Across all channels, there are simple steps you can take to improve your customer experience and increase the loyalty, satisfaction and retention of your customers and members. Below we’ll discuss our top four areas to focus on, from online to in-person, for improving your customer experience and driving profitability.

1. Online – Claim Your Local Listings

Oftentimes a prospect’s first interaction with your bank or credit union is through the results returned by an online search for your company. According to Google, 77% of consumers who search for a local business on their smartphone end up contacting that business within a day.

What should you do? Claim your local listings and verify that your company’s name, address and phone number is correct. And don’t just focus on Google. Claim your listings on all search engines including Bing and Yelp.

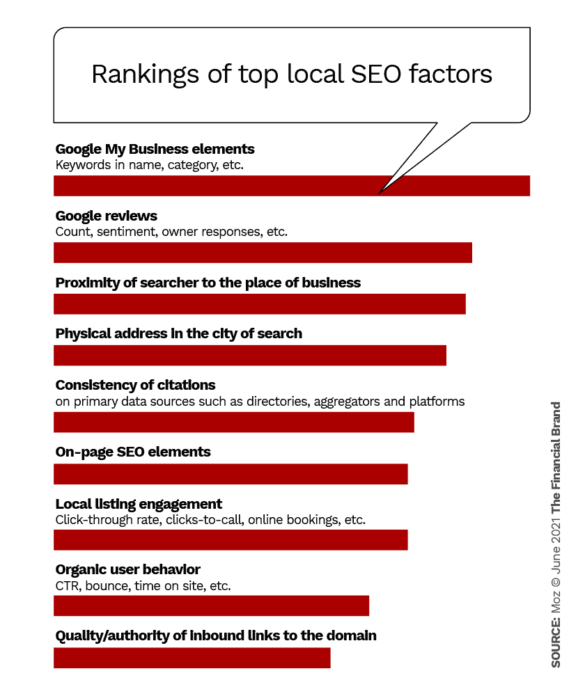

Once you have verified your local listings, you can start responding to any reviews left on your listing. This allows you to manage your online reputation, impact conversions, and drive both customer service and sales. Proactively managing your online reviews can also help improve your SEO rankings. According to Moz’s local SEO report, reviews ranked higher than proximity for the first time since 2017.

A pro tip for leveraging reviews in a proactive local listing management strategy is to include keywords in your responses. For example, a bank or credit union might reply with, “Thank you for your review about your experience at our financial institution,” before responding to the review’s content.

2. In Person – Make Your Branch an Advice Center

While the year 2020 brought more financial stress for some than others, among the issues highlighted by the Covid-19 pandemic is a declining financial literacy in the general U.S. population.

According to a National Financial Educators Council survey, the average amount of money lost by the average American adult due to lack of financial literacy was $1,634. Generalized to the over 250 million Americans, that loss totals $415 billion in 2020. This presents a huge opportunity for financial institutions to establish loyalty and gain lifelong consumers in the process.

How can you take advantage of this opportunity? Train your bankers to provide personal financial management assistance. It can be as simple as basic budgeting techniques or explaining how to use the financial management tools available within online banking.

Even if your bankers do not yet have the skill sets to offer financial advice, your website likely has a wealth of articles and tools that can help your customers and members better manage their money. Encourage your bankers to familiarize themselves with the financial education resources available to them so they can recommend or even show people where to locate this valuable information.

3. On Your Website – User Experience (UX) is Key

Your website is the first impression you give potential consumers and the foundation for a lasting relationship, so it’s crucial your site is up to date, optimized and functional 24/7. For many, customer experience begins and ends on your website — some may never have the need to enter a branch. So how user-friendly is your site?

If your website doesn’t offer a good experience for your users, they may have difficulty finding important information, won’t engage well with your content and could gravitate toward your competitors’ more user-centric sites.

In addition to your overall design, layout and responsiveness, two of the most important aspects of your website’s UX are content and accessibility.

Content

When reviewing content, you should pay close attention to its context, the value it offers users and site placement. Using Google Keyword Planner or another keyword research tool, you can build content that is rich in relevance and context for your consumers and helps get you ranked higher with search engines.

Find keywords that are searched more than 100 times per month on average and select two to three keywords or phrases most relevant to each product. Then, be sure to use those keywords or phrases throughout your content and product pages in the following key areas: Title tag, meta description, primary header, body content and within image ALT text.

Accessibility

Auditing your website accessibility ensures users with disabilities, including those with age-related impairments, can access your information. An accessible website with good user experience provides information through a variety of tactics and multisensory channels and includes alternative text for images.

4. In the Call Center – Invest in Customer Satisfaction

Leverage your call center employees to not only respond to inquiries, but to help proactively increase customer satisfaction. Exceptional customer experience leads to loyalty, which leads to advocacy for your financial institution. Loyalty is a sales and marketing strategy that cannot be overlooked. It increases consumer retention and acquisition and ultimately drives profitability.

One way to be proactive in the call center is to respond to people’s questions, issues and online reviews. Whether they have added a review to your local listing, posted a comment on Facebook or asked a question on Twitter, consumers appreciate a proactive response to their needs. Even if your marketing or PR team has replied to the feedback via the channel in which it was received, having a personalized follow up call goes a long way in resolving issues and rebuilding loyalty and trust.

By applying these four fast fixes both online and in-person, you can quickly establish more beneficial relationships with current and future consumers.