Despite ongoing public scrutiny, customer satisfaction with banks is at a record high as banks improve experiences for their customers, reduce problems and create a better understanding of fees, according to the J.D. Power 2014 U.S. Retail Banking Satisfaction Study. But midsize banks are missing the mark with key audience segments, such as millennials and minorities.

“Midsize banks are falling behind in meeting the needs of the fastest growing demographic groups, especially in online, mobile and problem resolution,” said Jim Miller, director of banking services at J.D. Power. “If midsize banks don’t change their focus to adjust to demographic shifts, they are extremely vulnerable and risk losing market share to competitors and becoming irrelevant.”

Improving consumer sentiment with the economy and personal finances has helped lift overall satisfaction with retail banks to an average score of 785 on J.D. Powers’ proprietary 1,000-point scale, up from 763 in 2013 — an increase of 2.3%.

“Even with record high satisfaction, there are some banks that fall far short in meeting customer needs. It is easy for banks to become complacent,” Miller observes. “To stay at the top of their game, banks should focus on consumers who are not satisfied.”

Among customers who switched banks during the past 12 months, the most common reasons were:

- Poor customer service (28%)

- Branches are not conveniently located (21%)

- Interest rates are not competitive (19%)

- High fees (15%)

Consumers are experiencing fewer problems with banks, and when problems do occur, they are more satisfied with how they are resolved. In 2014, 16% of customers have experienced a problem or had a complaint, down from 18% in 2013 and 24% in 2010. Satisfaction with the problem resolution process has improved 4.2% since 2013.

Satisfaction over fees rose 7.9% to the highest level in four years.

However, not all customers feel the same. Affluent consumers remain the most demanding and least satisfied segment. Expectations for personalized experiences are high among affluents, and banks have not provided a differentiated experience to meet those expectations.

“It’s remarkable that banks are failing to satisfy affluent consumers, especially with deposits and liquidity so important to the life of a financial institution,” said Miller. “As boomers age, the country is poised for a huge transfer of wealth in upcoming years. As this occurs, those banks that have satisfied the affluent segment will be more competitively positioned to prosper.”

The study measures customer satisfaction with banks in 11 regions. Study results by region are provided below.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

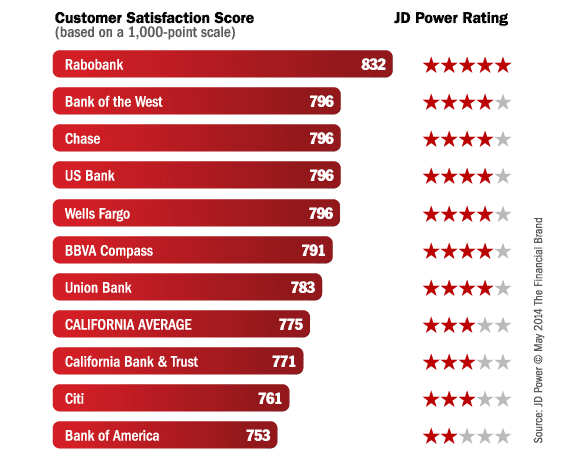

California Region

Rabobank ranks highest in the California region with a score of 832 and performs particularly well in the account information, fees and channel activities factors. Following Rabobank in the rankings are Bank of the West, Chase, U.S. Bank and Wells Fargo in a tie (796 each).

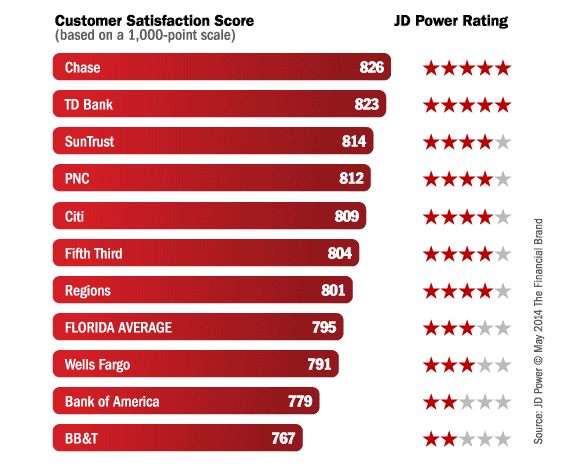

Florida Region

Chase ranks highest in the Florida region with a score of 826, performing particularly well in the facility and channel activities factors. TD Bank (823) and SunTrust (814) follow in the rankings.

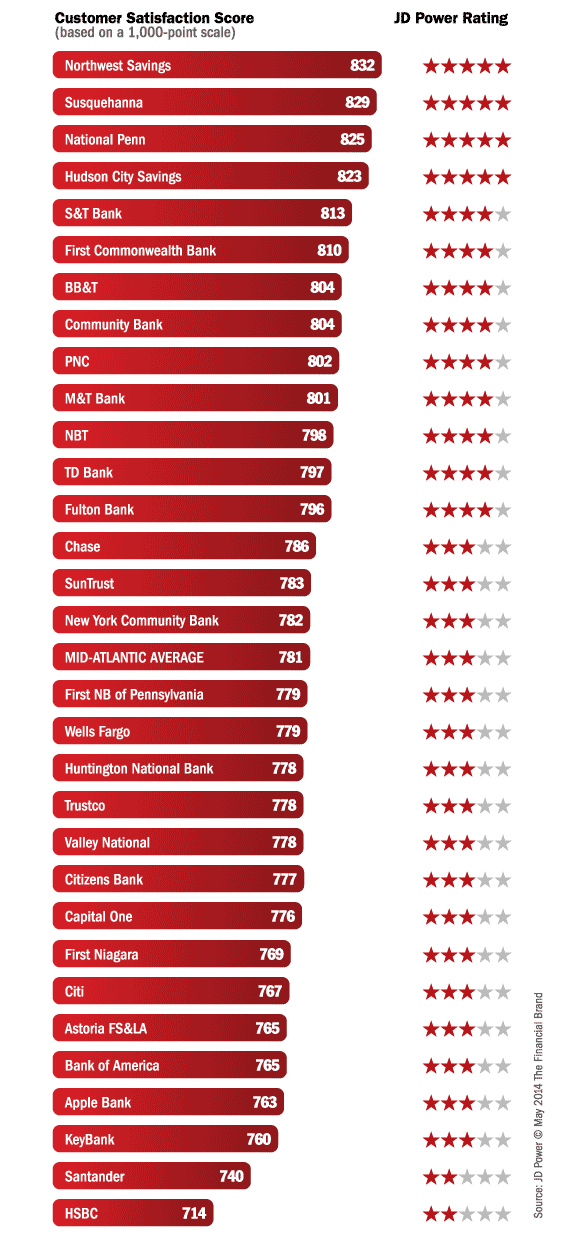

Mid-Atlantic Region

Northwest Savings Bank ranks highest in the region with a score of 832 and performs particularly well in the product offerings factor. Susquehanna Bank (829) and National Penn Bank (825) follow in the rankings.

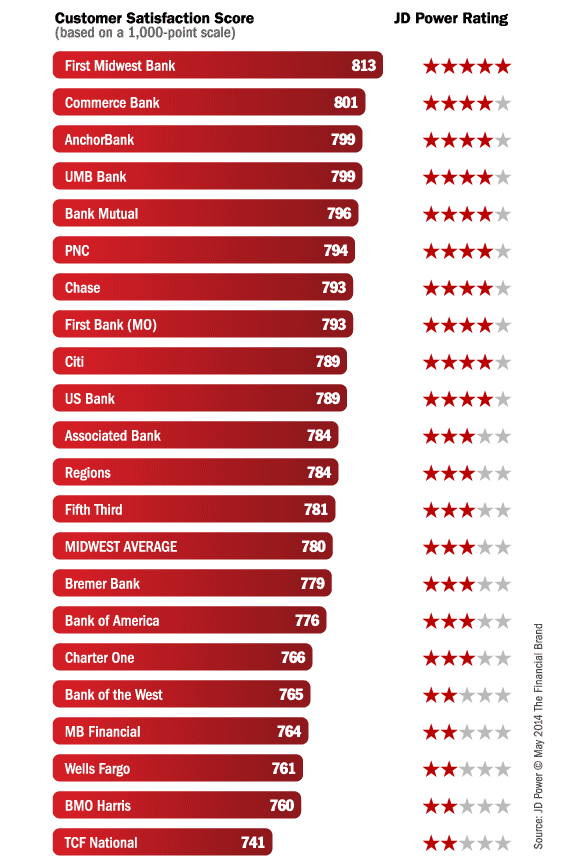

Midwest Region

First Midwest Bank ranks highest in the region with a score of 813 and performs particularly well in the facility, account information and channel activities factors. Following First Midwest Bank in the rankings are Commerce Bank (801) and AnchorBank and UMB Bank in a tie (799 each).

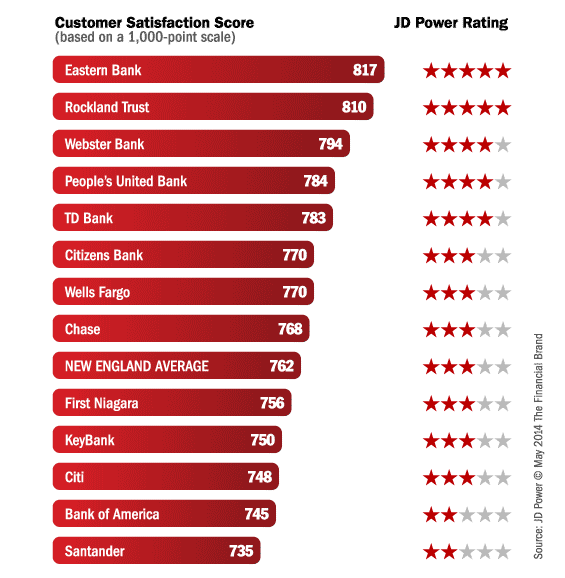

New England Region

Eastern Bank ranks highest in the region with a score of 817 and performs particularly well in the account information and fees factors. Rockland Trust Co. (810) and Webster Bank (794) follow in the rankings.

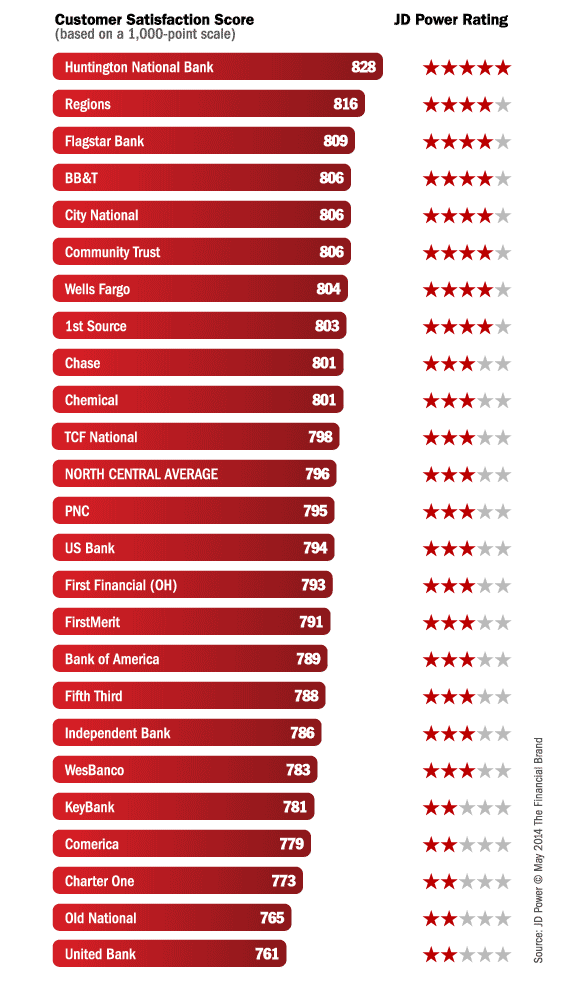

North Central Region

With a score of 828, Huntington National Bank ranks highest in the region, performing particularly well in the product offerings, account information and fees factors. Following in the rankings are Regions Bank (816) and Flagstar Bank (809).

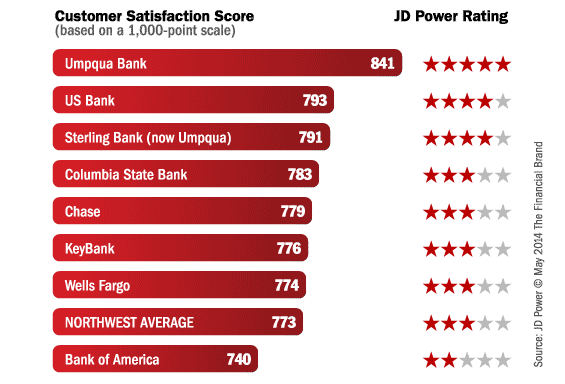

Northwest Region

Umpqua Bank ranks highest in the region with a score of 841 and performs particularly well in the product offerings, facility, account information, fees and channel activities factors. U.S. Bank (793) and Sterling Bank (791) follow in the rankings.

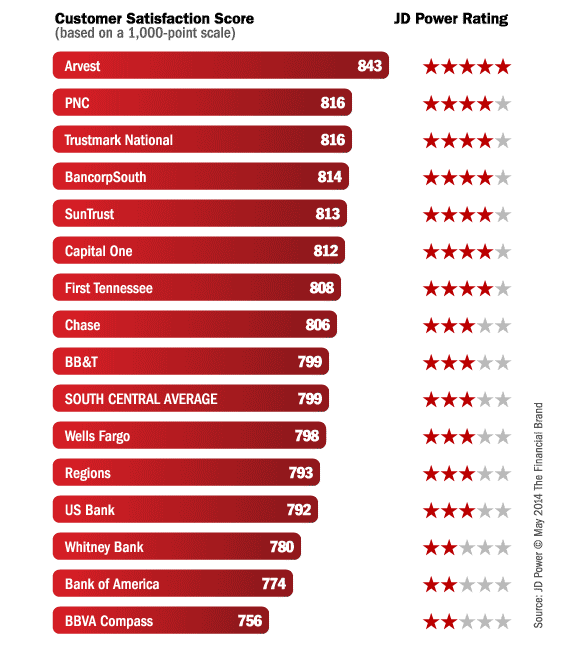

South Central Region

Arvest Bank ranks highest in the region with a score of 843, performing particularly well in the product offerings, facility, account information and channel activities factors. Following in the rankings are PNC Bank and Trustmark National Bank in a tie (816 each).

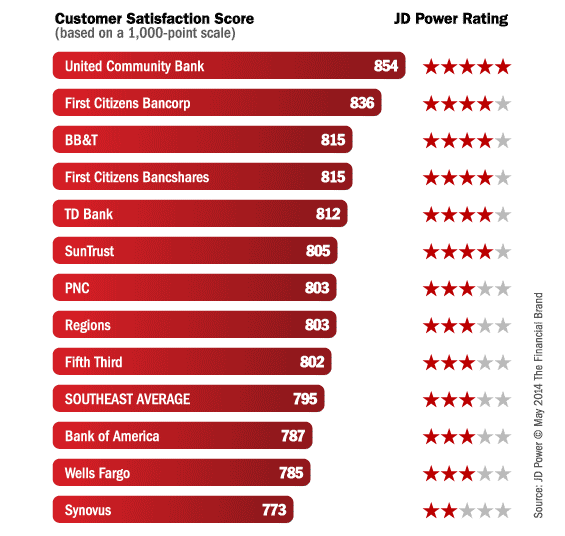

Southeast Region

United Community Bank ranks highest in the region with a score of 854 and performs particularly well in the product offerings, facility, account information, fees and channel activities factors. Following United Community Bank in the rankings are First Citizens Bancorp (836) and Branch Banking & Trust (BB&T) and First Citizens Bancshares in a tie (815 each).

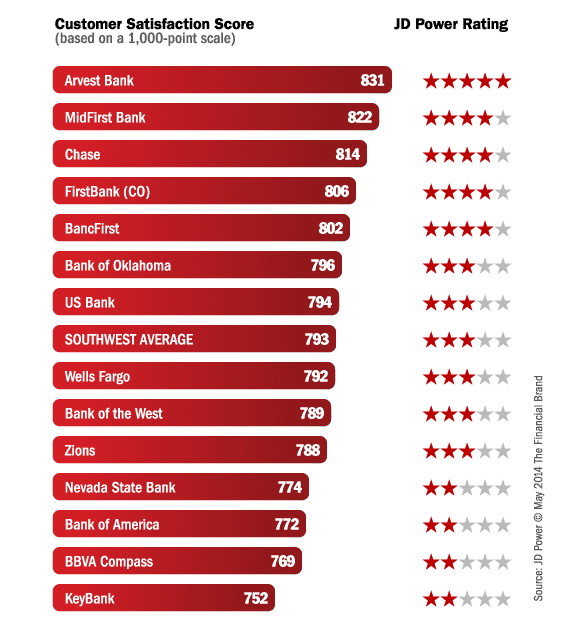

Southwest Region

With a score of 831, Arvest Bank ranks highest in the region, performing particularly well in the product offerings, facility, account information, fees and channel activities factors. MidFirst Bank (822) and Chase (814) follow in the rankings.

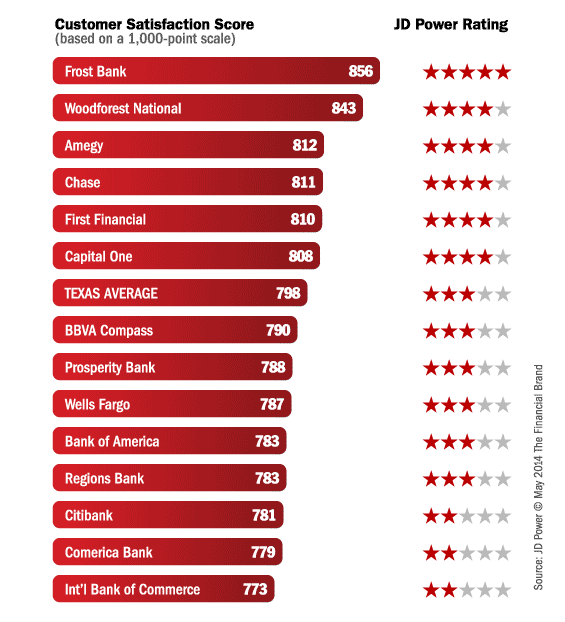

Texas Region

Frost Bank ranks highest in the Texas region with a score of 856, and performs particularly well in the product offerings, account activities, fees and account information factors. Woodforest National Bank (843) and Amegy Bank (812) follow in the rankings.