Despite warnings for more than a decade, most financial institutions are unable to manage the data at their disposal or extract actionable insights, leaving money and opportunities on the table. To compete with fintech, big tech and the largest banks, financial institutions of all sizes will need to harness the power of data, making insight-driven decisions and delivering the level of experiences consumers and businesses have come to expect from the firms with the highest levels of data analytics maturity, like Amazon, Google, Facebook, Apple and others.

In research done on behalf of Deluxe by the Digital Banking Report, it was found that many organizations have the ability to extract insights from various data sources, supporting foundational marketing decisions and creating segmented marketing programs. Where most organizations fall short, however, is in using data and artificial intelligence (AI) to power real-time decision-making throughout every aspect of the customer journey. The lack of data analytics maturity also hampers the ability create instantaneous learnings from marketing initiatives, using tools like machine learning (ML), that can improve marketing performance over time.

Moving from formative stages of data and analytics maturity to more advanced stages requires a strong data foundation, with an abundance of ‘clean data’. In other words, the insights and decisions made for marketing will only be as strong as the data on which they are based. It is also important that organizations know what data is needed to move decision-making forward and that the data is easily accessible. This can be a challenge in organizations where data resides in multiple data silos.

To progress along the data analytics maturity model requires several components that some organizations lack. These include:

- Senior level management commitment and a culture that supports the use of data for decision-making across the organization.

- Skills, training and third-party partnering that increases the ability to move from concept to actuality with analytic thinking.

- An enterprise-wide data structure and strategy that supports a singular view across the customer journey.

- Strong analytics and AI capabilities that support decision-making and creation of exceptional experiences across all channels.

- Ongoing measurement of impact of data-driven decisioning, including monetization of predictive tools and increased efficiencies.

It is important to realize that the aspiration of becoming a mature data and analytics organization is not a static target. In fact, as the amount and quality of data continues to grow and become more accessible, the ways in which financial institutions leverage data – and become data mature – will continue to evolve.

Read More:

- The Future of Customer Experience in Banking is Personalized

- Now is the Time for Intelligent Digital Banking Experiences

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Data-Driven Marketing Maturity Remains Low

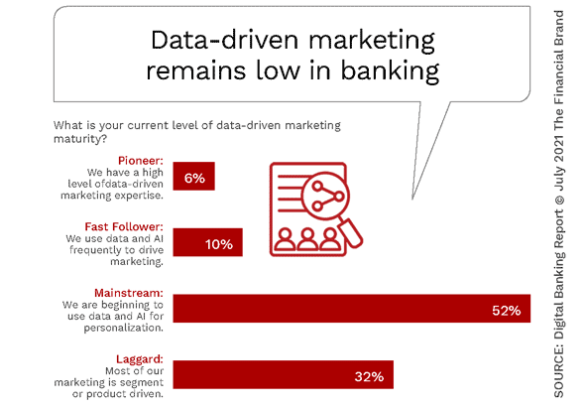

Over the last few years, the Digital Banking Report has done research to assess the data analytics maturity for financial institutions globally. In the analysis of where organizations ranked themselves, we position data analytics maturity as a series of steps that represent the evolution of an organization’s ability to access quality data and use this data to make business decisions and impact customer experiences. Bottom line, we ask organizations to assess how well they can use the data available to generate value.

When we focus on the use of data and analytics to positively impact marketing decisioning and customer experiences, we found that very few organizations considered themselves on the cutting edge of what is possible. In fact, only 6% of financial institutions globally considered themselves to be ‘Pioneers’, with just one in ten banks and credit unions considering themselves ‘Fast Followers’. The majority of organizations positioned themselves as being in the ‘Mainstream’, beginning to use data and advanced analytics for personalization and enhanced communication.

The lack of data-driven marketing maturity is not caused by financial marketers not understanding or believing in the importance of using data to drive results. In fact, quite the opposite is true. Financial marketers already use data to drive virtually all components of a strong communication strategy, including customer acquisition (78%), retention (63%), cross-selling (55%), targeted digital marketing (48%) and the overall desire to improve the customer experience (72%). The only areas where data was not being used as readily was to improve website experiences (34%) and to deliver a consistent message across channels (28%).

Data Silos Challenge Potential of Data

Financial institutions are investing more and more in data and analytics to grow their bottom line. However, in numerous studies by the Digital Banking Report, data silos are cited as an ongoing challenge, especially in larger financial institutions with multiple product divisions and complicated infrastructure. A Forrester report found that 72% of firms said their greatest sales and marketing challenge was managing data and sharing insights across organizational silos.

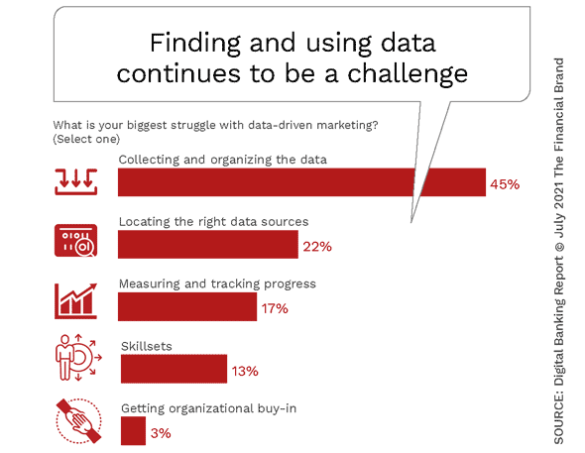

When we asked financial institutions to prioritize their biggest challenges for data-driven marketing, 45% of respondents said that they had difficulty collecting and organizing data, while 22% indicated a challenge in locating the right data sources. Both of these challenges are outgrowths of challenges related to data silos.

When Gartner analyzed the reason for challenges related to data silos, they found that firms less likely to have a robust data governance strategy in place were more prone to data silos. Financial institutions can reduce data silos with data governance initiatives that improve synergy and maximize data effectiveness. A data governance framework outlines the rules, ownership, and structure for data management throughout the organization.

The importance of breaking down these data silos can’t be overemphasized. That is because the impact reaches all areas of an organizations. Some of the challenges that occur with data silos include:

- Fragmented View of Data. With a lack of an overarching and complete view of company data in one place, deeper insights are missed, limiting revenue and efficiency opportunities and weakening customer experiences.

- Lower Data Integrity. Data silos create potential for data duplication and stale data that is not managed on an ongoing basis.

- Increased Data Costs. Storing data in solos increases the cost of both storage and management of data and insights.

- Internal Inefficiencies. With disparate data sources and data management processes across an organization, collaboration of marketing and communication initiatives becomes more difficult, if not impossible.

Read More: Beyond Personalization: Three Reasons to Focus on Customer Journeys

Marketers Still Rely on Rudimentary Data Strategies

Over the past decade, the power of database marketing has gone from simple, rudimentary messaging that pushed product with only modest targeting, to a more refined process aimed at understanding the consumer across their lifestage. During this period, the marketing mix model was created, focusing more on reaching the consumer with the right product, at the right time with the right message.

As digital technology has matured, the ability to use marketing communication to interact with the consumer has increased. In addition, the ability to use marketing measurements has improved as the number of channels have increased. With clean and accessible data, derived insights and the use of modern marketing technologies, financial marketers are now able to gain previously unimaginable insights into the behaviors of the consumers they engaged with, and leverage more sophisticated strategies to reach consumers at the exact time of need.

Despite these advances, most financial institutions are still only testing the waters with regard to advanced communication. This is problematic as consumers are becoming increasingly aware of what is possible related to personalization, real-time communication, predictive engagement and cross-channel integration.

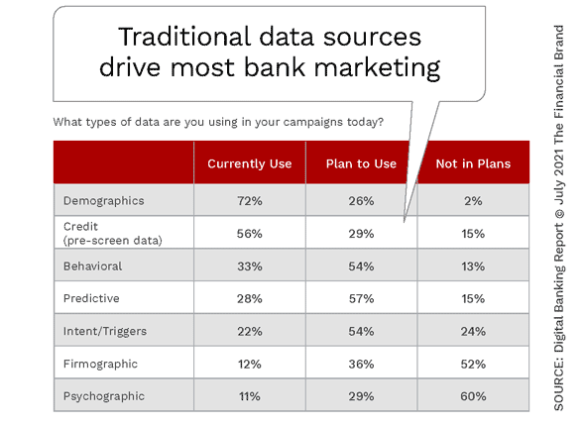

Research be the Digital Banking Report illustrates that traditional data sources and long-standing marketing strategies dominate the arsenal being used by the majority of marketers. Basic demographic and credit insights are the most used sources of data by financial marketers globally, with behavioral, predictive and firmographic insights being relied on to a far less degree. The good news is that many of these more advanced data sources are in the plans of marketers, illustrating a desire to move beyond the basics.

The Power of Marketing Triggers

As we look forward, the most emphasis by financial marketers is in the area of trigger and predictive marketing. This is not surprising given the power of timely data combined with highly personalized communication, including recommendations. According to Deluxe, “Trigger marketing provides a powerful way to automatically, seamlessly and effectively integrate with a customers’ life journey, fitting in neatly with their mindset and goals. This tool means you can place personalized, relevant offers into their purchase path and decision-making at the most opportune times possible.” Deluxe has found that consumer trigger programs can improve by 90%, with business marketing programs getting a 120% lift using triggers.

Lost Opportunity:

Waiting just three weeks from the trigger event can reduce responsiveness by 50 percent.

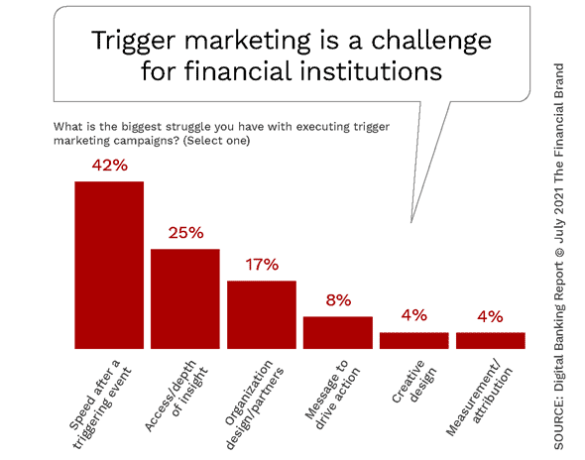

Unfortunately, most financial institutions are challenged to deliver a strong predictive marketing campaign for a number of reasons. Not surprisingly, the biggest challenge is the ability to access data in a timely manner to deliver real-time communications. In our research, 42% of banks and credit unions worldwide stated that the speed of data was their primary challenge, followed by the ability to access data (25%).

With trigger marketing and predictive campaigns, timing is everything. According to Deluxe, while using life-event triggers can double the targeted reach and almost double the marketing’s effectiveness of communication, this responsiveness declines 30%–40% each additional week after a trigger, meaning that organizations have to act quickly with the perfect message.

Engagement Beyond the Initial Sale

More than ever, consumers expect digital engagement not only as part of the initial sale, but across the entire customer journey. The process of using data and advanced analytics to make every interaction more personalized and meaningful – across channels – is imperative to optimize satisfaction and improve sales. The difference between old and new marketing is that the objective is for the consumer to want to engage as opposed to being bombarded to buy.

The most data analytic mature organizations use data for an in-depth understanding of the entire customer journey, connecting with the customer at anticipated times of need with the objective of helping the customer reach their financial goals. This strategy applies seamlessly across channels … and can involve human interaction.

The benefits of building the technical and organizational skillsets to support engagement throughout the customer relationship are significant. According to research from BCG and Google, companies that have the ability to deliver relevant content to consumers at multiple moments across the purchase journey reported cost savings of up to 30% and revenue increases of as much as 20%. In addition, those organizations that deploy machine learning-based technologies, with active human supervision, find that they can boost campaign performance by an additional 15%.

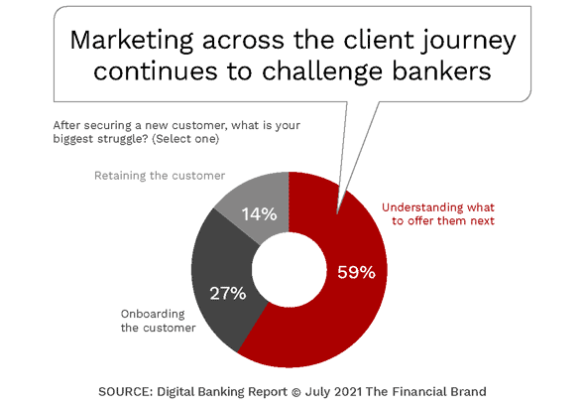

Delivering digital engagement across channels, at the right time, is not easy. Most financial institutions do not have the needed skillsets internally and may not have the marketing technology to support real-time engagement. When we asked financial marketers about the challenges of marketing to customers once they were acquired, close to 60% stated an inability to know the next best offer to suggest.

To resolve these issues, many banks and credit unions are beginning to leverage customer journey mapping, which helps organizations to understand and optimize the customer experience across channels based on different personas. According to Salesforce, customer journey mapping has several benefits, including:

- Allowing the optimization of the customer onboarding process

- Monitoring customer expectations against the experience they actually receive

- Understanding different buyer personas as progress along the customer journey

- Creating a logical sequence of communication

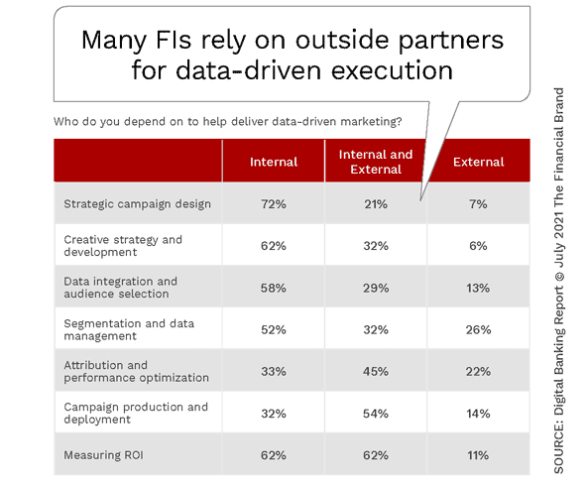

Partnering for Data and Analytics Success in Marketing

With the complexities of today’s marketing capabilities, and the need to access multiple data sources and leverage new technologies, internal and external partnerships must be developed and reinforced. Successful marketing organizations build relationships across all functions and departments to both gather data and deploy strategies that can positively impact the customer experience. This is the only way a customer will benefit from a seamless integration across all touchpoints.

Just as importantly, there must be partnerships developed outside the organization with marketing agencies, potential innovation partners (such as fintech firms), technology leaders, and firms experienced in transforming data to actionable insights. Many financial organizations are even partnering with part-time, contract and freelance workers who have the skillsets requisite to increase data and analytics maturity.

Our research found that financial institutions are tapping into a vast array of partnership opportunities to improve the speed and success of marketing initiatives.

It is time for financial institutions to invest in the marketing capabilities that will determine the success against an increasing array of competitors. Organizations at at the highest levels of data and analytics maturity enjoy increased agility, better integration with partners and suppliers, and the best use of advanced predictive and prescriptive forms of analytics. This all translates to competitive advantage and differentiation.