Improved customer experience (CX) results in several tangible benefits beyond a higher satisfaction score, according to Forrester research. Organizations with better customer experiences show higher revenues, reduced costs, lower risk of attrition and the ability to command a premium price for products and services. But, since the pandemic, the average CX quality for multichannel banks in the United States has dropped and the average CX quality for U.S. direct banks has flatlined.

As a result of this decline in CX quality, customer retention for the multichannel banking industry dropped from 78% in 2022 to 76% in 2023, according to Forrester. The direct banking industry’s retention rate remained stagnant at 72%.

“How an experience makes customers feel has a bigger influence on their loyalty to a brand than effectiveness or ease in every industry.”

— Forrester Research

Many banking executives don’t realize how much improvement in customer experiences can impact the bottom line. Without understanding the correlation between a better experience, loyalty and the financial benefits, investment in customer experiences may not get the commitment required.

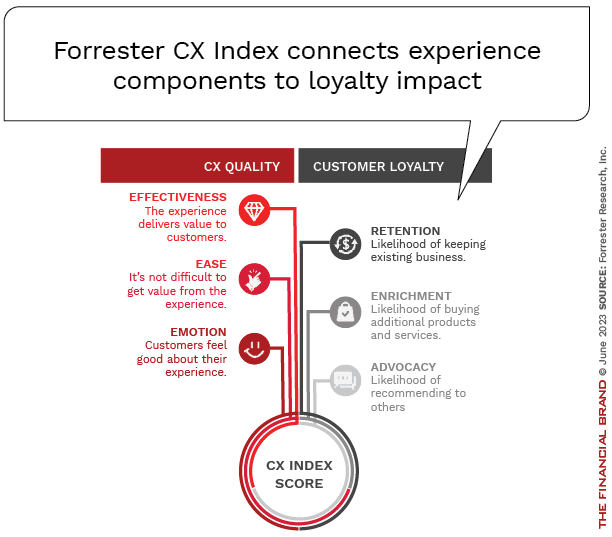

Beneath the surface, banks and credit unions must understand the underlying drivers of a positive customer experience and greater engagement, and then how the interaction of these components relates to customer perceptions and loyalty. All of these moving parts go into what Forrester calls CX quality.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

How Experience, Loyalty and the Bottom Line Correlate

When customers have positive experiences with a brand, they are more likely to develop a sense of trust, satisfaction and an emotional connection, increasing brand loyalty. Here are some ways in which a positive customer experience influences loyalty:

- Trust and Confidence: When customers consistently receive high-quality products, services and support, they feel confident in their choice of financial institution and are more likely to remain loyal.

- Emotional Connection: The most positive experiences create an emotional connection between customers and the brand. Beyond transactional accuracy, customers want to feel valued, understood and appreciated. This level of engagement creates an emotional attachment that fosters loyalty and can result in customers actively advocating for the brand.

- Repeat Purchases: It is no surprise that satisfied customers are more likely to become repeat customers. This is more important than ever at a time when exploring alternative options in banking is as easy as pushing a button on a mobile device. Repeat purchases and expanded relationships beyond a single product contribute to long-term business success.

- Word-of-Mouth Recommendations: Social media has exponentially increased the impact of both positive and negative word of mouth. Customers with exceptional and disastrous experiences will share their feelings with their friends, family and colleagues almost instantly.

- Higher Customer Retention: When customers have positive interactions with a financial institution, they are less likely to switch to traditional or nontraditional competitors. A well-tested axiom holds that retaining existing customers is more cost-effective than acquiring new ones and that the duration of a relationship often is correlated with the lifetime value of the relationship.

- Resistance to Competitive Influences: Loyal customers are less likely to open their minds to the influence of competitor messages. With so much “noise” in the marketplace, most customers won’t entertain alternative providers if their current experience and ongoing engagement is positive.

- Availability of Feedback: Loyal customers are more willing to provide feedback and suggestions to the brand that can support product improvement and innovation efforts.

- Reduced Operational Costs: Satisfied customers are less likely to require extensive customer support. Seamless experiences also can result in increased efficiency, streamlined processes and fewer errors.

- Data-Driven Insights: Longer-term customer relationships provide valuable data and insights regarding the customer journey, product usage and future revenue opportunities. By analyzing customer feedback, behavior and preferences, companies can make data-driven decisions to personalize their offerings and marketing efforts.

See all of our latest coverage of customer experience in banking

Customer Experiences in Banking Fail to Keep Pace with Expectations

Forrester surveyed the customers of direct and multichannel banks in the U.S. to determine how they perceive their experiences and what components of an experience have the greatest impact on loyalty. The bad news is that, despite continued emphasis on improving customer experiences across the industry, the vast majority of both multichannel banks and direct banks have seen very little, if any, improvement.

Among multichannel banking organizations, Navy Federal Credit Union retained its top position for the eighth consecutive year, but did not have a statistically significant improvement in its score despite making investments in many areas of the user experience. Wells Fargo was the only multichannel financial institution monitored that saw a significant improvement in customer experience. Forrester indicated that this improvement was the result of the combination of the introduction of a new mobile app and the recovery from recent scandals that negatively impacted Wells Fargo’s CX score in the past.

The direct banking industry average for customer experience was statistically flat for the fourth consecutive year, with eight of the 10 brands measured having no statistically significant change since last year. USAA and Ally Bank shared the top position, after USAA saw a significant drop in its CX score in the past year, the Forrester research shows. Interestingly, this drop could have been caused by negative customer reaction to an “improved” mobile app.

Read more:

- 7 Insights on How to Create a Winning Customer Experience Strategy

- The Top 5 Customer Experience Trends

Emotion is the Key to a Better Customer Experience

While virtually all financial institutions stress that improving the customer experience is a top objective, multichannel and direct banks struggle to differentiate their brands from competitors. When it comes to customer obsession, Forrester rates just 4% of companies offering financial services as “customer obsessed,” which is similar to the share of companies in other industries earning this distinction.

“Barriers to CX maturity can be caused by legacy business models, siloed product lines, too much emphasis on winning the features race, and a tendency to focus on legal and compliance concerns over customers’ evolving wants and needs.”

— Forrester Research

Financial services organizations must go beyond merely understanding the value of customer obsession to actually taking action.

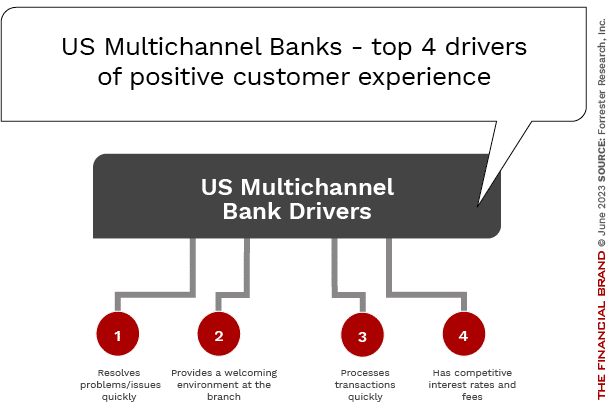

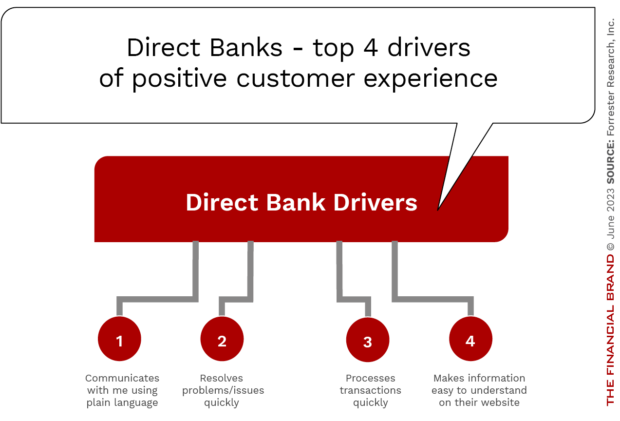

Forrester’s research indicates there are 30 underlying drivers that determine the overall CX quality by banking customers. These drivers fall into six broad categories for direct banks.

- Respects me as a customer

- Customer service

- Prices and fees

- Communication

- Website and mobile app

- Banking services

For multichannel banks, the same six broad categories existed, with the addition of a seventh category for the impact of branches.

Resolving problems and issues was the most important driver of CX for multichannel banks and the second most important driver for direct banks. Putting the customer in charge of helping to resolve issues was highly valued. While the speed of being able to transact was the third most important driver for both direct and multichannel banks, clear communication was more important for direct banks, with a “welcoming branch experience” being the second most important driver for multichannel banks.

The key is to find what differentiates both direct and multichannel financial institutions. Forrester found that emotion (such as “feeling valued”) was the key differentiator that drives loyalty, while “feeling unappreciated” was the most important negative driver of potential attrition.

Read more:

Branches Can Contribute to a Differentiated CX for Banks and Credit Unions

At a time when many banks and credit unions are focusing on driving customers to digital channels, it is important to realize that a hybrid (physical + digital) customer experience can contribute to a differentiated benefit. In fact, Forrester found that customers of both digital banks and multichannel banks prefer combined physical and digital experiences at a statistically significant level.

“For direct banking customers, the hybrid experience was rated 2.9 points better than the digital-only experience. For multichannel banking customers, the hybrid experience was rated 4.6 points better than the digital-only experience and 1.7 points better than the physical-only experience.”

— Forrester Research

Forrester says hybrid experiences scored the same or higher on effectiveness, ease and emotion compared to digital-only or physical-only experiences. Overall, for financial institutions to succeed, it is important to focus on the specific drivers that will most influence your own customers’ loyalty – then prioritize efforts accordingly.