Consumers are loyal to financial institutions that know them, understand them, and reward them with positive interactions. This is more important now than ever before. When the pandemic hit, those banks and credit unions that had access to real-time customer data, were able to integrate personalization tools into their marketing platforms, and scale new digital products and experiences had a competitive edge.

Financial institutions that offer a frictionless, personalized user experience that helps consumers get the products, services, or answers they need in real time will develop more engaged and more loyal customers.

Beyond supporting customer transactions, leading financial institutions are using new digital tools to engage customers online. This includes, but is not limited to creating new content and expanding the digital channels they use to interact (voice devices and video capabilities).

Organizations are also investing in new technologies and platforms to facilitate the customer experiences that consumers expect. These include:

- Marketing automation platforms. Used to automate personalized communications across digital channels.

- Customer data platforms. Used to create a single, trusted customer record.

- AI and machine learning. Beyond creating great internal views of customers, these tools provide ways for customers to know you know them.

- Personalization tools. Used to build customer and prospect profiles that can deliver tailored website and mobile content and a hyper-targeted omni-channel experience.

- Content management systems. Support customized financial education and insights throughout the customer journey.

Read More: 7 Essentials of Digital Transformation Success

Creating A Community with CQRC’s Branch Redesign

Find out how SLD helped CQRC Bank to create the perfect harmony of financial services, local culture, and the human touch in their branch transformation.

Read More about Creating A Community with CQRC’s Branch Redesign

The unfair advantage for financial brands.

Offering aggressive financial marketing strategies custom-built for leaders looking to redefine industry norms and establish market dominance.

Analysis Beyond Customer Satisfaction

Once you have committed to improving CX, it is necessary to understand each customer’s experience and interactions from a 360-degree perspective. This should include a new perspective on: changing consumer buying behaviors; web and mobile banking effort scores; purchase behavior across the customer journey; the size of deposits, loans and engagement; desired communication and product purchase channels, and sentiment analysis.

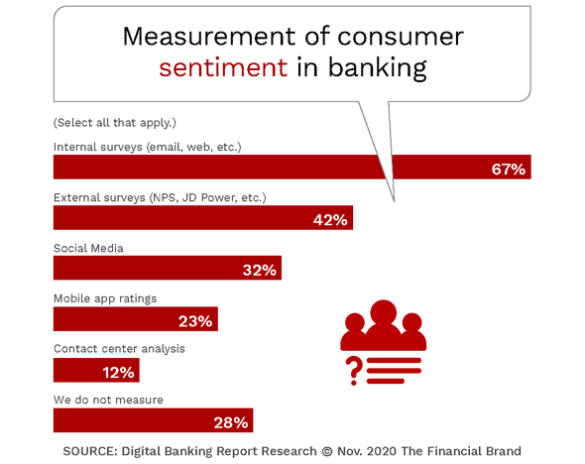

Measuring customer experience using internal surveys as well as popular external sentiment analysis such as Net Promoter Score (NPS), is considered a great first step, yet financial institutions should not stop there.

Usually, voice of customer or satisfaction surveys only measure aggregate results, segment results or transactions at specific touchpoints. These tools fail to measure individual customer perspectives or satisfaction across the entire customer journey.

Another challenge is that fewer customers are responding to surveys and, as consumers are changing their digital channel usage, the accuracy of many of these tools can come under scrutiny. That said, satisfaction surveys like NPS are good snapshots and point-in-time tracking tools, but a deeper dive is needed.

- Beyond Personalization: Three Reasons to Focus on Customer Journeys

- Financial Institutions Benefit from AI, But Consumers Remain Skeptical

Engagement as a Measurement of CX Success

A strong customer experience is important, but engagement is the way a strong experience pays off for an organization. When a customer is happy, they will be willing to do more with their primary (or even secondary) financial institution.

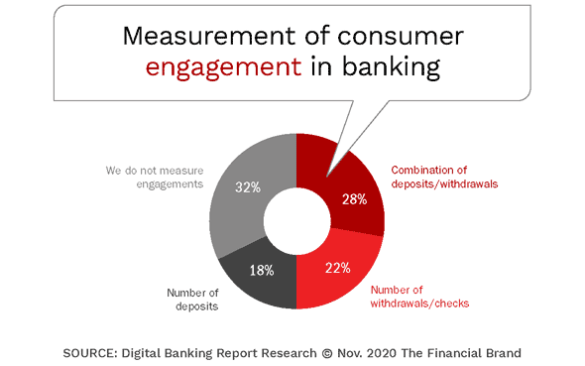

When the Digital Banking Report asked financial institutions globally whether they measured customer engagement, 68% of organizations said they used some form of customer engagement tracking. In 28% of organizations, there was tracking of deposits and withdrawals, with roughly one in five tracking either withdrawals (22%) or deposits (18%).

The benefit of this tracking should go beyond the traditional view of inactivity, to include trend analysis over time on a customer level and should include ancillary services, such as payments, transfers, digital engagement, etc.

Measuring Customer Journey Experiences

Especially in a digital banking environment, customers have different experiences and different needs at each stage of the customer journey. Understanding this cross-channel reality, banks and credit unions can’t use just a single satisfaction metric at each of these different stages.

Beyond NPS, financial institutions should use customer journey analytics to discover micro journeys from within macro journeys. This is not just a single measurement, but several measurements that look at friction, channel use, abandonment of processes, etc.

A strong customer journey analytics platform can measure engagement and satisfaction at any point in the customer journey using your existing customer experience tech stack. With the entire process automated, customers can easily provide feedback (overtly and/or through actions) and marketing professionals can gauge engagement and satisfaction at will. Using customer journey analytics, organizations can determine the most important points for interaction and engage customers for opinions at that point.

Another important component of customer journey analytics beyond determining if there is friction and engagement is to determine your most valuable segments so that you can replicate that success with other customer segments.

Finally, beyond satisfaction, there should be a focus on retention that allows a bank or credit union to keep their profitable customers, improve customer loyalty, reduce churn, increase cross-sell and up-sell, and increase customer lifetime value. Ways to monitor retention can be through traditional satisfaction research, churn metrics, customer effort scores, and average resolution time.

The Power of Digital Customer Experience Platforms (DXP)

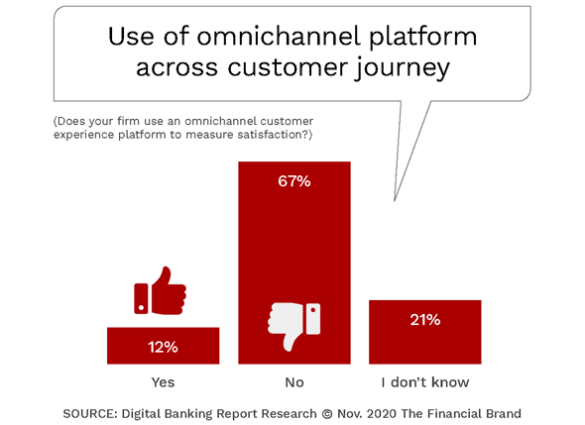

According to Gartner, a digital customer experience platform (DXP) is “an integrated and cohesive piece of technology designed to enable the composition, management, delivery and optimization of contextualized digital experiences across multi-experience customer journeys.” Just the definition itself can give organizations pause before embracing. But the technology is a requisite for those institutions committed to improving customer experiences.

What sets digital experience platforms apart from other tools is that they help to manage content delivered to customers across channels. Since most people use multiple devices on their path to purchase, the delivery of a consistent, connected, and continuous experience across channels to drive positive outcomes is imperative.

Bottom line, to meet the increased expectations and divergent behavior of audiences today, financial institutions need to provide the right content, at the right time, regardless of the device or channels used. Digital experience platforms can assist by aligning teams, streamlining processes, connecting systems, and transforming workflows to provide the customer experiences that are expected.

Despite the importance of digital experience platforms, the Digital Banking Report found that relatively few financial institutions currently use this technology. Part of this is because very few organizations have mature data/analytics positioning and most organizations surveyed still consider themselves to lack CX maturity.

For some organizations, a strong customer content management system (CMS) may be adequate. If this is the case, your organization must make sure that the CMS can scale easily, can be deployed on the cloud, and can be integrated into a DXP at a later time. As your digital transformation and CX capabilities mature, you can eventually move your learnings into a DXP platform.

Investment in digital experience platforms is expected to increase significantly as organizations double down on digital transformation, improving the digital customer experience and expand the use of content in the engagement of customers and prospects.