Here’s the challenge for all retail financial institutions: The single biggest component of customer satisfaction — directly impacting loyalty and revenue — is emotion.

Not “happiness,” but feeling respected, appreciated and valued. Historically traditional banks had an edge there because in-person interactions led to stronger emotional connections with consumers.

But COVID threw ‘in-person’ under the bus. It may or may not recover, and large segments of consumers had to learn how to deposit checks by mobile device and other digital transactions.

The digital functionality is there now for many institutions — both at traditional and direct institutions — but the emotion is lacking. It’s much harder to connect emotionally when the customer interaction is digital, but it’s no less important.

In fact, it’s probably more important now.

That is a key point from the latest U.S. Banking Customer Experience Index report from Forrester. The report identifies the traditional (or multichannel, as the firm prefers to call them) and direct banks and credit unions that are setting the pace in customer experience. Yet as Principal Analyst and report co-author, Gina Bhawalkar tells The Financial Brand, there is much work to be done in the area of emotion.

The CX Index, done annually, is part of a multi-industry project and is based on consumer responses to an online survey conducted from February to April 2020. The research polled 6,863 customers of nine direct banks and 13,095 customers of 17 multichannel banks and one credit union. The ranked institutions all have a national market presence. The rankings are based on a proprietary score reflecting three factors:

- Effectiveness: How effective the institution is at delivering value to customers.

- Ease: How easy it is for consumers to get value from the experience.

- Emotion: How consumers feel about their experiences with an institution.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Standouts in the CX Rankings

The top-ranked institutions in both categories were repeat winners. Among the traditional institutions, Navy Federal Credit Union came out on top for the fifth year in a row. Among the direct banks, USAA, even though its score dropped by several points, still had the best CX ranking, also for the fifth year in a row.

Here are the top five traditional institutions in Forrester’s 2020 CX ranking, with the 2019 rank in parentheses:

1. Navy Federal Credit Union (1.)

2. BB&T (now Truist) (7.)

3. TD Bank (2.)

4. PNC Bank (5.)

5. Regions Bank (3.)

In addition to BB&T’s jump from seventh to second spot, other moves of note include Chase going from 12th to ninth position and U.S. Bank rising from tenth to seventh. Of the other megabanks: Wells Fargo was 14th (up two spots), Citibank was 16th (up one), and Bank of America was unchanged at 18th. None of the 18 traditional institutions scored below what Forrester classifies as an “OK” level of CX quality. On the other hand, none reached the level of “Excellent,” although Navy Federal was quite close. The top nine were all in the “Good” range, while the bottom nine were all “OK.”

Here are the top five direct banks in Forrester’s 2020 CX ranking:

1. USAA (1.)

2. Discover Bank (3.)

3. Ally Bank (2.)

4. Charles Schwab Bank (5.)

5. American Express Bank (7.)

There was less movement among this group. Notable below the top five were Marcus, down one from eighth to seventh and Synchrony Bank occupying the bottom spot (ninth). None of the direct banks made excellent either. In fact, of the nine institutions only USAA and Discover were in the “Good” range, while all the rest achieved only “OK” status.

Read More: Digitizing Banking is All About Engagement and CX, Not ‘Tech’

Banks Do Best at What Has Least Impact

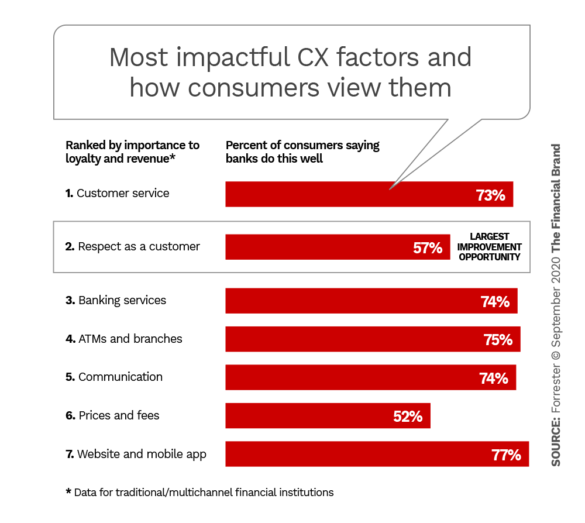

Forrester assessed the impact of numerous factors on not only the quality of customer experience, but their effect on loyalty, differentiation and revenue. The firm collated the factors into seven broad categories. These are shown in the graphic below ranked in descending order of their impact on loyalty and revenue. (The categories shown are for traditional institutions. Direct banks have the same categories minus the one for “ATMs and branches.”)

The percentages shown in the red bars indicate how well consumers think traditional institutions perform in that area. As can be seen, “Website and mobile app” performance is ranked highest by consumers (77%), while “Respect as a customer” is second-lowest at 57%.

The problem with that result, according to Forrester, is that banks and credit unions are doing best at the thing that has the least impact on loyalty and revenue. The factor with the most impact, as noted earlier, is “Emotion,” of which “Respect” is a key part. In fact, simply making people “happy” isn’t particularly effective, the report states. Making them feel appreciated, valued and respective is. “Among customers who feel valued 71% plan to stay with the bank, 87% will advocate for the bank and 82% plan to spend more with the bank,” according to Forrester.

The results for direct banks (not shown) were much the same: Consumers rated these banks the best in regard to their websites and mobile apps (74%) with “Respect as a customer” again showing up nearly last (59%).

The Financial Brand delved into the importance of emotion and other related topics from the Forrester CX report in an interview with Bhawalkar.

Let’s discuss emotion further. What’s involved in being appreciated, respected and valued?

Gina Bhawalkar: Emotion is an aspect of customer experience that most financial brands just are not getting right yet. More important than making experiences easy is making sure that customers feel good about the experience they have with the brand.

So let’s take feeling respected. Most banks and credit unions can get their head around the idea of feeling respected when it comes to branch interaction. For example, Navy Federal serves the military market and one of the reasons they continue to get very good customer experience scores is they make sure that they address the member who walks in by their rank. That is a way of showing respect.

Interestingly when I talk with bankers about evoking a feeling of respect in other channels — a mobile app for example — it’s hard for them to get their head around that.

“You can respect the customer’s time by eliminating unnecessary steps and jargon from your app and your website.”

— Gina Bhawalkar, Forrester Research

One way that can be done is by respecting the customer’s time. For example, by eliminating unnecessary steps and recognizing that a person doesn’t want to spend their whole day in your app or on your website. They want to accomplish their task and move on to other things. By streamlining these tasks you’re mindful of the person’s time and elicit a feeling of “This bank respects me as a person.”

Another example that covers all three aspects of emotion we talk about — respect, appreciation and valuing the relationship — relates to a persistent problem in the industry: Communicating with customers as if they have a degree in banking. Some of the neobanks are really starting to nail this by cutting out the jargon. Monzo, for example, rewrote their terms and conditions in less than 1,500 words at an eleventh-grade level. They appreciate their customers by talking to them in terms they understand and making sure that they feel good about the experience.

In-person interactions did well in terms of CX, was that a surprise?

Gina Bhawalkar: It doesn’t surprise me. When in-person interactions go well they have a very positive impact on how the customer feels about the brand overall. Since this survey was closed, consumers of course have essentially been forced in some cases to move to the digital channel. So the most important question right now is: What are we going to see in 2021?

In a separate survey we asked consumers what financial activity they had done online for the first time as a result of the pandemic. 14% said they paid a bill online for the first time. 14% also said they had banked online for the first time. That’s a large segment of individuals who had been transacting primarily in branches or over the phone and now are using digital banking. It’s safe to say that some of those new habits are likely going to stick. And so it may be that in 2021 digital experience will have a much higher impact on loyalty and how consumers feel about the brand.

Consider that many of that 14% I just mentioned are older adults who preferred to walk into their neighborhood branch and are now trying to figure out how to deposit a check on their phone for the first time. And some may be experiencing changes in vision, hearing and motor ability due to their age, which many banks and credit unions hadn’t thought about when they designed their digital experiences.

What are some suggestions for improving digital experience?

Gina Bhawalkar: Confidence is a very important dimension of user experience. A consumer should always know when they come into your app to pay a bill or find a recent transaction where they are within the experience and what’s coming next. Yet we still see many financial institutions creating these very complex navigation structures and using banking jargon that customers don’t understand which hinders confidence.

Take Zelle. Even though it’s been around for a couple of years we find in our usability testing that customers still have questions about it. Yet many banks and credit unions make the assumption that customers know how Zelle works.

However, we are seeing more financial institutions invest in design systems — a set of standards, guidelines and best practices for how you design your digital experience. USAA, Navy Federal and Ally Bank are getting this right. When you go to their website and when you open an email from them they’re talking to you in the same language. It sounds like the same company. With other institutions it’s clear their emails were written by the marketing team and the mobile app was developed by the product team and they didn’t talk to each other.

Read More: 16 Must-Have Mobile Banking Features that Raise the CX Bar

The report states that it’s a mistake to create an entirely digital experience. Why?

Gina Bhawalkar: Let’s take a consumer who has a preference for digital banking. They don’t want to talk to their bank unless they have to. But when something goes wrong — say, suspected fraud — even that digitally inclined consumer wants to get on the phone. When people are in an emotionally charged state, that’s when it’s important to be able to get that human connection.

We’re seeing many financial institutions turn to chatbots as a solution for customers to self-serve. But what they often overlook is that when a customer is in a situation like I just described, they don’t want to self-serve with a chatbot. They want to get on the phone and feel that the bank is taking care of the situation and watching out for them.

So it’s important when thinking about these digital assistants/chatbots that you are not making them your only solution for customers to get service.