A clear priority for many of today’s banks and other financial institutions is “removing friction from the customer journey.” According to The Financial Brand’s own 2023 Retail Banking Trends and Priorities report, 48% of respondents identified this as their number one priority.

With such a clear and growing mandate, it is staggering that only 3% of the world’s websites are considered accessible to the 1.3 billion people with disabilities around the world. This needs to change. Companies need to prioritize the digital financial services experience for people with disabilities, not just aim for the minimal compliance with the Americans with Disabilities Act (ADA) and Web Content Accessibility Guidelines (WCAG) standards.

With the recent advancements in generative AI, now is a great time to review and update your company’s approach to digital accessibility. We may be in early innings, but AI has enormous promise in both identifying and removing access barriers more efficiently, particularly with the proper human oversight.

In fact, in an initial pilot study, we’ve found that AI could reduce the time required to assess and correct a complex accessibility issue — such as determining whether a link is clear and accurate — by up to 10x. That’s a return on investment that is hard to pass up.

How Much Could AI Help the Accessibility of Your Website?

Artificial intelligence can find and solve accessibility issues up to 10x faster than doing it manually.

The Roadmap to Implementing Digital Accessibility

Overall, when it comes to accessibility, here are a few things for a financial institution to consider:

The customer experience must include dynamic accessibility solutions. While marketing teams continue to make significant investments in the customer experience, they sometimes (unintentionally) overlook accessibility issues that ultimately impede the very performance metrics marketers are chasing. And even worse, these oversights serve to further marginalize key audiences that rely on digital access the most.

Additionally, many organizations fail to see accessibility as a dynamic process – one that needs to keep up with constantly changing web pages, personalized experiences, and an ever-increasing number of web pages. Accessibility is not a “one and done” initiative, but an ongoing effort that ensures websites stay accessible as they evolve and change.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Poor accessibility challenges financial wellness — and your bottom line. For those relying on assistive technology, the user experience may be very different from what a product and marketing teams intended. For example, elements that may be on-brand and beautifully designed may also be inaccessible due to insufficient color contrast, poorly labeled sub headers, or missing or vague descriptions for visuals.

And for many, digital accessibility is vital to their financial wellbeing, so you can only imagine the intense and understandable frustration from the disabled community when the experience breaks down.

And, while this may be stating the obvious, if thousands of people with disabilities— or more —can’t access your basic, or even more complex, website features, you will lose those customers. Or they will remain as very unhappy ones. And that matters, given the purchasing, banking, and investing power of the 1.3 billion people with disabilities in the world today.

Learn more:

- Building Deeper Relationships with Data-Driven Journeys

- Customer Success Principles to Improve Your Customer Effort Score

Address Common Obstacles and Missteps

Recently, a group of accessibility experts we work with at AudioEye, all users of assistive technology, shared some common and recurring challenges they experience when accessing digital financial tools. Here are a few examples:

Information is more accessible than transactions. Accessing basic account info (balances, etc.) tends to be much easier than making a transaction or moving funds. A great deal of time can be spent finding the right buttons to continue a transaction process or meet security hurdles to prove my identity.”

Sometimes accessible is still inefficient. Some disabled users have shared that while a bank’s website may include the requisite accessibility options, they are forced to endure a long and repetitive experience to make a simple transaction. For this reason, many express a reluctance to move away from phone-based interactions (automated or human) because navigating digital options requires so much more work.

Many rely on a patchwork of platforms. Many people shared the need to use multiple platforms (and even institutions) to manage their finances, with some tasks still far easier by phone, others best executed on mobile and still others requiring a third party fintech solution for ease of use. Addressing this disparity in accessibility along the user experience can go a long way to engender loyalty among users with disabilities.

How AI is Transforming Digital Accessibility

Like in all industries, AI is changing the digital accessibility landscape. When done right, AI has the potential to significantly accelerate closing the accessibility gap.

It is important for financial institutions to embrace AI in accessibility responsibly, and in a way that puts people with disabilities at the center. More specifically:

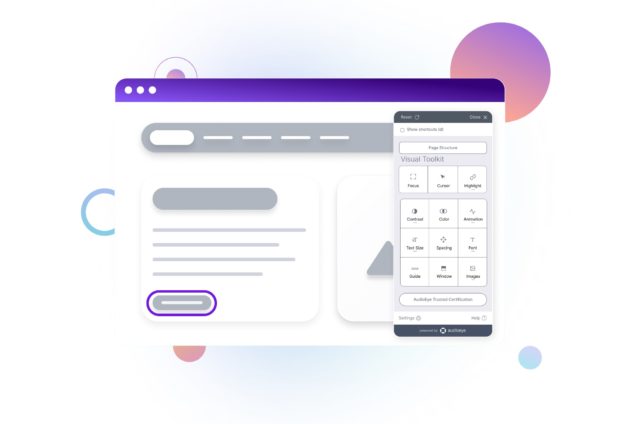

Ensure you have a solution for both identifying and fixing barriers to accessibility. Many solutions do a great job of scanning for issues and flagging those that need to be addressed. But companies need to match that surveillance with a plan to fix these issues and close the gaps. Development teams need to carefully evaluate solutions to ensure they have a comprehensive plan to ensure they cover off on both.

Combine AI’s speed with human expertise. With AI’s speed and efficiency, we can really begin to move the needle on accessibility. At a minimum, AI can be used as a highly effective first line of defense for detection and for recommending fixes. Human oversight and training should always be paired with AI to keep the technology on track from a quality perspective.

Always include people with disabilities in your solution. The disability community has not been given its rightful place as part of the solution in fixing digital accessibility issues at scale, and some are understandably frustrated. When it comes to AI, it is imperative to have people who live with disabilities as part of your team. Their lived experience will have a clear advantage for guiding AI in recommending and evaluating accessibility improvements.

Check out more on AI automating CX:

- Transforming CX in Financial Services with Generative AI

- How to Get Comfortable with Generative AI in Your Marketing Strategy

How to Measure Accessibility Success

The real North Star for artificial intelligence? When someone with a disability can’t tell the difference between an experience hand-crafted by an accessibility expert, and one created by expert-trained AI. On the way to that vision, financial institutions that deploy these new technologies in collaboration with the disability community will not only improve their own products, but will measurably improve the lives of people who struggle with accessibility issues on a daily basis.

David Moradi is the chief executive and largest shareholder of AudioEye. David is also co-founder, executive chairman and largest shareholder of virtual reality video game development studio First Contact Entertainment Inc. He is also the founder of Sero Capital, a private investment firm focused on growth opportunities in the technology sector.