Not many people are comfortable letting others know the state of their finances – a consumer’s checking account balance, size of mortgage, loans, even how much the person earns. Money is, after all, private. Which is why chatbots are going to be big in banking.

A chatbot is the closest channel we have to going into an actual branch to talk to a member of staff one to one. It’s personal, private and – when done well – the conversation is held not only at a level appropriate to the customer, but also in their style of language and at a time convenient to them. It’s a universal interface, also, so no one has to learn how to use it. Even better, they tend to sit within an existing chat platform such as Facebook or WeChat.

All this is important. For the consumer, its intimate nature ticks the privacy box; the appropriate level of communication and language tick the personalization box; and the lack of differentiated interface and the fact that you don’t need to install them tick the ease-of-use box. From the banks’ point of view, it opens up a direct line of communication that can be used to build a deep relationship – one less likely to be thrown over by a rival.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

What Sets Chatbots Apart

Chatbots are AI-enabled, text-based communication tools. They learn users’ language styles, picking up their words and expressions rather than remaining stuck with a vocabulary compiled by the programmer and bank’s marketing department. So if you say “pay the gas man”, it knows to transfer money to the gas supplier; similarly, if you say “move three grand to savings”, it knows to move $3,000 to your savings account. It’s much more like talking to a human than using a menu could ever be.

The quality of a chatbot will be measured by how quickly and how well it learns to understand the account holder. And a good chatbot service will get more personal and more proactive over time.

The payback for banks is clear: as anyone in sales knows, mirroring the target’s speech patterns and language builds empathy that helps clinch the deal.

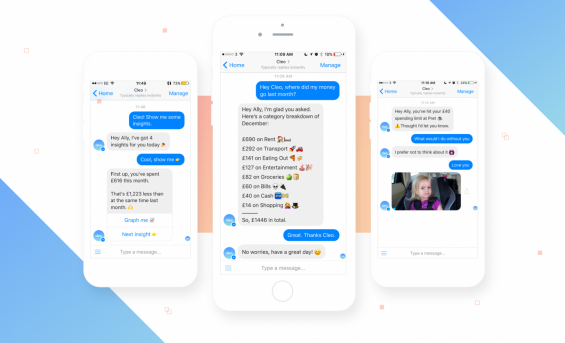

Meet Cleo

This is exactly what Cleo does. An AI-enabled chatbot from London, Cleo sits discretely within the Facebook platform – although Facebook has no access to Cleo chat or a user’s bank data. Messages pop up from Cleo about a user’s finances and with information that the user might find useful – when their salary has come in, or overspending in a category like entertainment. Notifications can be viewed by users at their convenience.

Although this information maybe available from the bank’s mobile or internet service, Cleo is more proactive and engaging by making interactions much more timely and relevant to the individual user’s circumstance. Cleo allows the user to be in control. It is the user who sets the frequency and tone of contact. The user can also initiate contact, asking questions or giving instructions.

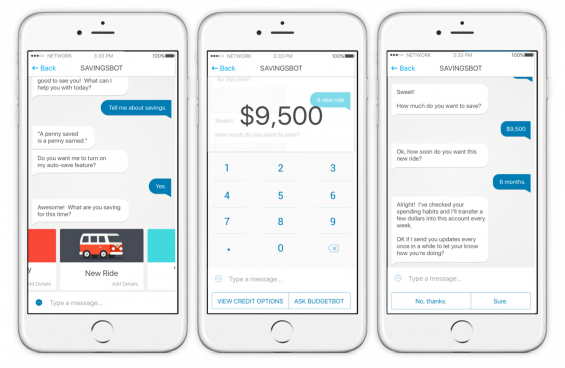

As chatbots develop, their role will expand to become more proactive, helping users achieve goals, avoid fees and better manage their money. For example, they will track spending, spot when it is lower than normal and suggest the difference is moved into savings.

Over time, this proactive role will deepen, so that with prior consent, chatbots could move money between accounts, pay invoices, set up direct debits for regular bills and find the best deals for savings accounts, credit cards, utilities and maybe help with automated switching of products … working on the consumer’s behalf.

The chatbot Finn from JPMorgan Chase also already does some of this. It acts as a savings coach, prompting users to round up transactions to save faster. For this to work, the user has to give the bank consent to act on their behalf – something that will become as common as a user giving consent for apps to access phone features. And it will mark an important watershed.

When banks have users’ consent, they will be able to take a truly holistic approach to managing users’ money. Their role will not be limited to advice. Once informed of a customer’s goals, banks can automate many of the decisions or tasks customers have to perform to manage their finances. Keeping the customer informed of actions and the reasons why the action was taken will then become as key as getting consent for actions.

This type of service will develop hand-in-hand with ecosystems featuring different companies, services and sectors. If banks get their chatbots right, they will be at the heart of the consumer’s financial ecosystem. Not only will banks be able to help people save for and buy a house, but they will also find that house, rate it environmentally, suggest lawyers, surveyors, builders, and assess whether it’s priced fairly.

Intelligent bots might also be able to warn clients when they are overspending or encourage them to save for a forthcoming holiday – which the bot knows about because it scouted the best deals, booked the flights and hotels, suggested suitable excursions and ordered the taxis to and from the airport.

People are always likely to want their financial affairs to be private and personal. Private banks have excelled at satisfying this need for the few. With chatbots, all banks will soon be able to play such a role for everybody.