals and priorities across the enterprise. More than ever, the development of a data strategy and adoption of AI technologies is no longer a choice, but a competitive necessity.