A new report from Forrester gauging how consumers view their banking providers finds that many financial institutions are perceived as self-serving. People are specifically concerned that larger banks aren’t acting in their best interests, but instead are focused on the bottom line.

“This is bad news in an age when ‘delighting the customer’ matters more than any other strategic imperative,” warn the report’s authors, Forrester research analysts Alyson Clarke and Caleb Ewald.

Clarke says advocacy goes beyond customer experience. A bank can present people with an Amazon-style online experience that’s easy and sophisticated. But what happens when a customer calls with a complaint about an erroneous mortgage charge, or a checking account problem? Do they get the runaround — bounced between evasive and defensive customer service reps who have been instructed to take a hard line in order to protect the bottom line? Or will the bank act to resolve the issue immediately and in the customer’s interest? That’s the lens through which Forrester says banks should view advocacy.

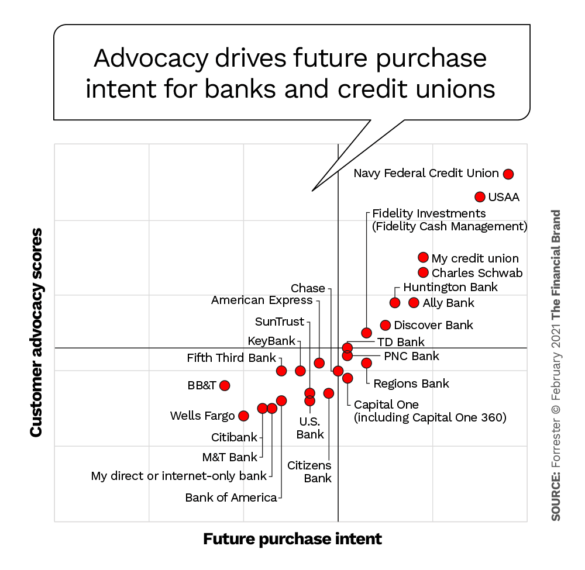

In study after study, banks have consistently ranked customer experience as a top priority, but what about customer advocacy? Between the two strategic issues, Forrester argues that advocacy is the superior predictor of whether a customer will stay at a financial institution for future purchases or services.

At the top of Forrester’s advocacy rankings were member-owned financial institutions such as Navy Federal Credit Union, USAA and Vanguard. Understandable, since these organizations are often structured as not-for-profit, member owned cooperatives, where ROI isn’t necessarily their fundamental raison d’etre.

Fewer than half the customers at nine of the 20+ banks included in Forrester’s study said their banking provider put their best interests ahead of the bottom line.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

On the technology side, the report recommends financial institutions ensure that their systems support the work of customer service reps by making advocacy easier. Forrester also notes that technology is quickly removing the obstacles that once prevented new competitors from carving into a wide range of financial services that have been dominated by legacy institutions. Nonetheless, direct/digital-only banks overall ranked near the bottom for advocacy among all banking providers — only Wells Fargo scored worse (more on that in a minute).

“A wave of disruptors using digital tools to deliver superior customer experiences at a fraction of the cost are besieging incumbent banks, credit card issuers, insurers, and wealth management firms,” says Forrester in its report. These disruptors are also taking a decidedly more customer friendly approach.

And that, Forrester explains, is why banks need to focus on customer loyalty, not just a smooth customer experience.

“We’ve tested dozens of traits that influence customer loyalty in retail financial services through the years,” Clarke explains. “One trumps all others: customer advocacy.”

What It Means:

A bank that does what’s best for customers and not just what’s best for the firm’s bottom line will reap the rewards — lower attrition, greater success with cross-selling, and more products per household.

Read More: Bank Customers Happier Using Branch+Digital vs. Digital Only

Progress With Digital Transformation Doesn’t Translate to Stronger Advocacy

Banks may think their investments in data have provided them a 360-degree view of their customers, but usually these profiles reveal little more than the suite of products customers hold with the bank while ignoring the other aspects of their financial life outside the bank. Many institutions just use their data solely to float other products to consumers, regardless of whether consumers truly need- or benefit from these cross-sold products.

Forrester says there are steps financial institutions can take that help reduce the perception that banking providers are selfishly obsessed with their own success. Even modest measures can bolster a sense of advocacy.

“There are firms that are coming up with proactive insights, such as warning a customer if she is about to be overdrawn, or a mobile app that can alert to duplicate charges, or warn that a [third party] free trial is ending soon,” Clarke points out. “That’s using data insights to make customers feel you are on their side.”

“Financial institutions have to stop thinking like retailers,” cautions Clarke. “For retailers, personalization is about suggesting socks that will match the shirt you just put in the cart.” And customers may return to a retailer monthly, or more often. But once a customer has a mortgage or a car loan, they are all set for years to come (unless, of course, the bank can offer a new loan at a better price).

Key Insight:

Much as banks may hate to admit it, they have to get used to the fact that people buy most financial products every three to five years, at most. A constant obsession with cross-selling sends the wrong message, and can quickly become counterproductive.

Read More:

CX is Just the First Step: Leading Banks Think Beyond the Basics

Financial institutions should also make it easy for customers to do business with them. For instance, Clarke says checking account customers should not need to fill out their name, address, and Social Security number when applying for a home equity loan.

In the U.K., Barclays has used customer data to determine the amounts it would approve for a mortgage and a personal loan for every customer in its database. After that, accepting a loan or mortgage application simply takes verifying that the customer’s information is still accurate. It may not be the strongest illustration of advocacy, but it does demonstrate the bank has taken steps to avoid wasting customers’ time.

Clarke, who is from Australia, has become accustomed to some pretty sophisticated retail banking strategies in her home country. The disparities she sees in the United States concern her.

“In the U.S., I have to give them everything from scratch,” she says.

The ways in which banks leverage their data (or don’t) is a perennial frustration for Clarke. Banks have the data to know if a customer prefers to interact with them by phone, text or email simply by looking at how they have contacted the bank in the past. But only rarely does a bank act on that data, if they look at it at all.

.

Many banking executives pay lip service to advocacy, claiming they put ‘improving the financial well-being of the customer’ at the center of their strategy, according to Clarke. Meanwhile, however, the metrics inside the company are still largely based on product sales.

“They go straight for the jugular — selling another product,” Clarke explains. “What you get is a disconnect between the rhetoric and the metric.”

Perhaps the strongest illustration of the impact that advocacy — or the perceived lack thereof — can have on a bank is what happened to Wells Fargo. Prior to their massive cross-selling scandal, where millions of accounts had been fraudulently opened, more than half of Wells Fargo’s customers saw the bank as an advocate on their behalf. After the breadth of the scheme became public, however, Wells Fargo saw its advocacy score plummet to 36%. In Forrester’s latest study, Wells Fargo has repaired its reputation somewhat and by 2020 had its advocacy metric back up to 44%.

Forrester says a handful of financial institutions are beginning to redefine how they measure performance, evaluate key employee traits, and measure customer satisfaction. Instead of simply looking at their balance sheet, they are measuring the banking experience from the outside in (i.e., from the customers’ point of view).

Between the Lines

Advocacy rankings, Forrester admits, can be undermined by isolated incidents, like online banking breakdowns, or bad PR.

According to Clarke, leaders in customer advocacy rankings tend to keep things simple and act benevolently — to both their customers and the community they operate it. Furthermore, they are transparent, and build trust by continually helping customers improve their financial well-being.

The entire 19-page report from Forrester, “Do The Right Thing: Advocating For Customers Drives Loyalty At Financial Firms,” comparing advocacy against loyalty and cross-sell propensity for banks, insurers and credit card issuers, is available for download.