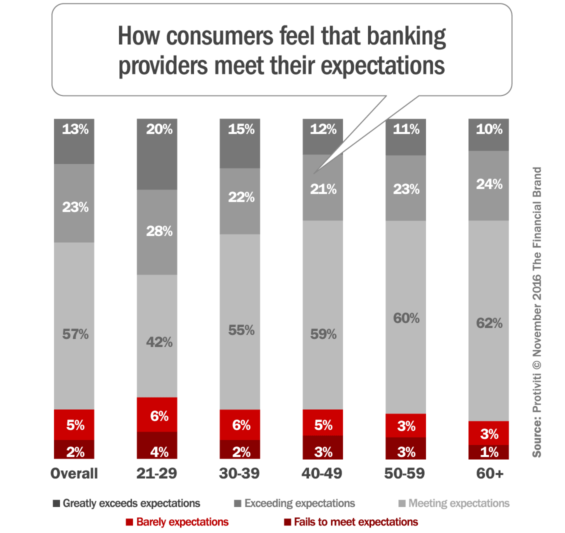

According to 93% of respondents in Protiviti’s second annual Consumer Banking Survey, banks at least meet their expectations. But do they go above and beyond? No. At least that’s what consumers say. Only 36% of respondents in Protiviti’s study feel their banking provider exceeds expectations.

Protiviti surveyed more than 2,000 consumers in the United States, across a broad spectrum of age and income groups, about a range of customer experience issues. They found that financial institutions have plenty of room for improvement when it comes to customer expectations, managing the overall customer experience and, perhaps more importantly, convincing consumers that they care about their complaints.

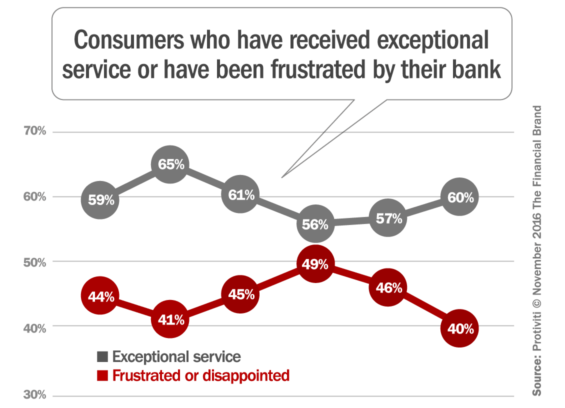

According to the study, only one in three consumers said they think that their financial institution “absolutely cares” about their problem after they have shared a complaint. An equal number of participants in the survey said their banking provider either “does not care” or the respondent as “unsure if they cared.” A dismal 36% of consumers said their bank “responds every time” with a resolution whenever they share a problem. And the higher a customer’s income level, the greater the likelihood is that the customer has been disappointed or frustrated by an financial services company.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

“For many consumers, a brand is directly equated with the customer’s experience.”

— Atul Garg, Protiviti

While merely meeting expectations may have cut it in the past, Protiviti says it isn’t sustainable going forward. Consumers expectations are rapidly evolving, particularly as more companies inside and outside the financial industry ramp up their efforts to enhance the customer experience.

“Traditional banking providers are no longer squaring off solely against each other when it comes to attracting and retaining customers,” explains Atul Garg, a managing director in Protiviti’s business performance improvement practice. “They’re also contending with established consumer brands like Amazon and Apple, as well as emerging fintech players and others.”

Garg says that in order to succeed in this new competitive landscape, banks and credit unions must maintain a renewed and rigorous focus on customer care.

“For financial institutions that want to face the future with confidence, they should increase their own expectations for customer satisfaction levels,” Garg continues. “It takes a commitment — at every level of the organization — to find ways to consistently exceed customer expectations.”

Deal With It: Consumers Are Going to Complain

When it comes to making complaints, the survey results found that different demographic and socioeconomic segments favor different communication channels. However, generally speaking, most customers lean on tried-and-true methods to lodge their grievances:

- 63% call the bank

- 40% visit a branch

- 18% use email

Taking care of customers and responding to their needs — particularly when they are frustrated — is critical if financial institutions hope to retain relationships, acquire new ones, and keep themselves out of trouble.

“Customer complaints are a fact of life in the financial services industry,” says Jason Goldberg, a director in Protiviti’s business performance improvement practice. “But these problems also present prime opportunities to delight the customer.”

Protiviti says that how customer service representatives respond to- and resolve complaints can transform dissatisfied customers into brand advocates, identify potential service improvements, and yield other valuable lessons on the customer experience.

According to Goldberg, most banks and credit unions would benefit from investing more time in understanding the best ways to handle complaints and learning from the lessons they contain.

“Resolving customer complaints in a timely and consistent manner is key to building an effective customer experience,” adds Goldberg. “Regulators increasingly review and act upon customer complaints, so compliance executives should be as concerned as their marketing counterparts about the speed and compassion with which issues are resolved.”