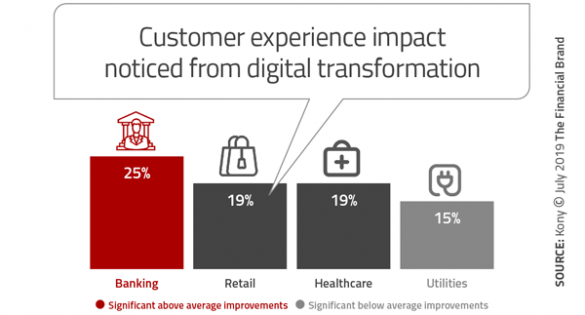

In an effort to determine the effectiveness of digital transformation investments on the customer experience, Kony, Inc. surveyed both enterprise businesses and their customers in the following four verticals: banking, retail, utilities, and healthcare. The study found that, despite nearly $5 trillion in overall investment, only 19% of consumers report any significant improvement in the experiences received. And while the banking industry performed better than the other three industries, it is possible that this rating was biased by lower initial consumer expectations.

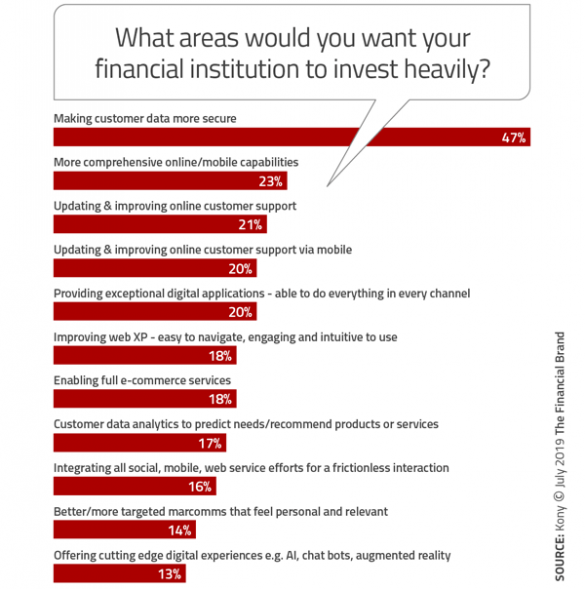

One issue is that consumers do not believe that businesses are investing in digital initiatives that result in meaningful outcomes. In fact, consumers underestimated the number of businesses that are investing heavily in important digital initiatives (such as data security, mobile access, customer support, etc.) by at least 50%. Part of the problem may be that only 28% of digital transformation initiatives are started with customer needs being the priority (68% were business process centered, with 4% being employee centered).

“The fact that only one in five consumer respondents felt any significant improvement demonstrates the enormous opportunity that remains for businesses to leverage digital for customer loyalty, service levels, convenience, and commerce,” said Thomas E. Hogan, chairman and CEO, Kony, Inc.

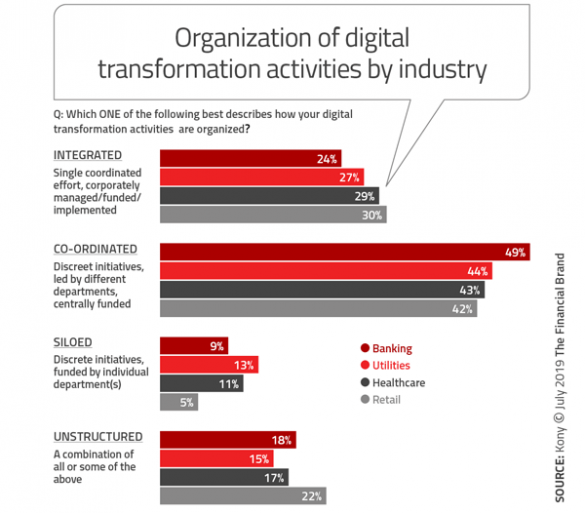

The fact that most organizations are also just beginning their digital transformation efforts indicates that many are playing ‘catch up’. In banking, 58% of organizations indicated that their digital transformation journey began less than two years ago. As a result, the banking industry was the least advanced sector, with only 24% of financial institutions stating that their efforts were integrated across the organization.

Read More:

- Financial Institutions Aren’t Prepared for the Digital Revolution

- Becoming a ‘Digital Bank’ Requires More Than Technology

Join industry’s leading AI conference - free passes available!

Ai4 is coming to Las Vegas, August 12-14 2024. Join thousands of executives and technology innovators at the epicenter of the AI community.

Read More about Join industry’s leading AI conference - free passes available!

Success Story — Driving Efficiency and Increasing Member Value

Discover how State Employees Credit Union maximized process efficiency, increased loan volumes, and enhanced member value by moving its indirect lending operations in-house with Origence.

Read More about Success Story — Driving Efficiency and Increasing Member Value

Digital Transformation Ignores Customer Experience Priorities

Given the low experiential impact from the high level of investment being made in digital change, Kony believes that businesses are not investing in what matters to their customers.

Even though the study found the banking industry to be the most successful industry vertical, with 25% of banking customers reporting a significant improvement in the level of customer experience, this is still not enough. For instance, 63% of consumers said that their primary financial provider is either ‘behind’ or just ‘keeping pace’ with similar companies. In other words, the investment in digital transformation is not creating a differentiated experience.

Worse yet, consumers do not believe that business are investing in digital transformation initiatives that deliver meaningful customer outcomes. In fact, consumers underestimate — by 50%! — the number of organizations that have invested heavily in key digital transformation initiatives. For instance, the most important customer experience outcome from the consumer’s perspective is investing to make their data more secure. Kony found that 31% of businesses are currently investing heavily in this, but only 15% of consumers perceive that they have.

As would be expected, banking and financial service customers are more focused on investment to protect their data than customers of other verticals.

Consumers Want Humanized Digital Interaction

It is clear that part of the digital transformation strategy is to offer consumers the ability to reach their providers 24/7/365. What many organizations overlook is that digital consumers want the option of engaging with a human when desired.

According to Kony, while 57% of consumers have a desire for products, services and support to be available digitally, “Consumers want to see this supported by a named company representative that is available to support them through interactive digital tools like live chat, real-time texting or a video call to address any issues immediately.” In financial services, 32% of consumers preferred this model with an additional 26% having a ‘strong preference’ for the digital + human model.

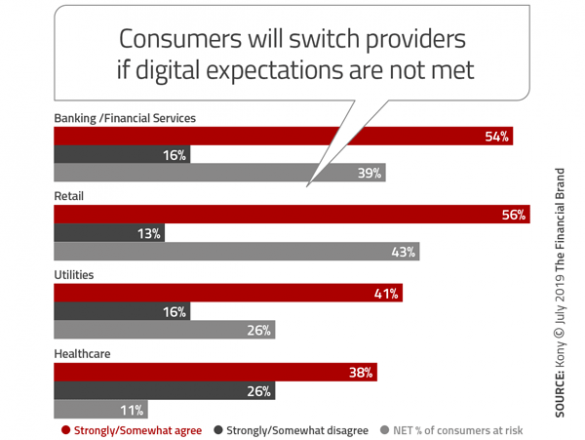

So what does this mean in terms of consumer loyalty? For the financial services industry, more than half (54%) of consumers surveyed said they will consider switching providers if their bank or credit union did not deliver the digital experiences that they demand and expect. Only 16% said they would not move if the digital experience didn’t meet expectations.

On a positive note, 70% of financial institution customers say that they spend more with banks or credit unions that offer effortless digital experiences, and 71% say they are more satisfied overall and are more likely to remain loyal. While actual switching of financial institutions usually falls short of what consumers state in surveys, can this risk be ignored completely?

Digital Transformation Must Go Beyond Cost Savings

According to the Kony research, only 28% of digital transformation initiatives at businesses are started specifically with customer needs as the priority. In contrast, 68% of digital transformation efforts were focused on business outcomes such as cost savings, revenue enhancement, etc. Research by the Digital Banking Report reinforces these findings in the banking industry specifically.

The good news is that organizations across all industries are planning to increase investment in consumer-focused initiatives. According to Kony, “Financial institutions are planning to increase their investment in every category by more than other industries. They are particularly focused on enhancing integrated online and mobile experiences, and thinking about e-commerce and the ability to do all transactions and buy/invest in products online.” Kony notes that this is most likely driven by the increased competition from non-traditional digital organizations.

Read More: What Makes A Great Digital Banking Transformation Leader?

Benchmarking Digital Transformation

To enable organizations to determine how their digital transformation efforts compare to industry leaders, Kony created the Kony Digital Experience Index (KDXi). The objective of this index is to score how an organization delivers on several digital experience outcomes, such as improving websites to make them easier to navigate, more engaging and intuitive to use; providing comprehensive online and mobile capabilities so users can do everything online or on their mobile device, quickly and easily; and offering cutting-edge digital experiences such as artificial intelligence, chatbots and augmented reality. From this index, ‘KDXi Leaders’ and ‘KDXi Laggards’ are determined.

It was found that KDXi Laggards have more of an internal focus (productivity, cost reduction, revenue enhancement, internal collaboration) while KDXi Leaders have a customer-centric focus. Furthermore, KDXi Leaders consistently recognize the need for change and are prepared to take risks. They understand that digital transformation requires a cultural change, not just technological investments.

Kony’s Thomas Hogan explained, “Laggards are simply trying to keep pace and improve internal efficiencies. The customer experience is not the main focus, and that’s painfully obvious to the customer. Businesses must listen to and understand customer needs such as data security, digital support and improving mobile experiences.”