A study from TransUnion’s Iovation unit finds that just over three out of five (61%) of consumers’ banking transactions in 2019 were conducted on mobile phones. Strikingly that figure is up from 52% in 2018 and 28% in 2014.

Another report predicts that finance apps are on the cusp of exponential growth globally, and that includes in North America.

Younger consumers are driving much of this trend. Their expectations have been set by experiences with Amazon, Uber and a slew of financial apps from fintechs and neobanks that often have superior data and analytics capabilities, according to the report, from mobile marketing and analytics firms Adjust and App Annie.

Many banks and credit unions realize that digital banking and a mobile-first strategy represents the primary competitive battlefield. Investment in advanced mobile capabilities, they believe, is an opportunity to extend and deepen relationships, especially as consumer visits to branches continue to decline.

Many mobile banking functions that were considered leading-edge even just a few years ago are now table stakes. These include:

- Balance information

- Transfer funds between accounts

- Pay bills

- Deposit checks using phone camera

- Fraud alerts

- ATM and branch locators

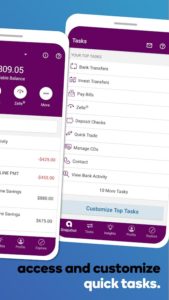

Here is a selection of the advanced mobile banking features and functions that banks and credit unions should consider adopting to stay up with consumer preferences.

1. Simple, intuitive design and navigation. It all begins here, but many mobile banking apps have a ways to go to catch up with best practices. Forrester, in a paper states that “Many banks inflict fragmented experiences on their customers” by forcing them to figure out how to complete tasks with poor navigational directions. The research firm cites several good examples, including letting a customer easily move from app to mobile web and back. An in-app search function is also an essential part of mobile design now. BBVA’s search tool lets consumers ask questions by voice or a typed query. Business Insider praises Citibank’s app for its “smart shortcuts” that make it simple to get to frequently used features.

Read More: Citi’s Chief Client Officer: People, Passion, Purpose Drive Banking Quality

Ally Bank, BBVA

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

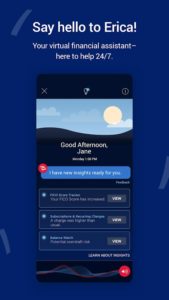

2. Personalized money management insights. In many ways this is the most significant mobile banking feature now — and likely for the foreseeable future. Fintech apps, notably Moven, Simple, Chime and Varo have led the way with intuitive, even fun, budgeting and savings tools, and some traditional institutions have caught up. Indicative of the power and appeal of such features, Erica, Bank of America’s in-app virtual assistant, hit ten million users within 18 months of its launch largely on the basis of the personalized insights it provides consumers through its use of machine learning. U.S. Bank’s “Insights” feature has also proven very popular. The AI-powered tool provides cash-flow analysis and categorizes spending.

BECU, Bank of America

Citibank, USAA

3. Easy-to-access customer service options. The best mobile banking apps make it clear on most screens how to get help — often by a simple tap. Assistance may come in the form of live chat, live phone, virtual chat or other means. Virtual chat has been successfully used by Capital One (Eno), Ally Bank (Ally Assist), and most notably Bank of America (Erica). Each of these three chatbots can accommodate both text and voice communications. USAA also makes it easy to directly connect with a person or digital assistant from within the institution’s app.

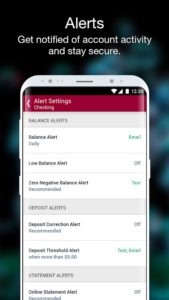

4. Vastly expanded alerts. There’s almost no end to the options here. Many of them have been prompted by customer requests. Beyond basic fraud alerts, some examples include:

- Deposit notification

- Bills coming due

- Low balance/overdraft risk

- Large purchases

- Certain categories of purchase

- Password/profile change

- Large ATM withdrawals

The ability to enroll and manage alerts should be easy, including choosing between push, text, email and phone alerts. In addition, some alerts should be made actionable: e.g. Tap to “pay now” or to select an amount to move to savings. Navy Federal Credit Union and Wells Fargo offer such easy actions.

Read More: Mobile Banking: Financial Institutions Must Clean Up Their Apps

BB&T, U.S. Bank

.

5. Instant account opening and onboarding. Leading banking apps not only allow a consumer to open another account on a mobile device, they make it simple and fast. The launch of the Apple Card raised the bar on this capability by enabling a new customer to open and begin using a virtual card in as little as three minutes. U.S. Bank in its redesigned mobile banking app enables quick applications for home equity loans and investment accounts. Smaller institutions can match many of these functions by using applications from vendors.

6. Biometric security. Mobile transactions are among the most secure if multi-factor authentication is used. Biometric features including fingerprint readers, now common, and facial recognition — less common but growing — make this much easier. Banks and credit unions must have this capability enabled in their mobile apps. Consumers expect it.

7. Digital payments and mobile wallet access. Aite Group says a digital payments strategy is a “must have” for banks and credit unions and mobile is the key to that strategy. McKinsey found that more than three quarters of U.S. consumers made a mobile payment in the 12 months ending in August 2019. Every mobile banking app should allow easy access to mobile wallets including PayPal, Apple Pay, Google Pay and Samsung Pay, or some combination of them.

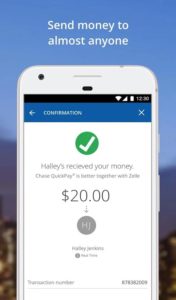

8. Seamless P2P payment interface. For most banks and credit unions, the person-to-person method of choice will be Zelle, the fast-growing bank-operated P2P network, although some institutions support Venmo, which is popular with Millennials and Gen Zers. Either way, the banking app must integrate smoothly with this capability. Forrester cites JP Morgan Chase as a good example of Zelle integration. The Chase app can group multiple emails and phone numbers for a single Zelle contact, for example.

BBVA, Capital One

Chase, Discover

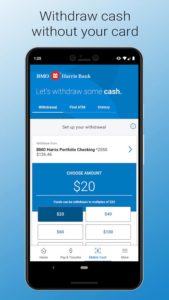

9. Cardless ATM access. Also referred to as pre-staging, this is increasingly showing up as a popular feature as it is 1. more secure, and 2. allows another option if you don’t have your ATM card with you or forgot your PIN. Some institutions enable this as part of Apple Pay or Google Pay, others use a QR code or push a code to enter at the ATM.

10. Detailed transaction descriptions. Instead of describing transactions using cryptic words and numbers like those seen on most card statements, the descriptions give the name of the merchant and show its location on a map. For any consumer using this feature, it instantly becomes the expectation, and several financial institutions are now beginning to provide it.

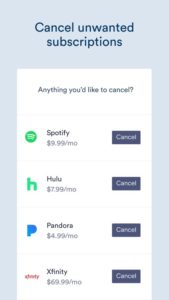

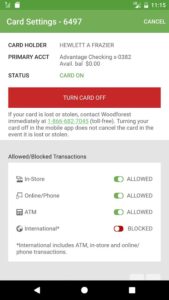

11. Advanced card controls. Travel alerts and the ability to turn a debit or credit card on or off are pretty close to table stakes now. More advanced features include what Wells Fargo is offering with its Control Tower application: enabling consumers to view recurring payments and keep track of places where they’ve shared card or account information. In addition, some institutions, including Citibank, now allow customers to review the status of card disputes within the banking app.

BMO/Harris, Clarity

Wells Fargo, Woodforest National Bank

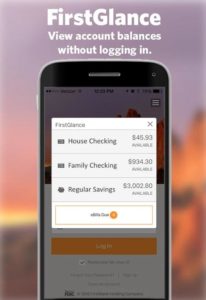

12. Account snapshot without logging in. As part of the trend to frictionless digital banking, more financial institutions are enabling this option, whereby consumers can view certain basic information at a quick glance. It has to be carefully balanced with privacy considerations and should be easily configurable by the consumer as to what will be shown.

13. Alternative language choice. Just as happened with ATMs in another era, multi-lingual banking apps are showing up to appeal to various market segments. Both Bank of America and U.S. Bank, among others, have come out with Spanish language options.

14. Push notifications. Part and parcel of alert capability is being able to send it in the manner consumers prefer. Push notifications are not text messages. They are sent by the app without requiring the person to be in the app. These notifications should be short, but can be very powerful for both customer experience and marketing. Uber uses them very successfully, e.g. “Your car is here, license plate 234LV5.” Open rates for push notifications can be 30% to 60% with interactive rates of 40%, states Ian Blair of mobile app development platform Buildfire.

Capital One, FirstBank

Moven, U.S. Bank

15. Advanced account management. The best banking apps make it simple to change credit or debit card PINs, change passwords, manage alerts and customize what is shown in the app.

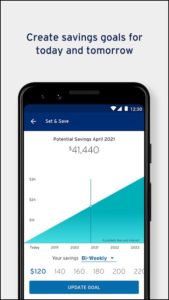

16. Automated savings tools. Pioneered by fintech apps like Moven and Digit as part of a package of financial management tools, app-based savings tools are becoming mainstream. Some of these reside within the main app, like U.S. Bank’s “Savings Analyzer.” Others are standalone, like Fifth Third’s Dobot. U.S. Bank’s app uses analytics to predict what a customer can save and asks them if they want to save that amount. Whereas with Digit and Dobot, algorithms automatically transfer the available funds to savings, once the consumer has agreed to the arrangement.