When banks migrate customers from channels they prefer to use to ones they don’t, there can be serious unintended consequences.

In the wake of the global financial meltdown, retail banks and credit unions were forced to reevaluate their mix of delivery channels. Increased pressures on revenues, fees and capital — from a multitude of different directions — left many scrambling to find ways to jam consumers into less costly channels — namely online/digital, and self-service. But how do customers feel about using all these various channels to conduct their banking business?

That was the driving question behind a Gallup research report examining which channels consumers use and for what banking tasks. Daniela Yu and John H. Fleming, the two researchers behind the report, studied how channel mix directly affects the health of each customer’s relationship with their bank.

It’s an important question, because if Gallup is right, banks have a lot riding on the line. Consumers attitudes towards different banking channels drives future behaviors, which in turn affects key factors like additional cross-sell success, increased profitability and reduced cost of service.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Channel Preferences for Common Banking Needs

To better understand these channel preferences and how they affect customers’ engagement with their bank, Gallup conducted a nationwide retail banking study that explored which channels customers prefer to use for 14 of their most common banking needs.

- 3 out of 4 consumers prefer in-branch interactions to open or close an account, apply for a loan or get financial advice.

- To report a problem or inquire about a fee or service charge, consumers prefer using a branch or interacting with a live call center representative.

- To make deposits, consumers still prefer using a branch. But consumers who want cash will use either a branch or ATM.

- When it comes to learning about new products and services, websites, branches and call centers are the most commonly preferred channels.

- For specific account enquiries and routine transactions, most consumers prefer going online, although a number of consumers also prefer using a branch.

- More consumers prefer to receive statements by mail, while they prefer the online channel to pay bills.

- Consumers want to receive account alerts through multiple channels, including online, mail and email.

Read More: Bank Switchers Insist They Must Have Branches

| Branch | Online | Mobile | Call Center | ATM | AVR System |

|||

|---|---|---|---|---|---|---|---|---|

| Open or close an account | 81% | 11% | – | – | 7% | – | 1% | – |

| Apply for a loan | 83% | 9% | – | – | 7% | – | – | – |

| Seek financial advice | 79% | 8% | – | 1% | 11% | – | 2% | – |

| Report a problem | 50% | 9% | – | 1% | 39% | – | – | 1% |

| Inquire about a fee | 46% | 10% | – | 1% | 41% | – | – | 1% |

| Make a deposit | 64% | 12% | 1% | – | 1% | 19% | 2% | 1% |

| Withdraw money | 47% | 4% | – | – | 1% | 47% | 1% | – |

| Learn about products or services | 37% | 38% | – | 2% | 10% | – | 13% | – |

| Request a loan payoff amount | 27% | 37% | 1% | 2% | 24% | – | 6% | 2% |

| Receive statements | 4% | 24% | – | 3% | 1% | – | 56% | – |

| Balance inquiry, transaction history | 30% | 43% | 1% | 1% | 17% | 2% | 3% | 3% |

| Transfer funds between accounts | 32% | 51% | 1% | – | 9% | 5% | – | 2% |

| Pay bills | 16% | 60% | 1% | 1% | 3% | 1% | 17% | 2% |

| Receive alerts | 5% | 41% | 3% | – | 7% | – | 29% | 1% |

The Consequences of Channel Mismatch

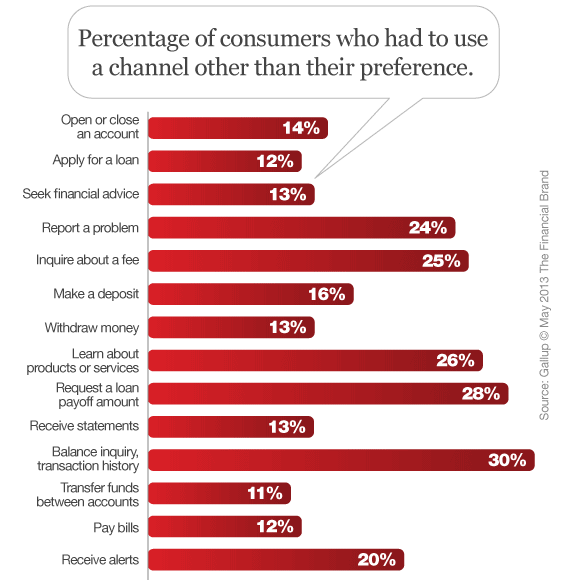

The study also explored the consequences of mismatch, or when the channels customers prefer to use for a given transaction differ from the channels they actually use to complete their business with the bank.

When customers can’t use the channel they prefer for a banking transaction, they are less satisfied with their experience than customers who used their preferred channel to meet their banking needs; they are also less engaged with the bank overall than customers who used their preferred channel. We observed significant declines in channel satisfaction for 12 of the 14 banking activities and significant declines in overall customer engagement for six of the 14.

Getting Customers to Go Digital

Gallup says there are steps financial marketers can take to lure customers into new banking channels. The three main tactics they recommend:

1. Offer positive (or negative) incentives. Gallup’s research showed that over half of consumers would be willing to switch to a lower-cost digital channels if they were given positive fee-based incentives, such as increasing interest rates on current deposits by 0.25% or decreasing interest rates on current loans by 0.25%. Imposing charges and restrictions to move customers to digital channels that they don’t prefer, in contrast, is unlikely to yield positive results. Gallup’s analysis suggests that using disincentives can have severe negative consequences, and is not recommended.

2. Set positive defaults. This concept comes from the field of behavioral economics. In general, people are more likely to engage in desired behaviors when they must “opt out” of a particular course of action than when they have to “opt in.” Employers often use this method to encourage workers to participate in their 401(k) program, for example. They automatically sign up new employees for a 401(k) contribution, and many employees continue to contribute rather than making the effort to cancel enrollment. Automatically setting the optimum defaults for channel use when customers open or adjust an account is an effective way to encourage them to try and then embrace using less costly channels to meet their banking needs.

3. Provide a technology concierge. This approach originated in the airline industry, as everyone migrated to self-service kiosks. To increase passenger acceptance and use of their kiosks, Continental began staffing the kiosk area with concierges whose job was to demonstrate the kiosks’ functionality and to help passengers check in using the machines. Banks can use a similar approach to motivate customers to move to digital channels.

Read More: The Branch Paradox: Consumers Say One Thing, Do Another

There can be unintended consequences to an increasing reliance on digital transaction channels. One is the “technology paradox.” Gallup says that when customers use digital technologies to perform simple tasks and transactions, they tend to rely more heavily on human channels like branches and call centers for their more complex or difficult transactions.

Gallup’s researchers caution bank and credit union executives who assume that increased customer use of digital channels will allow them to reduce branch headcount and costs. Financial institutions might be surprised to find that this strategy can have the opposite effect, with front-line employees spending more of their time handling complex or difficult activities.

Another unintended consequence is the “remote user paradox,” which means that the more consumers use digital channels the less they care about- and engage with their financial institution. Simply put: Customers get used to the impersonal experience, so satisfaction scores take a dive along with cross-selling ratios.

You can find more insights from Gallup research here: