Banks are adopting advanced technologies at faster and faster rates.

The COVID-19 pandemic accelerated a shift toward digital platforms and online banking that was already underway: In the decade prior to the pandemic, the number of physical bank branches in the U.S. had already shrunk by 20%, according to a report from McKinsey.

Now, the race to implement artificial intelligence tools has only accelerated the technological race. Nearly 43% of banking and investment firms say they are currently using or experimenting with AI technologies, according to 2023 research from consulting firm Gartner. In fact, banks reported the third highest adoption rate in Gartner’s survey, surpassed only by consumer service providers (46%) and retail (44%).

This wave of technological change is far from over. As the needs of customers evolve, banks continue to look to adopt better and more advanced technologies to meet customers where they are. But banks also face a big challenge when it comes to implementing new tools and platforms: Their customer-facing staff isn’t always up to speed.

The Growing Trends:

The number of banking and investments firms using or experimenting with AI:43%

All financial institutions, from megabanks to community credit unions, are struggling to keep their staff trained on the latest tech. These workers, who are often the first point of contact for frustrated customers, often don’t use the technology themselves, which can create gaps in knowledge when helping customers.

Others may also be reluctant to incorporate digital tools into their day-to-day work because they are afraid their role will be replaced by technology. (About 22% of all workers are concerned that AI will take their jobs, according to a Gallup poll.)

As a first step, banks need to address those fears and encourage staff to view digital technologies including AI as tools that can help them be more effective at their jobs, says Agustin Rubini, director analyst in the Financial Services and Banking team at Gartner.

Many banks are already creating tools that can do just that. JPMorgan Chase, for example, has developed IndexGPT, an AI investment tool that analyzes and selects securities based on customers’ needs. The bank is also experimenting with AI for document management.

Some banks, like ABN AMRO, use AI to listen in on customer calls and provide real-time feedback on how call center agents can improve their customer service, Rubini says. “With AI, you can transcribe all of these calls and you can understand what the best performers are doing,” he says. “Then you can provide real time feedback. If there’s one call that wasn’t compliant, you can flag it straight away.”

Such strategies are becoming commonplace. Even so, as advanced technologies like AI become a bigger and bigger part of the day-to-day, banks will need to find new strategies to support the training of their workers on these tools to help them do their jobs more effectively.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Employees Who Aren’t Customers

A major roadblock to training workers is that many don’t actually bank with their employer. This makes training critical, especially for frontline staff members, says John Findlay, chief executive and founder of digital learning company LemonadeLXP, based in Ontario, Canada.

“If their staff doesn’t bank with them, they don’t use the technologies on offer and it’s pretty difficult for them to promote them to customers,” he says. It’s also difficult for them to answer customer questions.

Brian McNutt, U.S. vice president of product management at Dutch engagement platform Backbase, says banks should incentivize their staff to actually use their services as much as possible. One approach is to offer special rates or deals to employees, he says.

“I think that really the most important thing is that they are customers themselves. There’s really no replacement for that. For somebody to really be able to empathize or understand customers, they have to experience the products themselves.”

For employees who are unwilling or unable to become customers themselves, other tools are available to address gaps in knowledge and experience. LemonadeLXP, which works with TD Bank and U.S. Bank, offers a tool that allows banks to simulate the experience of using their app, and gives staff the opportunity to test out the software in a low-risk environment. There’s also a learning center, where staff train on a variety of topics in game-based microsections, Findlay says.

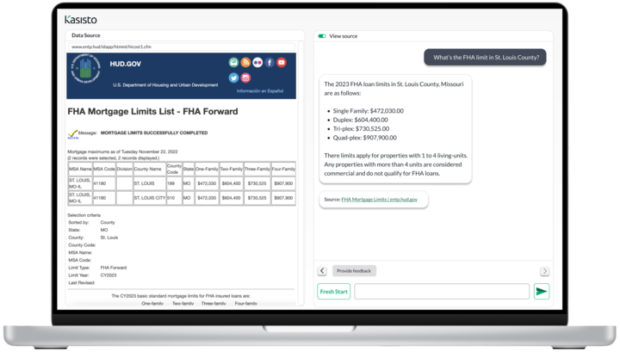

Kasisto, a New York City-based tech company that creates conversational AI tools for the financial services industry, developed a generative AI chatbot called Kai Answers designed to help staff answer customer questions.

Call center workers can use the chatbot to get quick answers to customer questions. If the question references a specific policy, the bot will provide the exact section of the document where it found the answer.

Zor Gorelov, chief executive and cofounder of Kasisto, says he thinks it’s important for there to be a human on the other side of the conversation with a customer, which is why their technology is marketed specifically to be used by employees. “Human oversight is important,” he says.

Gamification Can Be an Effective Training Tool

Banks can also seek out ways to boost employee knowledge by making learning more fun. This is especially true for compliance training, says Richard Winston, Financial Services Global Industry lead at N.Y.-based Slalom Consulting.

“The question is not what AI can do for us, it’s what we can do together with the AI.”

Agustin Rubini, Gartner

“Banks have to do compliance training and meet those requirements but that doesn’t mean they have to do it in a way that isn’t engaging,” Winston says. He suggests breaking up training into smaller, micro sections that include games that test staff on the content. There are also AI tools that simulate an interaction with a customer, he says.

“If we can take that experience and morph it, from what is currently a bit of a dreaded chore into an immersive and engaging experience, that will be better for everybody,” he says. “It will be a huge win for the financial institutions because it’ll be easier to get people to do it.”

Read more:

- Chatbots’ Future in Banking: Supporting Employees and Improving CX

- Solving the Mortgage Lending Challenge through Smart Automation

Who Owns Learning and Development?

Finally, leadership of staff training can be an overlooked obstacle. It’s often not clear which department inside of a bank is responsible for upskilling workers, especially in smaller institutions. In big banks, human resources or a designated learning and development (L&D) team can own the process.

But Findlay says LemonadeLXP often won’t work with a general learning and development department. Instead, they partner with whatever unit of the business plans to implement the software. “We sell directly to the business unit that has challenges,” he says. “Learning and development at financial institutions are in longer term contracts with traditional learning management systems. They’re typically older and aren’t tooled to teach technology.”

No matter what part of the company owns L&D, it’s important that responsibility isn’t an afterthought, especially in community banks. If your staff is properly trained, they’ll be better able to assist your customers – with a little help from artificial intelligence. “The question is not what AI can do for us, it’s what we can do together with the AI,” Gartner’s Rubini says.