Petco, Rite Aid, Tiffany & Co., Caesars Entertainment and… Solarity Credit Union.

Not typically a list of companies you would expect to see grouped together; one in particular stands out.

Petco has 1,400 locations. Rite Aid is a $4 billion company. Tiffany is the best known jeweler in the world. And Caesars is a venerated casino brand with billions in annual revenues.

Solarity, on the other hand, is a credit union with $720 million in assets and 61,000 members based in Yakima, Washington.

And yet, in March 2017, Solarity Credit Union was honored with a customer experience award right alongside Petco, Rite Aid, Tiffany and Caesars.

How did this happen?

A few years ago, back in 2015, Mina Worthington, President and CEO of Solarity Credit Union, and her leadership team were looking at the banking landscape during a strategic planning session when they made an audacious decision: they wanted to be the number one experience provider in financial services… nationwide.

Solarity wouldn’t differentiate itself on “money”, which has been- and will always be just a commodity. Instead, they would be known for delivering extraordinary experiences — how consumers feel when doing business with the credit union. It became the road map that would define Solarity’s future, a strategy that — if successful — would put the credit union right up there with the likes of USAA.

But then it started to sink in. They all looked at each other and said, “Okay, how are we really going to do this?”

They quickly realized that their experience would only be as good as the team they had in place to deliver it, so a priority was placed on sales/service training and hiring the right people. This meant looking beyond “prior banking experience” to encompass new skill sets, personality and shared values. Worthington also named then SVP and Chief Lending Officer/CIO Ralph Cumbee the new chief experience officer. She says he understood the vision and importance of CX.

“Credit unions talk about how great the service is, but then hire operations people with experience in ‘service’ but not ‘experience’,” Worthington explains. “We didn’t want this to be a shallow promise built on empty words. We wanted to make a real change.”

To really live it, the guiding question for every decision at Solarity would begin with a simple question: “Will this make for a better experience for our members?”

That’s why — unlike many of her contemporaries — Worthington downplays the importance of cross-selling. “It isn’t relevant to us,” she says. “Long term engagement and trust are the keys to enduring partnerships with our members. If we can successfully understand, anticipate and guide our members, we can continue providing extraordinary experiences that leave an impression.”

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Solarity’s team felt strongly that they would need to take the time to really understand their members, employees and prospects alike if they truly wanted to put the member experience first. So the credit union partnered with InMoment to launch an omnichannel listening program in October 2015.

“When we say we’re listening, we mean it.”

— Mina Worthington, CEO of Solarity Credit Union

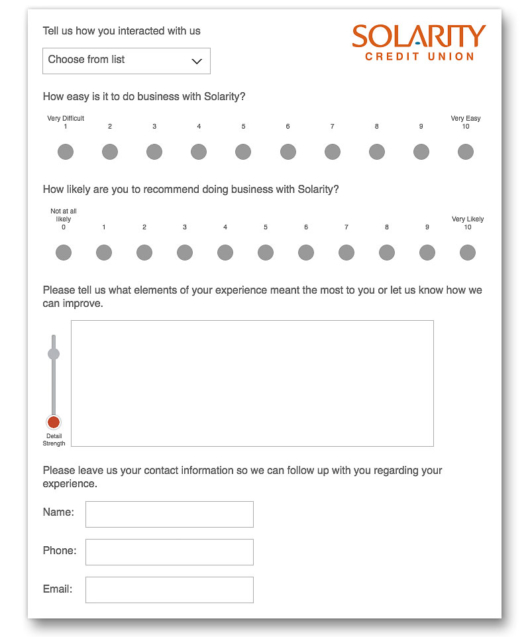

The Solarity CX feedback loop centers around surveys that ask members to gauge their experience. These surveys are automatically triggered by specific events and actions — e.g., after a member completes a transaction, hits the Solarity website, or speaks to someone in the contact center or at a branch. The information gathered is assessed to determine the root cause of issues, and then the loop is closed when permanent solutions are put in place to prevent repeat failures.

Cumbee, the credit union’s newly minted CXO, says their listening program has instilled a new level of accountability across the organization.

“We receive feedback immediately, both when we are doing things right and when we are not,” explains Cumbee. “We follow up with that member, discussing any shortcomings, then try to be creative and results-oriented when resolving any issues.”

During the initial launch, the senior management team personally responded to every member who provided input. They worked in rotating shifts, each devoting a solid day each week to call detractors back.

“You’d be amazed at what you can learn just by asking,” Worthington says. “We got a lot of value from members — even their complaints. They were impressed that a senior executive took the time to call them back, listen and discuss what’s been bothering them.”

The survey tool Solarity Credit Union uses on its website.

Cumbee says the credit union always thanks members for their feedback, then immediately turns the lessons around and shares them back to the team —praise if good, coaching if needed.

Thanking members not only helps Solarity better understand members and how to improve the experience. It also sends an important message to members, underscoring that it’s not just “a survey,” but a real door for two-way communication and interaction. In other words, meaningful engagement — not the trite flavor of “engagement” you often hear from consultants pimping the latest digital widget.

Today, the team still receives and reviews each survey response, but uses one dedicated representative for outreach and follow up. That job now belongs to Mandy Olson, who follows up with everyone that contacts the credit union through an array of various touch points.

Cumbee says they’ve found that listening to the voice of their members and responding quickly has been key to improving member experiences.

“It’s not just about converting detractors into fans,” he says. “We have many responses from members telling us what they love and it gives us guidance on what to enhance, and what we should do moving forward to stay relevant.”

The constant, real-time surveying of members has impacted many aspects of Solarity’s experience, both big and small. For instance, tellers have adjusted the order in which they insert cash denominations into their machines, a change that was easily and immediately implemented.

Worthington says the feedback has helped improve processes across the organization, and fueled many longer-term projects like its mobile friendly website redesign in 2016. The objective was to develop a digital experience that would be constantly evolving, improving, measuring and engaging.

The site’s features range from live chat and an online scheduling tool with mortgage experts to an improved, user-friendly “smart search” function that makes it easier to find the information you’re looking for. And by late 2017, Solarity says its digital banking services will deliver the same functionality as walking into a local branch. Members will have the ability to turn credit cards on or off, take a picture of a bill and pay it right away, or take a picture of their loan from another bank and have it transferred to Solarity. They will also be able to easily split and share their bills and payments among family and friends, have access to an online financial manager, and instantly send money to anyone, anywhere in the world for free.

The Solarity Credit Union website home page. “We take your feedback seriously,” Solarity says on its website. “When we say we’re listening, we mean it. We take the time to respond to 100% of the surveys we receive. In fact, we even meet twice a month to review all the surveys as a team to determine what our members love and what we could do better.”

Culture Critical to Exceptional CX

Cumbee wants every Solarity staffer to be obsessed with the experience, not just with members but inside the organization as well. Getting employee buy-in at every level and thinking beyond conventional definitions of “service” is something he’s trying to hardwire into the credit union’s culture, something that CEO Worthington strongly supports.

“I’ve toured other organizations that talk about culture in terms of perks like free snacks or a great break room,” says Worthington. “But they don’t talk about whether or not the culture aligns with the organization’s brand promise, and helps create an environment where every staff member is committed to the greater goal.”

Twice a month the entire Solarity team meets to review all the surveys to determine what members love and where they could do better. Employees are also empowered to make decisions that support delivering extraordinary experiences, whether it’s making an exception or sending a card or swag. Staffers share these ‘warm blanket’ moments — instances where they’ve gone above and beyond — on Yammer for all to see.

“Keeping the member experience our number one priority is a big challenge, so we keep reinforcing, applauding efforts, thanking each other and our members,” Worthington explains. “There are some unbelievably heartwarming stories about what employees have done for members that really drives the culture home. It costs little to give members a warm fuzzy that builds an emotional connection with our organization.”

Cumbee says fostering a sense of team and purpose among staffers through an employee onboarding program has been integral part of to the credit union’s CX strategy. New employee tours of the credit union and interviews with each department are the norm. Worthington personally meets with every newly hired employee. And a “Guiding Coalition”, which consists of employees at all levels from across the credit union helps impart important concepts. Solarity’s employee education initiatives are not about required coursework or standardized training modules, but rather consistently emphasize that everyone shares the responsibility for teaching how to deliver an exceptional experience — not just the training department or management.

Building on that sense of shared accountability, the credit union rolled out “Solarian Salutes”, a digital form employees can fill out to recognize a fellow employee’s extraordinary service. Once a staffer hits the “submit” button, the kudos are immediately shared with everyone in the organization via email. And such a simple idea only cost the marketing department a little time to create the form and design it.

The Voice of Employees Matters

Members aren’t the only ones who receive surveys gauging the Solarity experience and how it can be improved. Employees are surveyed as well, giving them opportunities to share their ideas (and frustrations) they encounter.

“Many times our members know they have an issue but they don’t know or understand what goes on in the back end, but our staff does,” Cumbee explains. “By inviting staff to participate and including them in the process, we learn how to close the loop much quicker and monitor issues before they become any larger.”

Cumbee says ideas that percolate up are addressed weekly via the credit union’s Yammer channel and/or explored in depth at their bimonthly all-hands staff meeting, particularly if a recurring theme emerges.

“It’s a waste to survey our employees, get results and dismiss them without action,” Worthington said. “We believe in transparency and are results oriented, so it’s critical that we address employee feedback.”

For example, when staffers commented that they felt they weren’t getting enough technical training, the orientation for member-facing employees was revamped accordingly. It’s all part of creating an environment that empowers employees who are engaged and actually want to contribute, says Cumbee.

This deliberate and agile philosophy seems to be paying dividends. Solarity’s focus on CX has yielded steady improvements in the credit union’s Net Promoter Score — an increase of over 40% in just a few quarters.

Cumbee says Solarity is now working on the next phase of its member experience to further refine how and who they survey, with a growing emphasis on lending and the broader customer experience.

“NPS is great, we just want to delve in and learn the whole story of our members journey and experience,” Worthington said.

Partnering with Temkin Group, Solarity will be zeroing in on three areas: Effectiveness — did the member accomplish what they needed to get done; Effort — was it easy; and Emotion — how did they feel about it? The three scores will be averaged to create a customer experience index that, when coupled with NPS metrics, will provide better insights to help shape service and deliver greater functionality across all platforms and product lines.

“We’re up against giants who are spending millions,” says Worthington. “We can’t afford to stand still so we keep evolving to deliver solutions that will deliver the most bang for the buck.”