Artificial Intelligence has become a buzzword in banking circles, similar to the way “omnichannel” was a while back. Everyone seems to be talking about it, but opinions differ on what exactly it means to implement it. So far, AI has not significantly changed the way most financial institutions operate.

But AI does have the potential to enhance — and indeed drastically change — the customer experience and customer relationships for banks and credit unions. To do that, however, it must go beyond simple window-dressing applications, such as a largely useless chatbot that can tell customers their checking account balance, or an esoteric Alexa skill that 90% of consumers won’t use.

Indeed, as the Harvard Business Review puts it, AI should change what you do, not simply how you do it. The publication notes that most financial institutions don’t use AI to pursue real digital transformation, but rather instead to pursue “digital incrementalism,” mostly using it to increase automation in order to cut costs.

Below are three practical applications for the use of AI in payments.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

1. Smarter Payments, Stickier Customers

One area where banks and credit unions can implement artificial intelligence technology to make a real and impactful difference in customer experience is payments. The HBR piece cites Goldman Sachs’ Marcus, its partnership with Apple Card, and its wider connected ecosystem as an example of how AI and digital technology overall can move banks beyond traditional transactions and into the realm of banking-as-a-service.

Goldman has leveraged modern digital technology to build distribution partnerships with Apple, Amazon, JetBlue and Intuit. These are all relationships based on data sharing, intermediated by machine intelligence, a subset of AI. “In the case of Amazon,” says HBR, “Marcus provides revolving credit lines to Amazon merchants, governed by data from their e-commerce trading activities.”

Key to Success:

Use AI to become the center of your customer’s financial life and part of a larger ecosystem.

In essence, using AI to create this sort of financial ecosystem, where users can access services with other firms and platforms they do business with, makes financial institutions an essential hub for their customers when they engage in commerce, rather than merely a back-end payments processor.

Read more: Why the ROI of AI Falls Short for Nearly Everyone

2. Using Payment Data to Improve Consumers’ Financial Health

Well before the rise of fintechs, personal financial management software (PFM) was supposed to be the savior of consumer finance and budgets according to many news articles, marketing materials and panel talks at industry conferences. That has hardly been the case.

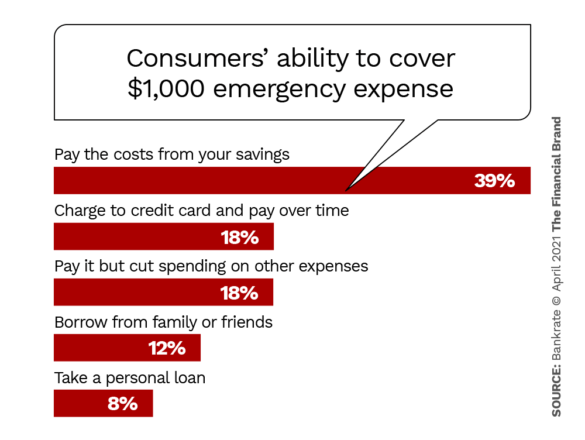

There continues to be a long-running savings crisis in America, and most agree one way to help stem this tide is by increasing financial education among consumers. PFM services are ostensibly one way to do that, but most simply offer customers itemized information on how they spent their money, not what to do about it.

However, the use of new AI-powered payment apps can help consumers spend more wisely and even build in protections for them, notes Amyn Dhala, Vice President and Global Head of Product and AI Express at Mastercard.

Dhala says the power of AI is to take and analyze data from many different payment streams to build highly accurate models that can predict potential spending risk for customers.

“I think increasingly, FIs realize that every opportunity to interact with a customer is an opportunity to engage the customer, to provide a better experience so that they can actually get a greater share of the customer’s financial activity, especially given the digital environment which we are in today,” Dhala told Pymnts.com.

For example, AI modeling can predict several months out whether a customer is likely to become delinquent, Dhala notes. That means banks and credit unions can be proactive and work with customers — through digital channels — to help them and provide the best possible experience.

Why it Matters:

Helping consumers spend smarter and, ultimately, manage their financial lives better creates loyal and more profitable customers.

AI can also work at the point of sale, helping consumers track and create better spending habits. In this way, it works as a personal financial manager; one that is free and provides advice instantaneously, all with little effort by the consumer, unlike earlier PFM software.

Read more: AI’s Real Impact on Banking: The Critical Importance of Human Skills

3. Key Tool in the Escalating Fraud Fight

For financial institutions it is of vital importance to enable the seamless, easy user experience that consumers want while still maintaining effective security controls. This is especially true in payments. Consumers want to make payments in a real-time, digital environment. But you can’t focus solely on the customer experience and ease of use while neglecting proper fraud controls. How can payments be frictionless for consumers but still stop fraudsters?

One answer is utilizing artificial intelligence to track data in real time. Citibank, for example, partners with Feedzai to create machine learning models for fraud detection.

Because cyber-attacks, fraud, payment processing, and fraud detection are all constantly evolving, Citi’s clients expect the institution to keep up as well. The bank claims that their integration of anomaly detection software helps their clients stay on top of new threats without slowing down their transactions.

AI can help detect anomalies in real-time and fine-tune fraud and security models automatically as needed, keeping customers safer and thus, happier and more brand loyal.

These days, most banks feel they have to “do AI” in some way, or at least talk about how they are doing it in their marketing materials and press releases. But actually making strategic investments in AI in payments products can be a real differentiator.

Banks don’t want to end up as the “dumb pipes” processing transactions behind slick customer-facing payments apps. By offering smart and helpful AI-powered payments products, they can instead retain customer mindshare and stay top of wallet.