With the rise of voice-controlled devices and intelligent assistants such as Alexa and Siri, it’s now fairly normal to talk to a digital device, ranging from a phone, to a voice activated assistant to a device in a car. This changes the norms for how people interact not just with information, but with brands.

The shift from screen-based interactions to voice conversations is particularly important for financial institutions, which are in the business of building relationships with consumers across channels. Financial marketers are spending more on digital and doubling down on personalization, but many are failing to blend online and offline touchpoints into a single experience.

As voice technologies become ubiquitous, and as it becomes even easier to have conversations that switch between mobile, web, and voice interfaces, financial marketers won’t be able to afford a fractured customer experience.

Rising Expectations

Just as smartphones changed consumers’ expectations for mobile experiences, voice interfaces will influence expectations for conversations with businesses. As Alexa, Siri, and Google’s assistant get smarter and more useful, expectations for the ease and quality of voice interactions will continue to rise.

According to a 2016 study by the communications technology company Nuance, 89% of consumers already prefer to get quick information by talking with a virtual assistant rather than search a web page or mobile app.

A number of banks are responding to this trend by adding voice features to their mobile services. Capital One connects with Amazon’s Alexa, so customers can use voice commands to make payments and check their account balances. Bank of America created its own artificially intelligent bot, called Erica, which provides services such as savings recommendations via text and voice. Barclays is using voice recognition as a way for customers to authenticate their identity over the phone instead of reading out their account number and answering security questions.

Improve Your Business Outcomes Through Data & Analytics

Gain centralized access to the credit bureaus and 20+ alternative data sources. Leverage advanced analytics to optimize marketing campaigns and loan decisions.

Read More about Improve Your Business Outcomes Through Data & Analytics

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Prioritizing Human Interactions

There’s a difference between adding novelty features and creating a good customer experience. Bots like Alexa, Siri, and more specialized AIs such as Erica can automate and expedite simple transactions, but they can’t entirely replace human interactions. Conversations between people — not just human and bots — are critical to building trust, confidence, and relationships. Given that people tend to be cautious with their finances, human-to-human conversations are particularly important for financial institutions. Customers want personalized, conversational service.

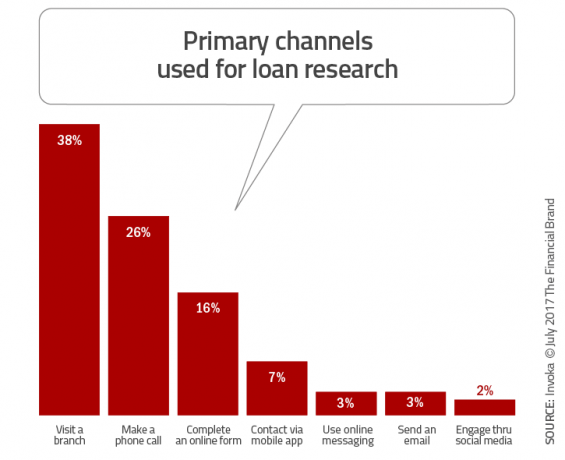

This preference is heightened when people make complex or high-value purchases. My company, Invoca, surveyed 1,2000 consumers who took out a loan of at least $15,000 in the past three years. While respondents said they use various modes of communication to interact with their banks, offline interactions have the largest impact on major decisions.

The majority of people (64%) prefer to visit a branch or make a phone call when evaluating an institution for a loan, and 84% made at least one phone call during the loan research phase. The question is whether these visits and calls were wanted or needed (caused by friction that still remains in the lending process.

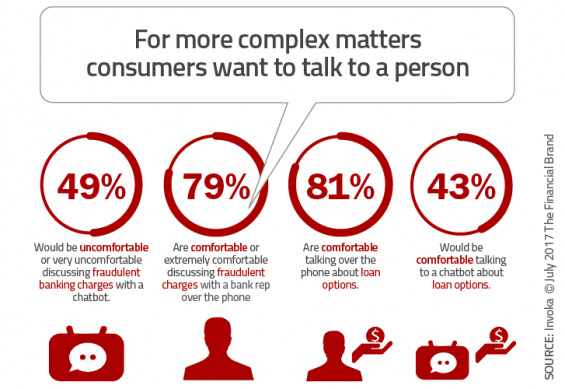

While people are comfortable with automated services for checking balances or transferring money, they still learn towards conversations — on the phone or in person — for more complex and high-value transactions. When it comes to complicated issues, such as evaluating a loan, our survey found that 81% of consumers would be comfortable talking on the phone with a human representative, compared to just 43% who would be comfortable talking with a bot.

These findings validated experiences at SunTrust, where more than 100 mortgage products were offered. Many of the customers found the bank online, but they called to get more information. In fact, it was found that 75% of people who visited the SunTrust website preferred a phone call to submitting a web form. Even as banking becomes more digital, many customers still want to call, and that experience needs to be seamless.

Thinking Beyond Digital

Financial services marketers recognize the importance of personalized and consistent customer experiences, but most are neglecting what happens when a customer picks up the phone. In doing so, they’re missing opportunities to connect with consumers during critical moments.

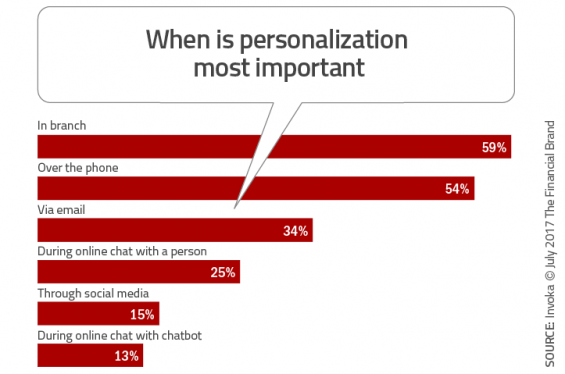

The Invoca survey investigated the situations in which people care most about personalized service and recommendations. The majority responded that personalization is “very important” for branch visits (59%) and phone conversations (54%). Just 13% said the same for interactions with a chatbot, and 15% said they would prioritize personalization on social media.

Marketers who have been focused on developing digital relationships with their customers will need to spend the coming years integrating this digital data with voice conversations. Invoca analyzed 50 million calls through their platform in 2015 and found that digital marketing drives 74% of all consumer phone calls to financial services companies.

Without visibility into calls, marketers are missing a huge part of the attribution picture; they’re unable to track phone calls — and the revenue they generate — to the ads that drove them. This has major implications for optimizing campaigns and delivering a better customer experience. Without insight into who’s calling and why, a business is likely to treat a 15-year customer like a first-time caller, or route an interested loan-seeker to a representative who isn’t equipped to answer the customer’s questions.

Businesses need to understand what happens during voice conversations and use these insights to personalize the next best action — whether that’s an email, retargeted ad, or follow-up phone call. If a loan-seeker has a conversation with a loan manager but ultimately doesn’t qualify, he/she shouldn’t be retargeted for that loan in online ads.

This consistency can make or break a customer’s experience and ultimate purchase decision. According to the Invoca survey, 45% of people would be less likely to take out a loan from a financial institution if they saw a digital ad that conflicted with a prior phone conversation.

Bridging the Offline-Online Experience Gap

Businesses can bridge the online-offline gap by combining online marketing analytics with call intelligence to track calls and get actionable insights from voice data. This data can then be segmented to enhance other interactions with customers — for instance, by personalizing a specific landing page or email offer.

As voice technologies continue to improve, conversations will become even more important for building relationships, gathering insights, and surpassing customer expectations. It’s time for marketers to unify the customer experience across channels, devices, and ways of interacting.

Consumers aren’t differentiating between digital interactions and voice communications — why should businesses?