World events have created economic uncertainty, resulting in financial unease among consumers and businesses. Daily necessities, such as food and gas, have grown more expensive. Jobs have been lost and housing costs have risen. People feel less secure than they did just 12 months ago. Navigating the complexities of these rapid changes and the tumultuous economic climate is daunting .

In the face of the current economic turbulence, customers are increasingly turning to their financial institutions for support and guidance. Consumers are seeking not just products, but solutions personalized to their specific needs. They crave proactive outreach, bespoke services, and, critically, the empathy that comes with a seamless hybrid experience that includes a human touch.

Accelerate Time-to-Market with Rapid Implementation

Create a sustainable competitive advantage with faster time to market by drastically reducing implementation time.

Read More about Accelerate Time-to-Market with Rapid Implementation

The New AI: A Banker’s Guide to Automation Intelligence

Manual tasks across channels is costly. And while AI is hot, there’s a simpler way to bring efficiency that many bankers have overlooked.

Read More about The New AI: A Banker’s Guide to Automation Intelligence

When Times Grow Tough, Experiences Matter More

The global economic upheaval and the pandemic’s aftermath have left consumers feeling on edge and significantly less secure. They expect their banks and credit unions to provide tailored advice, support and tools to help them navigate financial uncertainty. They demand transparency in the pricing of services, terms and conditions, and expect quick responses when they have a question or a problem. Consumers also want flexibility from their banks and credit unions, such as the ability to defer loan payments and coverage of minor overdrafts without incurring fees.

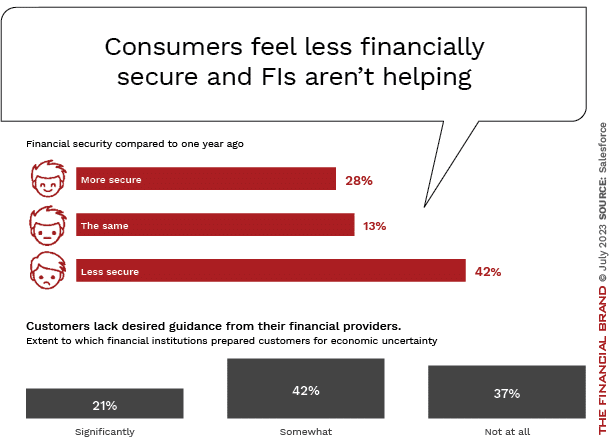

Unfortunately, most financial institutions offer inconsistent support, according to a recent research study by Salesforce. The report was based on a survey conducted in 12 countries around the world, with 43% of the respondents being Millennials and 12% Gen Z. Over 6,000 consumers were polled.

Only one in five customers believe their providers have significantly helped prepare them for the current economy. More than one-third report that their financial institutions have not provided any substantial help.

This dichotomy illustrates the pressing need for banks and credit unions to step up and offer comprehensive support and guidance to their customers during these challenging times. The study’s findings explore what that support and guidance should consist of.

Because of experiences outside financial services and the desire for support of financial wellness, customers consider an exceptional digital experience no longer a luxury but a requirement. That said, experiences remain challenging for many consumers. Of the various issues reported, the largest challenge is with poorly integrated, non-intelligent chatbots (39% stated a challenge in this area), indicating a gap between rapid technological adoption and customer satisfaction. It’s apparent that as chatbots become increasingly prevalent across the industry, their implementation does not always meet customer expectations. Other frequent issues include the struggle to locate information online (29%), inconsistent customer service (28%), and lack of personalization (24%).

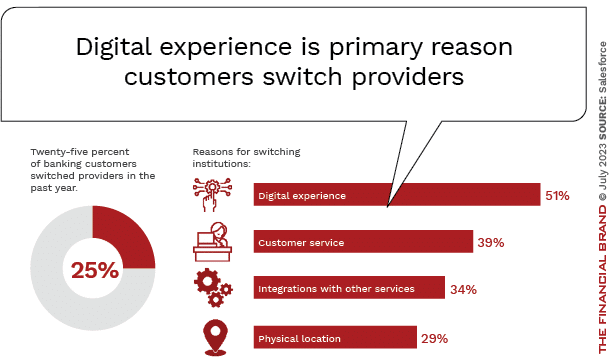

The performance gap in the quality of experiences with financial institutions has led to an increasing readiness to change providers in pursuit of superior experiences. Within the last year, a notable 25% of customers have changed their banks. Salesforce says the leading motivation for change in banking was the pursuit of an improved digital experience. Other catalysts for change include the quality of customer service (39%) and the aspiration for better coordination among financial products (34%).

Not surprisingly, a provider’s physical location has a decreasing influence on why some customers may switch.

Read More: Engagement Is Your Ultimate Goal, Not Customer Experience

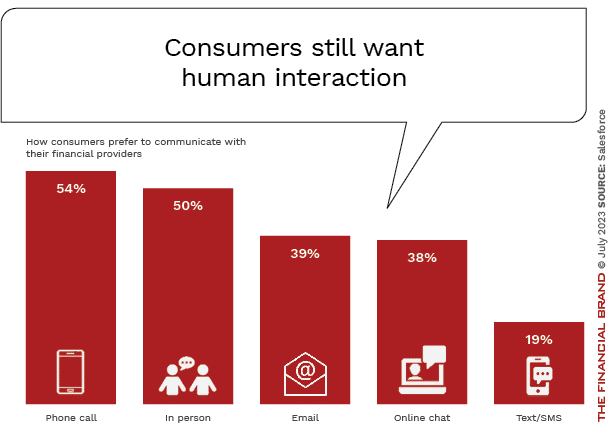

Consumers Still Want Human Interaction in Banking Relationships

The importance of digital excellence and human interaction often appears as two opposing forces. However, they are two sides of the same coin, both crucial for enhancing customer experiences. Balancing these two elements can significantly improve the service quality offered by financial institutions and drive success at a time when consumers are more unsure of their financial wellbeing. This hybrid model can help banks create more meaningful relationships with their customers, thereby boosting customer loyalty, satisfaction, and ultimately, their bottom line.

Consumers want reassurance that their needs are understood and addressed, which often comes best from personal contact. This is particularly true in handling more complex issues, providing personalized financial advice and nurturing customer relationships. Human interaction offers a sense of reassurance, trust and empathy that is difficult to replicate digitally.

When there is a desire for human interaction, consumers most want to communicate by phone, followed by face-to-face engagement, according to the Salesforce research. At a much lower preference level, consumers look to email, online chat and text communication.

Read more: Banks Struggle to Provide Personalized Engagement: Here’s Why

Proactive, Personalized Communication is Expected from Banks

Banks and credit unions must go further than just sending out regular messages to communicate with customers. Showing empathy and building stronger customer relationships involves understanding individual customers’ needs, preferences and behaviors to provide them with relevant and timely information.

Customers desire a business relationship where their providers understand their unique identities and needs. For instance, a person having difficulty keeping an adequate balance to pay bills may expect their financial providers to help them set a budget or refinance debt to reduce monthly payments. Customers with higher than normal average balances want their bank to offer suggestions for products with higher returns.

Moreover, simply reacting to customer inquiries or complaints isn’t enough. Banking institutions that proactively reach out to people with personalized communication are demonstrating a commitment to helping customers. Doing that naturally makes them stand out from the competition. This can involve alerts about potentially fraudulent activities, reminders of upcoming payments, or advice on financial planning based on the customer’s spending habits and savings goals.

“Beyond personalized products and services, people want empathetic interactions. They crave a human touch that cannot always be replaced by digital channels. Ultimately, they want to feel like their financial providers care about them.”

— Salesforce research

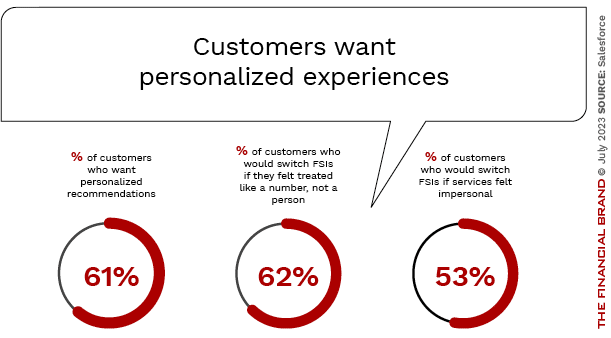

Three out of five — 61% — of banking customers expect companies to understand their unique needs and expectations, according to Salesforce research. The cost of not providing personalized service is steep, with more than 50% of customers saying they would switch providers if services were not personalized.

Read more:

- 7 Insights on How to Create a Winning Customer Experience Strategy

- Top 5 Customer Experience Trends for 2023 and Beyond

Is Generative AI the Solution to Banking Dissatisfaction?

Generative AI may hold significant potential for the financial sector. By using advanced algorithms and large datasets, generative AI can create personalized financial advice, identify potential fraud before it happens, and predict market trends with high accuracy, experts claim. However, its impact could be a double-edged sword. While it promises more personalized and efficient services, the increasing automation might be seen as reducing the human element in banking.

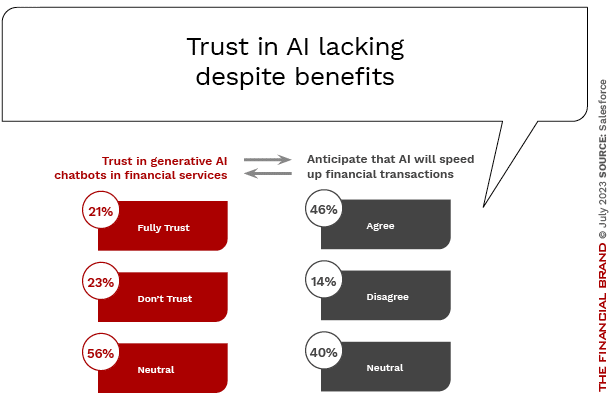

Customers exhibit mixed feelings towards chatbots driven by generative AI — a recent development in AI that creates novel content, such as text, images and audio. A possible explanation for these reservations could be a lack of familiarity with the technology. Notably, 40% of customers neither agree nor disagree with the notion that AI can expedite financial transactions, implying an uncertainty surrounding the technology’s implications. However, among those customers who have formed an opinion, a significantly larger proportion are hopeful about AI’s potential to save time.

Financial institutions will need to find a delicate balance between leveraging AI and maintaining the human touch that customers value. Part of the challenge is the concern around the use of data. For instance, customers expect their service providers to handle their data responsibly, utilizing it to craft more enriching, personalized and pertinent experiences and offerings.

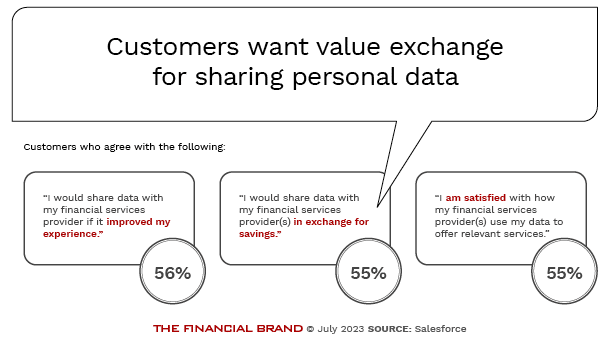

Over half of the customers surveyed are open to data sharing if it leads to an improved overall experience or financial incentives such as reduced rates or discounts. Interestingly, one out of four customers are ready to share specific information, like their location and movements, in return for more customized service.

However, despite some level of comfort with data sharing, about a third of customers remain reluctant to divulge any personal information.

Maintaining customer loyalty has become more challenging as the economy becomes more uncertain and marketplace options increase. Banks and credit unions must up their game, offering top-notch experiences that cater to the emotional and practical needs of consumers. This includes demonstrating empathy during hard times, providing expert human interaction, ensuring data security, and leveraging AI to offer personalized and predictive services.

Want to learn more? Download the Salesforce report here.