Not that long ago, one financial institution’s lost customer became another’s new customer. Most of the churn related to changed circumstances: moving to a new city, getting married or divorced, and changing jobs, and, on occasion, consumer frustration.

Now consumers have many more financial services options. While the checking account remains the primary financial anchor, for now, increasing numbers of partnerships between legacy institutions and mobile-only challenger banks are beginning to change the landscape.

It’s vital that traditional banks and credit unions track shifts in consumer attitudes regarding intent to switch banking providers — and the reasons for doing so. Even if consumers aren’t ready to defect en masse to fintech providers, the competition between legacy institutions is more intense than ever.

“5.3% of the online adult population in the U.S. is considering switching financial institutions. That represents about 12 million people. Another 16% is on the fence.”

New research from Resonate’s large consumer database finds that 5.3% of the online adult population in the U.S. is considering switching financial institutions. That represents about 12 million people. In addition, another 16% is on the fence about switching banking providers. That’s 36 million more people who could be persuaded to switch with the right combination of message and offer. Resonate calls the first group “switchers” and the second group “persuadables.”

Ericka McCoy, Chief Marketing Officer for the consumer intelligence firm, notes that financial institutions are becoming much more aggressive in going after the persuadable consumers. Unlike the switchers, “persuadables” are not necessarily unhappy, she says, but potentially receptive to certain offers. Right now account-opening bonuses are a frequent ploy. However, Resonate’s data suggest that other avenues could become more effective and longer-lasting.

The firm’s data is mined from an ongoing series of research waves. The latest wave polled approximately 200,000 U.S. consumers over the age of 18 who are active online. Both the number of persuadables and switchers increased from the previous (2018) wave. Most of the people not in those two categories are “non-switchers” in Resonate parlance, although a small portion of the sample are not users of banking services.

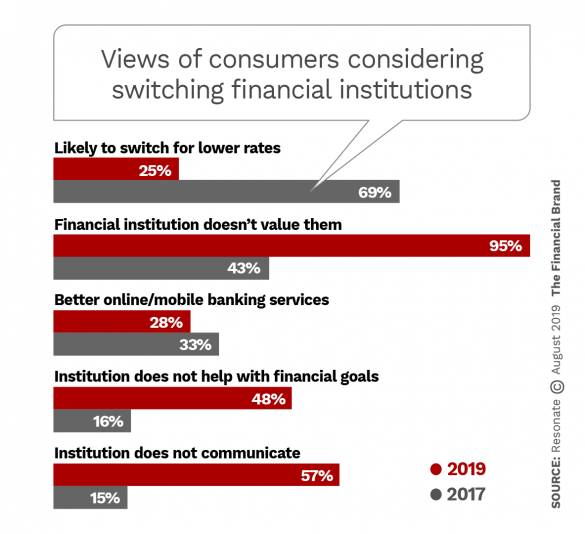

An analysis comparing the views of consumers thinking about switching financial institutions to views of non-switchers yields significantly different results from the previous research a year earlier. That indicates that consumer attitudes toward banks and credit unions are evolving rapidly.

As can be seen in the chart, far fewer persuadable consumers are likely to switch banking providers for lower rates or fees than in the previous wave (a 44% decrease). Three factors matter a great deal more to this large segment of potential switchers:

- Not feeling valued by their financial institution (up by 52%)

- Unhappiness with communications received from their current banking provider (up by 42%)

- A sense that their bank or credit union is not helping them meet their financial goals (up by 32%).

Also notable is that better digital banking is not a major issue with these consumers. As Resonate observes, it’s an important factor, but taken almost as a given now.

“You can’t even have an app that’s hard to use anymore,” McCoy believes. “That alone would likely move people away.”

A telling point. While almost all traditional financial institutions have mobile banking apps, not all are in the same league as those offered by the likes of Chase, Bank of America, Wells Fargo, not to mention Uber, Netflix, and a host of other nonbank companies that consumers routinely deal with.

Read More: Just Because Banking Customers Don’t ‘Switch’ Doesn’t Mean They Love You

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Reasons Why ‘Switchers’ Plan to Head for the Exit

In contrast to the persuadable consumers who are not necessarily unhappy with their current financial provider, but open to changing for something better, the roughly 12 million Americans adults who say they plan to switch are frustrated, according to McCoy.

“They know they want to switch and they have some very specific things prompting that.” The top four reasons, according to Resonate’s research:

- Desire for tools and ideas for financial preparedness

- Account consolidation

- Better customer service

- Recommendations from family and friends.

The point about financial preparedness is held in common with the consumers who are just thinking about switching, but is of much higher importance to people who have already decided to switch providers, McCoy states.

The unhappiness with customer service is echoed in comments in J.D. Power’s 2019 Bank Satisfaction study: “Customers currently view their banks as being more innovative and financially stable. However, customer perceptions of retail banks having a good reputation and being customer driven are lower in 2019 than in 2009,” the research firm states. “The industry has improved convenience and driven increased levels of operating efficiency, but a trade-off for banks is a decline in easy interaction, providing advice and strengthening customer relationships.”

Still, J.D. Power found that a record low 4% of banking customers actually switched institutions in 2018. The Resonate data, updated as of June 2019, points to a possible jump in the rate of switching — to 5.3%, if the consumers who say they’re planning to switch do so.

According to Resonate, most of the consumers likely to switch are from the three largest institutions: Chase, Bank of America and Wells Fargo. As McCoy observes, part of the reason for that is simply that those institutions have so many more customers that it’s logical they might lose more.

The Resonate data is based on expected behavior versus actual, so it isn’t known where these banking switchers would move to. Judging by the amount of sign-up bonuses being offered, it may simply be from one large financial institution to another. Novantas research finds that one quarter of recent bank account openers said a cash incentive played a role in their primary bank choice. About a third of these offers exceeded $200.

The Resonate results raise the question of whether such marketing tactics will continue to work or whether other factors will become more important.

Read More:

- Innovation Driving More Consumers to Switch Banks Now

- Millennials, Gen X and Even Boomers Will Ditch Banks for Amazon

Will ‘Soft’ Issues Beat Hard-Cash Offers?

Financial marketers may wonder whether the factors that are top-of-mind for the consumers described as switchers and persuadables will really get people to pull the trigger and switch, or, conversely, get them to stay if those issues were better addressed by their current financial institution.

McCoy’s take is that consumers have new expectations for the brands they do business with. This is particularly true with Millennials, as discussed further on, but not exclusively so. There are factors now that never existed before due to both technological and social changes, McCoy states.

“‘My bank does not communicate well with me,’ probably wouldn’t have been raised as an issue ten years ago. But smartphones changed that.”

— Ericka McCoy, Resonate

For example, the point raised about “My bank does not communicate well with me,” probably wouldn’t have been raised as an issue ten years ago, says McCoy. But all the new forms of communication ushered in by smartphones has changed perceptions, habits and expectations.

In the past people would go into a bank, she notes. Now they’re doing most of their banking online or with an app. “Banks and credit unions need to closely examine how they are communicating with both long-term customers who now have raised expectations, as well as with people who are not customers who the institution is trying to persuade to become one.”

“People have a much different idea now of what a bank does, McCoy believes. “It’s much more than cashing a check and providing a savings account. So marketers need to think about what they need to ‘lean into’ as a bank brand around the types of services that are becoming very important to people.”

Some of that is still transactional, of course, but both switchers and persuadables in the Resonate research pointed to help with financial goals. That dovetails with the general sense among traditional institutions of a shift to more of an advisory role. It’s not a change that can be contemplated at leisure. Many fintech advisory solutions are already well established in that space. Partnering with one of them may be the most practical route.

Read More:

- Surprising Reasons Why Consumers Would Switch Banking Providers

- How to Acquire More Checking Accounts in an Amazon World

What Would Make Millennials Move Their Accounts?

While cautioning against stereotyping such a diverse generation, McCoy notes that some key distinctions emerge from the data for the large generational segment.

“Millennials are definitely more likely to choose brands that have values important to them, and will want to know clearly what the brand stands for,” McCoy states.

In broad terms, the generation includes some of the most cash-strapped consumers, who shoulder a great deal of student-loan debt. “They’re trying to figure out how to buy a home,” says McCoy, “and they’re looking for a financial institution that partners with them. They think, ‘How is this bank or credit union helping me with my financial goals?'”

She also notes that switching providers is not a big deal to Millennials. Based on Resonate’s data, McCoy says that of the people in the “switchers” category, Millennials is the largest segment, at 35%, followed by Gen X at 30%.

As a marketer herself, McCoy says that if she were working for a traditional banking provider, she would view the perspectives of the persuadable audience, especially Millennials, and see how the institution is targeting this group. Are our offers in sync with what they see as important? Are we making offers equal to what others are making?