Personalization has long been touted as the future of financial services, yet it still doesn’t get the full attention of incumbents or challenger banks. It’s not an issue of investment spend or cost, it’s more about taking it seriously and doing it right which financial institutions are struggling with.

It doesn’t help that much of what is said about personalization is from a thought leadership and influencer perspective. Few sources tell banks and credit unions exactly what personalization means and how to do it. In fact, many bankers are still unclear about what personalization really means.

It’s quite simple in concept: Sending the right information to the right person at the right time. In the context of digital messaging or notifications, when banks try to be everything to everyone, they end up delivering it to no one. What’s more, with Amazon and Google delivering convincing personalized experiences, today’s customers are ultra-savvy — if a gesture is insincere or not applicable, they’ll see right through it.

A raft of freely available, open-source artificial intelligence tools, and an abundance of data would seem to make it easy to execute personalization. It’s not. It is very difficult. The rest of this article will provide some advice about building the personalization foundation that financial institutions need, and a few use cases to inspire some creativity.

An Example of What Not to Do

To start, a non-digital example illustrates just how detached and impersonal banking can be. Imagine walking into a branch and being greeted by a customer service representative. Rather than asking what you would like to do, or how they can assist you, the greeter launches into a sales pitch of the bank’s recently launched products.

Although it’s entirely possible that one of those products might be exactly what you are looking for, it’s far more likely the staff member lost your attention the moment it became obvious that his spiel wasn’t relevant to you. Likewise, with digital, where attention span is even less, a bank or credit union will never have a chance of truly engaging customers if they treat them like a catch-all “lead,” rather than treating you like … well, you.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Creating Your Own Customer Experience Database

The first thing financial institutions will need to do is to build a Customer Experience Database (CXDB). I say “build” because there isn’t an off-the-shelf product out there today that does this even remotely well, and if you want something that is truly unique to your organization’s strengths then you are going to need to acquire the technical skills (either internally or from a vendor) and then develop a solution using your in-house business expertise. You don’t need a Top 50 budget to do this.

The CXDB will be a work in progress, constantly evolving and improving over time, but importantly will give the institution a baseline for its personalization journey. Naturally it will increase in complexity as the organization’s culture adapts to becoming a dynamic, personalized service provider.

CXDB 1.0 – ‘Moments of Truth’

The initial version of your CXDB will probably be a rules-based engine in which the financial institution will identify actionable tasks and the corresponding data triggers for each task. It requires a simple If-This-Then-That (IFTTT) tool. The easiest actionable tasks to identify for your first version of the CXDB will likely be the scenarios that are triggered at “moments of truth.”

The term “moments of truth” — first coined in 2005 by A.G. Lafley, CEO of Procter & Gamble — refers to the moment when a consumer interacts with your brand, product or service and forms (or changes) an impression about that particular brand, product or service. This has evolved into three primary moments of truth:

- When a consumer first confronts your product, either offline or online. You have three to seven seconds to turn a browser into a buyer. Consider this to be the moment a consumer chooses your product over your competitors.

- When a consumer is acquired and experiences the quality of the product or service as per your brand’s promise.

- The overall impression you have made on your customer. The ultimate reward being that your customer becomes a brand advocate and promotes you via word of mouth or through social media.

In banking, these moments of truth do not happen often, but when they do, they represent a real opportunity to sell, upsell or cross-sell a product or service, or amend an existing service that is being provided. Below is a typical list of such key moments.

| Buying a car | Death of spouse | Job loss |

| Buying a house | Divorce | Vacation |

| Having a baby | Jail term | Spouse job change |

| Getting engaged/married | New job | Religion event |

| Pass driving test | Child leaving home | Inheritance |

| Moving | Illness | Promotion |

| Graduation | Accident | New grandchild |

Each of the above moments or events can lead to a contextual “conversation” between the bank and the consumer, providing the bank has acquired the necessary data to trigger the conversation. That data is the bread and butter of today’s data scientists and product owners who will be well versed on what that data should be and the sources from which it can be acquired.

Read More: What Financial Marketers Can Learn About Personalization from Amazon

CXDB 2.0 – ‘Everyday Banking’

The next phase in the evolution of your CXDB can be a focus on more everyday events. Each of these will have data points that trigger a propensity rule that corresponds to a service or product you can offer in real-time, or useful advice that will be valued by the consumer and reinforce trust.

For example, lets assume you offer a credit card with a range of travel-related benefits —miles, lounge access, multi-currency FX, hotel points, etc. Each of the detectable data points in the list below could infer a real-time conversation to the customer about how to use a feature of the product, or possibly present a cross-sell opportunity:

| Hotel spend | 3rd party FX transaction |

| Frequent foreign country spend | Airline spend |

| Airport parking payment | Duty-free/travel-related spend |

| Arrived at the airport | Purchased travel insurance |

| 3rd party travel partner data | Paid for ride share |

| Gas station spend | Social media travel-related data |

| Airport ATM use | Car rental spend |

| Travel-related browsing data |

It is possible to extend the data points even further to trigger a policy quote at precisely the right time and location — say to offer card-based travel insurance:

| Ski resort destination | Extreme sports merchant purchase |

| Cruise with stopover destination | Accessed ATM at airport |

| Weather at destination | Lack of medical insurance |

| Publicity regarding pandemic | Regularity of specific flight delays |

| Arrived at airport | Flight or hotel refund transaction |

Taking it All the Way to Real-Time Insights

As you may have figured out, acquiring the data, and ensuring it is clean, structured and has integrity, is the crucial component in the start of the personalization journey. Most of the data points can be ascertained through clever analysis of raw transaction data, but this tends to be post-facto. The real magic happens when data is acquired in real-time and acted upon from consumers’ most personal belonging — their mobile phone.

When people install certain apps on their phone, the app requests access to certain content or functions and most people happily give it. The phone thus provides date and time of the day, the location where the user is standing, how they got there (drive, walk, train etc.), what’s specific to that location (home, office, beach, mall, restaurant etc.). Combine this with what you understand about the customer through their spend analysis and other mobile phone actions like taking a photo. Then, using readily available artificial intelligence tools, a bank or credit union can offer advice that is laser-focused and timely.

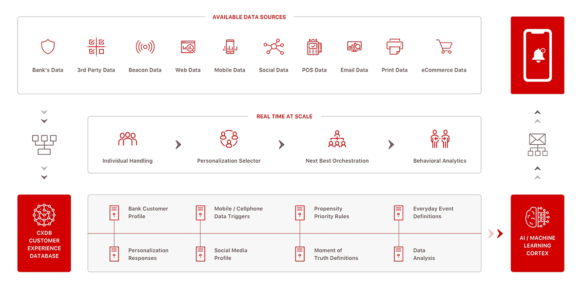

Thynk Digital created the diagram below to visually present the way an advanced personalization process works.

Core components of a CX database v2.0

Here are a few notification examples of what is possible:

- “It’s lunchtime and three of your friends ate at Jim’s Diner this week (1 minute away) for under $7.00, which would allow you to save $3.00 towards your holiday fund. There’s also free parking just around the corner on Main Street.”

- “That’s a picture of the new 3 Series BMW which costs $32,450 or an auto loan payment of $400 per month, which you are already approved for. Would you like more info?”

- “You are in Peak Mountain Ski Shop, and we wanted to let you know that your Platinum Credit card qualifies you for a 15% discount there, and includes free travel insurance in February. You also have enough airmiles to fly to Aspen.”

- “Nice picture, but FYI you can’t afford new shoes this month, your annual car insurance renewal is due on the 20th.”

Read More:

- How Banks & Credit Unions Can Turn Good Service Into Awesome CX

- Secrets to Building One-to-One Digital Banking Experiences

How Much Is Too Far? The Personalization Privacy Paradox

With so much incentive to become a truly AI driven, hyper-personalized business and break through the noise in the market, there is a danger that too much insight into the personal affairs of your customers can trigger the “spider-sense” in people — freaking them out, and making them less likely to engage with you.

We saw a perfect example of this in some ads from U.K. challenger bank Revolut that triggered a backlash from consumers who found the message to be a step too far. Based on transaction data, the campaign was not much different to that used by music streaming site Spotify, but music is music, and banking is … not music!

Revolut’s data scientists may have been clever, but did not consider their customers reaction.

Enter the Privacy Paradox, a term coined to describe the manner in which customers today are split between their desire for hyper-personalized advice and their natural instinct to protect their personal details. A major reason for the paradox is simply because many consumers don’t really grasp what the term “personal data” comprises, and what snippets of information financial institutions can pull together to create customer personas. Obviously, bank details, addresses and passport numbers are all clearly sensitive data that should be actively protected.

Just because you have access to all the information on your customer’s life doesn’t mean you need to provide them with advice on everything and basically over-exploit the access given to you. You should exercise transparency and practice restraint when acquiring data. Only seek what will elevate the experience of the service you are offering.

Often the age-old advice is still the best. Less is more. If customers sense that a financial institution knows too much about them, they probably do.